Original|Odaily Planet Daily (@OdailyChina)

ZEC's market cap surpasses a new high of 7 billion, and DASH's contract volume hits a historical peak, bringing privacy tokens back to the mainstream market stage, prompting one to wonder what year it is today? As the market experiences a downward trend, privacy coins have become one of the few sectors that remain strong or even continue to rise, leading many to place high hopes on them. Crypto KOL Ansem places ZEC on par with BTC, and BitMEX co-founder Arthur Hayes has called for ZEC to rise to 10,000 USD twice. Behind this fervent rise, privacy coins are actually playing an alternative role in "value transfer." Odaily Planet Daily will briefly analyze and discuss the truth behind the surge in the privacy coin sector in this article for readers' reference.

The resurgence of enthusiasm in the privacy coin market: multiple factors analyzed

It is worth mentioning that the emergence and development of privacy coins is not an overnight affair.

As early as 2014, DASH became known in the market as a "privacy token." Before it, Bytecoin, which introduced the CryptoNote protocol and used Ring Signatures technology to achieve anonymous transactions, was a pioneer in the field.

In 2016, ZEC was born, characterized by the use of zk-SNARKs (zero-knowledge proof technology) to achieve "optional privacy," giving users the choice of transparent or shielded transactions. Around the same time, XMR forked from Bytecoin, using the RingCT protocol to provide default full privacy protection, thus gaining market popularity.

After 2019, due to regulatory pressure and delistings from exchanges, privacy coins faced a temporary downturn, but new privacy coin projects emerged, such as ZEN, which introduced the concept of sidechain privacy, and ARRR, which achieved 100% enforced privacy.

Strictly speaking, privacy coins can be referred to as the "most in line with the spirit of decentralization after BTC" in the cryptocurrency sector. Looking at the recent collective surge in the privacy coin sector, aside from the high-profile endorsement of ZEC by well-known Silicon Valley investor Naval, there are still multiple underlying reasons—

The U.S. government's seizure of 15 billion USD in BTC may be a direct trigger

On the 14th of this month, the news that "the U.S. Department of Justice seized a large amount of BTC assets from the founder of the Cambodian Prince Group, Chen Zhi" was made public through a lawsuit, and this asset, amounting to 127,271 BTC worth 15 billion USD, once again cast a shadow over the past "advantages" of decentralization and anonymity in the cryptocurrency market.

When regulatory iron fists target a specific individual, no matter how much wealth one possesses, it is powerless against the suppression of the iron fist, thus the market demand and attention for privacy coins have surged again. Further reading: 15 billion USD in BTC changes hands: U.S. Department of Justice eradicates the Cambodian Prince Group, transforming into the world's largest BTC whale.

Celebrity endorsements and institutional support, privacy coins regain liquidity

In the recent surge, the rise of ZEC, as a benchmark in the sector, is undoubtedly the most eye-catching. However, upon examining the initial reasons for its continuously rising price, it actually stems from a post made by well-known Silicon Valley investor Naval on October 1, quoting Helius founder mert: “Bitcoin is insurance against fiat currency. ZCash is insurance against Bitcoin.”** At that time, ZEC's price was only around 68 USD.**

On October 20, Naval reiterated ZEC and emphasized its advantages: “(Although privacy coins like XMR have been delisted from CEX), this is why Zcash offers a transparent option—to maintain its listing status on exchanges for as long as possible. However, as we gradually enter the DEX era, this is no longer as important.” His words reflect full confidence in ZEC's technical route.

Investment moguls and billionaires act like a "butterfly flapping its wings," triggering a fervent "privacy coin storm" in the crypto market.

Additionally, the over 100 million USD in assets held by Grayscale's ZCSH Trust and the listing of ZEC on Coinbase have also brought significant institutional support to ZEC and the entire privacy coin sector, leading to increased market liquidity.

Continuous development of privacy projects and ongoing technological upgrades

Recently, the ZEC development organization Electric Coin Co. (ECC) released its roadmap for the fourth quarter of 2025, focusing on reducing technical debt, enhancing the privacy and usability of the Zashi wallet, and ensuring stable management of the development fund. Key plans include: adding temporary transparent addresses for all ZEC swaps using the NEAR Intents protocol, generating a new transparent address after the address receives funds, and supporting Pay-to-Script-Hash (P2SH) multi-signature for Keystone hardware wallets.

