莫愁前路无知己,投资路上有知音,各位朋友们,大家下午好!我是币胜团的币天王,感谢各位来到这里观看天王的文章和视频,每天都为大家带来不一样的币圈消息,精准行情分析。首先从市场当下的 “矛盾点” 切入:大家看到风险市场涨了,都以为是老美停摆要解决,但实际上谈判连共识都没有,这个 “利好” 根本站不住脚 —— 这一步是先纠正普遍误解,为后面说清 “真正涨因” 做铺垫。

点击链接观看视频:https://www.bilibili.com/video/BV1du2FBuEwA/

接着就拆解 “市场到底为什么动”:核心不是停摆谈判,而是最高法院对川子全球关税的判决概率变了,维持概率从高位掉到 29%。这里要顺着推导:要是关税真被判非法,老美企业供应链成本会降,利润和通胀都会好转,科技、半导体这些行业直接受益,而华尔街其实是闻到了利益才推动市场,不是替普通人着想。

但不能只说利好,得拉回宏观现实:现在 ISM 制造业 PMI 还在低位,铜金比也低得不行,宏观面还是弱的。更关键的是美联储,老是 “看倒后镜做政策”,这么搞下去经济容易加速衰退,到时候可能先 “砸个坑” 再放水救市 —— 这又会影响大饼:放水可能让大饼涨到泡沫破,不放水就可能回调甚至转熊,把利弊都讲清楚。

然后结合市场里的具体现象强化观点:某交易所的杠杆多头,明明价格在跌,却不止损还加仓。虽然他们 2024-2025 赚过,但 2021 也被割过,说明操作不是绝对靠谱,所以币胜团还是坚持 “近期看空”。再看大饼技术面,这次下跌针和 6 月 22 号的 98.2K 几乎连在一起,99K 附近是流动性聚集区,就像磁铁一样,价格大概率还会回去摸,所以 98K 肯定不是大底;要是反弹时做市商没力气,要么砸穿 98K,要么搞止损猎杀,风险得点出来。

讲完判断,就给具体操作建议:先明确短期别追涨,昨天反弹只是 100K 虚破后多头的最后抵抗。空单套了不用急,72 小时内大概率能翻红;但多单套了就看运气,因为周线月线都在压着,真要反弹至少得等 1-2 根日线信号,而且顶多到 108.8K,110K 以上就是天花板。

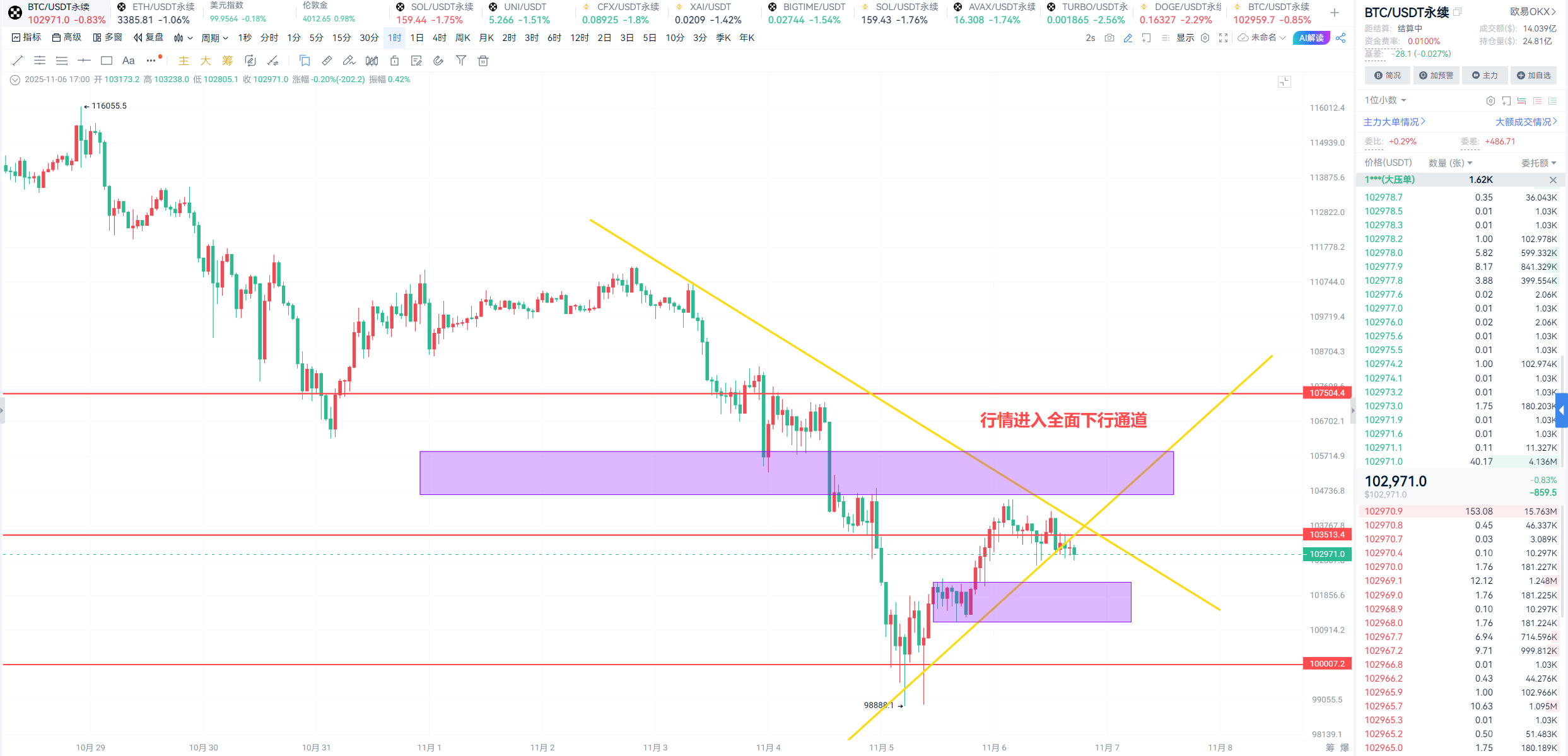

再细化点位和策略:大饼这边,阻力看 105700 和 104500,支撑看 102700 和 101600。现在 1 小时级别有 20MA 加趋势线托底,下影线长,102.7K 被认作短期底,但没成交量的反弹都是虚的 —— 跌破趋势线就得回 101K-102K,失守 103K 会加速跌,因为中间没接盘;多头要反转,必须突破 104500 且站稳。波段上暂时不建议做多,做空就看 104500-105000,防守 105700,目标 102700,破了再看 101600。以太更简单,今天阻力 3480,3570 是大压,上不去就空,支撑看 3360-3336。

最后还要提醒避坑:币圈很多人是 “表演型选手”,天天晒截图说自己抓顶抄底,其实都是马后炮。真正值得关注的,是那些交易逻辑前后一致、能经得起推敲的,不是行情动了才来喊的。所以得长期观察,别被截图骗了,分清谁是真思考、谁是造梦。

想学好投资,得跟着靠谱的持续看,不能看几次就下结论。币胜团全网同名,公众号、粉丝群里有免费体验、直播和技巧教学,最后再用 “币圈套路深,别当接盘人,跟着币胜团走,做空不迷路” 加深印象,把观点和引流顺理成章串起来。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。