原文标题:《2025 年 Q4 比特币估值报告》

原文来源:Tiger Research

律动注:本文首发于 2025 年 10 月 27 日。11 月 6 日,Tiger Research 再次发文表示,在市场波动加剧之际,仍旧维持 20 万美元目标价位不变。原因如下:

· 美国政府停摆已持续 35 天,造成短期压力——美国财政部 TGA 流动性冻结,Polymarket 预测显示,此次停摆持续到 11 月中旬之后的可能性为 73%

· 创纪录的强平清算事件打击市场情绪——10 月 10 日的强制平仓规模达 200 亿美元,影响 160 万交易员,市场清理了过高杠杆,引发暂时性回调。

· 基本面依然稳固,长期上涨趋势不变——全球流动性扩张,M2 广义货币供应量超过 96 万亿美元,机构投资者维持战略性买入,比特币目标价 20 万美元维持不变。以下为原文内容:

关键要点

· 机构投资者在波动中持续增持——第三季度 ETF 净流入保持稳定,MSTR 单月增持 388 枚比特币,坚定长期投资信念;

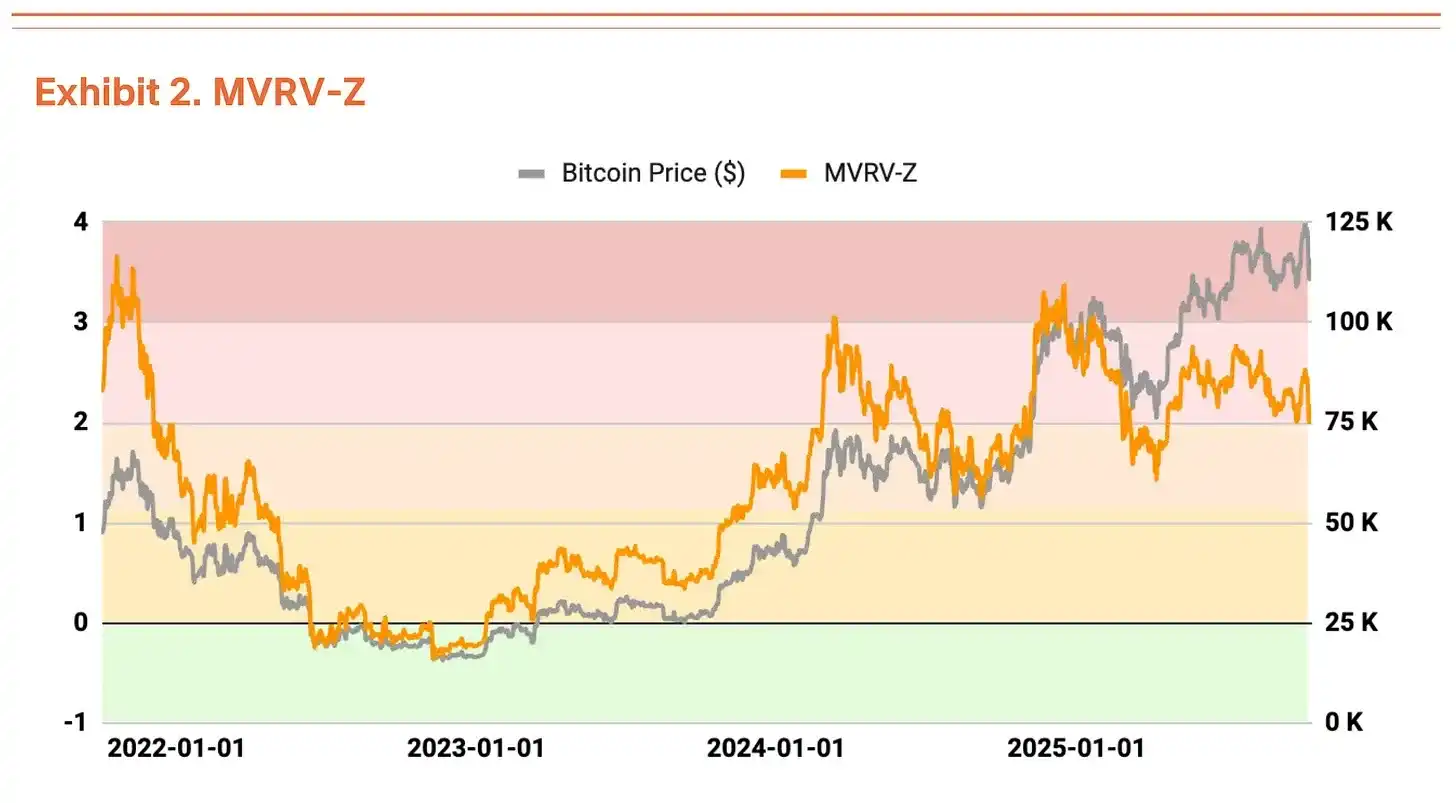

· 过热但尚未极端——MVRV-Z 指数为 2.31,表明估值偏高但尚未达到极端水平,杠杆资金的出清清除了短期交易者,为下一波上涨创造了空间;

