作者:Fairy,ChainCatcher

编辑:TB,ChainCatcher

「装修」还能修掉美联储主席?

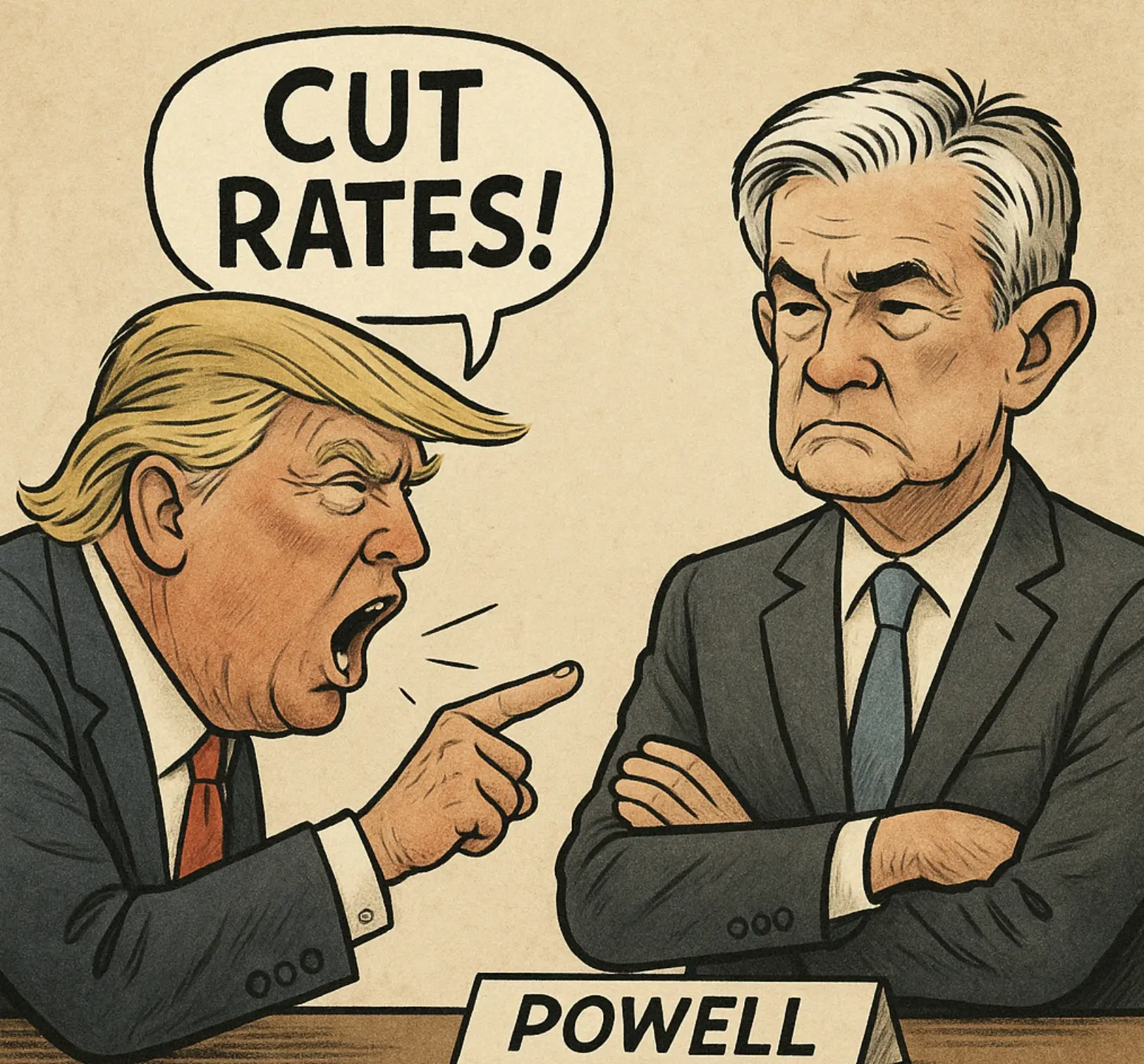

特朗普早在大选期间就开始「炮轰」鲍威尔,如今更借装修争议之名,上阵「逼宫」。这场看似离谱的政治戏码,正将全球市场情绪推向临界点。

如今,鲍威尔背负着怎样的压力?如果他真的被迫离任,将引发怎样的风暴?

