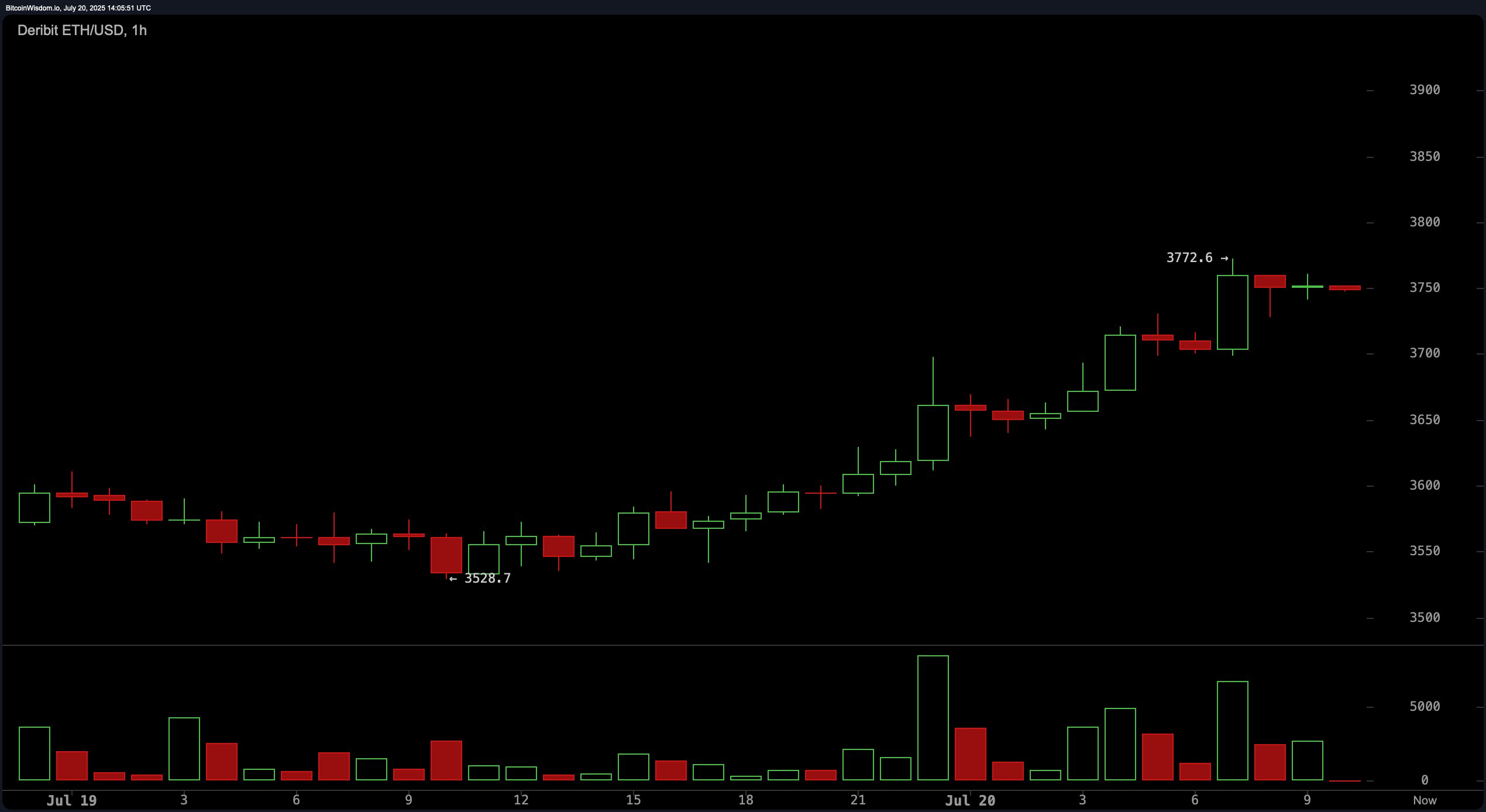

截至7月20日星期日,以太坊(ETH)的每个价值为3,745美元,本周上涨了25.5%。就在三天前,一个以太坊的价值为0.029 BTC,而现在已攀升至0.03173 BTC。在社交媒体平台如X上,许多ETH粉丝相信这仅仅是个开始。

“以太坊即将经历的上涨将是辉煌的,”一位用户写道。“BTC的主导地位下降,替代币每天都在变得更强,”该X账户补充道。

今天,BTC的市场份额降至60.2%,而ETH的市场份额已上升至3.9万亿美元加密市场的11.6%。对以太坊兴趣增加的一个重要原因是公共公司将ETH纳入其财务计划,以及现货ETH交易所交易基金(ETF)带来了大量资本流入。

