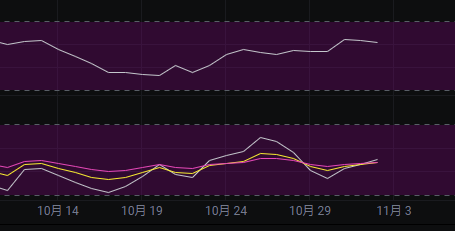

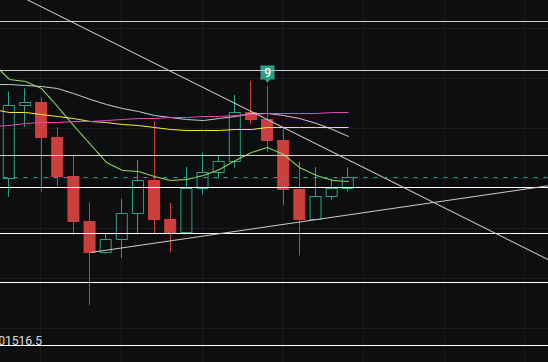

行情从宽幅过渡到窄幅后,前两天又继续走窄,目前看上下已经没有多少波动空间了,所以预计下周即可变盘。

Macd上看,随着这三天的上涨,能量柱有了一点回升,但幅度不大,毕竟行情在压缩,所以没量能也是可以理解的。

Cci上看,这几天的上涨使得cci有了一定回升,但距离零轴还有一定距离,没有回到零轴就继续保持空头思路。

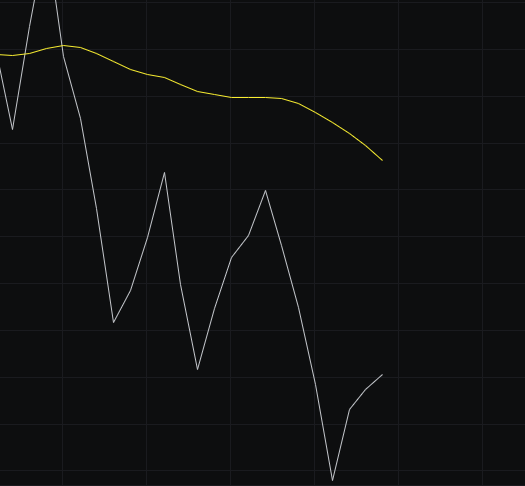

Obv上看,obv回升并不明显,同时慢线也在继续下压,这里还看不到多头的量能,所以继续保持空头思路。

Kdj上看,随着这三天的上涨,kdj有了拐头向上的倾向,但幅度不大,可以看作是横盘,kdj也在等着行情的选择。

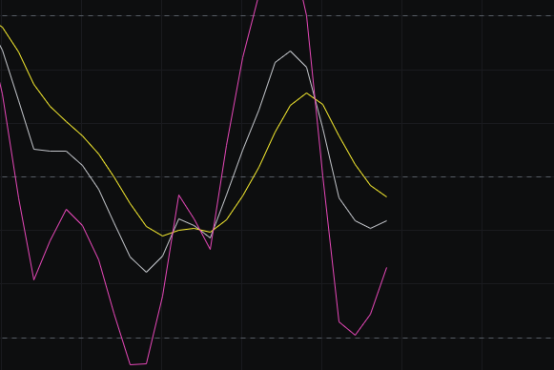

Mfi和rsi上看,两个指标都在中性区间,同时方向不一致,所以这里就看作是震荡,后续要想方向一致,需要行情连续几天向一个方向发展。

均线上看,随着这几天的上涨,价格突破到了bbi的上方,但能不能站稳是另外一回事,价格在bbi附近,这里我们就当震荡来看,同时30虽然继续下压,但120还没开始向下,所以均线上看也是在等着出方向。

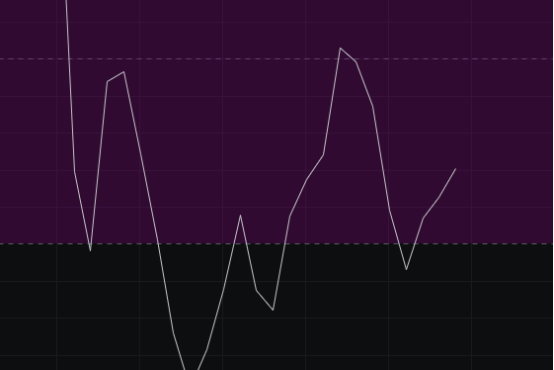

Boll上看,今天boll继续走窄,符合窄幅的逻辑,后续就是走到一个临界点,然后放量向一个方向突破,大家看到这个形态的时候要敢于上车。

综上:行情继续走窄,符合窄幅的逻辑,由于行情已没有多少压缩的空间了,所以预计下个周就会变盘。本周给空军的目标还是跌破109000,今天的压力看112000-114000,支撑看110000-109000.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。