原文标题:Why did Bitcoin's largest buyers suddenly stop accumulating?

原文作者:Oluwapelumi Adejumo,Crypto Slate

原文编译:Luffy,Foresight News

2025 年大部分时间,比特币的支撑位之所以看似难以撼动,是因为企业数字资产库(DAT)与交易所交易基金(ETF)意外结盟,共同构成了支撑基础。

企业通过发行股票和可转换债券购买比特币,ETF 资金流入则悄然吸纳新增供应量。两者共同构建了稳固的需求基础,助力比特币抵御了金融环境收紧的压力。

如今,这一基础正开始松动。

11 月 3 日,Capriole Investments 创始人 Charles Edwards 在 X 平台发文称,随着机构增持步伐放缓,他的看涨预期已减弱。

他指出:「7 个月来,机构净买入量首次跌破每日挖矿供应量,情况不妙。」

比特币机构买入量,来源:Capriole Investments

Edwards 表示,即便其他资产表现优于比特币,这一指标仍是他保持乐观的关键原因。

但就目前情况而言,约有 188 家企业财库持有可观的比特币头寸,其中许多企业除了比特币敞口外,商业模式较为单一。

比特币财库增持放缓

没有哪家公司比近期更名为「Strategy」的微策略更能代表企业比特币交易。

这家由 Michael Saylor 领导的软件制造商已转型为比特币财库公司,目前持有超 67.4 万枚比特币,稳居全球最大单一企业持有者地位。

然而,其近几个月的买入节奏大幅放缓。

