🧐 UnifAI Network When will AI begin to have "action rights"?

As nof1 launches the "real trading competition" among six major AI models, the narrative of AI and Crypto is once again exploding into the mainstream:

While everyone watches various models "automatically decide and place orders" on Hyperliquid, questions arise:

If AI can truly learn and execute on-chain, will the next step be that even "trading rights" no longer belong to humans?

This could be a turning point for AI in human society!

UnifAI @UnifaiNetwork is building this turning point, and today Binance officially announced that it will launch Alpha on November 6, becoming one of the first featured projects on the Binance Alpha platform, officially entering the exposure landscape of the Binance ecosystem.

So, taking this opportunity, I researched this project:

Here are some of my findings 👇

1️⃣ From suggestion to action: The paradigm leap of Agentic Finance

In the past, AI could only "suggest" what you should do;

UnifAI aims to have AI directly "help you do it": they are not talking about "AI assisting human trading," but rather having AI execute directly.

The core logic is straightforward: users design their own Agent: it can scan the market, execute operations, and automatically rebalance positions, continuously learning and optimizing on-chain.

In other words: AI moves from "suggesting you buy and sell" to "placing orders for you." This change is essentially a leap from AI's mouth to its hands.

This is what they define as—

Agentic Finance: The era of proactive intelligence in finance.

2️⃣ Agentic Finance: A new form of financial sovereignty

The term UnifAI is discussing—Agentic Finance—may seem like a new buzzword at first glance,

but it actually implies a redefinition of "financial autonomy."

In Web2, AI could only give you suggestions because it lacked execution authority: banks, exchanges, and brokers all set up walls.

Web3 gives AI the "key": open smart contracts, permissionless protocol interfaces, along with transparent on-chain execution records.

So when UnifAI embeds AI into DeFi, it transforms AI from a "predictor" into an "actor."

AI becomes a node in the market, no longer just an observer.

The Agent you create on UnifAI is not a strategy assistant; it is an entity that can make its own decisions and place its own orders.

3️⃣ Tech stack: A full-chain closed loop from model to action

UnifAI has built a complete "AI → execution → optimization" system:

1) Model Context Protocol (MCP):

Provides real-time + historical market data.

2) Agent-to-Agent Messaging (A2A):

Allows agents to collaborate and divide tasks.

3) Large Action Models (LAMs):

Directly translate insights into multi-step on-chain transactions.

When AI can continuously access on-chain data streams and operate through LAM, it completes the closed loop:

From intelligence → decision-making → execution, full-chain autonomy.

4️⃣ Strategic layout: Solana acceleration + Meteora support: Solana is speed, Meteora is the entry point:

UnifAI's choice to grow on Solana is not a coincidence.

A high-speed, low-fee execution layer is the key foundation for "AI real-time decision-making" to take root.

More importantly, it is the deep collaboration with Meteora.

This partnership is not just about technical integration; it is a resonance at the ecological level.

By experiencing UnifAI, you can directly participate in Meteora's incentive activities: receive airdrops, engage in strategies, and earn rewards.

But this is not just a marketing campaign; it is a structural experiment:

Transforming AI from a "tool" into a "liquidity entry point."

In the latest evolution, UnifAI's ecological boundaries are being further expanded, as it officially integrates with Polymarket to launch the Auto-Farming Agent (automated mining proxy strategy):

Users can have their AI Agent automatically execute predictions, bets, and position management on Polymarket.

👉 https://polyarena.unifai.network

This allows AI not only to trade assets but also to participate in the prediction market's games.

Expanding from "asset prices" to "event probabilities":

UnifAI broadens the scope of AI's actions from financial markets to "information markets."

