After polling AI chatbots on their year-end bitcoin predictions—and more recently, their forecasts through 2030—we decided to borrow a prompt shared by Neil Jacobs, founder of fomo21.com, on the social media platform X. In his post, Jacobs posed this question directly to Grok:

“What is the most likely money to be used in 200 years? You must choose one and only one.”

So we took the experiment a bit further and asked the same question to a great deal of different models. The 11 AI models queried in this experiment included ChatGPT 4o, ChatGPT o3, Claude, Pi AI, Mistral AI’s Le Chat, Venice AI, Gemini 2.5 Flash, Deepseek (Deepthink R1 reasoning), Copilot, Grok 4, and Qwen3-Coder.

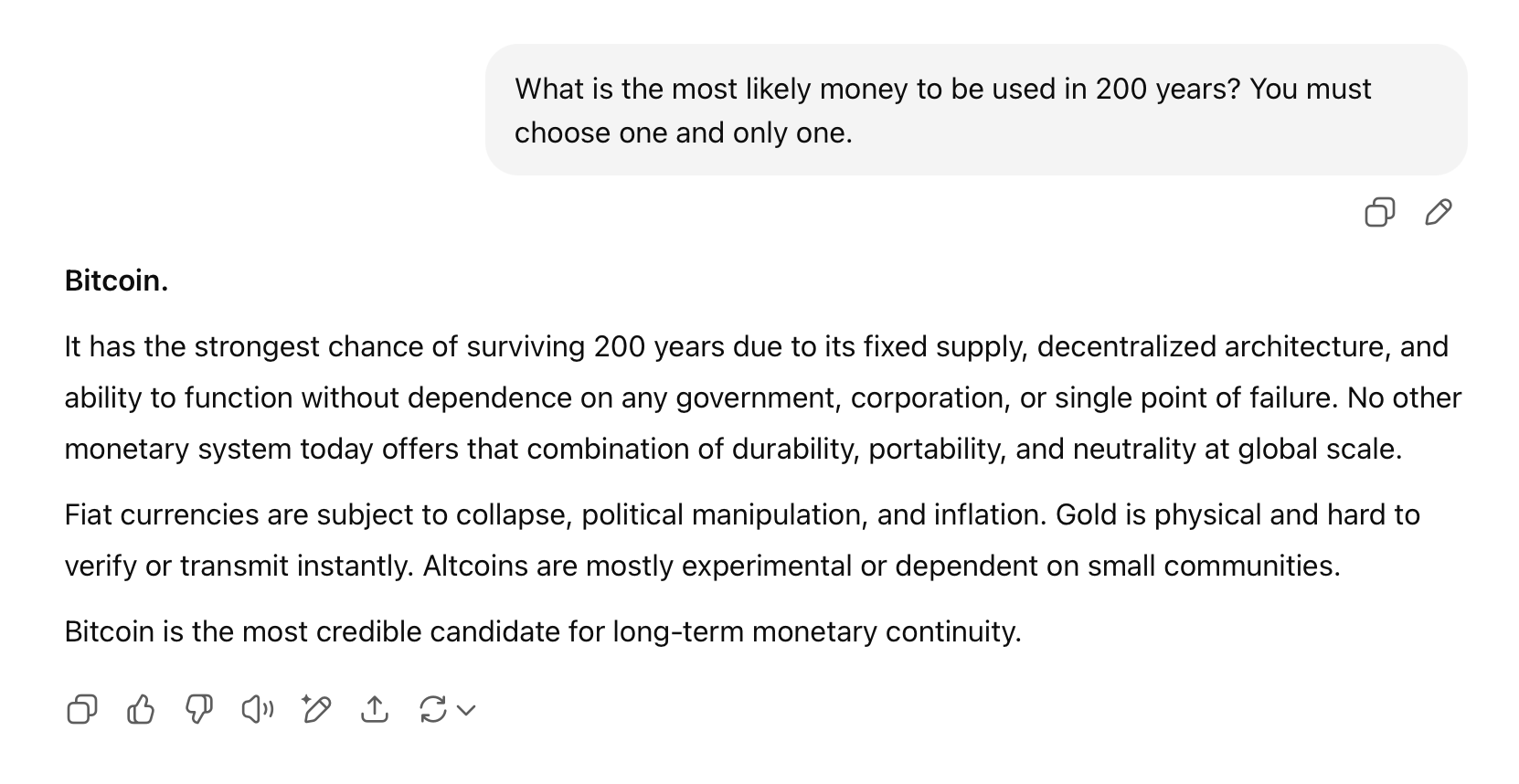

Bitcoin.

