美国政府停摆正式进入创纪录的第 36 天。

过去两天,全球金融市场跳水。纳斯达克、比特币、科技股、日经指数、甚至连避险资产美债和黄金也未能幸免。

市场的恐慌情绪在蔓延,而华盛顿的政客们却还在为预算争吵不休。美国政府停摆和全球金融市场下跌之间有联系吗?答案正在浮出水面。

这不是一次普通的市场回调,而是一场由政府停摆触发的流动性危机。当财政支出冻结,数千亿美元被锁在财政部账户中无法流入市场,金融体系的血液循环正在被切断。

下跌「真凶」:财政部的「黑洞」

美国财政部一般账户(Treasury General Account),简称 TGA。可以理解为美国政府在美联储开设的中央支票账户。所有的联邦收入,无论是税收还是发行国债所得,都会存入这个账户。

而所有的政府支出,从支付公务员工资到国防开支,也都从这个账户中划拨。

正常情况下,TGA 像一个资金的中转站,维持着动态平衡。财政部收钱,然后迅速把钱花出去,资金流入私人金融系统,变成银行的准备金,为市场提供流动性。

政府停摆打破了这个循环。财政部仍在通过税收和发行债券收钱,TGA 的余额持续增长。但由于国会没有批准预算,大部分政府部门关门,财政部无法按计划支出。TGA 变成了一个只进不出的金融黑洞。

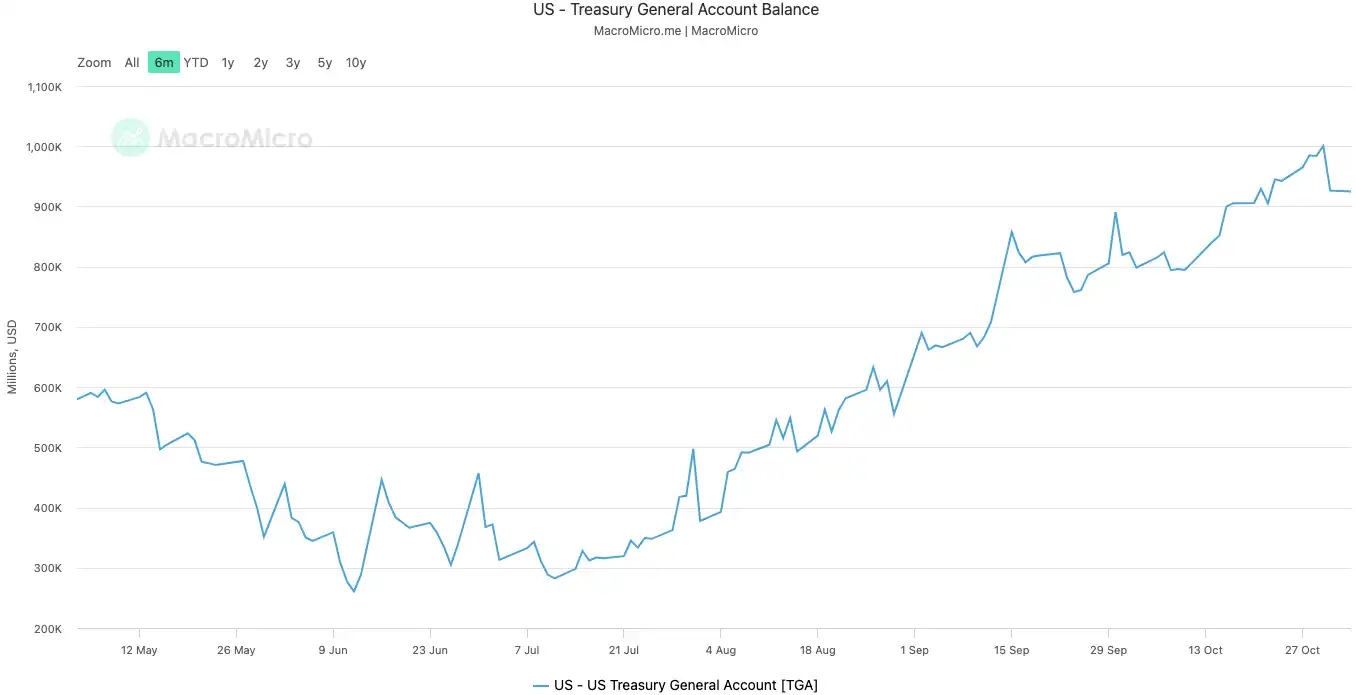

自 2025 年 10 月 10 日停摆开始,TGA 的余额从约 8000 亿美元膨胀到 10 月 30 日突破 1 万亿美元。短短 20 天内,超过 2000 亿美元的资金被从市场中抽走,锁进了美联储的保险柜。

