Written by: Oliver, Mars Finance

It's hard to imagine someone holding a gun to steal your real estate, but if what you own is a string of easily transferable, globally redeemable cryptocurrencies, then to criminals, it's like a perfect walking ATM. However, risk and opportunity always go hand in hand. For small and medium-sized businesses struggling to survive in global trade, this string of code represents not danger, but the only hope to escape the high fees and long settlement periods of traditional banking systems.

Now, this digital wilderness, full of raw vitality and chaos, is welcoming a group of well-dressed "regular troops." They are not individual investors looking to strike gold, but empires of payment that control trillions of dollars in global capital flows. In the summer of 2025, the air is thick with the calm and tension of an impending battle. Following PayPal and Robinhood, giants Stripe and Shopify, who have commanded the traditional world, have finally planted their flags on the land of blockchain.

This is not a simple technical experiment, but a covert war over the control of the future internet's "settlement layer." The core weapon of this war is a digital dollar known as "stablecoin." The battlefield quietly unfolds on the underlying networks known as Layer 1 and Layer 2, which users cannot see.

Silent Gunfire: Stripe's L1 Rumors

On July 7, 2025, an ordinary Monday. Developers and investors in Silicon Valley were stirred by a seemingly inconspicuous rumor on social platform X. Crypto observer @ayyyeandy posted:

"There are rumors that payment service provider Stripe plans to launch an L1 blockchain, rather than choosing to build an L2 network like Robinhood. There is no official confirmation yet, but I have heard this from multiple sources (including offline and private messages). Currently, it's Robinhood against Coinbase, and soon, Stripe will join this battle."

The message was brief, but it was like a stone thrown into a deep pool. In the blockchain world, "L1" (Layer 1) and "L2" (Layer 2) are two distinctly different strategic choices. Choosing L2 means building your application on top of an existing, mature public chain (like Ethereum), akin to driving on a pre-built highway; it's convenient, but you must follow the highway rules and pay tolls. Robinhood's choice to build on Ethereum's L2 network Arbitrum is this route.

Choosing L1, however, is a more difficult and ambitious path. It means starting from scratch to build a brand new, independent blockchain. This is equivalent to investing in the construction of a new highway and setting all the traffic rules. This move is costly and presents significant technical challenges, but once successful, the builder will have supreme sovereignty over this "highway" — the verification of transactions, the collection of fees, and the rules of the ecosystem will all be defined by themselves.

Why would Stripe, a payment giant that processed over $817 billion in transactions in 2023, choose this most difficult path?

The answer lies in a recent public comment by Alchemy's engineering director, Noam Hurwitz. He asserted, "Stablecoins have become the backbone of internet payments, with adoption rates now surpassing major traditional card networks… and are becoming the default settlement layer of the internet."

For Stripe, if the internet's "default settlement layer" is built on someone else's L1 public chain, it will forever be just a "tenant." Stripe's goal is clearly to become the "landlord" of this new territory. They embraced Bitcoin in 2014, only to abandon it in 2018 due to its volatility and slowness. In 2022, they chose to partner with Circle to support the stablecoin USDC it issues. Every step has been extremely cautious. Now, building their own L1 is undoubtedly the most significant move the company has made after recognizing the ultimate fate of stablecoins. They are not looking for a ticket; they want control over the entire table.

The Merchant's Dilemma

Beyond Stripe's grand narrative, this transformation first touches the capillaries at the very end of the global trade network.

Isabella is a small business owner living in Madrid, Spain, running a handmade leather goods experience store on the e-commerce platform Shopify. Her customers are spread across the globe, including tourists from Buenos Aires, Argentina. In the past, when an Argentine customer wanted to book her course, they had to pay through traditional credit card networks. This euro payment had to go through an Argentine bank, international card organizations (like Visa or Mastercard), Stripe's payment gateway, and finally to Isabella's bank account in Spain.

The entire process took 3 to 5 days, with each step taking a "cut," resulting in a comprehensive fee rate close to 5%. Worse still, due to Argentina's strict foreign exchange controls and the volatile peso, the dollar equivalent paid by the customer and the euros Isabella ultimately received suffered immeasurable exchange rate losses.

On June 13, 2025, Isabella received an email from Shopify. The subject line was simple: "Now, receive global payments in USDC."

The email announced that Shopify had officially partnered with Coinbase and Stripe, allowing merchants to accept USDC stablecoin payments based on the Base chain (an L2 network launched by Coinbase). The most critical line was: "Merchants can choose to receive payments in local fiat currency and deposit them directly into their bank accounts without having to build their own crypto payment infrastructure."

Following the instructions, Isabella enabled a new payment option in her Shopify backend. A few days later, a new customer from Buenos Aires booked a course. On the payment page, the customer saw a QR code. He scanned it with his digital wallet (such as Coinbase Wallet), and the USDC preloaded in his wallet was transferred in seconds.

