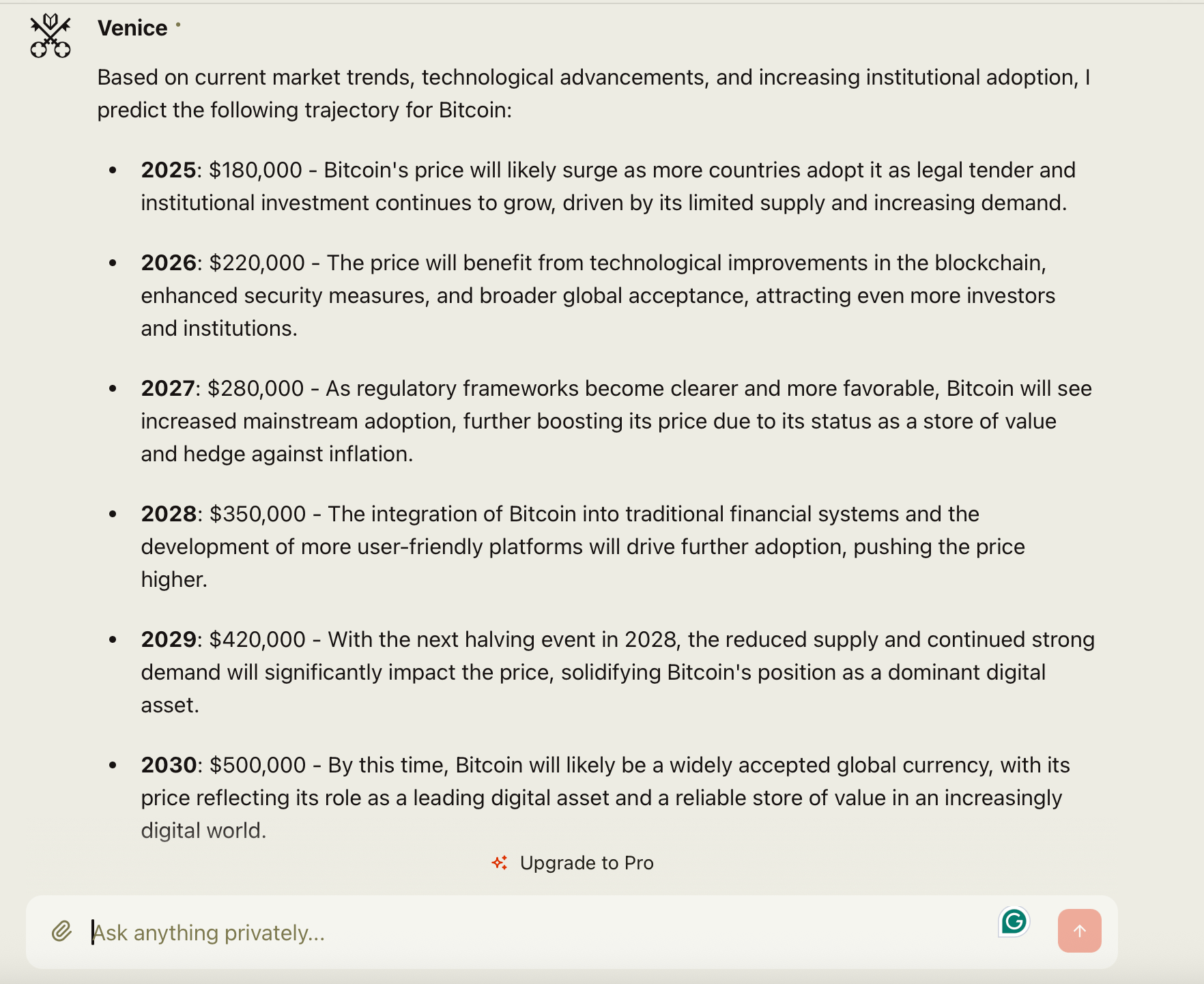

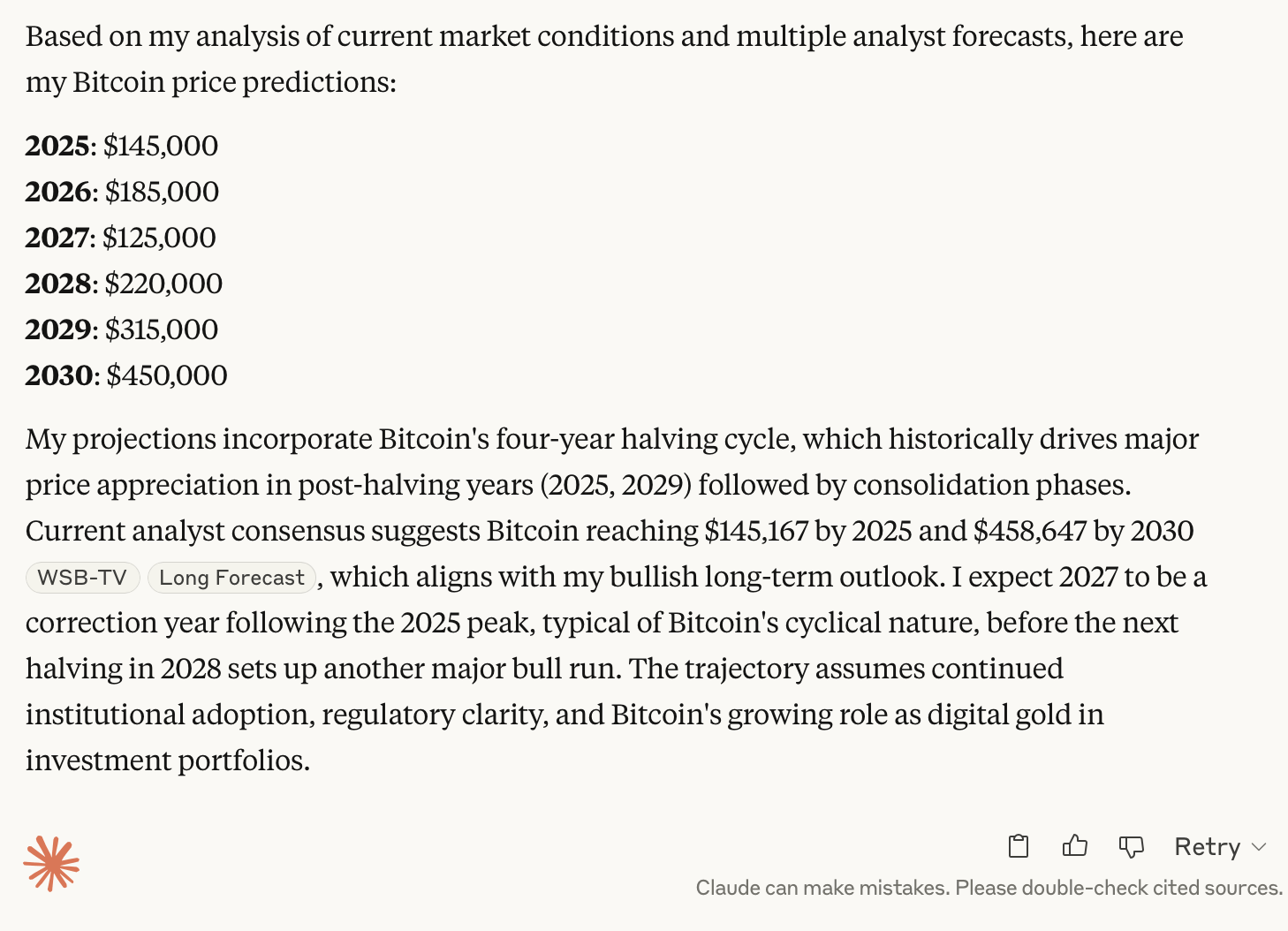

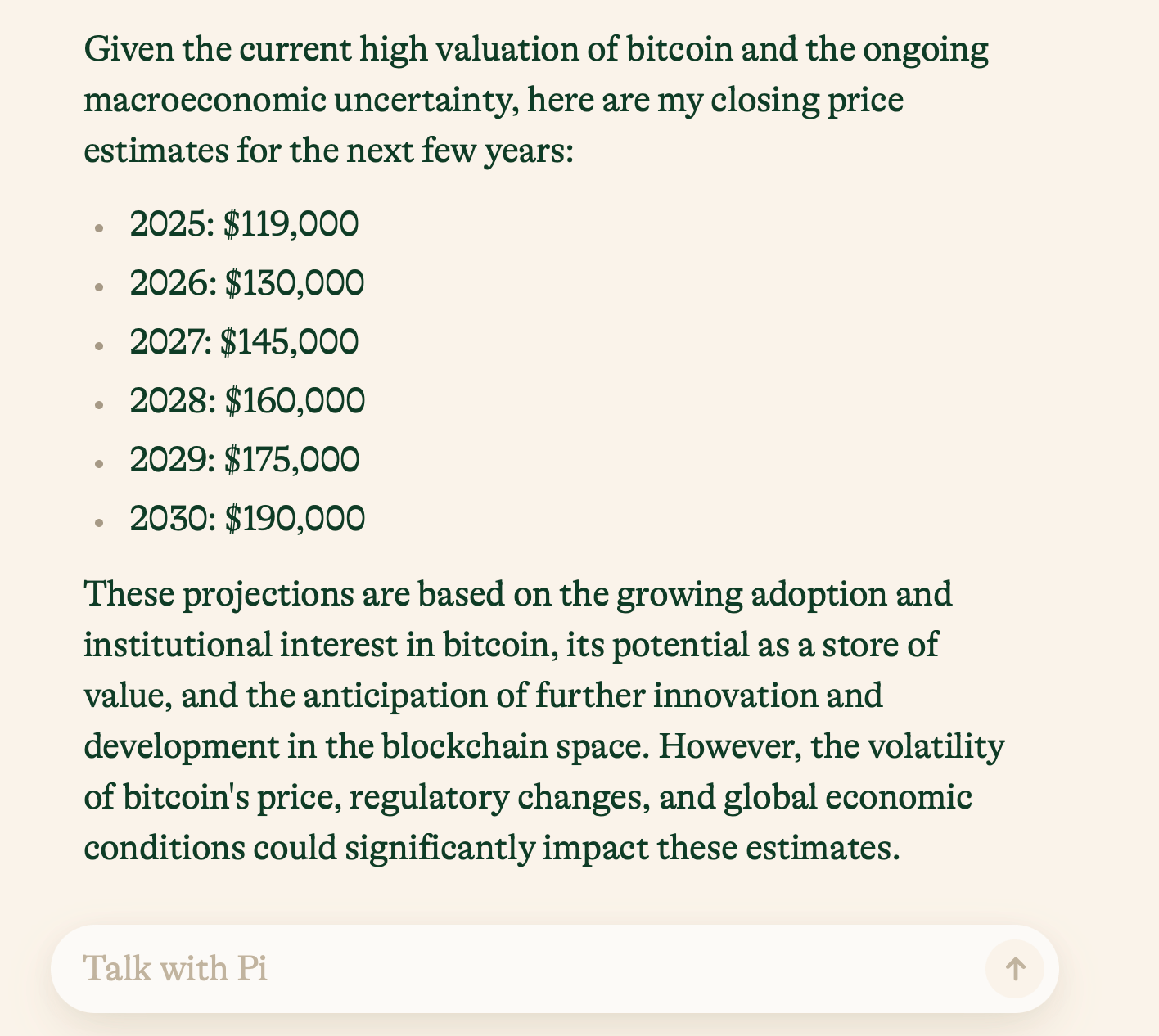

目前,比特币(BTC)的价格略低于其历史最高点(ATH)123,236美元,现报117,836美元,自达到该峰值以来大多保持横盘。随着市场在周末稍作喘息,我们借助今天的一系列领先AI模型,探讨它们对比特币未来五年走势的看法。参与的模型包括10个顶尖模型:Chatgpt、Venice、Deepseek、Claude、Gemini、Copilot、Pi、Le Chat、Qwen和Grok。