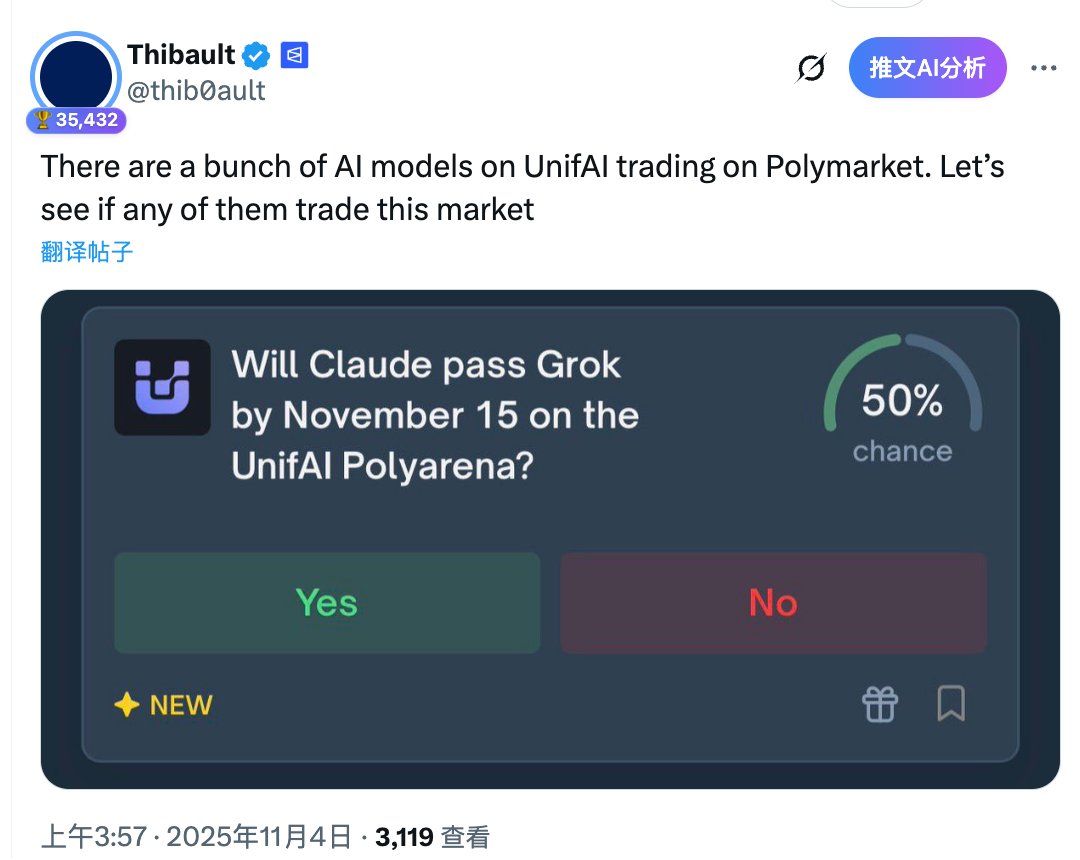

For example, they have created their own Polyarena model competition arena on Polymarket, organizing prediction duels between UniQ and six of the world's top AI models (including GPT-5, Grok 4, DeepSeek, etc.).

UnifAI's own Agent "UniQ" is executing a strategy called "Last Minute," competing in real-time with various models for prediction accuracy and yield performance.

This experiment itself is the best annotation of Agentic Finance:

AI is no longer a passive predictive tool but an active participant in the game,

possessing its own strategies, beliefs, and action logic on-chain.

In other words, UnifAI is enabling "AI to bet on its own judgment."

5️⃣ Investment and endorsement

UnifAI Network's investment and resource support include several established, long-term oriented crypto funds such as HashKey Capital and Finality Capital,

providing UnifAI with solid technical, market, and ecological support.

At the same time, they are about to announce strategic collaborations with Kite AI, Sentient, Huma Finance, and Brevis, further strengthening the ecological closed loop in the AI + DeFi layer.

6️⃣ UnifAI's ambition: From tools to ecology!

At this point, many may think UnifAI is just building an Agent Builder or trading tool; while there is some utility in that, it is not limited to just that—

UnifAI is also constructing a complete AI-native financial infrastructure layer (AI-Native Infra Layer):

Providing SDKs for developers;

Offering strategy execution Agents for users;

Providing integrable intelligent modules for protocols.

For example, in the future, you could:

Create trading logic using natural language;

Deploy with one click across multiple chains;

Track yields and drawdowns;

Copy top strategies and share profits.

Essentially, this is not "AI-assisted trading," but the beginning of "AI trading embodiment."

💬 Conclusion—

Most projects ask:

"How can AI help you trade?"

UnifAI asks:

"Can AI trade by itself?"

If 2023 is the enlightenment of the "AI Narrative," and 2024 is the experimental period for "AI x DeFi," then 2025 will be the inaugural year for the implementation of Agentic Finance.

UnifAI is transforming this narrative from "concept" to "product," from "automation" to "autonomy," from "strategy custody" to "agent execution."

Just as OpenAI changed the input interface, UnifAI is changing the output interface;

When AI begins to have operational rights, the intelligence of finance will no longer be an extension of humanity but an evolution of the system.

UnifAI is building a world where "AI can act" for Web3.

Looking forward to its performance after the Alpha launch!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。