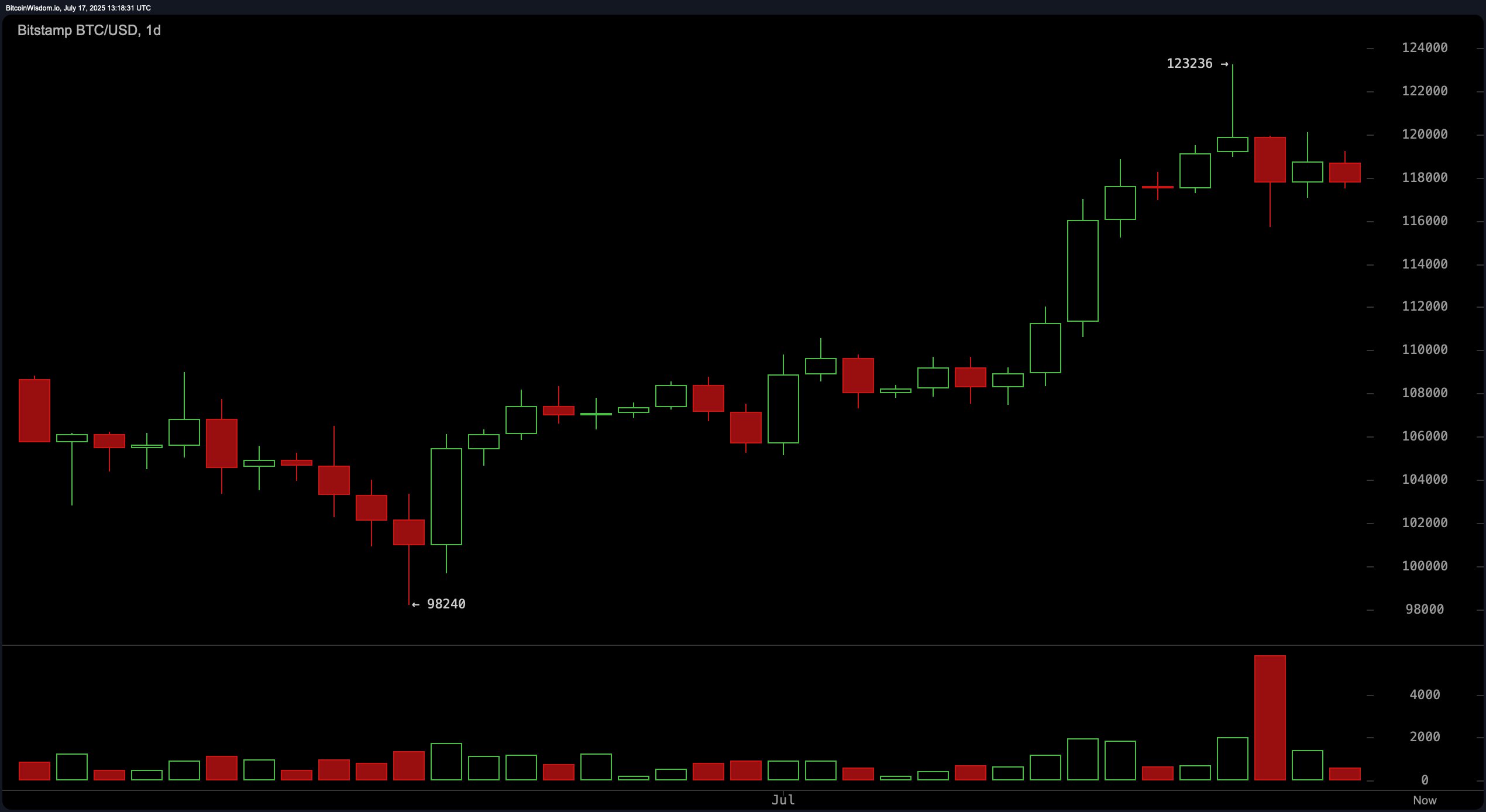

在日线图上,比特币从最近的低点约98,240美元反弹,确立了明显的看涨趋势,达到123,236美元的峰值后面临显著的卖压。最新的蜡烛图形态显示出较小的实体和交易量的显著减少,表明反弹已转变为整合或短期冷却期。对于风险管理的多头头寸,交易者可以考虑在回调至110,000美元至114,000美元的前突破区间时入场,特别是如果出现新的看涨反转形态。阻力在123,000美元附近依然强劲,之前曾发生过大量卖出,使其成为潜在的获利了结区。

