Original|Odaily Planet Daily (@OdailyChina)

The cryptocurrency market has once again entered a period of decline and volatility, and the major crypto whales, known for being the "trading barometers," have resumed their performances as expected. However, for these whales with substantial capital, recent trading operations have been far from satisfactory. Some have chosen to continue increasing their positions after experiencing a market rebound, only to face unrealized losses of tens of millions of dollars; others have profited from token surges but are still far from breaking even; and some have opted to sell BTC directly on exchanges to lock in profits. Odaily Planet Daily will summarize the recent operations of crypto whales in this article for readers' reference.

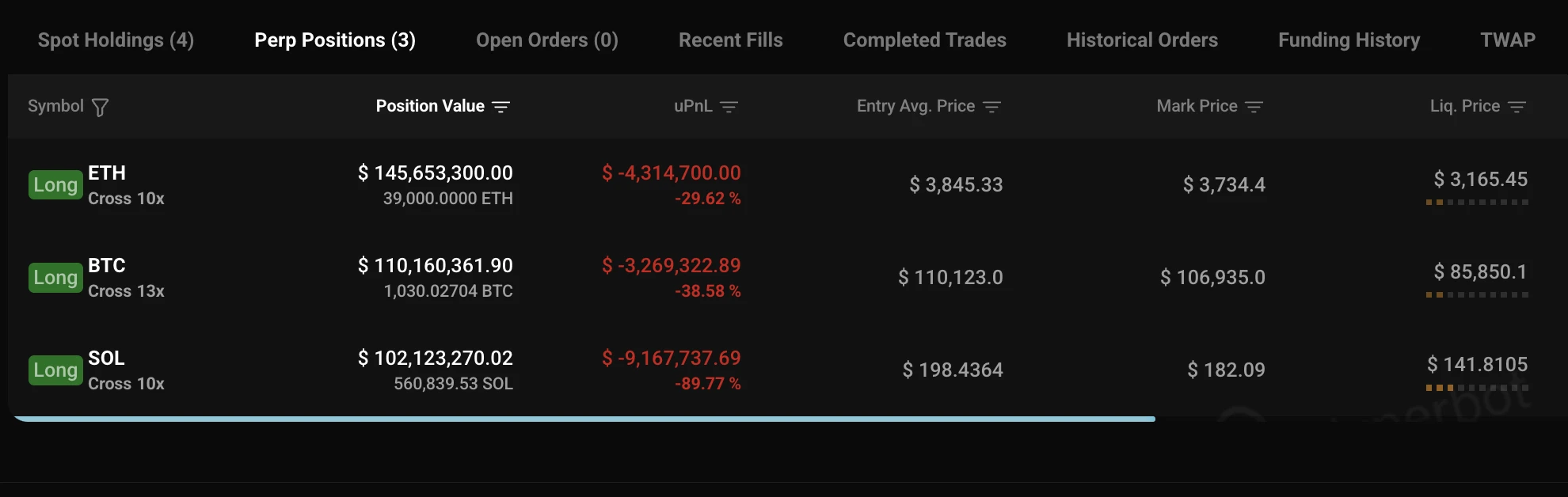

Whale with 100% Win Rate Faces Nearly $40 Million in Unrealized Losses Over the Past Week, Position Value Exceeds $380 Million

As the crypto whale with the highest win rate since the "October 11 Crash," known in the community as the "100% Win Rate Whale," the current position status is also not optimistic.

At the end of October, it opened long positions in BTC and ETH, with unrealized profits exceeding $10 million in three days;

On October 27, its position once had unrealized profits exceeding $20 million;

On October 28, it opened a long position in SOL and quickly pushed the position value to over $21 million that day;

On October 29, it closed its BTC long position, realizing a profit of $1.4 million; at that time, it still held long positions in ETH (5x leverage) and SOL (10x leverage), valued at $263 million, with an unrealized loss of $1.3 million; that afternoon, it began to reduce its ETH long position, first reducing by 3,400 ETH, realizing a profit of $186,000; then reducing by 11,000 ETH, realizing a profit of $618,000. Ultimately, that afternoon, it closed its ETH long position, with a total profit of $1.637 million; it only held a SOL long position, valued at $74.21 million, with an unrealized loss of $1.68 million.

On October 30, it opened a long position in BTC again, and combined with the SOL long position, it quickly faced a total unrealized loss of $3.33 million; subsequently, after Powell's speech caused the market to decline, it opened a long position in ETH. By noon that day, its unrealized loss surged to around $6.5 million.