· 全球流动性环境持续向好——广义货币供应量(M2)突破 96 万亿美元,创历史新高,美联储降息预期升温,预计年内还将降息 1-2 次。

机构投资者在中美贸易不确定性中买入

2025 年第三季度,比特币市场从第二季度强劲的涨势(环比增长 28%)放缓,进入波动的横盘阶段(环比增长 1%)。

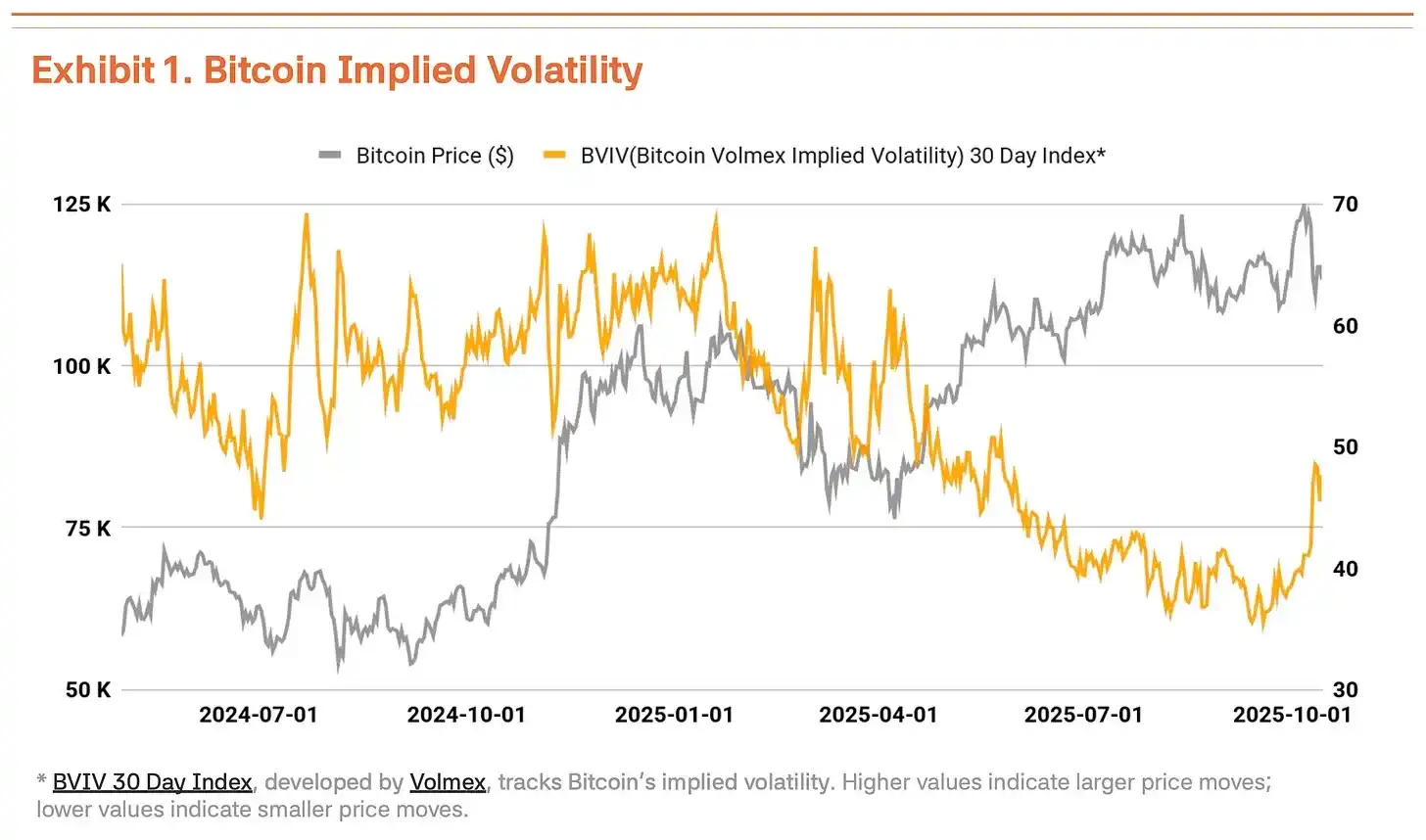

10 月 6 日,比特币创下 126,210 美元的历史新高,但特朗普政府再次对中国施加贸易压力,导致比特币价格回调 18% 至 104,000 美元,波动性显著增强。根据 Volmex Finance 的比特币波动率指数(BVIV),随着机构投资者稳步增持,比特币波动率从 3 月到 9 月有所收窄,但在 9 月之后飙升 41%,加剧了市场的不确定性(图表 1)。

受中美贸易摩擦重现和特朗普强硬言论的推动,此次回调看似暂时。以 Strategy Inc. (MSTR) 为首的机构战略性增持实际上正在加速。宏观环境也起到了推波助澜的作用。全球广义货币供应量(M2)突破 96 万亿美元,创历史新高,而美联储于 9 月 17 日将利率下调 25 个基点至 4.00%-4.25%。美联储暗示今年将再降息 1-2 次,稳定的劳动力市场加上经济复苏为风险资产创造了有利条件。

机构资金流入保持强劲。第三季度比特币现货 ETF 净流入达到 78 亿美元。尽管低于第二季度的 124 亿美元,但整个第三季度保持净流入证实了机构投资者的稳定买入。这一势头延续到了第四季度——仅 10 月第一周就录得 32 亿美元,创下 2025 年单周流入量新高。这表明机构投资者将价格回调视为战略入场机会。Strategy 在市场回调期间仍持续买入,10 月 13 日购入 220 枚比特币,10 月 20 日购入 168 枚比特币,一周内累计购入 388 枚比特币。这表明,无论短期波动如何,机构投资者都坚定地相信比特币的长期价值。

链上数据信号过热,基本面不变

链上分析揭示了一些过热迹象,不过估值尚不令人担忧。MVRV-Z 指标(市值与已实现价值之比)目前处于过热区域,为 2.31,但相对于 7-8 月接近的极端估值区间,已趋于稳定(图表 2)。

