大家好,我是老吕,今日已经是回归后的第三篇文章了,昨天的文章是否精彩,是否给力,我相信此时应该要有掌声了,如果你喜欢老吕的风格和文章,不妨分享点赞转发给需要的人,又何尝不是对老吕精神上的激励呢?昨天我们思路很清晰,点位很精确。就是要看双币种双双突破支撑位,拉个瀑布。到目前为止,没有让老吕失望,比特总跌幅达到了4000美金,以太坊接近300美金,但以破位的力度来说的话还不够,虽然跌了不少,但是老吕还是那句话,它依旧是个震荡行情,不属于那种日线级别的破位单边,而是上涨后周期性调整,这波空头走完,多头还是要慢慢回归的,所以,有现货的朋友把心放在肚子里,日线级别多头并没有结束,但是也请给它们调整的时间,在正式开始解析之前,我们先来回顾一下昨天的价格走势。

比特币,昨天我们从头到尾说的十分坚决,就是要看跌破看大跌,用的技术原理也十分简单,十分粗暴。技术点:支撑位反复测试的失效性,所以说技术不要搞得太复杂,最简单的就是最有用的,有些朋友搞了一堆技术指标,看这个也行,看那个也行,最后得出的结论就是:技术指标都不行,其实说到底还是没理解透彻。当然,老吕嘴上虽说的轻巧,这也跟经验分不开,离不开日日夜夜的盯盘和总结。比特币昨天小时线一路连阴下跌,亚盘时间段破了新低,随后下午欧盘继续破新低,这个时候你就要注意,美盘那个时候的突然拉伸,一定是诱多,也就是我们交易人常说的骗盘,所以,昨天老吕抓紧在晚间19点8分做了紧急提醒,要大家破位后一定要及时锁仓和割肉,果不其然,老美在晚间10点时,将比特价格缓慢拉伸至108300美元,也就是要骗欧洲盘和亚洲盘的多单上车,然后继续砸盘,有人说,老吕你怎么知道这些套?老吕想说的是,老吕不仅是一名交易者,更是一名资深老韭菜,只是走在了大部分人前面,我们晚上没有犹豫,提示所有人以108400美元为压力点,继续看下方破位大跌!目前近4000美元的下跌,能吃多少,全看各位的胆量,这也将是今年老吕的主要交易风格,小单不看,专盯大単,当然这也是需要大波动支持的,而当下比特10万刀的大基数,哪怕是每天只波动2%,也十分足够,也吃得很饱!

当下比特破位后,做空一定是需要激进的,因为这才刚刚跌破支撑位,如果出现了较大幅度的反弹,接下来价格肯定是不好跌的,继续按照昨晚的循环下跌思路,把进场点位直接放在小时线去看,最近的压力点在106000-106500这个区间,也就是0.618反弹的位置,而106000美元也正是前期下跌的支撑位,当前破位后能否形成短期顶部,就需要看这个位置的有效性,所以,不妨大胆一点!

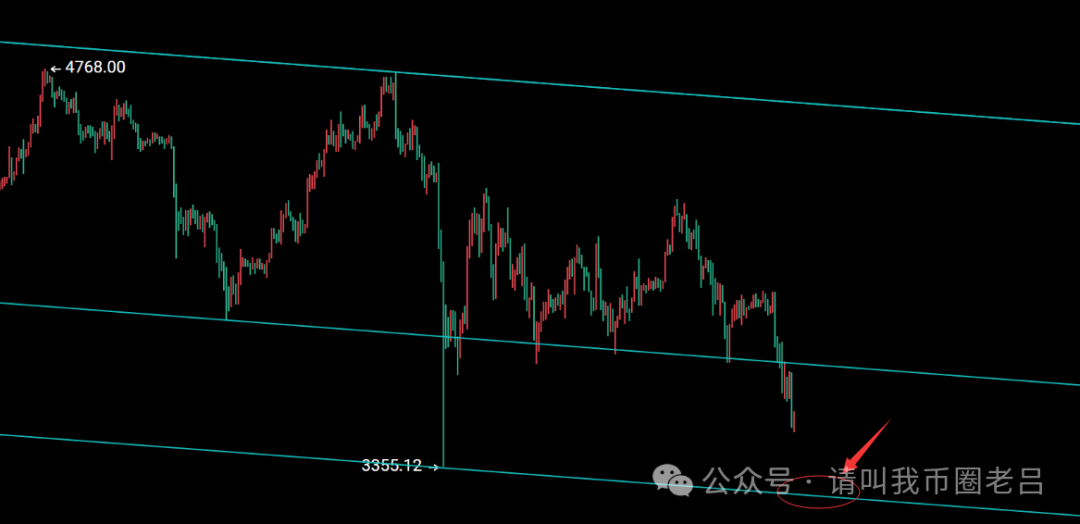

以太坊,其实没有太多必要拿出来讲,走势跟比特完全一致,只是跌幅上稍加逊色,昨天明确提示3750附近做空,价格最高给到3748美元,压力点十分有效,目前价格最低3459美元,接近300,但也够吃,就不反复阐述了,说多了就显得老吕又骄傲了,就当下的下跌而言,目前已经引起市面上大多数人的恐慌了,大家不是对市场没信心,而是对兜里那几个子没信心了,也不确定接下里的跌幅,能不能支撑得起。别急!它来了,老吕预计这波跌幅将会在3340-3280这个区间,迎来止跌,比特的话预计在101000-101300,因为它的基数够大,所以会加大的下跌幅度。早间以太坊已经完成上方的顶底转换,也就是老吕前期说的大支撑3640美元,刚好早间也是以3640为起点再次大跌。但是价格真要再回到这个位置,今天肯定也不太好跌了,综上,以太做空也是激进原则,以3580小周期为压力,继续看循环下跌。

区别:目前比特币在10月10号大跌之后,形成了二次反弹低点,也就是103450美元,今天刚好就是也刚好在这个位置形成短暂支撑,所以,比特币的空我认为需要稍微保守一点,毕竟形态上强于以太坊,所以同时在下跌的过程中,比特在加速,也就是要追上以太的下跌形态,称为补跌,回头看以太,已经破位了前期二次反抽低点3640美元,并且早间已经完成形态转换,所以空单,可以稍微激进一些。这是思路上的不同。

比特币上方105800附近空

以太坊上方3570附近空

今日:2025年11月4日晚间19点49分撰写 老吕,注意所有策略生效一次,不可反复使用!关注微信公众号:请叫我币圈老吕,每日首发

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。