特朗普与鲍威尔:长达七年的爱恨情仇

特朗普和鲍威尔的矛盾,归根结底就是一句话:一个想降息,一个死扛不降。就这个核心分歧,两人从 2018 年僵持至今。

有趣的是,鲍威尔的上任其实来自特朗普的钦点。2018 年 2 月,鲍威尔正式就任美联储主席,由特朗普提名。此时的特朗普期待鲍威尔推行宽松货币政策以支持经济增长。

2018 年 10 月,特朗普首次公开批评鲍威尔,称美联储加息过快是「最大的威胁」,指责鲍威尔「疯了」。两人的矛盾开始公开化,此后特朗普持续向鲍威尔施压,口水战持续不断。

2022 年,鲍威尔获拜登提名连任、任期延至 2026 年 5 月。进入 2024 年大选年后,情况进一步升级。无论是在竞选过程中,还是胜出之后,特朗普都持续批评鲍威尔「行动太慢、降息不力」。这几个月来,特朗普已 N 次点名要求鲍威尔辞职。

不过,特朗普想换掉鲍威尔,并非易事。按照美国法律,总统无权因政策分歧解除美联储主席职务,除非能拿出「违法或严重失职」的证据。

今年 7 月,真正的突破口出现。特朗普团队突然抛出「新剧本」:特朗普以「存在政治立场偏差」和「在国会做虚假陈述」为由,要求国会调查鲍威尔,指控鲍威尔牵头的美联储总部建筑翻新项目存在重大违规嫌疑。

就在这期间,有传言称鲍威尔正「考虑离职」,使得整件事迅速发酵。七年权力对抗,迎来高潮。

政策两难:鲍威尔的「货币炼狱」

前美联储经济学家罗伯特·赫策尔直言:「美联储已被逼入死角」。

当前,鲍威尔正身处货币政策的「炼狱」:一边是特朗普关税政策可能带来物价上行压力,另一边却是劳动力市场已显现降温迹象。双重威胁给鲍威尔和美联储的政策制定带来了难题。

若美联储过早降息,可能导致消费者通胀预期失控;若选择加息稳通胀,可能导致债市动荡、利率飙升,或触发「金融恐慌」。

经济困局之外,其还面临激烈的政治攻防战。不过,对于特朗普的施压,鲍威尔选择迎战。他请求监察长继续审查总部翻新项目,并罕见地通过美联储官网发声,详细回应成本上涨原因,反驳「奢华装修」指控。

经济、政治双线夹击,鲍威尔正处职业生涯中的艰难时刻。

若鲍威尔离职,会发生什么?

如果鲍威尔顶不住压力下台,整个全球金融市场的「定价锚」或将发生松动。

德意志银行外汇策略全球主管 Saravelos 分析称,若特朗普强行撤换鲍威尔,随后 24 小时内贸易加权美元指数可能暴跌 3%-4%,固定收益市场将出现 30-40 个基点的抛售。美元和债券将背负「持续性」风险溢价,投资者还可能担忧美联储与其他央行的货币互换协议被政治化。

Saravelos 进一步指出:「更令人担忧的是美国经济当前脆弱的外部融资状况,这可能导致比我们预测更剧烈、更具破坏性的价格波动。」

此外,荷兰国际集团策略师团队 Padhraic Garvey 等人发布报告称,鲍威尔提前离任「可能性较低」,但若发生将导致美债收益率曲线陡峭化,因为投资者会预期利率下行、通胀加速以及美联储独立性减弱。他们还指出,这将形成美元贬值的「致命组合」。

加密 KOL Phyrex的分析更具风险资产视角。其分析道,即便特朗普顺利换掉鲍威尔,也未必就能「只手遮天」控制美联储。一旦通胀真的再度抬头,新主席最终也得乖乖回归紧缩路线。如果美联储在经济尚稳、失业率低的前提下于 9 月开始降息,那么风险资产可能短期迎来提振,加密市场也将受益。但当前利率仍在 4.5%,后续要释放的水仍然「多得很」。

鲍威尔的位子轻轻一晃,市场便会震荡。这不仅是一场货币政策的博弈,更是一场权力与独立性的较量。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。