Strategy 在第三季度仅增持约 4.3 万枚比特币,为今年以来最低季度买入量。考虑到该公司在此期间部分比特币购买量骤降至仅几百枚,这一数字并不令人意外。

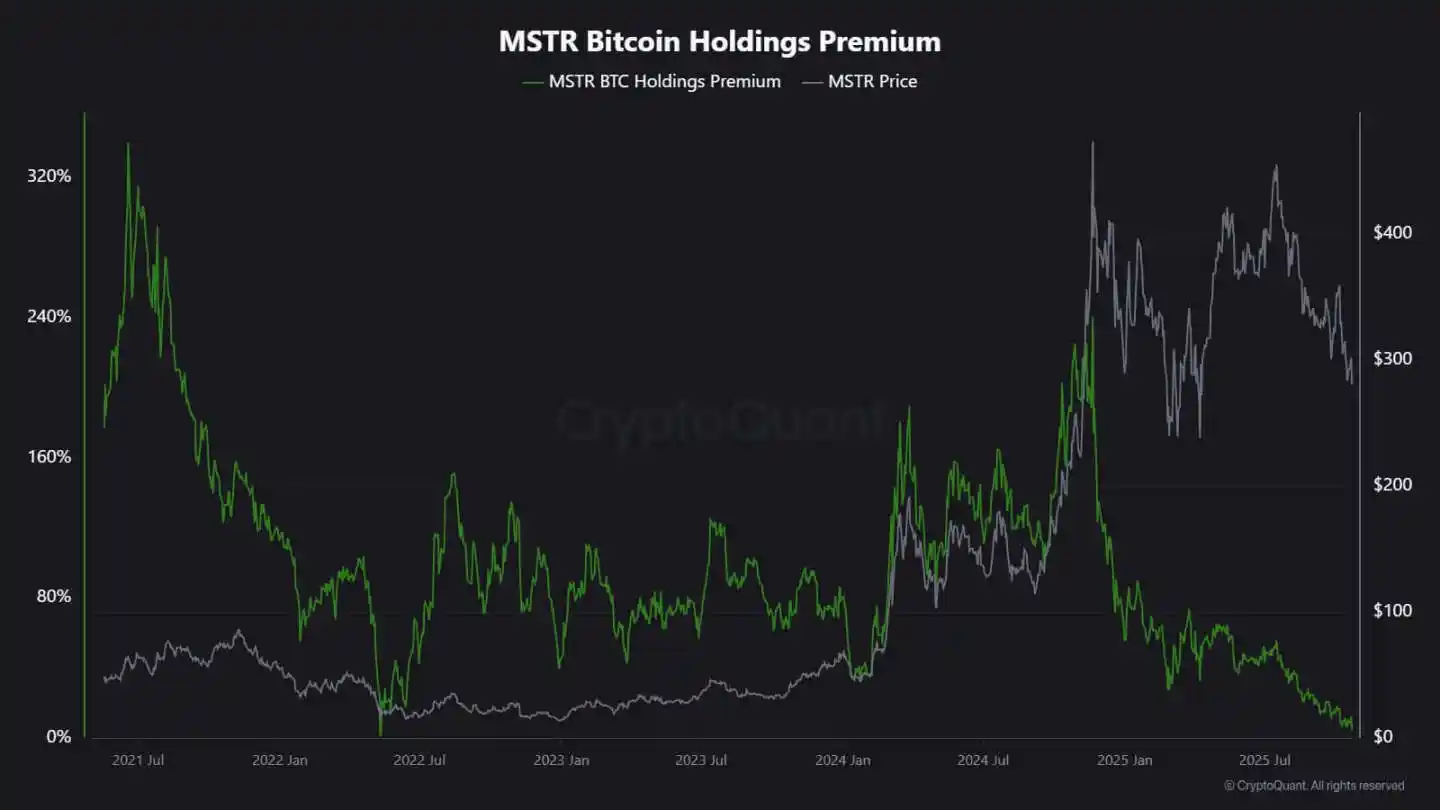

CryptoQuant 分析师 J.A. Maarturn 解释,增持放缓可能与 Strategy 的净资产价值(NAV)下跌有关。

他表示,投资者曾为 Strategy 资产负债表上每 1 美元的比特币支付高额「NAV 溢价」,实际上是通过杠杆敞口让股东分享比特币上涨收益。但自年中以来,这一溢价已大幅收窄。

估值红利减弱后,通过发行新股购买比特币不再能带来显著增值,企业融资增持的动力也随之下降。

Maarturn 指出:「融资难度加大,股票发行溢价已从 208% 降至 4%。」

Strategy 股票溢价,来源:CryptoQuant

与此同时,增持降温的趋势并非仅限于 Strategy。

东京上市企业 Metaplanet 曾效仿这家美国先驱企业的模式,但其股价在大幅下跌后,近期交易价格低于其持有的比特币市值。

作为回应,该公司批准了股票回购计划,同时推出了新增融资指导方针以扩大比特币财库。此举表明该公司对其资产负债表充满信心,但也凸显了投资者对「加密财库」商业模式的热情正在减退。

事实上,比特币资产库增持放缓已导致部分企业合并。

上月,资产管理公司 Strive 宣布收购规模较小的比特币资产库公司 Semler Scientific。合并后,这些公司将持有近 1.1 万枚比特币。

这些案例反映的是结构性约束,而非信念动摇。当股票或可转换债券发行不再能获得市场溢价时,资金流入就会枯竭,企业增持自然随之放缓。

ETF 资金流向如何?