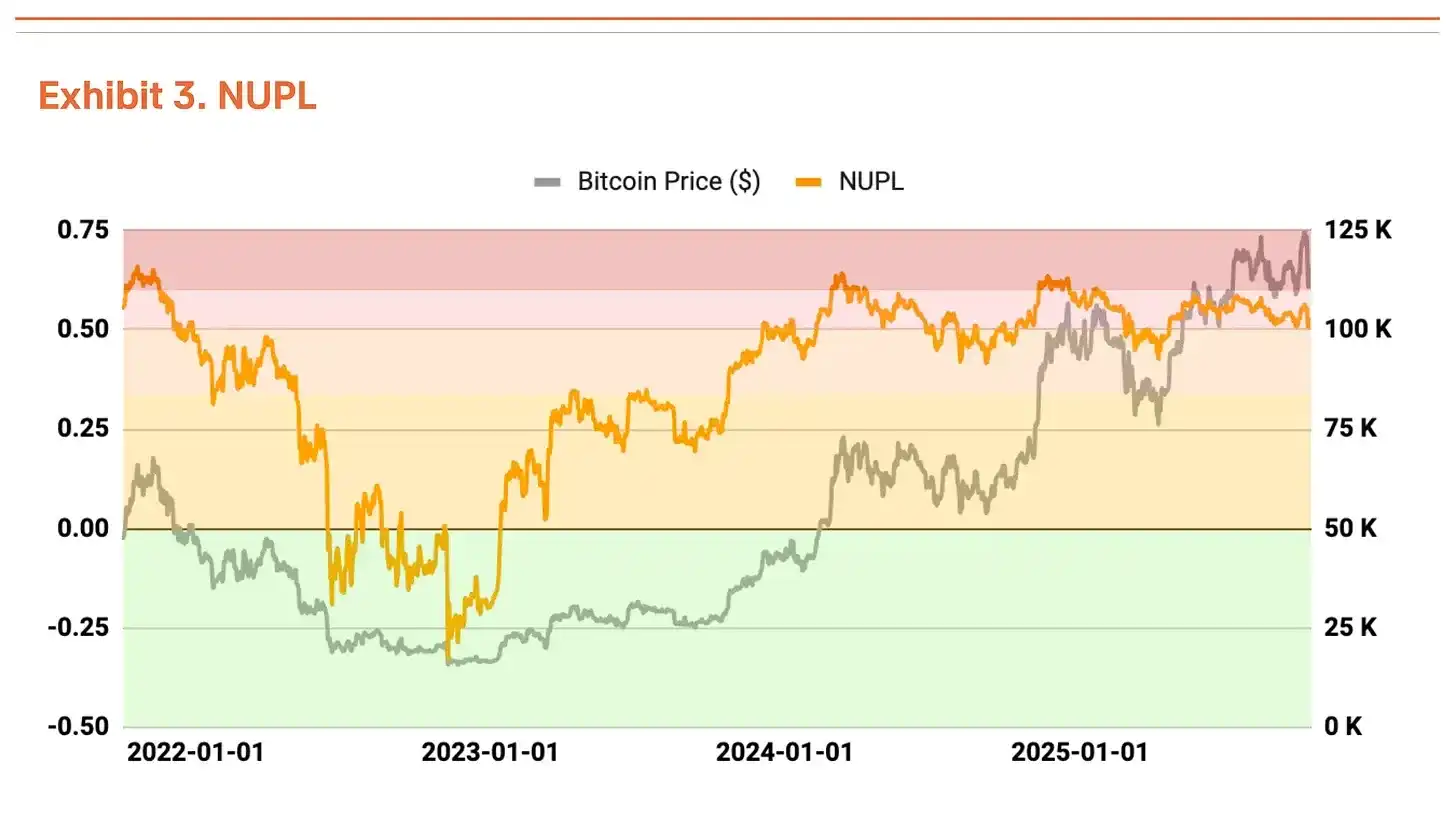

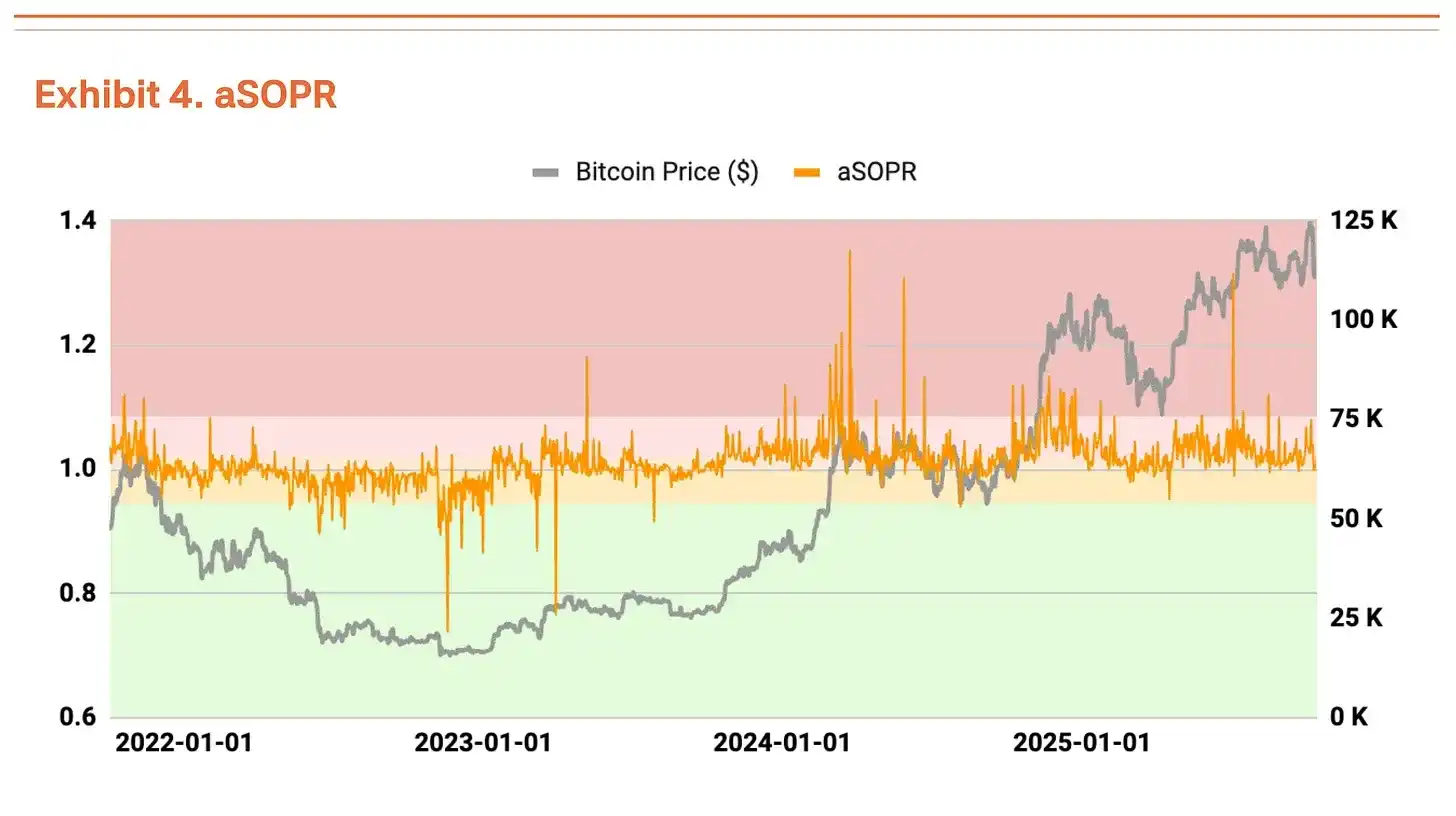

净未实现盈亏比 (NUPL) 也显示出过热区域,但较第二季度的高未实现利润状况已有所缓和(图表 3)。调整后的支出产出利润率 (aSOPR) 反映了投资者的已实现盈亏,该比率非常接近均衡值 1.03,表明无需担忧(图表 4)。

