加密市场今天下跌:真正的罪魁祸首是谁?

目前,加密市场 正在经历急剧下跌,比特币、以太坊和其他主要加密货币的价值大幅下滑。该行业的总市值下降了3.21%,降至3.6万亿美元,导致在短短24小时内超过4.5亿美元的清算。

随着市场持续波动,审视推动下跌的因素以及这对未来的影响至关重要。

加密市场今天下跌:更深入的分析

全球数字资产行业再次进入红色区域,令投资者保持谨慎。在一个矛盾的看跌“十月”之后,市场正准备迎接一个不确定的“十二月”。当前的市场崩溃可能归因于多种因素的结合,包括持续的美国政府停摆、联邦主席的鹰派言论、ETF资金流出以及数百万的清算。

美国政府停摆

值得注意的是,美国政府停摆 现在已经进入第二个月,仍未见解决的迹象。由于停摆,关于重要经济数据的的不确定性也直接影响了加密领域。总体而言,经济正面临压力,22个美国州正在经历经济收缩。这一衰退对低收入和中等收入家庭的影响尤为严重,他们在维持生计方面面临困难。这种更广泛的衰退在数字资产行业中也有所体现,行业持续下滑。

联邦主席暗示没有可能的降息

联邦主席杰罗姆·鲍威尔最近的鹰派货币政策言论引发了市场的恐慌,导致市场下跌。尽管降息25个基点,鲍威尔的言论却暗示对利率采取更谨慎的态度,导致显著的波动。他指出,

“在本次会议的委员会讨论中,对于如何在十二月进行下一步行动存在强烈的分歧。十二月会议上进一步降低政策利率并不是一个必然的结论,远非如此。”

比特币ETF资金流出

比特币ETF 正在承受巨大压力,持续的大量资金流出加剧了市场的困境。根据Fairside的最新数据,仅上周,美国现货比特币ETF就出现了11.5亿美元的提款。大型公司如黑石、ARK投资和富达管理的基金也记录了最大的资金流出,显示出投资者不情愿地从支撑比特币的金融产品中撤回。

加密清算

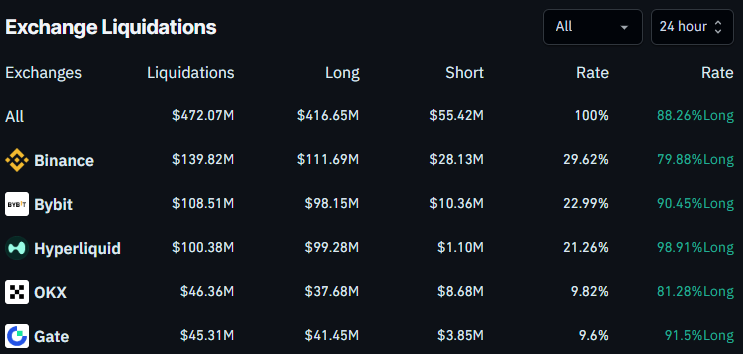

在过去的24小时内,主要交易所(包括Binance、Bybit、Hyperliquid等)上约有4.72亿美元的资产被清算。尽管4.13亿美元的多头头寸被清算,但仅有5900万美元的空头头寸被清算。在过去的12小时内,清算金额为3.66亿美元,其中335百万为多头,3100万为空头。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。