BTC/USD 1日图,来源于Bitstamp,日期为2025年7月17日。

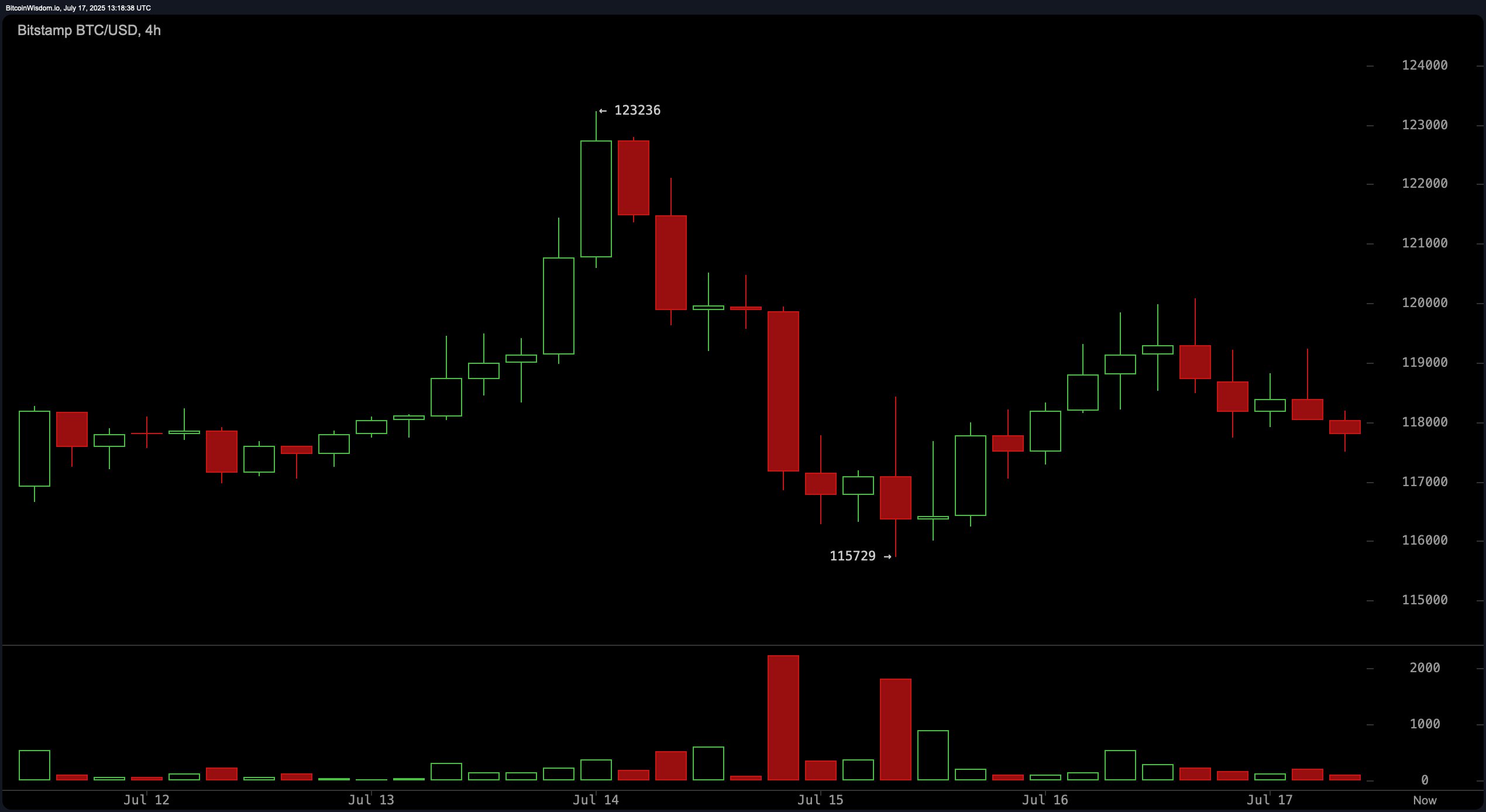

对4小时比特币图表的分析显示,比特币的急剧上升趋势在123,236美元达到顶峰,随后出现了以显著红蜡烛和高卖出活动为特征的决定性反转。临时底部在115,729美元找到,之后的温和反弹未能突破之前的高点。最近一系列的低高点和低低点指向看涨动能的减弱。如果比特币保持在115,700美元至116,000美元的支撑区间之上,可能会出现短期的多头入场,但获利目标应设定在120,000美元至121,000美元附近,预计会遇到阻力。相反,如果价格在119,000美元至120,000美元处失败并形成看跌反转信号,可能会出现更深的修正。