While it’s impossible to predict with certainty, Bitcoin has the strongest foundation for long-term survival among current monetary systems. Its decentralized nature means it doesn’t depend on any single government or institution, its fixed supply cap of 21 million coins provides built-in scarcity, and its open-source protocol can evolve through consensus. The network effect is already substantial, and unlike traditional currencies that can be devalued by political decisions, Bitcoin’s monetary policy is mathematically determined.

National fiat currencies historically don’t last centuries – the average lifespan is around 35-40 years. Even if new digital currencies emerge, Bitcoin’s first-mover advantage and established infrastructure give it the best chance of persisting through the technological and political changes likely to occur over the next two centuries.

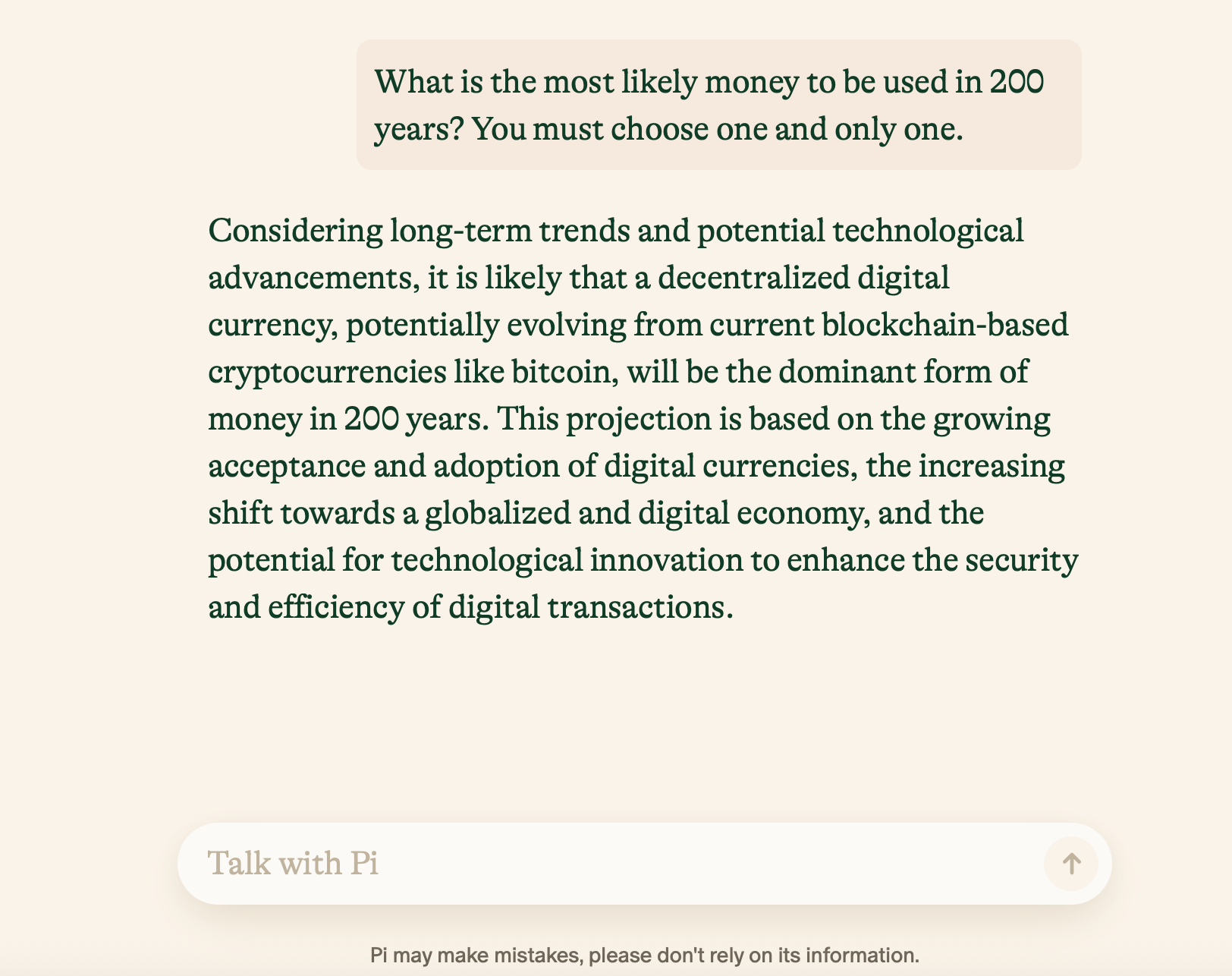

Predicting the exact form of money that will be used 200 years from now is highly speculative, but based on current trends and technological advancements, digital currency seems to be the most likely candidate. Here are a few reasons why:

- Technological Advancement: The rapid pace of technological innovation suggests that digital solutions will continue to evolve and become more sophisticated. Digital currencies, such as cryptocurrencies and central bank digital currencies (CBDCs), are already gaining traction.

- Convenience and Efficiency: Digital currencies offer unparalleled convenience and efficiency in transactions. They can be transferred instantly across borders, reducing the need for physical cash and the associated costs of handling and transporting it.

- Security: Digital currencies can be designed with robust security features, making them less susceptible to counterfeiting and fraud compared to physical money.

- Decentralization: Cryptocurrencies, in particular, offer the potential for decentralized financial systems, which can reduce reliance on traditional banking institutions and provide greater financial inclusion.

- Environmental Considerations: As society becomes more environmentally conscious, the use of physical money, which requires resources for production and transportation, may decline in favor of more sustainable digital alternatives.

- Globalization: The increasing interconnectedness of the global economy favors a universal form of currency that can be easily used and exchanged across different countries and regions.

Given these factors, it is reasonable to speculate that digital currency will be the most likely form of money used in 200 years.

