原文标题:How We Made +$50M Sniping Shitcoins On DEXs

原文作者:CBB,加密 KOL

原文编译:Luffy,Foresight News

编者语:本文作者 CBB 是活跃于 DeFi 与杠杆交易社区的知名玩家,曾因分享利用 HyperEVM 套利机器人赚取 500 万美元的经历而受到广泛关注(详见:《解析 HyperEVM 套利机器人:如何抓住 2 秒机会赚到 500 万美元?》)。在 10 月 29 日,CBB 还曾发文提醒 Stream 旗下 xUSD 存在高杠杆风险。今日,或受到 Balancer 被盗影响,XUSD 果然大幅脱锚。

在本文中,他讲述了自己在一年时间内,从初入加密世界,到在 DEX 狙击山寨币实现 5000 万美元盈利的完整历程。以下为原文内容:

2020 年 8 月。我哥哥在大学里教信息技术,而我刚结束一份为期 18 个月的保险公司产品经理工作。

加密货币行业告别了多年来的低迷,正从新冠疫情引发的崩盘潮中缓慢复苏。我们在币安 Launchpad 上小赚了几笔,但投资组合总价值勉强只有 5 万美元。

这时,我们开始听说一个叫 Uniswap 的新协议。朋友们在上面交易山寨币,常常能在几小时内斩获 3-4 倍收益。我们完全不清楚这是什么,但直觉告诉我们,这东西不一般。

一个朋友跟我聊起了「狙击交易」。他说 bZx 代币在 Uniswap 上线时,一个机器人单靠狙击就赚了 50 万美元。简直难以置信。我和哥哥都惊呆了,迫切想知道这到底是怎么做到的。

当时我哥哥对 Solidity 智能合约语言一窍不通,我们甚至都不明白区块链的底层逻辑。

首次狙击尝试

8 月下旬,我们和家人在西班牙度假。为了尝试在 Uniswap 上做狙击交易,我哥哥几天前刚开始学习 Solidity。

有个叫 YMPL 的代币要上线了,市场热度看起来还不错。我们组建了一个狙击小组,还拉了几个朋友一起凑资金——毕竟我们还是新手,不想独自承担风险。

我们投入了 50 枚 ETH(当时价值约 2 万美元)。YMPL 一上线,我们就成功狙击到了上线供应量的 8%。我登录 Uniswap,不到 30 分钟就全部卖出。

盈利多少?60 枚 ETH(约 3 万美元)。要知道我们当时整个投资组合还不到 5 万美元,那一刻我们欣喜若狂,感觉赚钱竟如此容易。

我们想要赚更多。

两天后,新的狙击目标出现:VIDYA。这次有了上一轮的盈利加持,资金更充裕,心态也更自信了。我们投入 165 枚 ETH,15 分钟内净赚 159 枚 ETH,比上一次收益还高。

四天后,又一个狙击机会来了。我们投入 460 枚 ETH,盈利 353 枚 ETH,折合 13.5 万美元。这是我们第一次在不到一小时内斩获六位数收益,那种感觉简直太棒了。

Uniswap 的热度彻底爆发,交易量飙升,加密货币狂热玩家蜂拥而入。我们心里清楚,这种轻松赚钱的日子不会长久。我们必须变得更专业,得真正搞懂狙击交易的底层逻辑。

狙击交易的原理是什么?

要在 Uniswap 上发行代币,项目方必须先向资金池添加流动性。我们前几次狙击时,都是等「添加流动性」的交易记录上链后才发送买入交易,结果总是慢了一个区块。

而有些竞争对手,却能做到和添加流动性的交易「同区块入账」。

经过一番研究我们发现,通过以太坊节点,我们可以监控公开内存池(mempool),在交易正式上链前就能看到待处理的交易信息。

从 9 月开始,我们的狙击流程变成了这样:

1. 监控内存池,捕捉待处理的「添加流动性」交易;

2. 立即发送买入交易,设置相同的 Gas 费;

