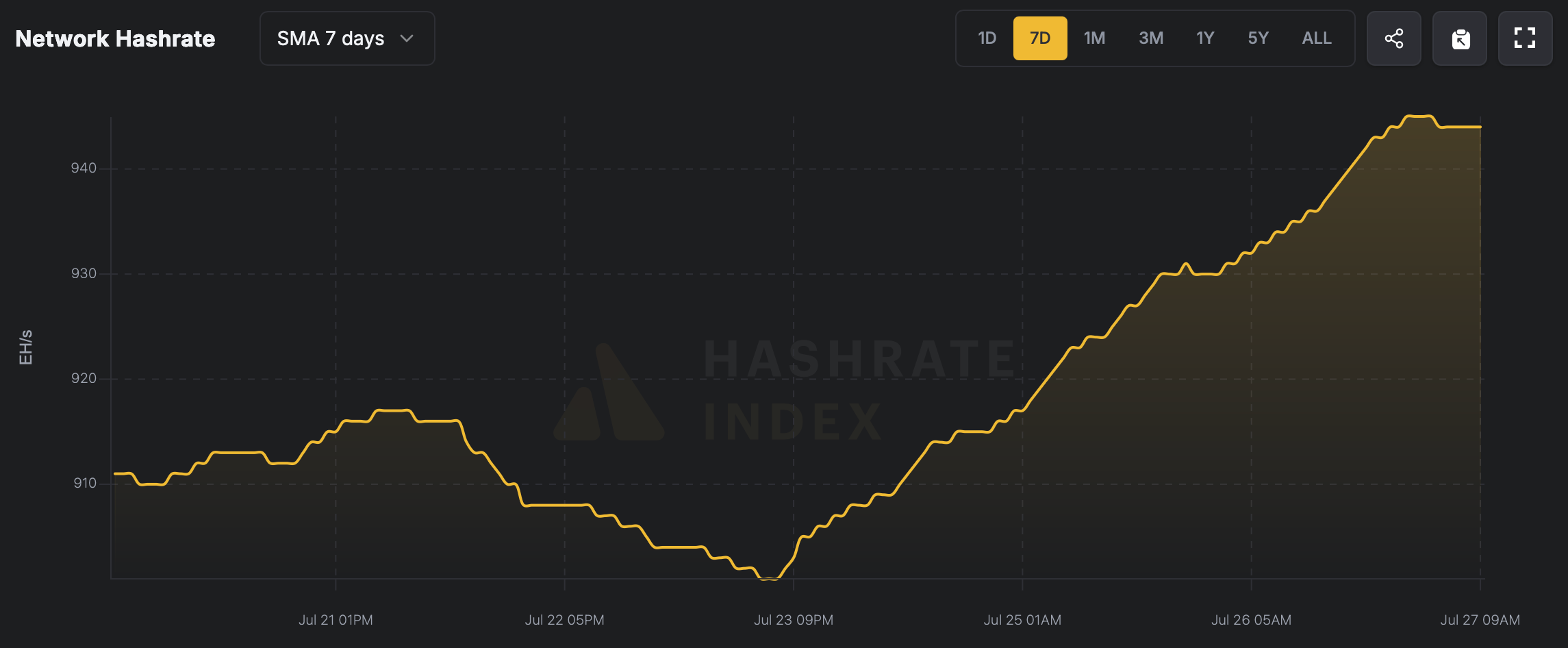

截至7月27日星期日东部时间上午10点,比特币的哈希率为942.96 exahash每秒(EH/s),距离其历史最高点仅差3 EH/s。这一高水平可以归因于过去一个月更稳定、更具吸引力的挖矿利润。

来源:hashrateindex.com

比特币的哈希价格从6月27日的每petahash每秒(PH/s)约54美元跃升至7月10日接近64美元的月度峰值——这是本月的突出增长。但这一涨势并未持续太久。随后出现了下跌,并在58美元和62美元PH/s之间经历了一些适度的波动。

自7月中旬以来,哈希价格大多保持平稳,徘徊在60美元PH/s以下,仅有轻微波动。目前,区块的挖掘速度快于标准的10分钟目标,平均为9分钟44秒。如果这种快速的节奏保持不变,预计在8月8日的重新调整中将会出现难度增加。

矿池Foundry在SHA256哈希率生产中领先,拥有247 EH/s的计算能力。Antpool以183 EH/s位居第二。ViaBTC在比特币矿池中占据第三位,F2pool位列第四,MARA Pool则位居第五。Spiderpool排名第六,Secpool紧随其后位列第七。

Luxor占据第八位,Binance Pool位列第九,Braiins Pool完成前十名。随着领先矿池争夺主导地位,效率提升和战略扩展可能会决定谁能在争夺比特币下一个区块的紧张竞赛中生存下来。前三大矿池长期以来一直保持着主导地位,背靠庞大的exahash算力,使其在战略上占据优势。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。