就在比特币(BTC) flirted with $120,000大关的前一天,经历了一次迅速的下跌,跌至$115,000以下——这是近两周未见的水平。Bitstamp的数据描绘了这种波动,显示这款旗舰加密货币在7月25日东部时间凌晨2:45短暂下跌至$114,518。尽管BTC设法恢复,并最初似乎在$115,000以上找到了脆弱的支撑,但随后又显示出新的力量,回升至$116,000。

然而,BTC在24小时内约2%的下跌触发了超过$1.4亿的多头头寸被清算。Coinglass的数据揭示,仅被清算的比特币(BTC)多头头寸就占到了在24小时内被抹去的$3.82亿总多头头寸的近一半。

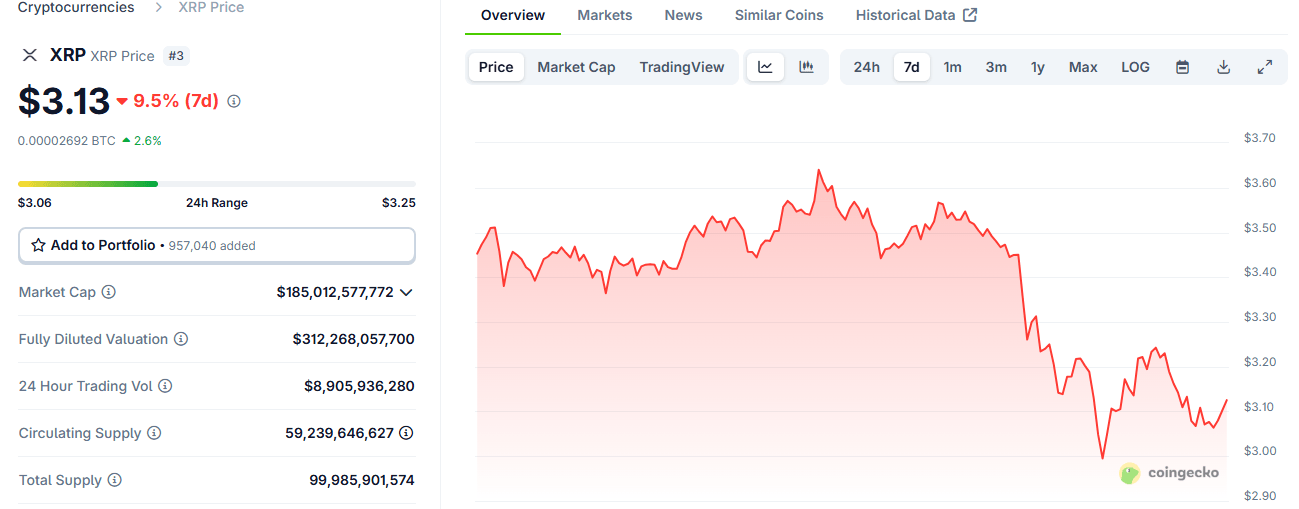

与此同时,XRP在最近的历史最高点$3.40下跌后,似乎继续自由下跌。这种数字资产短暂突破了关键的$3.00心理关口,随后小幅反弹,重新回到$3.12以上交易。XRP的这一下跌引发了交易者的新一波绝望,24小时内超过$1,645万的多头头寸被清算。自7月21日以来,XRP的价值已下降超过10%,成为过去七天中最显著的下跌者之一。

索拉纳(Solana)的情况类似,下降了2.8%,而狗狗币(DOGE)在同一时间段内下跌了2.3%。另一方面,以太坊(ETH)上涨了近2%,而最近创下$808新历史高点的BNB上涨了0.9%,成为少数几个例外之一。

在撰写本文时,Coinglass在7月25日凌晨5:00的数据表明,过去24小时内约有142,437名交易者被清算,总清算额达到$5.3169亿。被清算的多头头寸占所有被抹去头寸的70%以上($3.8288亿)。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。