晚上好,兄弟们!

巴菲特说,伯克希尔始终奉行的原则是:永远不要冒永久损失的风险。得益于美国经济的繁荣和复利的威力,如果你一生中做了几个正确的决定,避免了严重的错误,必然会有所回报。长期以来,伯克希尔持有的现金和美国国债数量,远远超过了传统观点所认为的必要水平。

超过必要水平,意味着极其充裕的安全边际。伯克希尔奉行极端的财务保守主义政策让巴菲特有理由相信,伯克希尔完全有能力应对前所未有的金融危机。当经济动荡发生时,伯克希尔的目标是协助国家“灭火”,而不是成为许多无意或有意“点火”的公司之一。纵观巴菲特历年致股东的信,字里行间始终充满着“防风险”的忧患意识。

在我看来,对待杠杆的态度就如同官员对待贿赂的态度一样,一定要坚决杜绝“第一次”。很多人的侥幸心理是:只此一次,下不为例。事实上,但凡有了第一次,就一定会有第二次、第三次乃至无数次,直至爆仓,几无例外。谨慎负债,不加杠杆,其实就是巴菲特所谓的不那么秘密的武器,也是伯克希尔基业长青的基石。

......

今天市场主要推动力,是和期货市场的联动。期货市场短暂调整之后,继续大涨,从而进一步带动了市场的风险偏好。A股则进行反内卷扩大化,以至于低位的板块,可以快速轮动。

站上3600点之后,投资者反而容易亏钱。因为踏空的投资者,会在踏空的焦虑之下,盲目追高。但是,这显然是错误的。

这个阶段,我们的建议是,要么考虑大类资产配置,从所有的资产中寻找性价比。要么坚决做低位轮动,选择波动率更低,位置也很合理的资产。

......

【回调之际,我的仓位剩下10%!】

大盘回调,很正常的表现,而且目前看市场并未大跌,已经算是很强势的表现了,所谓的牛市“千金难买牛回头”,是机会还是风险呢?

说实话,目前看,市场短线回调风险是大于机会的,虽然这种火热行情中给大家“泼冷水”很容易被骂,但是市场事实就是如此。

无论买啥东西,买的便宜才有性价比,再好的股票你买贵了性价比肯定是低,所以在上涨中我依旧按照计划减仓止盈一些仓位,当然了,有出现适合买的价格,我也是会按照交易计划去买入。虽然我的账户前几天一直创新收益,但是持仓在不断下降,这正是我想要的,或许短线舍弃一些利润,但是可以规避市场极大风险,比如突如其来的大阴线。

写在牛市中,未必有人赞同,但这是我交易的记录。

......

【基建股再大涨短期内不可能了】

今天市场回调,很正常的走势,上涨多了回调,回调多了反弹,再正常不过了。

最近最热的基建板块,高争民爆和西藏天路,一个开板后再封板,一个开板后下跌-4.5%。同时,还有一个韩建山河,直接从涨停到跌停。

这是市场资金开始出现分歧的信号,短线基建板块还有机会,但是个股特别是热门基建股风险太大,一言不合你就站岗!

......

全球股市今年呈现出惊人的上涨势头,尽管面临贸易争端、地缘政治风险和全球经济增长前景下滑等多重挑战。推动这一轮市场狂欢的,不再仅仅是传统意义上的“贪婪”,而是投资者对人工智能革命可能带来的变革性机遇的“错失恐惧”(FOMO)。

BTC:4小时级别看,价格继续保持在布林线下轨附近附近,价格走势弱势。

日线级别看,价格继续保持在均线支撑之下,短线价格弱势。

综上,支撑位116200,压力位116600.

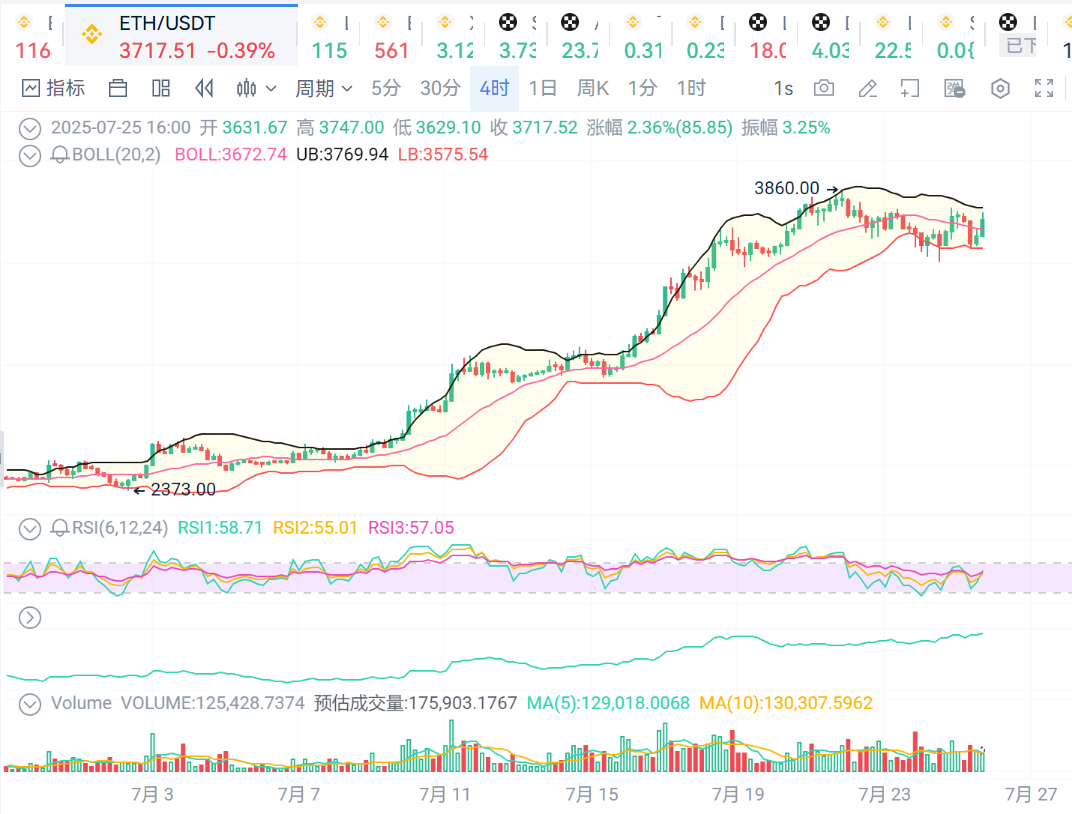

ETH:4小时级别看,价格继续保持在布林线中轨之上,价格走势强势,支撑位3710,压力位3730.

LTC:价格继续保持在布林线中轨之上,价格走势依旧健康,支撑位110,压力位118.

BCH:价格反弹强势,符合我们的预期,短线行情有做空机会,支撑位550,压力位570.

先说这些,晚安!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。