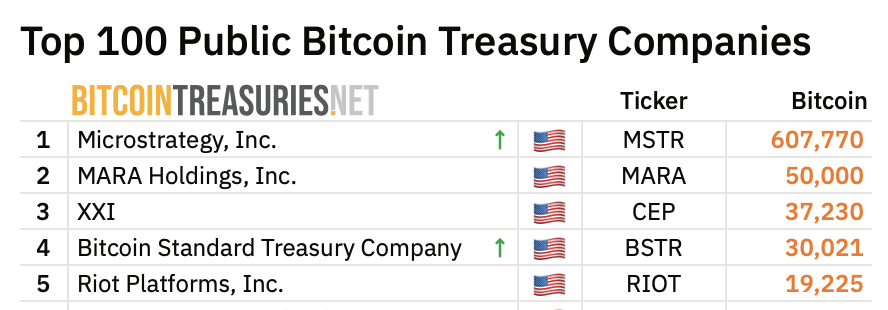

就在上周,BSTR以超过30,000个比特币的储备拉开了帷幕。来自bitcointreasuries.net的数据表明,BSTR现在在公共公司财库中排名第四大比特币持有者。周二,肖恩·比尔在彭博加密货币节目中分享了公司策略的见解,并解释了他们的游戏计划与众不同之处。

来源:bitcointreasuries.net

比尔认为,比特币远不止是对价格的简单押注——它具有现实世界的实用性。他举了一个例子,表示通过在金融工具中使用比特币(如比特币循环信贷)来产生收益,尤其是与像黑石这样的知名机构合作。他还强调了一个新的用例:在保险市场中将比特币作为抵押品。

虽然这在传统保险公司中尚未普遍,但他指出加勒比海保险行业是早期采用者,比特币已经在支持保单承保方面发挥作用——这是他认为充满可能性的市场角落。

比尔还向彭博主持人解释,一些金融公司已经开始接受比特币作为抵押品用于抵押贷款。借款人可以质押他们的比特币,获得预付款,并使用数字资产和房产作为担保——通常贷款价值比为50%。他说,传统金融(TradFi)机构在适应这一趋势方面仍然落后。

当被问及“市场为什么需要更多比特币财库公司?”时,比尔表示:“我同意最终只有少数公司会在这里获胜。但我们相信BSTR会是其中之一。我们带着推土机和清理比特币的许可证而来。我们在第四的位置,但我们认为我们会迅速弹射到第二。这是我们的使命,”BSTR的首席信息官说道。

BSTR的高管补充道:

“我们可以以1%的利率发行债务,购买比特币,随着比特币升值,它自然会降低我们的资产负债表杠杆。这是比特币财库所具备的独特能力,大多数公司没有。”

BSTR旨在成为需要比特币流动性或信贷的公司的首选。“随着时间的推移,我们的目标是成为金融机构的首选交易对手。如果银行或金融公司需要比特币循环信贷,我们希望BSTR成为他们的第一通电话,”他说。

在采访的最后,比尔强调,比特币历史上一些最早和最有影响力的人物正在支持他们的公司——包括亚当·巴克,他的Hashcash发明在中本聪的原始比特币白皮书中被直接引用。他将巴克描述为比特币生态系统的“零号病人”,强调了公司关系的深度。

他补充说,这些关系使公司在获取大量沉睡比特币方面具有战略优势——这些持有的比特币目前不在交易所上。比尔表示,凭借正确的网络和方法,他相信他们可以解锁这一未开发的供应。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。