Meanwhile, latest data shows that, possibly influenced by the Orchard protocol upgrade, the total amount of Zcash's privacy pool (Shielded Supply) has recently surpassed 4.9 million tokens, reaching 4.927 million, accounting for about 30% of the total circulating supply, indicating real adoption.

On the other hand, the established stablecoin DASH is also advancing the development of its Evolution testnet, with plans to support privacy DeFi in the future, combining cross-chain bridges (such as Solana integration) to increase TPS to over 1000, which is expected to attract more new projects to join its ecosystem.

In the crypto market, tokens reign supreme, but technological strength is also indispensable. Without continuous technological progress and user experience improvements, no matter how high the token price rises, it ultimately remains an illusion, leaving investors with nothing but a mess.

Surface privacy as a medium for dumping, is the value of privacy coins only in BTC conversion?

Aside from the above more objective facts, another possible speculation regarding the surge in privacy coins is their value as "anonymous exchange cash."

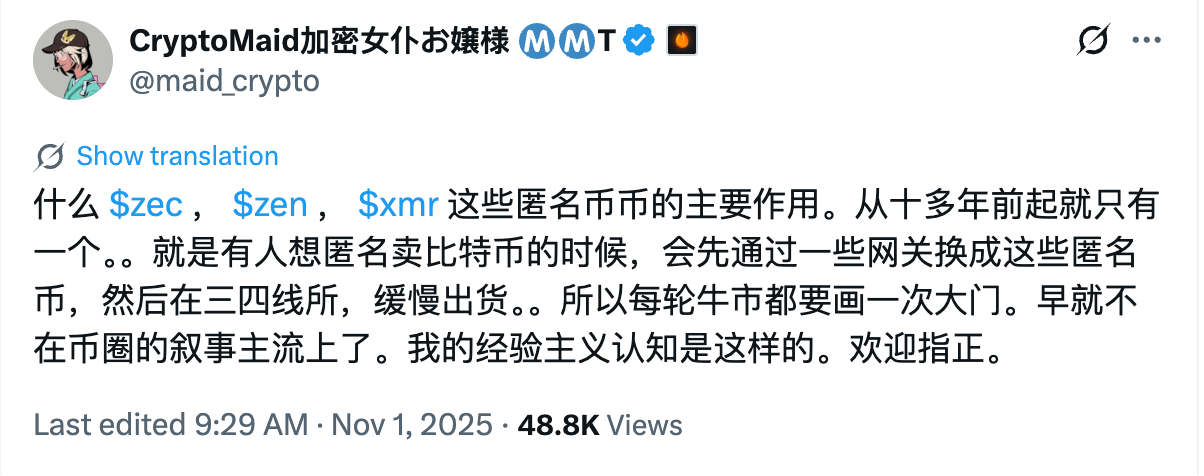

Crypto KOL CryptoMaid wrote: “What ZEC, ZEN, XMR, these anonymous coins mainly do. For over a decade, it has only been one thing—when someone wants to anonymously sell Bitcoin, they will first exchange it for these anonymous coins through some gateways, and then slowly sell it off in third or fourth-tier exchanges. So every bull market requires a big door to be drawn. It has long been off the mainstream narrative in the crypto space.”

It must be said that, in light of the recent downward trend of BTC, this viewpoint also holds some reference value.

Many times, the so-called "decentralization" and "privacy" are merely packaging concepts for offloading, while more importantly, it is the interests carried behind the concepts.

In a bustling world, where benefits are exchanged, the crypto market is particularly so.

Conclusion: Privacy is not a "cure-all," speculation can only serve as a quick remedy

Of course, privacy coins are not a "cure-all." As mentioned in a post by the Super Community's Super King here, “After researching, I found that two specific privacy coins removed their privacy features two years ago, so they shouldn't be considered privacy coins.” Upon checking one of them, it turned out that the privacy coin project no longer even had its main chain, merely relying on ordinary tokens on the Base chain. (Odaily Planet Daily Note: Many users in the comments pointed out that this viewpoint directly targets the privacy token project ZEN.)

In the pursuit of privacy, no one wishes to participate in a purely altruistic project waving the banner of "decentralization ideals," but even fewer want to become mere "air coin investors." After all, the cost of the latter is often much more painful.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。