1.项目简介

MegaETH 是为 Web3 实时交互时代而打造的高性能以太坊 Layer2,目标是让以太坊具备 Web2 级运算与交互体验。它采用完全兼容 EVM 的执行环境,并通过自研高并发架构与并行状态管理机制,将链上响应从秒级确认推进到毫秒级交互,实现实时交易确认与近乎零延迟的链上体验。同时,MegaETH 引入多线程执行引擎、异步调度系统和低延迟共识机制,在架构层面突破单线程瓶颈,能显著降低 Gas 成本与交互延迟。

MegaETH的核心愿景是成为以太坊的性能引擎,在不牺牲以太坊安全性与生态兼容性的前提下,将执行层拆分为独立且可水平扩展的高性能计算层,让以太坊原生资产与应用能够直接继承这份算力优势。MegaETH 认为,未来公链不会是彼此割裂的生态孤岛,而会发展为互联的计算能力网络,其中以太坊作为结算与价值层,需要一个能够承载实时应用与高密度交互的性能加速层来支撑生态升级。因此,MegaETH 的目标是推动以太坊从资产与价值结算层,进一步发展为通用实时计算与交互层,成为下一代链上应用的基础设施。

2.市场动态

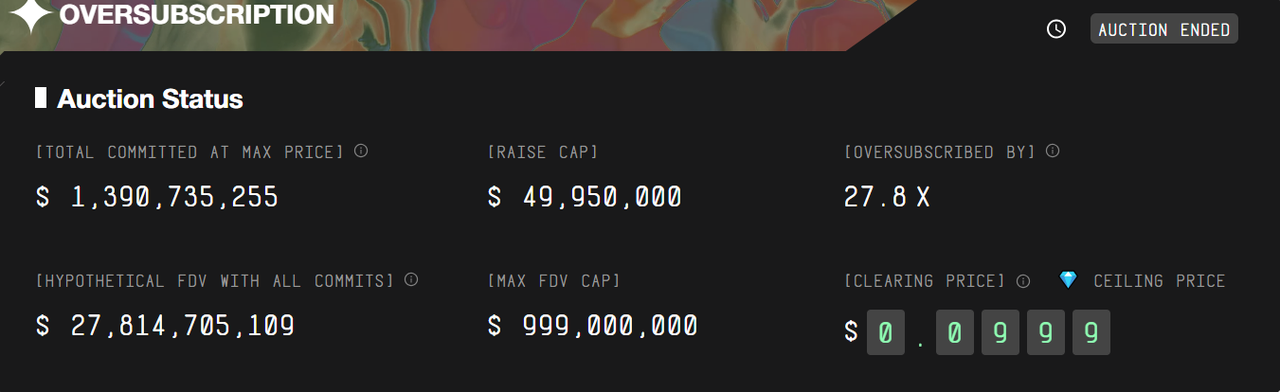

MegaETH公募阶段已结束,整体热度显著超出预期,最终认购规模约13.9亿美元,超额认购27.8倍。此次发行在 Echo 的 Sonar 平台完成,代币总供应100 亿枚中有 5 亿枚以 USDT 公开拍卖,占比 5%,参与门槛设定为最低 2,650 美元、最高 186,282 美元。本次发行采用英式竞拍模式,即价格从预设的低价起拍,随着竞拍的不断上升,直到达成市场统一成交价之后全体中标者按照同一价格结算。在本轮中,起拍价为 0.0001 美元/枚(对应 FDV 100 万美元),且设置最高封顶价 0.0999 美元/枚(对应 FDV 9.99 亿美元)。参与者以愿意支付的最高价格提交申购,但最终价格并非按个人出价,而是由市场有效需求共同决定最终的成交价,所有成功分配者均以该统一价格获得代币(本轮中MegaETH对出价低于 9.99 亿美元 FDV的参与者进行了退款)。因此,用户的最终成本取决于最终的成交价,而非个人申购的价格上限,其机制更接近于统一价格拍卖而非连续竞价。

