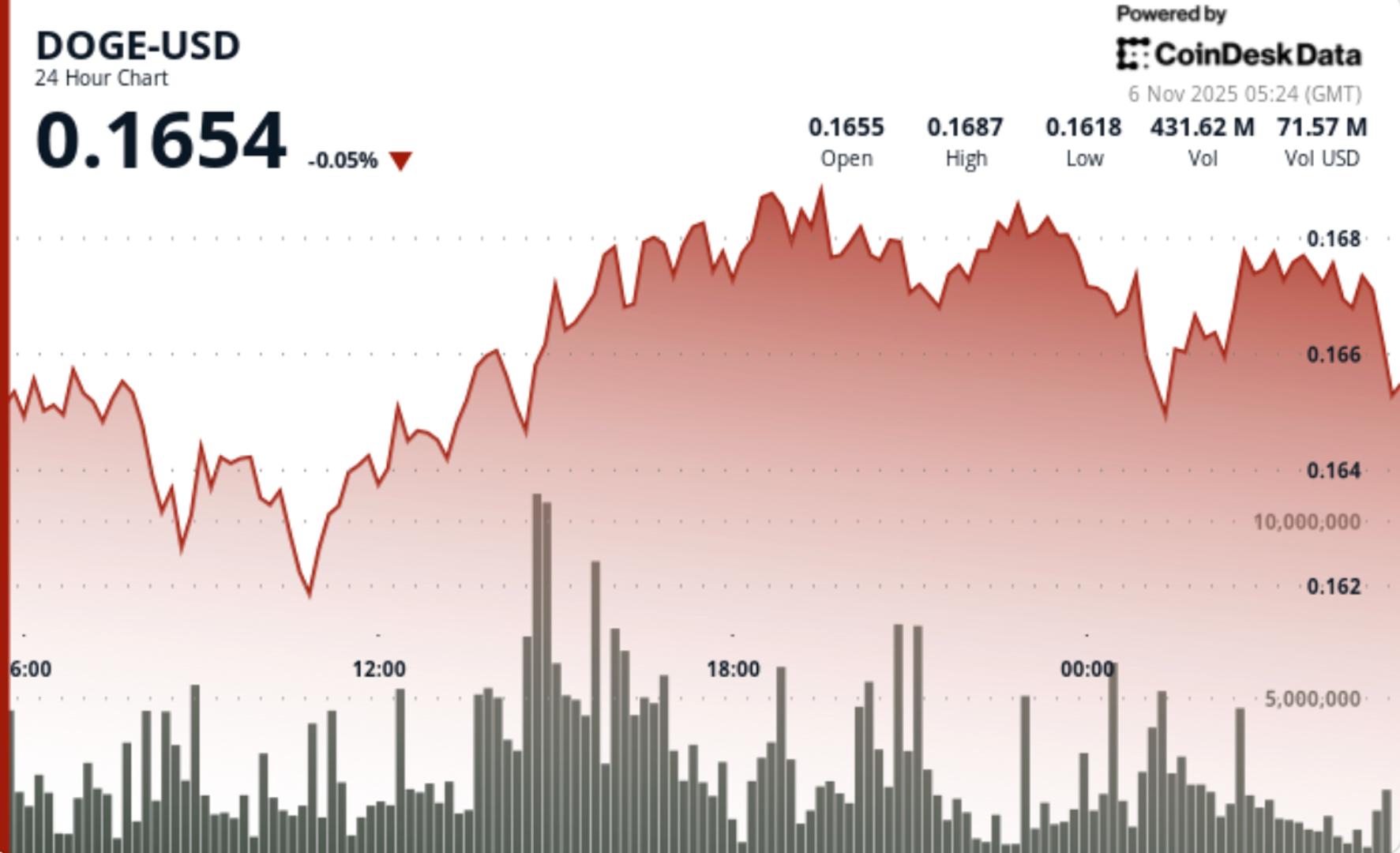

狗狗币在周三的交易中下跌了0.5%,至0.1657美元,因为机构资金在阻力位附近轮换,交易量在日均水平上方激增了104%。尽管在上边界面临分配压力,该代币仍然捍卫了其上升通道结构,使短期偏向保持在0.16美元以上的中性至看涨状态。

新闻背景

- 机构定位继续定义DOGE的日内结构。本周早些时候,大型持有者在0.1620美元附近积累,然后在0.1670美元附近出价减少时削减了持仓。

- 周二774M的交易量突破尝试标志着该交易时段的转折点——确认了聪明资金的参与,而非零售噪音推动了这一走势。

- 尽管DOGE期货的衍生品未平仓合约在Binance和Bybit上小幅上升,暗示出投机性对冲而非直接冒险,但整个迷因币的情绪仍然低迷。

- 分析师表示,该交易对在0.16美元以上的韧性反映了有纪律的利润轮换,而非趋势疲软。

价格行动总结

• DOGE从0.1646美元上涨至0.1665美元,然后轻微回调至0.1657美元

• 支持在四次连续的小时测试中保持在0.1617–0.1620美元

• 交易量集中在0.1665美元的高点(在02:10–02:11期间为8.9M),显示机构分配

• 通道结构保持良好,低点逐渐抬高,暗示在0.16美元以上可能会有新的突破尝试。

技术分析

• 趋势:在上升通道内横盘至看涨

• 支持:0.1620美元为主要支撑;0.1617美元为次要缓冲

• 阻力:0.1665–0.1670美元区域在高交易量下多次被拒绝

• 交易量:774M的成交量(比SMA增加104%)确认了机构参与

• 结构:通道完好,波动率为4.2%——在下一个方向性移动之前的压缩阶段。

交易者关注的事项

• 多头在交易量下降时捍卫0.1620美元的能力——对结构完整性至关重要

• 在0.1670美元以上确认突破,以继续向0.17–0.175美元推进

• 任何低于0.1615美元的日内收盘信号表明结构失败和下行扩展

• 来自BTC或SOL轮换的跨资产流动,作为更广泛市场对风险的胃口的衡量

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。