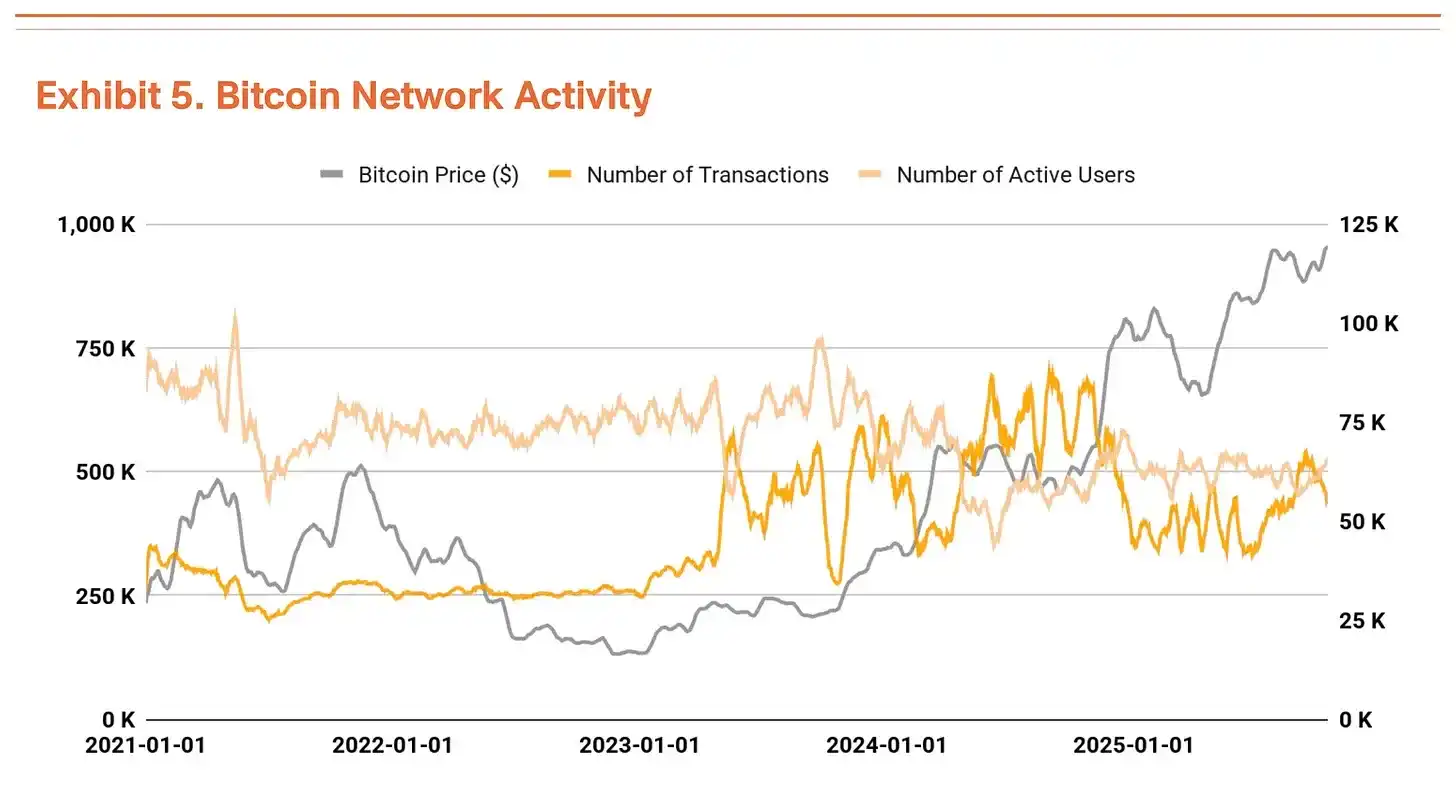

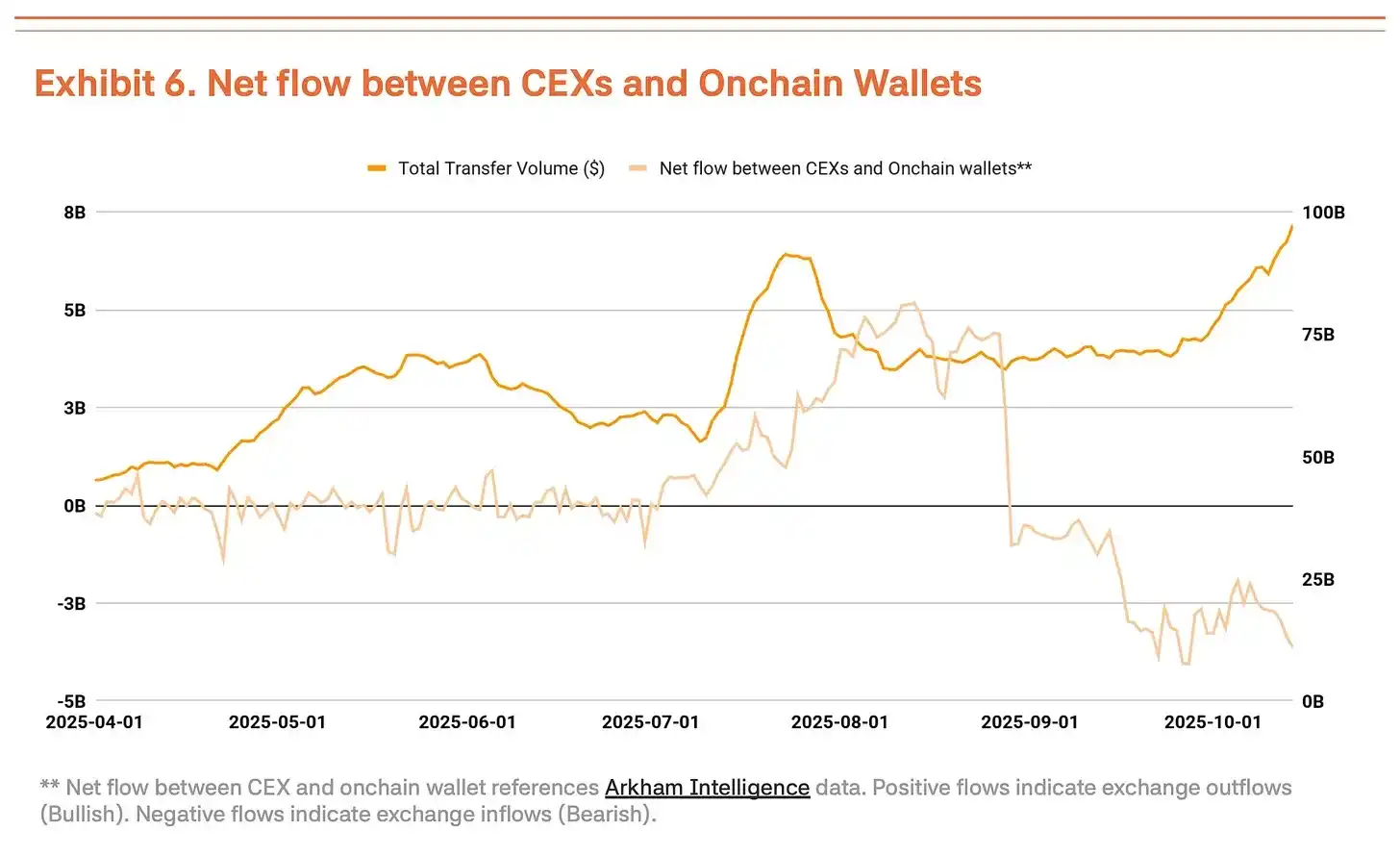

比特币的交易笔数和活跃用户数与上一季度保持相似水平,表明网络增长势头暂时放缓(图表 5)。与此同时,总交易量呈上升趋势。交易笔数减少但交易量增加意味着在更少的交易中转移了更大的资金,这表明大规模资金流动有所增加。

然而,我们不能单纯地将交易量的扩大视为积极的信号。近期流入中心化交易所的资金有所增加,这通常表明持有者准备抛售(图表 6)。在交易笔数和活跃用户等基本面指标没有改善的情况下,交易量的上升更多地表明在高波动性环境下短期资金的流动和抛售压力,而非真实需求的扩大。

10 月 11 日崩盘证明市场已转向机构主导

10 月 11 日中心化交易所的崩盘(下跌 14%)证明比特币市场已从散户主导转变为机构主导。

关键点在于:市场反应与以往截然不同。在 2021 年末类似的环境下,以散户为主的市场恐慌情绪蔓延,随后崩盘。这一次,回调幅度有限。在大规模平仓之后,机构投资者持续买入,这表明机构投资者坚决捍卫市场下行空间。此外,机构似乎将此视为健康的盘整,有助于消除过度投机需求。

短期内,连环抛售会降低散户投资者的平均买入价,并加大心理压力,可能因市场情绪受挫而加剧波动。但如果机构投资者在横盘整理期间持续入场,此次回调可能为下一轮上涨奠定基础。

目标价上调至 20 万美元

使用我们的 TVM 方法进行第三季度分析,得出中性基准价格为 15.4 万美元,较第二季度的 13.5 万美元上涨 14%。在此基础上,我们应用了 -2% 的基本面调整和+35% 的宏观调整,得出 20 万美元的目标价格。

-2% 的基本面调整反映了网络活动暂时放缓,以及中心化交易所存款增加,表明短期疲软。宏观调整维持在 35%。全球流动性扩张和机构资金流入持续,美联储的降息立场为第四季度的上涨提供了强大的催化剂。

短期回调可能源于过热迹象,但这属于健康的盘整,而非趋势或市场认知转变。基准价格持续上涨,表明比特币的内在价值稳步提升。尽管暂时疲软,但中长期上涨前景依然稳固。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。