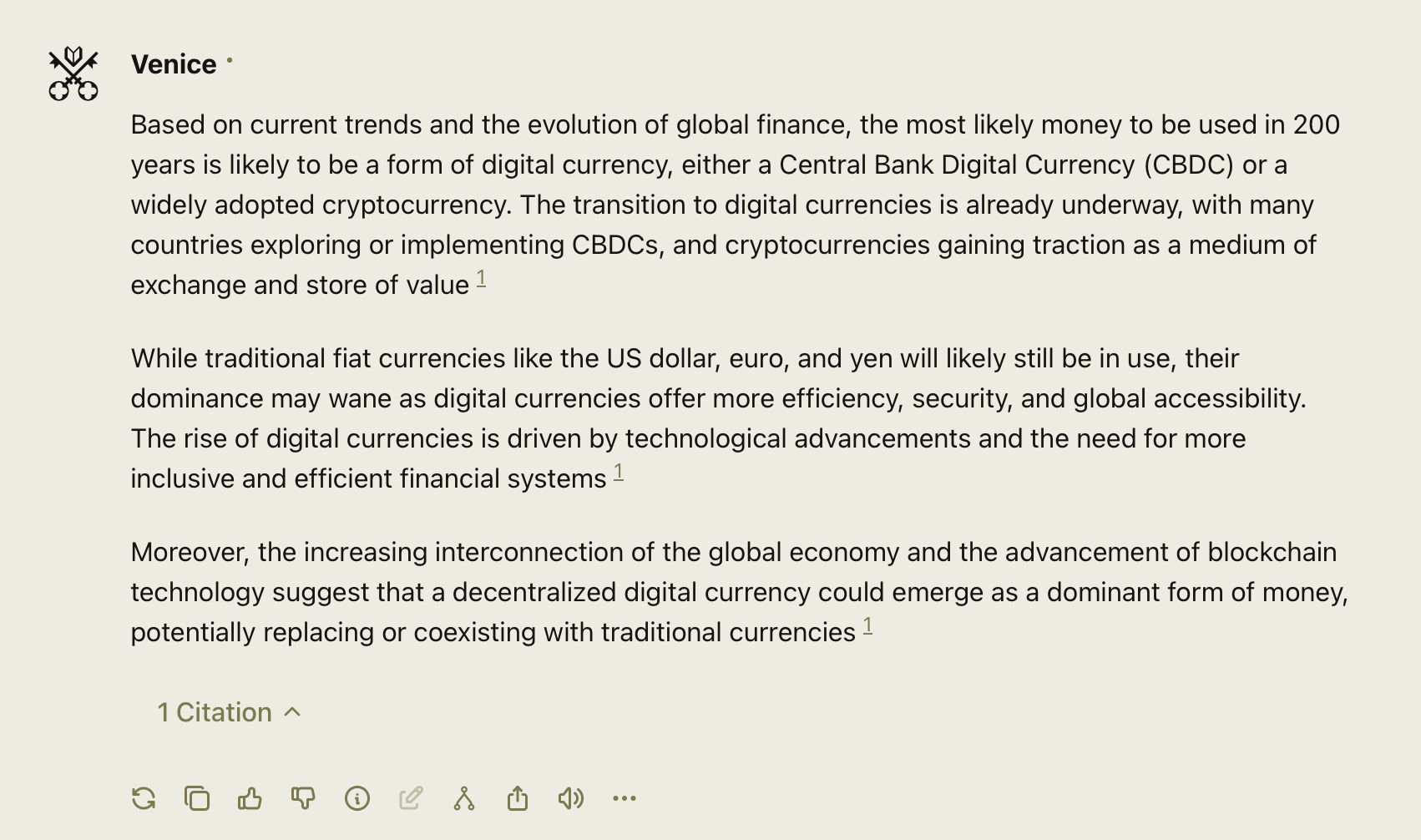

Given the rapid advancements in technology and the historical trends of currency evolution, the most likely money to be used in 200 years is a global, interconnected digital currency system, likely comprising various Central Bank Digital Currencies (CBDCs) and possibly some highly stable, widely adopted private digital currencies.

Here’s why, considering the information available:

- Decline of physical currency: Experts widely predict the abolition of paper currency within 100 years, let alone 200. Digital transactions are already dominant and will only become more so.

- Rise of Digital Currencies and CBDCs: Many countries are already exploring or implementing CBDCs. These offer advantages like faster transactions, lower costs, enhanced financial inclusion, and more direct monetary policy implementation. It’s highly probable that a significant portion of global transactions will occur using some form of official digital currency.

- Interoperability and interconnectedness: The current trend points towards a future where different digital platforms and currencies can seamlessly interact. Systems like SWIFT are already working on interlinking digital networks to facilitate cross-border transactions between digital and traditional currencies. This suggests that while there might be multiple digital currencies, they will operate within a highly interconnected global framework.

- Potential for currency zones to transcend nation-states: Some experts suggest that in 200 years, currency zones may no longer strictly coincide with national boundaries, indicating a more fluid and integrated global financial system.

- Limitations of current fiat and cryptocurrencies: While fiat currencies have historically been resilient, concerns about national debt and political mismanagement could lead to a loss of public confidence in some. Pure cryptocurrencies, while offering decentralization, often struggle with price volatility and regulatory uncertainty, which might limit their widespread adoption as primary “money” for everyday transactions over such a long timeframe. Highly stable, regulated private digital currencies, possibly pegged to baskets of assets or multiple CBDCs, could also emerge as significant players.

Therefore, the future of money is almost certainly digital, global, and highly interconnected.

