交易的精髓在于做找机会的能力,谋定而后动,运筹帷幄,这是明辉一直制胜市场的关键,很多人都是败于操作杂乱,没规划更没计划,大多亏损都是死于锁仓、扛单、不带止损上,究其原因还是自身没技术,没思路,轻信他人的操作,跟错单,跟多人,自己心态又不好,总是小盈大亏,所谓三思而后行,唯有斟酌过的点位才得以进场,激进的点位让人多空两难,亦或是抓到最高点,或是最低点,价格差异大,舍不得止损就只能扛,稳健的点位,进可盈利出局,退可抽身离场。

7.25币圈明辉:以太坊(ETH)行情策略分析参考

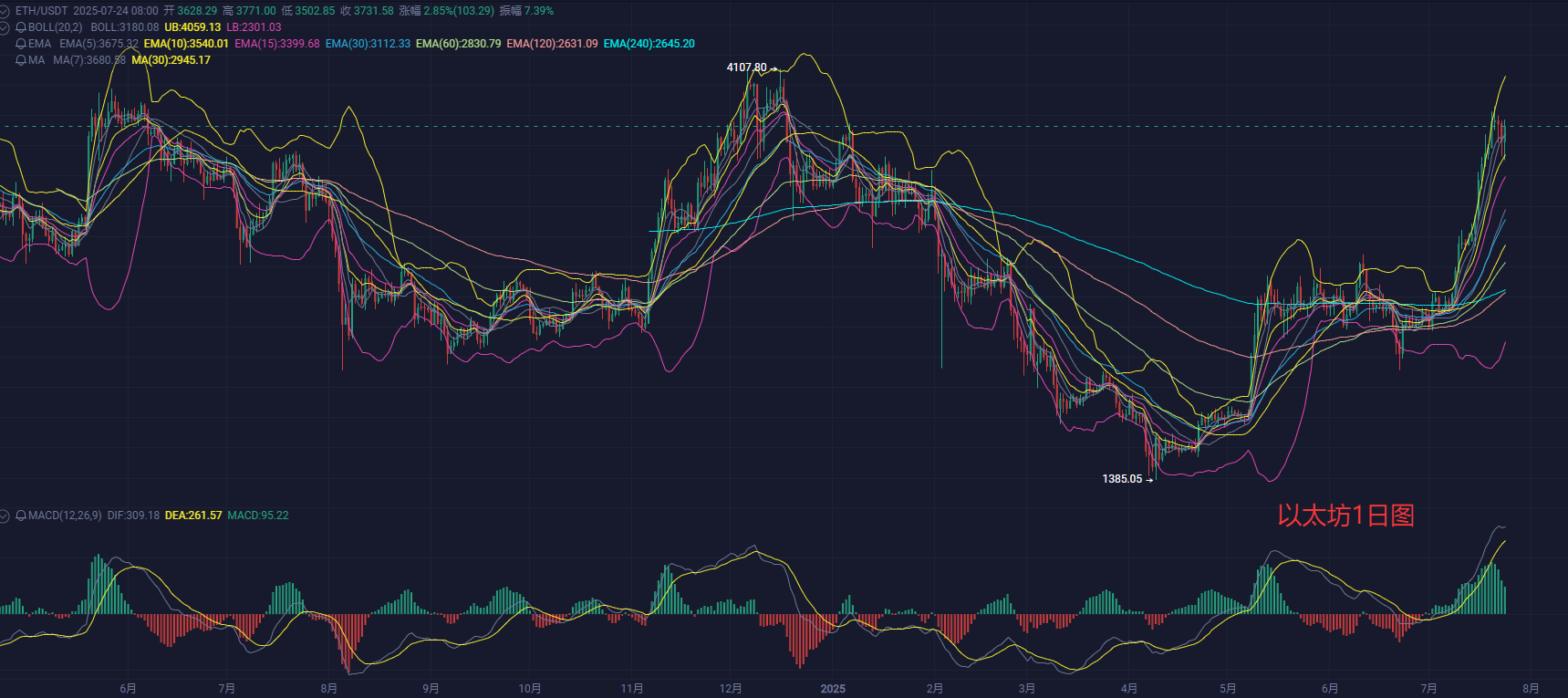

以太坊早间承压回踩3505一线,午后走势小幅调整走出强势反弹,目前已经突破多重压制,且顺势突破3760一线,反弹已经到达200多余点,短期多头情绪较为浓重,当前币价在高位震荡修复,

日线级别出现连续大阳线突破前高3771,短期形成上升通道,7月24日下影线较长(3502→3738)显示买盘强劲,小时线在3700-3750区间震荡蓄力,未破前低3502,MACD日线金叉持续扩散(DIF 309.7/DEA 261.67),小时线出现顶背离需警惕,EMA多头排列(7>30>120),日线EMA7(3628)成为动态支撑,整体来看多头逐渐回暖,所以个人建议顺趋势做多即可。下方支撑关注3660区域,后续若是涨幅不断延续,再度突破3800一线,多单可以轻仓跟进,止盈看30点收益即可。

每日更多实时单策略,在线技术学习,解套出局等可关注导师公众号:(币圈明辉),每日前十名可获得无偿提供解套策略

7.25以太坊短线策略参考:

倥建议3760-3805,止损30点,目标3700下方,

哆建议3620-3675,防守3320补,止损30点,目标3670附近,

7.25比特币短信策略参考:

倥建议120500-119500,防守122900补,止损500点,目标118500下方,

哆建议117500-116500,防守114000补,止损500点,目标118500上方,

点位具有时效性,帖子发送有延迟,所以具体请以实时行情为准。再次强调,做好风控,不管你对未来行情的判断把握有多高,止盈止损一定要带好!有需要其他币种分析,欢迎私聊评论,喜欢的朋友多多点赞支持每日更多实时单策略,在线技术学习,解套出局等可关注导师公众号:(币圈明辉),每日前十名可获得无偿提供解套策略

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。