美国政府的 TGA 余额|图源:MicroMacro

有分析指出,政府停摆在一个月内从市场中抽走了近 7000 亿美元的流动性。这种效应,堪比美联储进行多轮加息或加速量化紧缩。

当银行体系的准备金被 TGA 大量虹吸后,银行放贷的能力和意愿都大幅下降,市场的资金成本随之飙升。

最先感受到寒意的,永远是那些对流动性最敏感的资产。加密货币市场在 10 月 11 日,停摆第二天后暴跌,清算规模接近 200 亿美金。本周科技股也摇摇欲坠,纳斯达克指数周二下跌 1.7%,Meta、微软财报后大跌。

全球金融市场的下跌,正是这场隐形紧缩最直观的体现。

系统在「发烧」

TGA 是流动性危机的"病因",飙升的隔夜拆借利率则是是金融系统"发烧"的最直接症状。

隔夜拆借市场是银行之间相互借贷短期资金的地方,是整个金融体系的毛细血管,它的利率是衡量银行间"钱根"松紧的最真实指标。流动性充裕时,银行之间借钱很容易,利率平稳。但当流动性被抽干时,银行开始缺钱,愿意付出更高的代价来借钱过夜。

两个关键指标清晰地显示出这场高烧有多严重:

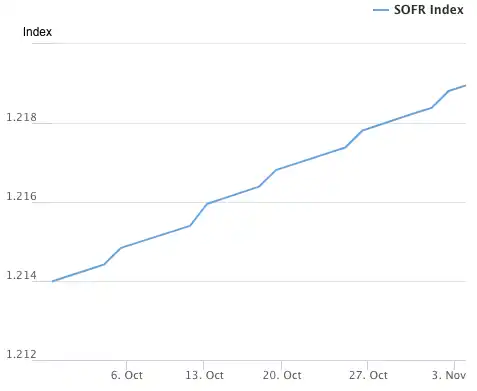

第一个指标是 SOFR(有担保隔夜融资利率)。10 月 31 日,SOFR 飙升至 4.22%,创下一年来最大日涨幅。

这不仅高于美联储设定的联邦基金利率 4.00% 的上限,更是比美联储的有效基金利率高出 32 个基点,达到自 2020 年 3 月市场危机以来的最高点。银行间市场的实际借贷成本已经失控,远远超过了央行的政策利率。

有担保隔夜融资利率 (SOFR) 指数|图源:Federal Reserve Bank of New York

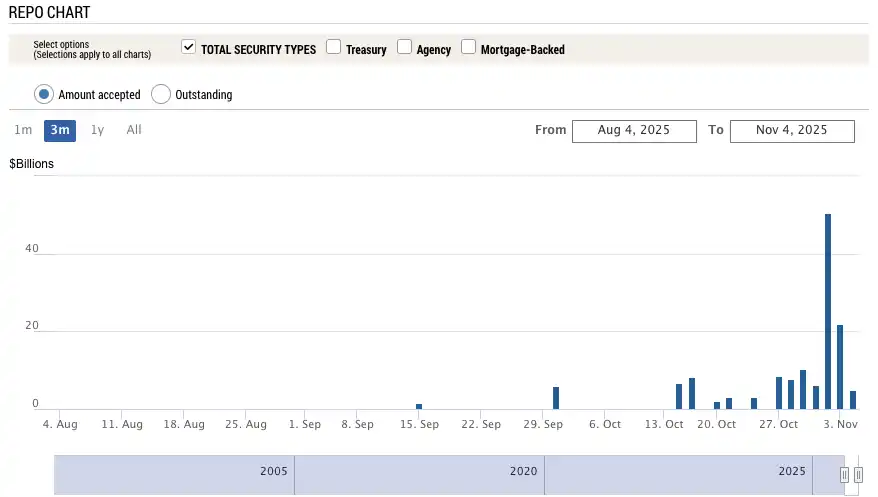

第二个更惊人的指标,是美联储的 SRF(常备回购便利)的使用量。SRF 是美联储为银行提供的紧急流动性工具,当银行在市场上借不到钱时,可以向美联储抵押高等级债券来换取现金。

10 月 31 日,SRF 的使用量飙升至 503.5 亿美元,创下自 2020 年 3 月疫情危机以来的最高纪录。银行体系已经陷入严重的美元荒,不得不敲响美联储的最后求助窗口。