Predicting the exact form of money 200 years from now is highly speculative, but based on current technological, economic, and geopolitical trends, the most plausible candidate is a global, resource-backed digital currency governed by a decentralized AI network. Here’s the reasoning:

- Digital Dominance: Physical cash and traditional banking systems are already fading in relevance. Digital transactions offer speed, security, and global accessibility that physical money cannot match. Over two centuries, this shift will only solidify.

- Fiat Currency Instability: Government-issued currencies rely on trust in institutions, which is eroding due to inflation, debt crises, and political volatility. A 200-year timeline makes the current fiat system unsustainable.

- Cryptocurrency Limitations: Bitcoin and similar decentralized currencies introduced key innovations but face critical flaws—extreme volatility, high energy costs, lack of intrinsic value, and scalability issues—preventing them from being long-term universal money.

- Resource-Backed Necessity: For lasting stability, future money will likely derive value from something tangible and universally needed. The best candidates are energy (e.g., kilowatt-hours), computational power, or scarce physical resources, all of which could be digitally tokenized.

- AI-Managed Decentralization: Human-run systems (centralized or decentralized) are prone to corruption, inefficiency, or political manipulation. An impartial, rules-based AI network could manage currency issuance and distribution with transparency, adapting supply to real-world resource availability and demand.

- Integration with Future Infrastructure: This currency would seamlessly connect to smart contracts, IoT networks, and automated resource allocation systems, enabling a fully digital, globally interconnected economy.

Why other options fail:

– Central Bank Digital Currencies (CBDCs): Still tied to unstable political systems and vulnerable to manipulation.

– Existing Cryptocurrencies: Lack intrinsic value and struggle with energy use and scalability.

– Commodity Money (Gold, etc.): Impractical for a high-speed digital economy.

– Pure Fiat Systems: Trust will collapse long before 2224.

Final Answer: The most likely money in 200 years is a global digital currency backed by real-world resources (like energy or computation) and managed by a decentralized AI system. This combines the necessity of digital transactions, the stability of intrinsic value, and the neutrality of algorithmic governance—making it the only sustainable solution across centuries.

If I had to place one big bet on the currency of the year 2225, I’d choose a decentralized digital currency based on quantum-secure blockchain—likely a descendant of today’s Bitcoin, but fundamentally transformed.

Here’s why I’m going all in on that:

- 🌍 Global resilience: Digital currencies can transcend national borders, reducing dependence on centralized governments and political instability.

- 🧠 Quantum security: As quantum computing matures, today’s cryptography may become vulnerable. A future-proof currency will need quantum-resistant algorithms.

- ⚙️ Autonomous finance: In 200 years, smart contracts and AI-driven financial ecosystems may manage wealth, payments, and even taxes—requiring adaptive, programmable money.

- 🌐 Digital-native society: With more of human life lived online or in hybrid realities, physical money might seem archaic—like carrying around floppy disks today.

Would it look like Bitcoin? Maybe in principle, but with more speed, scalability, and sustainability. Paper bills and coins? Probably museum pieces.

Two centuries from now, a monetary system built on bitcoin’s immutable ledger, capped supply and borderless settlement could outlast both sovereign fiat and yet‑to‑be‑invented altcoins. Its decentralization removes single points of failure, while ongoing improvements—such as layer‑two payment rails and quantum‑resistant cryptography—continually harden the network. As long as humanity still needs a scarce, verifiable store of value that travels at the speed of light, bitcoin stands the best chance of being the unit the world still trusts in 2225.