3. 目标是让买入交易与添加流动性的交易处于同一个区块,且紧随其后执行。

以太坊上狙击的新时代

2020 年 9 月中旬。

连续十天都没有新代币上线,这段平静期正好让我们升级机器人。

但新的挑战也随之而来:暑假结束了,我哥哥还要继续在大学教书,有时候狙击机会正好赶上他上课。幸运的是,当时还处于新冠疫情期间,所有课程都是线上进行。

每当有代币即将上线,他就会跟学生说:「你们自己研究十分钟。」借着这个空档,他就能专心操作狙击交易。

下一个狙击目标是 CHADS。市场热度空前,我们准备投入 200 枚 ETH,志在必得。

我和哥哥开着语音通话,既紧张又兴奋,压力拉满。

他是第一个在终端上看到「添加流动性」交易的人。当机器人检测到信号时,他用严肃的语气说:「Ça part.(法语,意为『开始了』)」

这句话我一辈子都忘不了。之后每次狙击前,他都会用一模一样的语气说出这句话,瞬间让我肾上腺素飙升。

一听到这句话,我就疯狂刷新 Etherscan 浏览器,盼着看到我们的 ETH 余额清零——这意味着我们成功入场了。

我们真的买到了,200 枚 ETH 的仓位。K 线图瞬间暴涨,我的任务就是在 Uniswap 上手动卖出。

CHADS 的收益数字实在太惊人了。我手抖得厉害,浑身冒汗,注意力高度集中,只是一批接一批地卖出,尽可能锁定更多利润。

最终我们净赚 675 枚 ETH(约 27 万美元)。那种感觉难以置信,但巨大的压力和肾上腺素也让我们筋疲力尽。

根本没时间休息。三天后是 FRONTIER,同样的操作流程,同样的紧张刺激,盈利 800 枚 ETH。

两天后是 CHARTEX,盈利 700 枚 ETH。

六天时间,我们累计盈利 2300 枚 ETH,简直疯狂。而就在一个月前,我们在加密行业摸爬滚打多年,总资产最高也才 10 万美元。

9 月 18 日,一个意外惊喜降临:Uniswap 空投。所有与 Uniswap 有过交互的地址都有资格领取。

由于之前几周我们一直在进行大规模测试,手里积累了大量符合条件的地址,每个地址能领到约 2 万美元。我记得我哥哥翻遍了所有能找到的钱包,总共从中领取了数百万美元。

那个月我们最后一次狙击的是 POLS——Polkastarter 的平台币,而 Polkastarter 在当年晚些时候成为了顶级 Launchpad。

智能合约与基础设施升级

是时候再次升级我们的机器人了。

在狙击的第一个月,我们设置了买入限额:投入 X ETH,至少要买到 Y 数量的代币。这种机制下,我们必须分多笔交易执行,尤其是在大多数情况下,我们根本不知道项目方会添加多少流动性。

举个例子:如果项目方只添加 20 ETH 的流动性,而我们试图用 200 ETH 买入,预设的限价就会完全失效。

我哥哥设计了一套新系统:每投入 1 ETH,至少要买到 Y 数量的代币,在达到这个限价前,能买多少就买多少。我们是第一个实现这种机制的。

另外一个难题是,我们永远不知道项目方会用 ETH、USDT 还是 USDC 来添加流动性。我哥哥为此设计了一款智能合约,无论上线交易对是什么,都能自动买入目标代币。

我们还在努力提升机器人的速度。在 CHADS 狙击战中,虽然盈利丰厚,但我们显然不是添加流动性后第一个入场的狙击者。

我们在多个地区部署了以太坊节点,让它们相互竞争,争夺同一笔交易的狙击权。很快我们发现,部署在弗吉尼亚州北部的节点速度始终最快。

这让我们相信,弗吉尼亚州北部是运行狙击服务器的最佳地点。

进一步研究后,我们的猜测得到了证实。当时几乎所有用户都通过 MetaMask 进行交易,而 MetaMask 会将所有「添加流动性」交易通过 Infura 的公开 RPC 端点路由,而 Infura 的服务器就位于弗吉尼亚州北部。更广泛地说,大部分以太坊基础设施都集中在该地区。

因此,亚马逊云服务弗吉尼亚州北部节点被证明是最具竞争力、延迟最优的狙击配置。

我们还制定了一套非常规范的山寨币狙击流程:

1. 寻找狙击目标:通常有 10-15 个加密圈朋友帮我们挖掘新的热门山寨币。谁先发现目标,就能以 15% 的资金比例参与狙击(同时也要承担相应风险)。有些朋友单靠发现狙击目标,就赚了 30 万到 70 万美元。