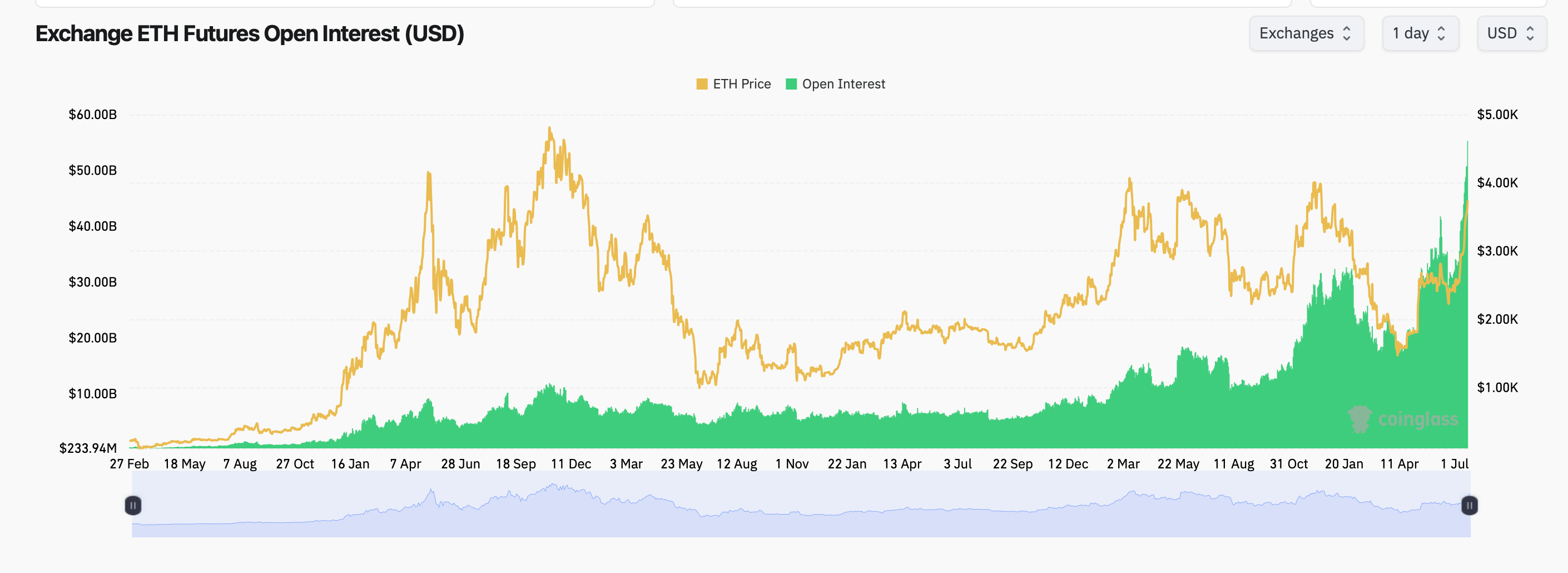

以太坊期货未平仓合约(OI)已突破550亿美元,创下历史新高,图表因兴奋而变绿。随着ETH价格向4,000美元线冲刺,未平仓合约的上升潮流引起了严重关注。数据显示,价格与OI之间存在同步舞蹈,二者共同积累动能——尤其是自4月中旬以来。

这清楚地表明交易者正在大量涌入,押注以太坊的下一步。CME和Binance引领期货热潮,Binance占据最大份额——264万ETH的未平仓合约,价值98.8亿美元。CME紧随其后,未平仓合约达到70亿美元,而Gate则悄然积累了71.5亿美元,成为第二大ETH持仓。

值得注意的是,MEXC和BingX的24小时增长率最高,分别上涨6.86%和惊人的11.18%。然而,并非所有人都步调一致——Kucoin和BingX在短期收益和每日下跌之间显示出明显的分歧,暗示着表面下的动荡交易。

以太坊期权市场迅速升温,数据传达出强烈的看涨情绪。在Deribit上,最受欢迎的合约充满了看涨的押注——例如2025年9月26日的4,000美元看涨期权,未平仓合约接近100,000 ETH。交易者们还在关注2025年12月的6,000美元行权价,显示他们不怕冒险。甚至12,000美元的看涨期权在过去24小时内的交易量最大——没错,你没看错,12,000美元——这可是相当疯狂的月球谈话。

看涨期权绝对主导了看跌期权,未平仓合约的比例为66.43%对33.57%。这意味着有229万ETH的看涨押注与115万ETH的看跌押注。相同的模式在24小时交易量中也得以体现——62.49%的交易量来自看涨期权,进一步强调了期权交易台上涌现的乐观情绪。这种向上合约的倾斜表明交易者正在为爆发性走势做准备,而不是对下行进行对冲。

长话短说:交易者正在全面增持现货ETH、期货和期权,随着现货价格和未平仓合约的双双上升,市场对接下来会发生什么保持高度关注。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。