BTC/USD 4小时图,来源于Bitstamp,日期为2025年7月17日。

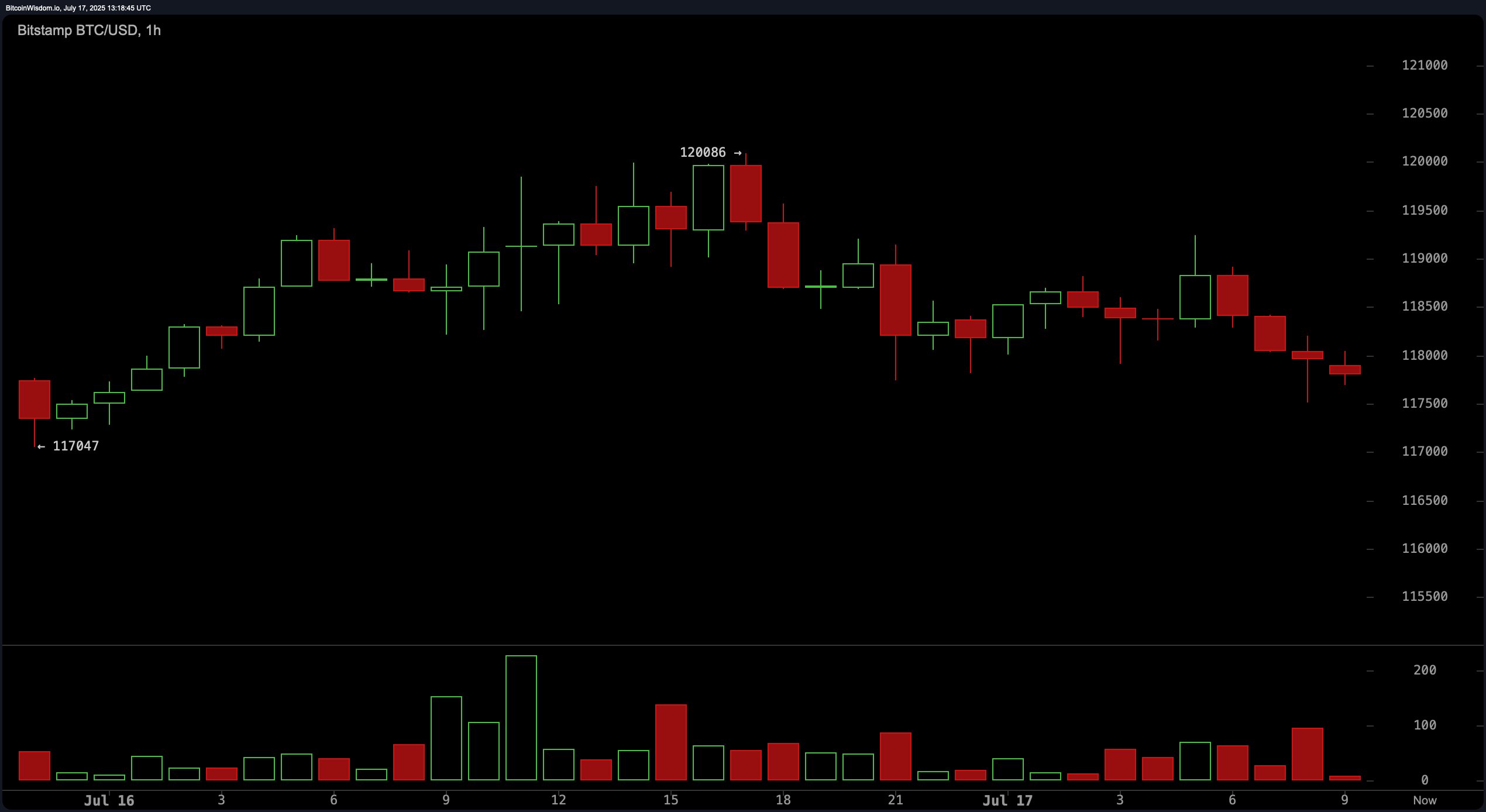

转向1小时比特币图表,出现了一个圆顶形态,反复未能突破120,086美元的关口,随后动能转向下行。随着下跌,卖出量增加,目前比特币正朝117,500美元至118,000美元的支撑区间趋势。如果在117,000美元至117,500美元附近形成看涨反转蜡烛(如锤子形态或吞没形态),可能会存在短线交易机会,短期退出点设在119,000美元的阻力位。若在强劲的成交量下跌破117,000美元,可能会引发加速的抛售,利于短线继续做空策略。

BTC/USD 1小时图,来源于Bitstamp,日期为2025年7月17日。

日线的振荡器读数提供了主要中性的前景,相对强弱指数(RSI)为66.0,随机指标为69.1,商品通道指数(CCI)为87.3,平均方向指数(ADX)为25.8,强势振荡器读数为9,679.9。然而,动量指标在9,499.0的看涨区域,移动平均收敛发散(MACD)为3,333.0,尽管整体上显示整合的迹象,但短期内仍显示出一些潜在的积极偏向。

所有主要周期的移动平均线(MAs)——包括10、20、30、50、100和200周期的指数移动平均线(EMA)和简单移动平均线(SMA)——均呈现看涨模式。这表明尽管在较低时间框架内动能似乎减弱,但长期趋势仍然看涨。关键支撑位于115,700美元至117,000美元之间,而阻力则在120,000美元至123,200美元之间依然坚固。目前,比特币的价格走势继续整合,预计在确认突破这些关键水平后将出现决定性运动。

看涨判决:

如果比特币成功守住115,700美元至117,000美元的支撑区间,并且看涨信号重新出现,移动平均线和动量指标的普遍排列表明,整体上升趋势可能会恢复。突破120,000美元至123,200美元的阻力带可能会发出重新买入力量的信号,为向新的历史高点的潜在走势打开大门。

看跌判决:

如果比特币失去115,700美元的支撑,且卖压加剧,特别是在较低时间框架上确认了看跌形态,可能会出现更深的修正。这将使看涨结构失效,并可能导致重新测试接近110,000美元的之前摆动低点,甚至更低,因为整合转变为延长的回调。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。