2. 确认上线的去中心化交易所(Uniswap、Sushiswap 等);

3. 确认上线交易对(ETH、USDT、USDC 等);

4. 找到负责上线的钱包地址(链上追踪);

5. 部署狙击智能合约,设置参数:资金规模和买入限价;

6. 上线后立即抛售,通常在 30 分钟内完成——因为大多数山寨币都是垃圾。

Polkastarter 时代

从 10 月到 12 月初,市场相对平静。新代币上线速度放缓,我们甚至一度以为狙击时代就要结束了。好在我们已经积累了大量 ETH,就算只是持有也过得不错,日子很惬意。

但到了 12 月,山寨币市场卷土重来。Uniswap 上的代币发行重新活跃,一个新的 Launchpad 也悄然登场:Polkastarter。

它的首次发售是 SpiderDAO 项目,每个钱包限购 2.5 ETH。但我哥哥发现,这个限购只在用户界面(UI)层面生效,我们仍然可以通过合约直接大额买入。我们发送了几笔大额交易,成功买下了发售总量的 50%,还在上线时进行了狙击。这笔交易让我们赚了 50 万美元,我们又回来了。

这个例子充分反映了加密生态的现状。大多数项目方完全是门外汉,根本不知道自己在做什么。这对我们来说简直是天赐良机,我们当然要好好利用。

当时一些去中心化金融(DeFi)项目开始推出合成资产,我们通过套利从中赚了 60 万美元。

12 月成为了我们创业旅程的转折点——我哥哥决定辞去大学教授的职位。

次年 1 月,我们搬到了迪拜,两人都全身心投入到狙击交易中。

我们的心态很简单:只要有机会,就绝不放过。哪怕只有「区区」1 万美元的盈利空间,我们也会出手。我们知道这个窗口期不会永远存在,不想错过任何一次机会。

1 月我们又斩获了几笔不错的收益,比如 PHOON,累计盈利 300 万美元。

这些盈利大部分都以 ETH 形式持有,而 ETH 的价格也一路飙升——从我们开始狙击时的 200 美元,涨到了 1 月底的 1400 美元,前后仅五个月时间。

反狙击措施

从 2021 年 2 月开始,越来越多的项目方在代币上线时设置了反狙击措施。人们已经厌倦了狙击者,开始在代币发行中加入反狙击机制。

第一种措施:买入限额。代币上线后的前几分钟,用户只能买入 X 数量的代币。我哥哥率先设计了带有循环功能的狙击智能合约,一笔交易就能买入大部分上线供应量——每个循环都买入限额数量的代币。凭借这款智能合约,我们在竞争中脱颖而出,因为大多数竞争对手都没有掌握这种技术。

智能合约创新是我们最大的优势之一。我哥哥总能找到狙击的突破口,而且我们其实很欢迎反狙击措施——这会让竞争变得没那么激烈。

第二种措施:单钱包买入限额。我哥哥设计了带有「子智能合约」的主合约,主合约会为每一笔买入交易调用一个新的子合约。

这些功能非常实用,在接下来几个月 Binance 智能链上的山寨币狂热期发挥了巨大作用。

Polkastarter 鼎盛期与激烈竞争

从 2021 年 2 月开始,正式进入 Polkastarter 时代。每个在 Polkastarter 上发行的代币都暴涨,对狙击者来说每一个代币都是赚七位数的机会。

但竞争也变得异常激烈。我们虽然仍能盈利,但日子越来越不好过。

我们设计了一个名为「自杀式狙击」的新功能。

原理很简单:我们发现很多狂热玩家在狙击时不设任何买入限价。我们的「自杀式狙击」功能会多发送一笔无限价买入交易,然后在四个区块后自动卖出,收割所有在我们之后入场的狙击者。

这算不上能改变命运的策略,但从中赚 50-150 枚 ETH 却很容易。

后来竞争变得白热化,一个名叫 0x887 的家伙速度比所有人都快。我们花了无数个小时升级机器人,尝试定制以太坊节点以实现最快狙击速度,日复一日地反复测试,但始终无法超越这个狙击者。

Binance 智能链狂热季

时间来到 2021 年 2 月中旬。我和哥哥搬到了迪拜的同一处住所——这太令人开心了,因为过去六年我们都没在同一个城市生活过。我们全身心投入狙击交易,时刻寻找新机会,随时准备设计和开发新功能。