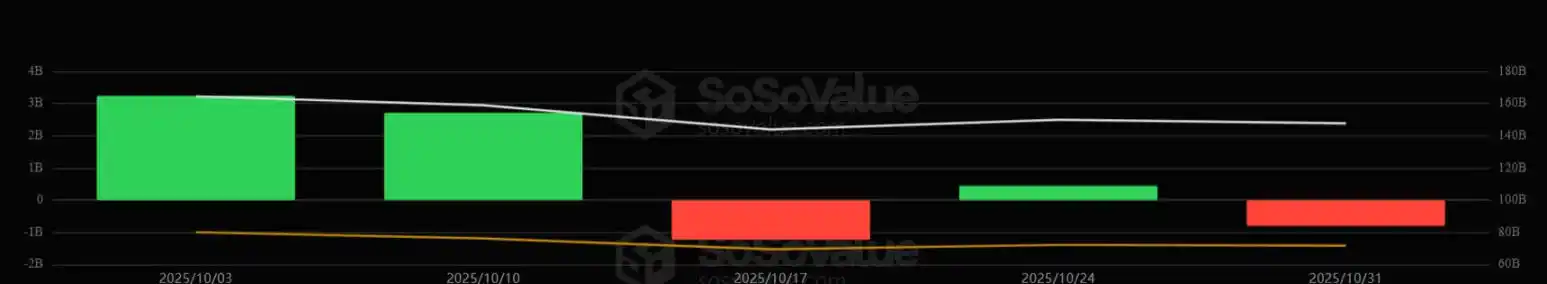

长期被视为「新增供应量自动吸纳器」的现货比特币 ETF,也出现了类似的乏力迹象。

2025 年大部分时间里,这些金融投资工具主导了净需求,申购量持续超过赎回量,尤其是在比特币飙升至历史高点期间。

但到 10 月下旬,其资金流向变得不稳定。受利率预期变化影响,投资组合经理调整头寸、风险部门削减敞口,部分周资金流向转为负值。这种波动性标志着比特币 ETF 进入了行为新阶段。

宏观环境已收紧,快速降息的希望逐渐破灭,流动性条件降温。尽管如此,市场对比特币敞口的需求依然强劲,但已从「稳步流入」转为「脉冲式流入」。

SoSoValue 的数据直观反映了这一转变。10 月前两周,加密资产投资产品吸引了近 60 亿美元资金流入;但截至月末,随着赎回量增至 20 多亿美元,部分流入被抹去。

比特币 ETF 周资金流向,来源:SoSoValue

这一模式表明,比特币 ETF 已成熟为真正的双向市场。它们仍能提供深厚流动性和机构准入渠道,但不再是单向的增持工具。

当宏观信号波动时,ETF 投资者的退出速度可能与入场速度同样迅速。

对比特币的市场影响

这一转变并不必然意味着比特币将迎来下跌,但确实预示着波动性将加大。随着企业和 ETF 的吸纳能力减弱,比特币的价格走势将越来越受短期交易者和宏观情绪驱动。

Edwards 认为,在这种情况下,新的催化剂——如货币宽松、监管明确或股市风险偏好回归——可能会重新点燃机构买盘。

但就目前而言,边际买家态度更为谨慎,这使得价格发现对全球流动性周期更为敏感。

影响主要体现在两方面:

第一,曾作为支撑位的结构性买盘正在减弱。在吸纳不足的时期,盘中波动可能加剧,因为缺乏足够的稳定买家来抑制波动性。2024 年 4 月的减半从机制上减少了新增供应量,但若无持续需求,仅靠稀缺性无法保证价格上涨。

第二,比特币的相关性特征正在转变。随着资产负债表增持降温,该资产可能再次跟随整体流动性周期波动。实际利率上升和美元走强时期可能对价格构成压力,而宽松环境则可能使其在风险偏好回升行情中重拾领涨地位。

本质上,比特币正重新进入宏观反射阶段,其表现更接近高 beta 风险资产,而非数字黄金。

与此同时,这一切并未否定比特币作为稀缺、可编程资产的长期叙事。相反,这反映了机构动态的影响力日益增强——这些机构曾使比特币免受散户驱动的波动影响,而如今,正是当初将比特币推入主流投资组合的机制,使其与资本市场的关联更为紧密。

未来几个月将考验在缺乏企业和 ETF 自动资金流入的情况下,比特币能否维持价值存储属性。

如果参照历史,比特币往往具备适应能力。当一个需求渠道放缓时,另一个渠道就会涌现——可能来国家储备、金融科技整合,或宏观宽松周期中散户的回归。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。