Almost simultaneously, Isabella's Stripe account showed that an equivalent amount in euros had been credited, with fees of less than 1%. No exchange rate losses, no waiting period. For her, it didn't matter whether the customer paid in pesos, dollars, or USDC; the process was completely seamless. She didn't need to understand what the "Base chain" was, nor did she need to manage complex private keys.

This is the power of the "Business Payment Protocol" jointly launched by Coinbase and Shopify. It completely encapsulates the complexity of cryptocurrency payments in the background. What merchants face remains the familiar fiat currency and bank accounts. This significantly lowers the adoption threshold.

For Isabella, this is a simple business optimization. But for Coinbase and Stripe, this is a key battle for millions of merchants on the new battlefield. Coinbase, through its Base chain and wallet, controls the user side; while Stripe, through its mature payment settlement network, controls the merchant side. They are both collaborators and potential competitors. Today, merchants can receive payments from the Coinbase network through Stripe; tomorrow, when Stripe's own L1 goes live, merchants may be guided to a brand new, more "efficient" Stripe payment network.

The choice seems to be in the hands of the merchants, but the real rules of the game have long been written by the platform giants.

The Crossroads of Old and New Worlds

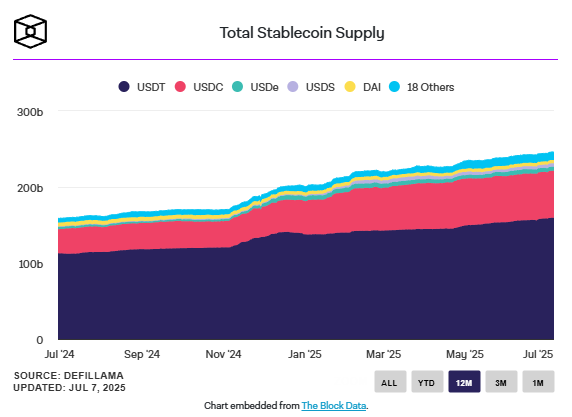

At the core of this transformation is the "explosive" adoption rate of stablecoins. According to reports from authoritative data agencies, by the end of 2024, the annual settlement volume of stablecoins on-chain had reached an astonishing $10 trillion, surpassing the annual processing volume of mainstream card organizations like Mastercard.

The entry of giants like PayPal, Stripe, and Shopify is happening against this macro backdrop. They see an undeniable trend: capital is flowing globally in a whole new way — faster, cheaper, and available 24/7.

"Stablecoins make money 'cheap, fast, global, and securely transferable,'" Noam Hurwitz's statement precisely summarizes its core advantages. These features make it thrive in cross-border payments, gig economy settlements, and even prediction markets like Polymarket.

However, as the old world's financial giants begin to embrace the underlying technologies of the new world, a profound contradiction emerges: the conflict between the ideal of decentralization and the commercial reality of centralization.

The birth of Bitcoin was intended to create a peer-to-peer electronic cash system not controlled by any single entity. Yet now, the issuance rights of stablecoins are highly concentrated in the hands of a few companies (like Circle and Tether), while the entry to stablecoin payments is firmly controlled by centralized giants like Stripe and Coinbase.

Shopify's Chief Operating Officer stated during the announcement of the partnership that this move would "help merchants easily meet global stablecoin payment demands." The key word here is "easily." To achieve this "ease," the system must hide complexity, and the process of hiding complexity itself is a concentration of power. Users and merchants give up direct control over underlying assets (such as private key management) in exchange for convenience.

This creates a new crossroads. On one hand, blockchain technology does address real pain points in the traditional financial system; on the other hand, the new infrastructure built using this technology seems to replicate the power structures of the old world, merely replacing banks and card organizations with tech companies.

The Invisible Empire

Back in Madrid, Isabella's business is thriving due to the new payment method. She doesn't care whether the payment request is processed through the Base chain or potentially through some "Stripe Chain" in the future. What she cares about is the speed of settlement and the fees.

This is precisely the most hidden and profound aspect of this war. It is not a geek debate about the merits of technology, but a silent revolution in commercial infrastructure. As millions of merchants and hundreds of millions of users enjoy the convenience brought by stablecoin payments, the land beneath their feet is quietly changing hands.

Companies like Stripe, Coinbase, and PayPal are building a new global payment network parallel to the traditional banking system. This network has stablecoins as its lifeblood and blockchain as its skeleton. They are becoming the "East India Company" of the 21st century, establishing an invisible financial empire composed of code and protocols.

For ordinary users, everything seems unchanged; the payment interface may just have an additional option. But behind this simple interface, the rules of global capital flow, power, and profit distribution are being completely rewritten. This war has no smoke, yet it will determine who the king of internet finance will be in the next decade.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。