精选要闻

1、GIGGLE 持续拉升短时突破 143 美元,24 小时涨幅扩大至 178%

3、比特币回升突破 102,000 美元,24 小时跌幅收窄至 4.7%

5、Nansen 披露数据,「币安人生」前百地址持币量过去 30 日上涨 714%

Trending 话题

来源:Overheard on CT(tg:@overheardonct),Kaito

以下是对原文内容的中文翻译:

[PEPE]

今天围绕 PEPE 的讨论主要集中在重大的市场活动和引人注目的购买上。一个新的中国巨鲸一直在积极收购 Plush Pepe NFT,花费数百万美元来托底,而另一个值得注意的购买是 Plush Pepe #1442,以 9718 TON 的价格成交。此外,一个之前从 PEPE 中获利的聪明巨鲸对 ASTER 进行了大量投资。尽管加密市场整体情绪看跌,但由于这些备受瞩目的交易,PEPE 仍然是一个热门话题。

[STREAM]

STREAM Finance 今天成为讨论的焦点,原因是外部基金经理造成了 9300 万美元的重大损失,导致存款和取款被冻结,其稳定币 xUSD 的价值下跌。该事件引发了人们对更广泛的 DeFi 生态系统暴露于 STREAM 财务困境的担忧,其他协议(如 Morpho、Euler 和 Silo)也可能受到蔓延风险的影响。这种情况引发了关于风险管理实践和 DeFi 运营透明度重要性的辩论。

[MORPHO]

今天围绕 MORPHO 的讨论主要集中在 Stream Finance 崩溃的后果上,这导致人们对 Morpho 使用的策展人模型进行了严格审查。该事件凸显了与高收益金库相关的风险以及 DeFi 中风险管理的重要性。尽管存在负面情绪,但一些推文为 Morpho 的孤立市场模型辩护,强调它防止了更广泛的蔓延。讨论还涉及策展人需要更好的透明度和问责制,以及 DeFi 负责任地扩展的潜力。

[LINK]

今天,Chainlink (LINK) 因几项重大公告和发展而备受关注。Chainlink 运行时环境 (CRE) 和 Chainlink 机密计算的推出被强调为关键创新,可实现私有智能合约并增强链上金融。瑞银 (UBS) 使用 Chainlink 的数字转让代理成功执行了首次链上代币化基金赎回,这标志着区块链基础设施的一个里程碑。此外,Tradeweb 与 Chainlink 合作,通过 DataLink 在链上发布美国国债数据,进一步推动了机构代币化的努力。尽管有这些积极的发展,但仍有人担心 Chainlink 预言机故障导致 Moonwell 协议中出现 100 万美元的漏洞。

[MOMENTUM]

Momentum (MMT) 今天因在包括币安、Bybit 和 OKX 在内的多个主要交易所上市而备受关注。该代币的推出以各种交易机会、空投领取和投资者保护功能为标志。社区对该项目的潜力感到兴奋,讨论强调了其创新的 DeFi 机制,例如 ve(3,3) 模型及其战略合作伙伴关系。该代币的表现、交易激励和未来增长前景是推动 MMT 热议的关键话题。

精选文章

11 月的第一周,币圈情绪很差。比特币已经下探到「10.11」大暴跌的更低点,没守住 10 万美元大关,甚至跌破 9.9 万美元,是这半年里的新低,以太坊最低触及 3000 美元。全网 24 小时爆仓金额超过 20 亿美元,多头损失 16.3 亿美元,空头爆了 4 亿美元。

2.《为什么美国政府开门比特币才能涨?》

美国政府停摆正式进入创纪录的第 36 天。过去两天,全球金融市场跳水。纳斯达克、比特币、科技股、日经指数、甚至连避险资产美债和黄金也未能幸免。市场的恐慌情绪在蔓延,而华盛顿的政客们却还在为预算争吵不休。美国政府停摆和全球金融市场下跌之间有联系吗?答案正在浮出水面。

链上数据

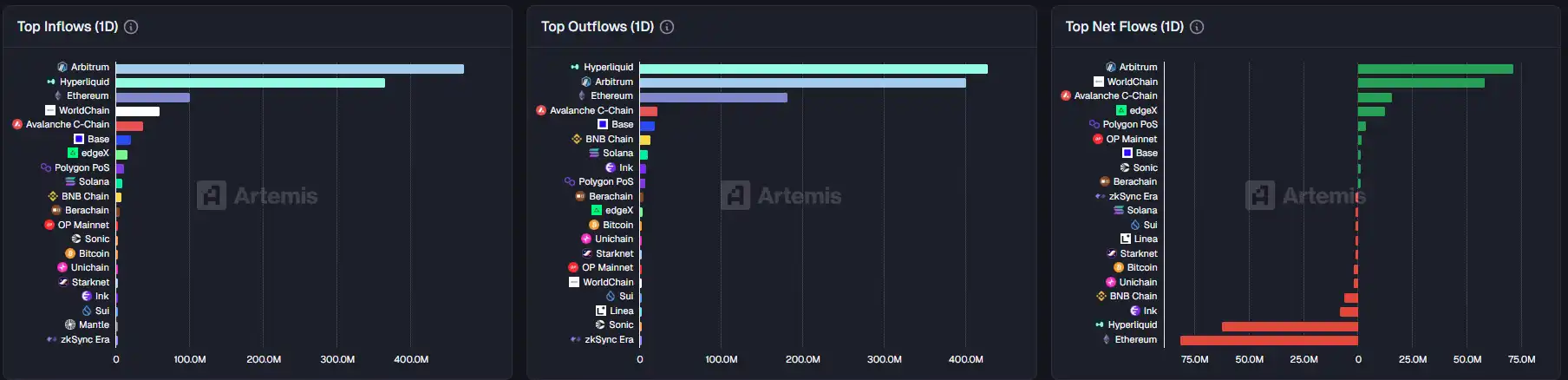

11 月 5 日上周链上资金流动情况

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。