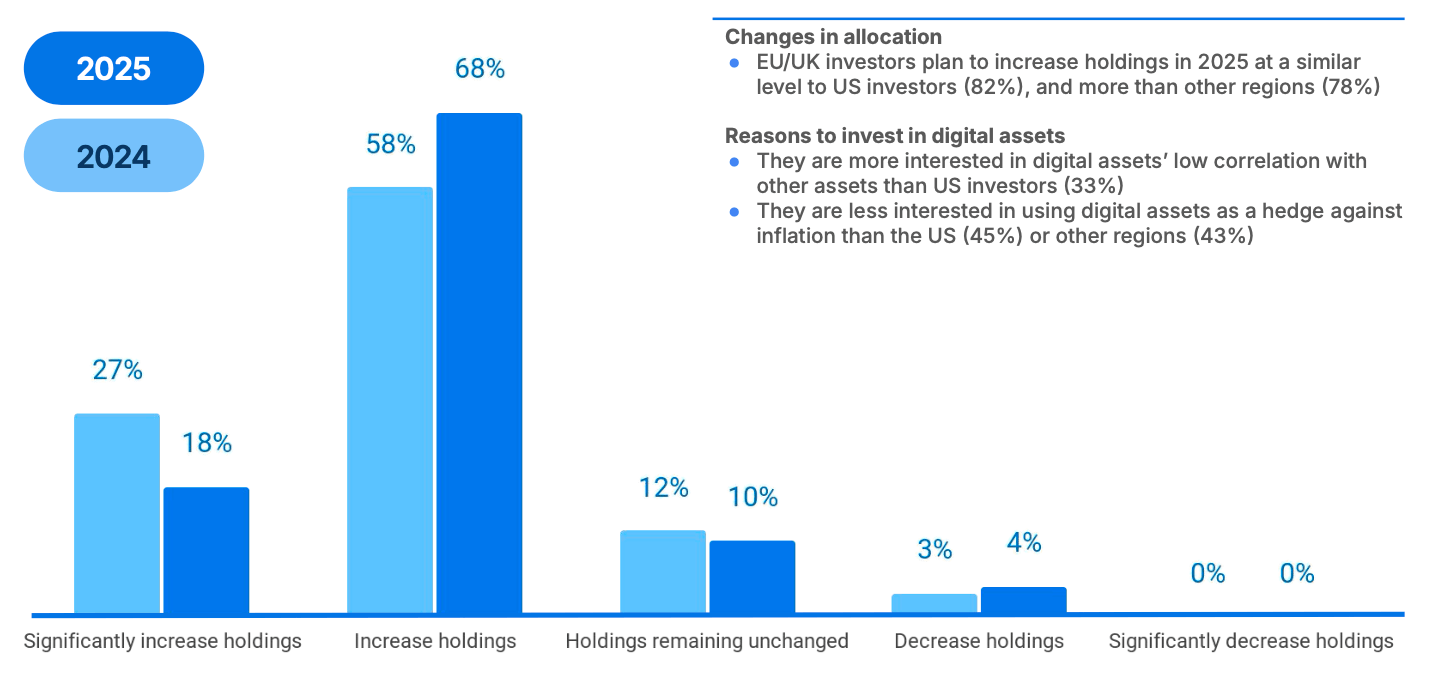

一半的受访者打算将超过5%的管理资产(AUM)分配给数字资产,较2024年的46%有所上升,尽管存在波动性担忧,这表明了对数字资产的更深承诺。

监管透明度被认为是增长的主要催化剂(58%),受访者指出,许可框架、保管规则和税收处理是关键需求。尽管波动性(51%)和市场操纵风险(42%)仍然是主要担忧,但71%的机构已经持有比特币和以太坊以外的其他币种。

“监管透明度被认为是数字资产管理者的首要关注点,受访者表示,增加的监管透明度将是推动行业前进的第一催化剂,”Coinbase和EY-Parthenon的报告指出。

研究的作者补充道:

“欧洲的资产管理者也更加重视消费者采用和对数字资产的更大了解,以支持采用。”

首选的投资途径包括注册的投资工具,如交易所交易产品(ETPs),57%的受访者对此表示青睐。代币化引起了强烈的兴趣,58%的受访者对代币化商品(56%)和房地产(42%)等资产“非常感兴趣”。近70%的投资者计划在2026年前进行配置,主要用于投资组合多样化。

预计去中心化金融(DeFi)的参与将在两年内激增2.5倍,达到68%,尽管66%的非参与者表示知识差距是一个障碍。稳定币的实用性强劲,81%的机构正在使用或探索稳定币用于外汇(75%)和交易效率(67%)。

尽管乐观,Coinbase和EY-Parthenon的报告指出,66%的人将内部专业知识短缺视为DeFi采用的障碍,而62%的人强调了合规风险。这些发现表明,欧洲市场正在成熟,资产配置的增加与对更清晰框架和教育的需求相吻合。

Coinbase和EY-Parthenon于2025年1月进行了全球调查,欧洲数据反映了管理超过10亿美元资产的机构。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。