虽然以太坊上的竞争已经白热化,但我们仍在继续狙击,盈利也还在持续,但我们知道这种情况不会永远持续下去。

我们听说 Binance 智能链(BSC)生态发展得很好,有些代币表现亮眼。我们决定大举买入 BNB,当时价格约 80 美元——反正之后狙击也可能用得上。

我们在 BSC 上的第一次狙击是 2 月 16 日的山寨币 BRY。我们对 BSC 上的狙击模式和竞争情况一无所知,是时候一探究竟了。

投入 200 枚 BNB,30 分钟内全部卖出,盈利 800 枚 BNB,折合 8 万美元。虽然不如以太坊上的盈利,但也相当不错,潜力可期。

我们的第二次 BSC 狙击目标是 MATTER:投入 75 枚 BNB,卖出 2100 枚 BNB。我的天,净赚 2000 枚 BNB!而且 BNB 价格表现强劲,到 2 月底已经涨到了 240 美元。我们感受到了巨大的潜力——顶级狙击者 0x887 似乎根本不关注 BSC,这对我们来说简直是白送钱。我们必须全力以赴,狙击所有目标。

3 月是丰收的一个月。以太坊上的代币发行依然火爆,我们赚了数百万美元;而 BSC 市场更是疯狂,整个 3 月我们盈利 1.5 万枚 BNB,尤其是 KPAD 这一笔,就赚了 8300 枚 BNB。

我对 KPAD 的狙击战记忆犹新,这是我们迄今为止最大的一笔单笔收益。

当时我在迪拜的公寓里,知道这个代币上线热度极高,肯定会暴涨。我紧张得冒汗,甚至怀疑自己能不能成功入场。

项目方上线后,BSCscan 浏览器卡得要命,我登录 Pancakeswap,看到钱包里躺着一大堆 KPAD——我的天!注意力瞬间高度集中,我简直像个痴迷的电脑狂人,开始分批抛售。仅仅卖出 1% 的仓位,就赚了一大笔钱。我手抖得厉害,全神贯注地执行抛售操作,一小时内盈利 200 万美元。

五天后,一个叫 COOK 的山寨币要在多条链上上线。我跟哥哥说,应该把狙击重点放在火币生态链(HECO)上,因为那里的竞争会非常小。代币在 HECO 上线后,我们投入 550 枚 BNB 买入,然后在 BSC 上的交易对还未解锁时,成功跨链转到 BSC,全部抛售,盈利 3000 枚 BNB。那种感觉太棒了!

到 3 月底,BNB 的价格已经涨到了 300 美元。

BSC 基础设施与优化

4 月初,市场节奏放缓。我们趁机去马尔代夫度假放松,但刚落地就听说 BSC 上有几款热门山寨币即将上线,必须做好准备。

我们决定在 BSC 上进行速度测试。当时 BSC 的运作模式和以太坊不同:在以太坊上,你需要快速检测到待处理的添加流动性交易,然后快速将自己的交易发送到其他节点。

而几周前我们就发现,BSC 上区块内的交易排序是随机的。当你检测到待处理交易并发送买入交易时,你的交易可能会排在添加流动性交易之前,导致交易失败。

我们在亚马逊云服务(AWS)的全球节点上部署了 10 个节点,每个节点发送 50 笔交易,尝试狙击一笔随机测试交易。完成 20 组测试后,我们对与添加流动性交易同区块的交易进行了分析。

得出以下几个结论:

1. 性能最佳的节点位于弗吉尼亚州北部、法兰克福,有时东京的节点也表现不错;

2. 单个节点发送的前 5-15 笔交易最有可能成功进入目标区块;