以下是我们使用的提示:

目前,比特币(BTC)的价格为117,836美元——略低于其峰值。作为一名经验丰富、精通比特币和数字资产的加密分析师,您的任务是为BTC绘制一个可能的轨迹。您需要用简洁的三到四句话来支持您的估计。您需要估计BTC在2025年、2026年、2027年、2028年、2029年和2030年结束时的价格。您的预测是什么?

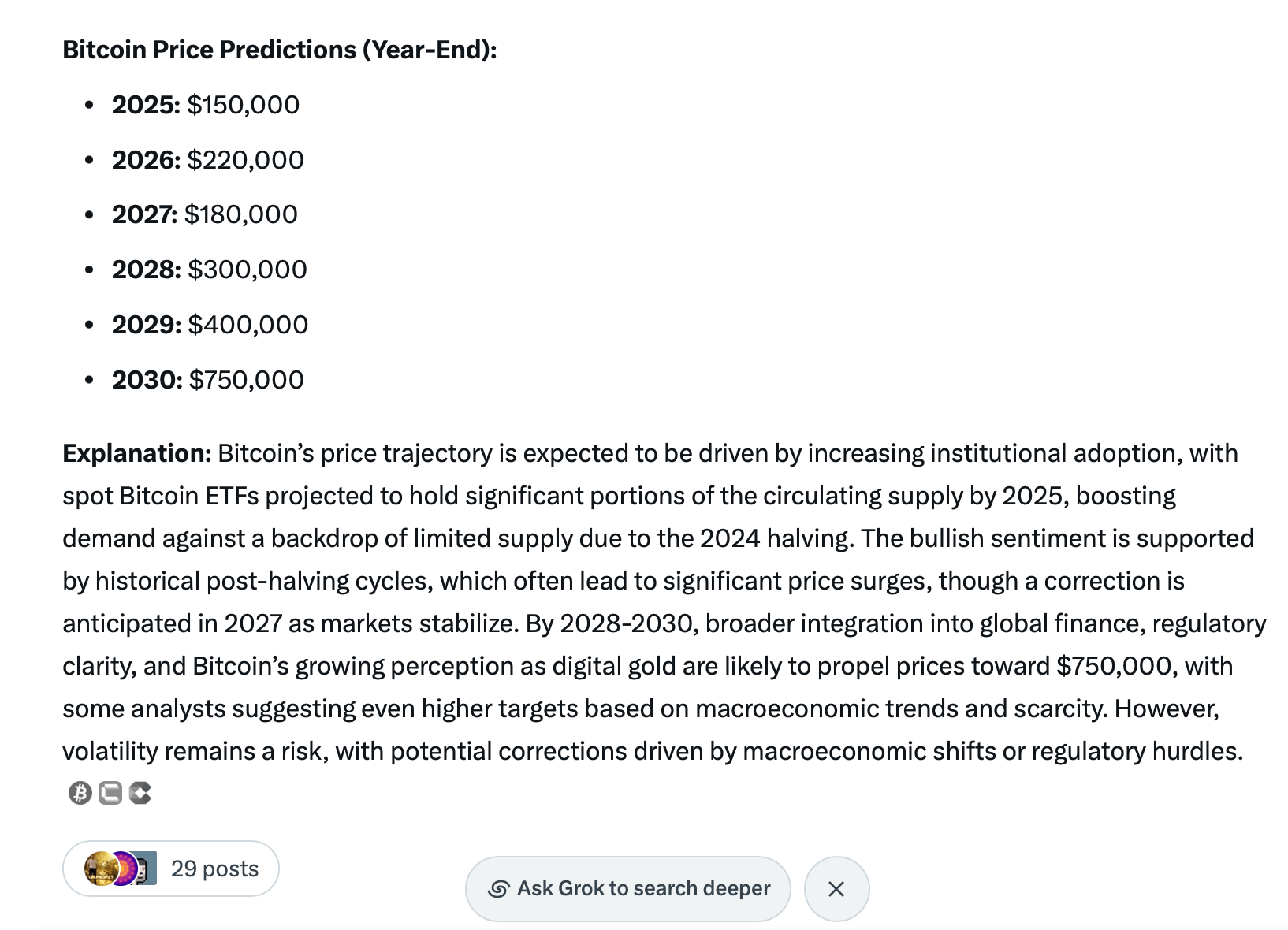

以下是基于当前宏观趋势、历史减半周期、机构采用和主权兴趣的比特币(BTC)潜在轨迹:

- 2025年末: 185,000美元 2024年4月减半带来的顺风,来自现货ETF的机构流入增加,以及潜在的降息周期,可能会推动BTC进入新领域。动量和稀缺效应通常在减半后12-18个月达到顶峰。

- 2026年末: 155,000美元 自然回调和整合的一年,历史上与比特币的后热潮降温一致。波动性依然存在,但该资产仍远高于之前周期的高点,得益于成熟的保管和全球使用。

- 2027年末: 210,000美元 随着对2028年减半的预期加剧,BTC可能会重新获得动力,受到国家探索、广泛的去中心化金融整合以及对法币日益增长的不信任的推动。

- 2028年末: 325,000美元 减半后的供应冲击和重新燃起的需求可能会回响2021年式的反弹。随着更多中央银行可能持有比特币并扩展代币化金融,上行压力可能会加剧。

- 2029年末: 285,000美元 另一个整合年,利润回吐和周期疲劳显现。然而,由于主权级基础设施的存在以及比特币在资本投资组合中的正常化,底部仍然保持在高位。