需要注意的是,英式竞拍机制在传统金融体系中往往用于高价值、稀缺且难以准确定价的资产,如古董、艺术品等。其底价往往基于专业估值、历史成交价与独立评估模型确定,高价则通过公开竞价逐级抬升形成,竞价过程透明、参与者经验丰富且具备定价能力,从而实现价格发现与相对公平分配,并有效防范操纵行为。然而在加密市场中,由于代币资产尚缺乏成熟的估值框架,且发行方通常预先设定价格区间,投资者在认购阶段可能难以对项目整体估值与风险水平形成明确认知,市场存在一定的信息不对称性。在此条件下,英式竞拍机制在加密场景的效果与传统金融或存在一定的差异,其价格形成过程可能更多受到参与者行为预期、叙事驱动与市场情绪影响。而 MegaETH选择英式竞拍,不仅是融资方式,更是叙事策略、用户心理博弈机制与资本效率工具。整体来看,MegaETH 的认购热度与资金结构,正体现出高性能型以太坊执行层正在成为资金的布局方向,而 MegaETH 作为该赛道代表项目,已开始进入资本与用户认知的加速阶段。

Source:sale.megaeth

3.团队背景

MegaETH的团队兼具底层技术实力与以太坊生态经验,创始成员覆盖分布式系统研究、工程实现与业务落地能力。联合创始人兼 CEO Shuyao Kong早期就进入了区块链行业,曾担任 ConsenSys 全球 BD 主管,并毕业于哈佛商学院,对以太坊生态逻辑和全球 Web3 产业布局有深度认知。技术团队同样具备强学术背景与实践能力,联合创始人 Yilong Li 拥有斯坦福博士背景,CTO Lei Yang 则是 MIT 博士,长期专注于分布式系统、共识机制与同步算法等底层方向,这些技术正是构建高性能执行层的关键。整体来看,团队既有理论深度,也具备行业执行经验,为 MegaETH 的高性能路线提供了可信的工程落地能力。

自2024 年以来,MegaETH累计获得约 3,000 万美元融资,其中 2024 年 6 月完成 2,000 万美元种子轮,由 Dragonfly 等头部基金领投,参投方包括 Figment Capital、Robot Ventures、Big Brain Holdings等,同时吸引了 Vitalik Buterin、Joseph Lubin、Sreeram Kannan、Cobie等多位行业核心人物参与;2024 年 12 月又通过社区轮募集 1,000 万美元,进一步强化用户与社区绑定。

4.代币信息

MegaETH的原生代币为 $MEGA,总供应量为100亿枚。代币采用 KPI驱动分配机制,即代币释放与网络的实际增长数据挂钩,当网络达到特定的性能与生态目标时会触发新一轮代币释放,代币分配结构如下:

KPI 奖励池占比约53%,只有质押用户才能参与,质押周期在 10–30 天之间,质押时间越长,收益权重越高。据网络指标,随时间推移发放的基于绩效的质押奖励。

其他投资者与早期轮占比约24.7%,包括机构投资者占比约14.7%、Echo 轮投资者占比约5%、Fluffle 购买者占比约2.5%以及Sonar 奖励池占比约2.5%。

团队与顾问占比约9.5%,设有1年锁定期,且在 3 年内按线性方式逐步解锁。

基金会与生态系统储备金占比约7.5%,用于生态系统发展、战略合作及协议可持续性维护。

公开发售占比约5%,所有代币将全部分配给购买者,发行方不直接留存任何资产。

5.竞争格局

在 Layer2 竞争加速进入执行层差异化阶段后,MegaETH 选择了性能优先路线,目标不是与传统通用 Layer2 打价格战或补贴战,而是在高并发、低延迟、实时应用方向上抢占优势。随着链上交易与交互密度不断提升,实时订单簿、高频 DeFi、AI 智能体等新形态应用逐步进入验证周期,高性能型 Layer2 具备一定的叙事与需求支撑。MegaETH 已吸引多个赛道项目提前布局,生态搭建节奏快于同阶段项目,有望率先跑通高性能、高价值应用、用户活跃、资本沉淀的增长曲线。如果这一飞轮顺利转动,MegaETH有潜力成为以太坊体系内的高性能执行层的代表项目,为下阶段 Web3 大规模应用落地提供算力与实时交互基础。

需要关注的是,MegaETH 仍处于早期阶段,主网长期稳定性、执行性能表现以及与以太坊主网的长期兼容性都需要时间验证。同时,代币尚未 TGE,未来市场定价与流动性释放存在不确定性。此外,性能换取速度的架构思路也对安全性、节点参与门槛、网络去中心化程度提出更高要求。如果生态增长未能跟上、性能无法持续兑现,或市场出现更具差异化性能路线的竞争者,MegaETH 的优势周期可能缩短。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。