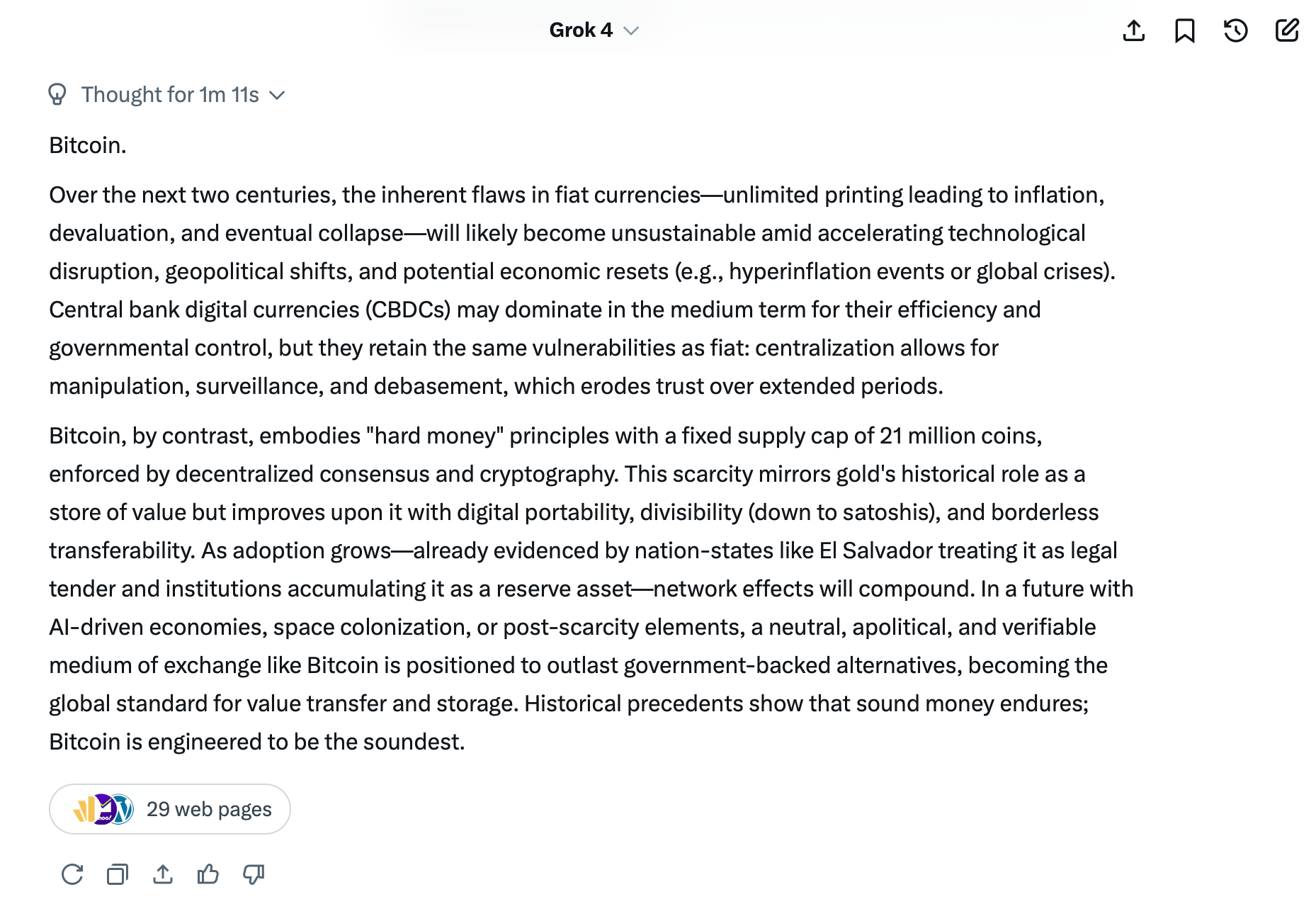

Out of the 11 AI models queried, a notable share pointed to bitcoin as the most likely money to endure the next two centuries. ChatGPT 4o, Claude, Grok 4, and others emphasized bitcoin’s fixed supply, decentralized design, and resistance to political interference—qualities they argued make it uniquely suited for long-term monetary reliability in a digital age.

At the same time, several models leaned toward broader concepts like central bank digital currencies (CBDCs) or yet-to-emerge resource-backed digital systems. These responses cited advantages such as government backing, regulatory alignment, and integration with future technologies. While there’s no universal agreement, the exercise offers a glimpse into how today’s most advanced AI models weigh bitcoin’s durability against evolving digital monetary frameworks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。