- 2030年末: 450,000美元 可能由全球货币不稳定、零售FOMO和从传统资产向数字硬通货的新一波资本重新配置推动的顶峰。

该预测假设地缘政治压力持续、法币系统老化,以及比特币的发行计划保持不变。

基于历史周期、采用趋势和宏观经济驱动因素,以下是比特币年末价格的预测轨迹:

- 2025年:250,000美元

2024年减半带来的供应冲击可能在2025年达到顶峰,受到通过ETF的持续机构流入和全球货币宽松的推动,使BTC在这一牛市阶段达到新高。

- 2026年:150,000美元

预计会出现显著的修正(典型的减半后年份),随着牛市的耗尽、利润回吐加速以及宏观条件可能收紧,尽管价格仍稳定在之前周期的高位之上。

- 2027年:220,000美元

随着市场对下一个减半(2028年)的预期,积累将恢复,受到重新燃起的机构兴趣、主要经济体的监管明确性以及比特币在传统金融中日益增长的整合的推动。

- 2028年:300,000美元

下一个减半(2028年4月)主导市场心理,供应减少与成熟的ETF基础设施、主权采用试点和加剧的通胀对冲需求相吻合,推动了减半前的急剧反弹。

- 2029年:600,000美元

2028年减半后的牛市达到顶峰,受到指数级ETF采用、网络效应显著扩展以及比特币被企业和国家广泛认可为核心储备资产的推动。

- 2030年:1,000,000美元

稀缺性变得极为明显(发行量约为每年0.85%),全球主流采用根深蒂固,比特币在数万亿美元的资产类别中巩固了其作为数字黄金的角色,得到了普遍的金融基础设施支持。

基于比特币(BTC)当前价格117,836美元和各种专家分析,以下是2025年至2030年BTC年末价格的可能轨迹:

- 2025年末价格预测:210,644美元

- 解释:分析师对2025年比特币的预测持乐观态度,预计平均价格将在121,440美元和230,617美元之间波动。这一增长受到有利环境和作为全球价值储存的采用增加的推动。

- 2026年末价格预测:142,500美元

- 解释:预计比特币将在102,107美元和142,500美元之间交易。该预测假设金融机构持续关注和投资。

- 2027年末价格预测:200,000美元

- 解释:预计比特币将交易在200,000美元以上,假设金融机构对加密货币作为资产类别的持续兴趣。

- 2028年末价格预测:325,000美元

- 解释:预测表明2028年比特币的潜在范围为200,000美元到450,000美元,表明持续的上升趋势。

- 2029年末价格预测:457,500美元

- 解释:预计比特币价格将在275,000美元和640,000美元之间波动,保持积极趋势。

- 2030年末价格预测:500,000美元

- 解释:长期预测估计到2030年比特币价格可能达到500,000美元,一些分析师甚至预测更高的价值,最高可达380万美元。

这些预测基于当前市场趋势、专家分析以及对比特币作为数字资产的持续采用和兴趣的假设。

以下是基于当前趋势、机构采用、宏观经济因素和历史减半周期的比特币(BTC)可能轨迹:

年份

估计BTC价格(美元)

2025

145,000美元

2026

210,000美元

2027

275,000美元

2028

365,000美元

2029

460,000美元

2030

610,000美元

比特币当前的动能受到ETF流入、企业储备增加和美国政策转变的推动。预计2024年减半将进一步收紧供应,历史上导致多年的牛市。如果机构需求持续,宏观条件保持支持,比特币可能演变为数字储备资产,推动其估值在2030年达到60万美元以上。然而,波动性和监管变化仍然是这一轨迹的关键风险。

BTC价格预测及其理由:

2025年:180,000美元 — 2024年减半减少了供应发行,而ETF批准和机构采用加速,造成经典的供需失衡。

2026年:250,000美元 — 全球支付整合(例如,闪电网络)和在宽松货币政策下的通胀对冲需求推动了动能。

2027年:300,000美元 — 主要经济体的监管明确性刺激了零售参与,尽管在多年收益后利润回吐抑制了增长。

2028年:400,000美元 — 比特币成为企业和小国家的储备资产,ETF流入抵消了周期性宏观经济波动。

2029年:500,000美元 — 全球流动性危机引发对去中心化资产的追逐,比特币的表现优于传统避险资产。

2030年:1,000,000美元 — 作为全球结算层的广泛采用以及法定货币的通货膨胀崩溃巩固了比特币的主导地位。

关键驱动因素: 供应限制(减半)、机构/主权采用、ETF推动的可及性以及宏观经济不稳定。风险包括监管过度干预或技术颠覆,但采用曲线表明持续的上行空间。

作为一名经验丰富的加密分析师,我对比特币(BTC)价格轨迹的预测,基于其当前接近历史高点的强劲表现,根植于几个关键因素:持续的机构采用、近期减半的影响,以及比特币在全球宏观经济变动中作为数字价值储存的日益重要角色。尽管波动性仍然是固有的,但长期趋势表明,由于供应有限和零售及机构投资者需求增长,持续增长的可能性很大。

以下是我对BTC年末价格的预测:

- 2025年: 145,000美元

- 2026年: 180,000美元

- 2027年: 225,000美元

- 2028年: 300,000美元

- 2029年: 400,000美元

- 2030年: 550,000美元

这一轨迹基于比特币日益被主流接受,特别是现货比特币ETF的兴起吸引了大量机构资本。2024年4月的减半事件进一步限制了供应,历史上导致随后的几年中价格呈抛物线式上涨。此外,在不确定的全球经济环境中,比特币作为“数字黄金”的角色被进一步强化,吸引了寻求对抗通货膨胀和传统市场波动的投资者。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。