3. 亚马逊云服务(AWS)上配置最高的服务器,能让更多交易成功进入目标区块。

为了后续的狙击交易,我们在 BSC 上搭建了由 150-200 个节点组成的基础设施,每个节点发送 10 笔交易。

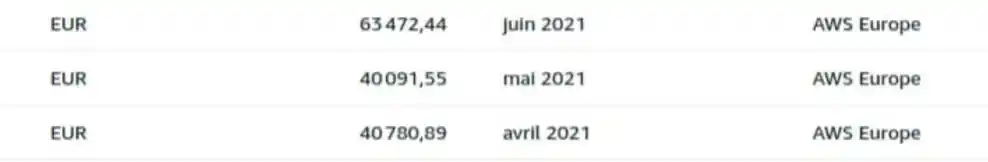

运行这样一套基础设施的 AWS 费用每月在 4 万到 6 万美元之间。

对我哥哥来说,运营这套基础设施是个不小的挑战——他必须在 150 个终端上逐个启动节点。要知道,我们没有任何员工,所有事情都得自己来,就我和哥哥两个人。

我们在 BSC 上拥有巨大优势:一方面有以太坊上的丰富经验,另一方面也愿意在基础设施上投入资金,这为小型狙击者设置了很高的门槛。

BSC 上的 Memecoin 时代

现在我们全身心聚焦 BSC,有时一天要进行 6 次狙击,几乎没有时间正常生活,满脑子都是狙击山寨币。我们总是在与时间赛跑,大部分时间都花在筹备新的狙击交易上,几乎没功夫优化设备。

我记得很多次狙击经历,尤其是 PINKM(Pinkmoon)那次——由于有买入限额,我们用 120 个钱包进行狙击,两小时内盈利 300 万美元。第二天,我就买了一辆兰博基尼 Aventador SV 跑车。

2021 年 5 月,BSC 上有两个 Launchpad 开始走红,任何人都可以执行上线交易。我哥哥率先设计并开发了一款智能合约,能在同一笔交易中完成代币上线和买入操作。

现在看来这可能很平常,但在当时,没人这么做过。我记得有一周,这两个 Launchpad 上的项目火爆异常,我们几乎狙击了所有上线代币,整整一周每天都赚七位数。有一天晚上,我和朋友们在 Nammos 餐厅吃饭,哥哥给我发消息说要去狙击一个项目,等我回家时,我们的盈利又多了 100 万美元。

月底,BSC 上的市场热度开始降温,我们决定在 BNB 价格约 450 美元时,抛售大部分持仓。

6 月还会有几次狙击机会,但市场整体感觉相当疲软。

这个狙击时代的结束,对我们来说其实是一种解脱——我们已经筋疲力尽,确实需要好好休息了。

整个夏天,我们都在四处旅行,终于能好好享受生活了。

一笔意外之财

2021 年 8 月,我们正在享受暑假,没怎么涉足加密货币市场,只做些基础操作。偶然间,我们发现一个被列入黑名单的钱包里,还持有之前没能卖出的 EVN 代币。

当时 EVN 的价格暴涨,仅这一个钱包里的代币就价值约 100 万美元(不含滑点,Etherscan 显示金额)——而我们被列入黑名单的钱包有 20 多个。

我们先试着在 Uniswap 上卖出价值 200 美元的代币,成功了。我们心想:「哇,或许可以每个钱包都少量抛售,说不定能赚几千美元。」

我们又在同一个钱包里尝试卖出,这次赚了 2000 美元。我们惊呆了,感觉这个下午可能会有大收获。

接着我们再次尝试,这次把这个钱包里的代币全部卖出:最终得到 233 枚 ETH(当初买入时仅花了 2.5 枚 ETH)。

肾上腺素飙升,我们赶紧检查所有被列入黑名单的钱包,尽快在 Uniswap 上抛售。有些钱包仍然处于黑名单状态,有些却解除了限制——我们完全不知道原因。我们疯狂抛售,看着数百万美元源源不断到账,简直像印钞一样。

连续 15 分钟,我们拼命抛售能找到的所有代币,然后把资金全部转入冷钱包,原本预计能赚 200-300 万美元,结果那个夏日午后,我们凭空赚了 600 万美元。

到现在我们都完全不清楚发生了什么,也不知道这些钱包为什么会被解除限制。

这个月,我们还在 ETH 价格突破 3000 美元时,卖出了大量通过狙击赚到的 ETH——我们觉得是时候锁定收益,实现财务自由了。

结语

那一年可能是我们迄今为止最疯狂的一年。最初只有 4 万美元资金,完全不懂区块链底层逻辑,甚至对 Solidity 一窍不通。

最终,我们在 10 多条不同的链上,狙击了 200 多种山寨币。能和我哥哥一起经历这一切,是我莫大的荣幸。

那些情绪起伏和刺激体验,几乎无法用言语形容。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。