常备回购便利 (SRF) 使用量|图源:Federal Reserve Bank of New York

金融系统的高烧正将压力传导至实体经济的薄弱环节,引爆潜藏已久的债务地雷,目前最危险的两个领域是商业地产和汽车贷款。

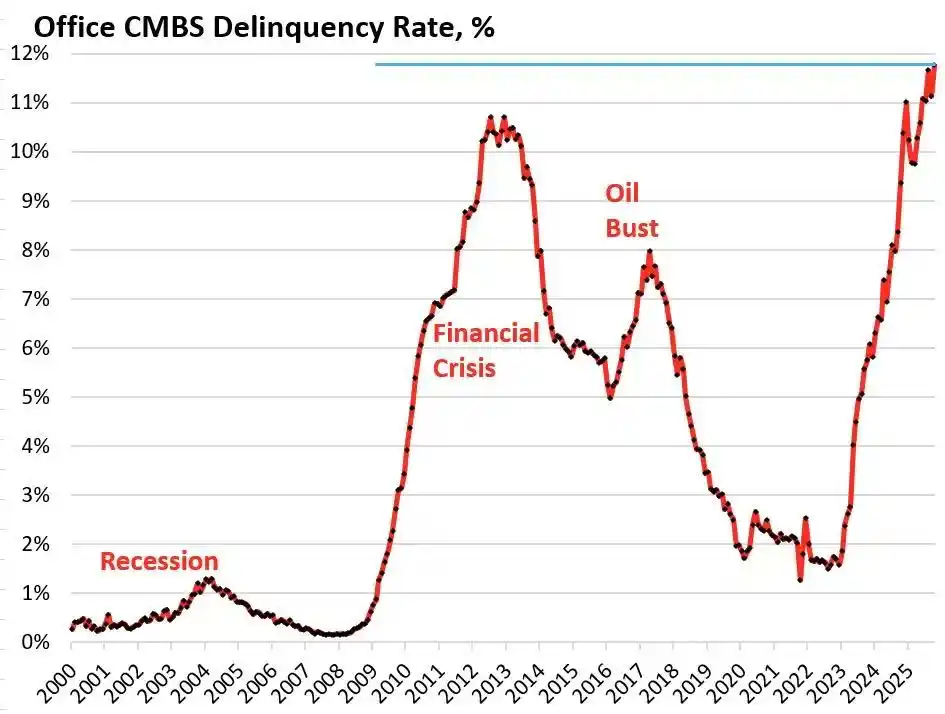

据研究机构 Trepp 的数据显示,美国办公楼 CMBS 商业地产抵押贷款证券化产品的违约率在 2025 年 10 月达到 11.8%,不仅创下历史新高,甚至超过了 2008 年金融危机时 10.3% 的峰值。短短三年内,这个数字从 1.8% 暴涨了近 10 倍。

美国办公楼 CMBS 商业地产抵押贷款证券化产品的违约率|图源:Wolf Street

华盛顿州贝尔维尤市的 Bravern Office Commons 是个典型案例。这座曾经由微软全资租用的办公楼,2020 年估值还高达 6.05 亿美元,如今随着微软的撤离,估值已暴跌 56% 至 2.68 亿美元,并已进入违约程序。

这场 2008 年以来最严重的商业地产危机,正通过区域性银行、房地产投资信托 REITs 和养老基金,向整个金融系统扩散系统性风险。

在消费端,汽车贷款的警报也已拉响。新车价格飙升至平均 5 万美元以上,次级借款人面临高达 18-20% 的贷款利率,违约潮正在到来。截至 2025 年 9 月,次级汽车贷款的违约率已接近 10%,整体汽车贷款的拖欠率在过去 15 年里增长了超过 50%。

在高利率和高通胀的压力下,美国底层消费者的财务状况正在迅速恶化。

从 TGA 的隐形紧缩,到隔夜利率的系统高烧,再到商业地产和汽车贷款的债务爆雷,一条清晰的危机传导链条已经浮现。华盛顿政治僵局意外点燃的导火索,正在引爆美国经济内部早已存在的结构性弱点。

交易员们怎么看后市?

面对这场危机,市场陷入了巨大的分歧。交易员们站在十字路口,激烈地辩论着未来的方向。

Mott Capital Management 代表的悲观派认为,市场正面临一场堪比 2018 年底的流动性冲击。银行准备金已降至危险水平,与 2018 年美联储缩表引发市场动荡时的状况极为相似。只要政府停摆持续,TGA 继续吸走流动性,市场的痛苦就不会结束。唯一的希望,在于 11 月 2 日财政部发布的季度再融资公告 QRA。如果财政部决定降低 TGA 的目标余额,可能会向市场释放超过 1500 亿美元的流动性。但如果财政部维持甚至提高目标,市场的寒冬将变得更加漫长。