On October 31, its long position saw unrealized losses increase to over $16 million, including:

- ETH long position unrealized loss of $4.31 million;

- BTC long position unrealized loss of $3.27 million;

- SOL long position unrealized loss of $9.16 million.

The subsequent story is well-known—

On November 1, the unrealized loss narrowed to around $7 million;

On November 2, it increased its SOL long position again, adding 23,871.83 SOL, spending about $4.39 million, and the unrealized loss narrowed again to $6.3 million.

As of the time of writing, this insider whale has given back the profits from previous contract openings; its unrealized losses over the past week have increased to nearly $40 million.

For on-chain information, see: https://hyperbot.network/trader/0xc2a30212a8DdAc9e123944d6e29FADdCe994E5f2

Copycat Whales Also Hit Hard by the Market, Two Whales Lose Over $1.2 Million

Ironically, perhaps due to the impressive past performance of the 100% Win Rate Whale, there are many followers in the market. However, as the market continued to decline, these followers quickly learned their lesson.

Address 0x955…396A8 opened a long position in BTC during the morning of October 30 when BTC rebounded, but then panicked and closed the position during a rapid midday pullback, losing about $217,000 in just 4 hours;

Address 0x960…0e2Ee chased BTC and ETH on October 27 when the BTC price hit a high of $115,372.8, with a total position that once reached $36.87 million, ultimately liquidating during the decline, with a loss of about $1.061 million in 24 hours.

It is worth mentioning that the whales who lost heavily by going long on BTC are far more than these three.

40x Long BTC, Whale Liquidated in One Day, Losing $6.3 Million

On October 30, a whale using 40x leverage to go long on $107 million worth of BTC was liquidated during the subsequent drop that evening; ultimately, a long position valued at $143 million was entirely liquidated, resulting in a loss of $6.3 million.

This whale subsequently used the remaining $470,000 after liquidation to continue going long on BTC with 40x leverage, with a position value of $19 million, and the liquidation price was only $1,200 away from the current price.

Currently, this whale's address has chosen to go long on ASTER, VIRTUAL, and ZEC with 5x leverage, all of which are in a loss state.

For on-chain information: https://hyperbot.network/trader/0xf35a60331a38326a6af92badd89622555181fb59

Two Whales Go Long on ZEC, Profits Once Exceed $4 Million, One Loses Over $6 Million

On November 1, according to OnchainLens monitoring, as ZEC's market cap surpassed XMR, two whales holding positions on HyperLiquid significantly profited from their long positions, including:

New address 0x519c held a 5x long position in ZEC, with unrealized profits of about $2.2 million at that time; this address has now closed its position, with total profits exceeding $1.58 million.

For on-chain information: https://hyperbot.network/trader/0x519c721de735f7c9e6146d167852e60d60496a47

Address 0x549e also held a 5x long position in ZEC, with unrealized profits of about $1.8 million at that time; currently, profits have retraced to around $1.14 million;

Meanwhile, its HYPE 10x long position, which once had unrealized profits of about $2.3 million, has now also retraced to a loss state.

Currently, this whale's overall account is still in an unrealized loss state exceeding $6 million.

For on-chain information:

https://hyperbot.network/trader/0x549e6dd8453ed87fccdcf4f8b37162b10edc0533

Insider Whale Quietly Locks in Profits, Long-Term Player Gains Over $14.43 Million

While some choose to battle in the market, others opt to take profits.

Long-Term Whale Sells 5,000 ETH, Profiting $14.43 Million

On October 29, according to The Data Nerd monitoring, a whale (0x742…ede) deposited 5,000 ETH into Kraken, valued at approximately $19.91 million.

It is reported that these funds were purchased by the whale six months ago at an average price of $1,582, realizing a profit of about $14.43 million in this transaction, with a return on investment of 152%. Additionally, this address accumulated 8,240 ETH three years ago at an average price of $1,195 and sold them last year at an average price of $2,954.

Insider Whale Dumps 1,200 BTC, Valued at $132 Million

On November 2, according to on-chain analyst Ai Yi monitoring, a whale (1E2…ZRpQ) that previously made substantial profits by shorting before the October 11 flash crash has transferred a total of 1,200 BTC to Kraken over the past week, valued at $132 million.

The most recent transfer involved 500 BTC, and this address has now fully liquidated its holdings.

https://intel.arkm.com/explorer/address/1E2JG2cZNkVdpdHQJ54MrpgoD28HHnZRpQ

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。