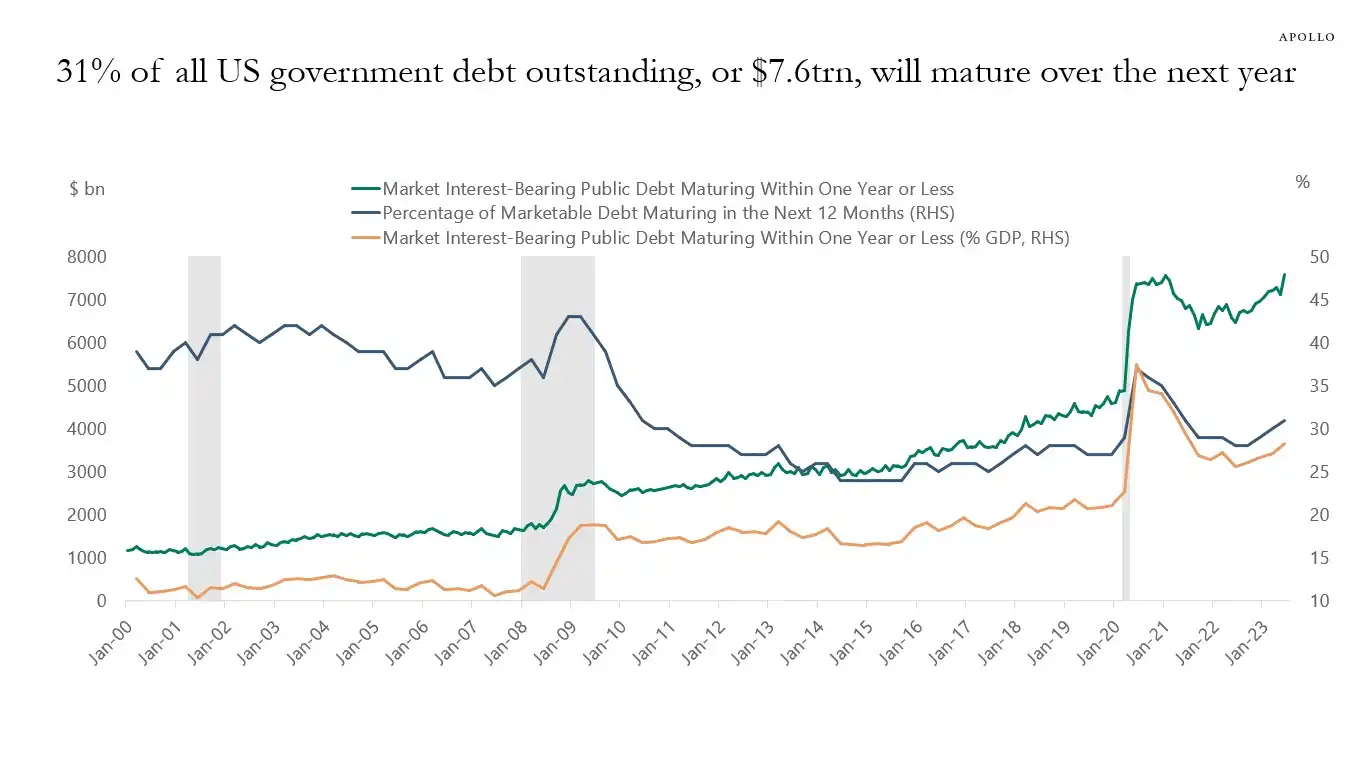

知名宏观分析师 Raoul Pal 代表的乐观派,提出了一个引人入胜的痛苦之窗理论。他承认,当前市场正处于流动性紧缩的痛苦之窗中,但他坚信,在这之后将是流动性洪流。未来 12 个月,美国政府有高达 10 万亿美元的债务需要滚动续作,这迫使它必须确保市场的稳定和流动性。

31% 的美国政府债务(约 7 万亿美元)将在未来一年内到期,加上新增债务发行,总规模可能达到 10 万亿美元|图源:Apollo Academy

一旦政府停摆结束,被压抑的数千亿美元财政支出将如洪水般涌入市场,美联储的量化紧缩 QT 也将技术性结束,甚至可能转向。

为了迎接 2026 年的中期选举,美国政府将不惜一切代价刺激经济,包括降息、放松银行监管、通过加密货币法案等。在中国和日本也将继续扩张流动性的背景下,全球将迎来新一轮的放水。当前的回调只是牛市中的一次洗盘,真正的策略应该是逢低买入。

高盛、花旗等主流机构则持相对中性的看法。他们普遍预计,政府停摆将在未来一到两周内结束。一旦僵局打破,TGA 中被锁定的巨额现金将迅速释放,从而缓解市场的流动性压力。但长期的方向,仍取决于财政部的 QRA 公告和美联储的后续政策。

历史似乎总在重复。无论是 2018 年的缩表恐慌,还是 2019 年 9 月的回购危机,最终都以美联储的投降和重新注入流动性而告终。这一次,面对政治僵局和经济风险的双重压力,政策制定者们似乎又一次走到了熟悉的十字路口。

短期来看,市场的命运悬于华盛顿政客们的一念之间。但从长期来看,全球经济似乎已经深陷债务-放水-泡沫的循环而无法自拔。

这场由政府停摆意外触发的危机,可能只是下一轮更大规模流动性狂潮来临前的序曲。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。