作者:Bill Buchanan

来源:Medium

编译:Shaw 金色财经

不久之后,我们需要意识到我们正在运行一个传统的金融世界,并且需要构建一个更值得信赖的数字基础设施。实际上,我们需要变革的不只是金融领域,还有任何需要高度信任、安全性和分布性的领域。为此,我们可以采用像以太坊这样的 Layer1 区块链方法,但它已经暴露出扩展性问题,其主账本和计算基础设施无法处理每秒超过 15 到 30 笔的交易。不过,如今正在采用新的方法来减轻以太坊的负担——同时仍保持其可信度和分布性。这些方法包括用于共享的 Layer 1 实现,以及向权益证明 (PoS) 的过渡。然而,最令人关注的进展发生在 Layer 2 方法中,这些方法建立在核心以太坊网络(主网)之上。

Layer 2: 状态通道

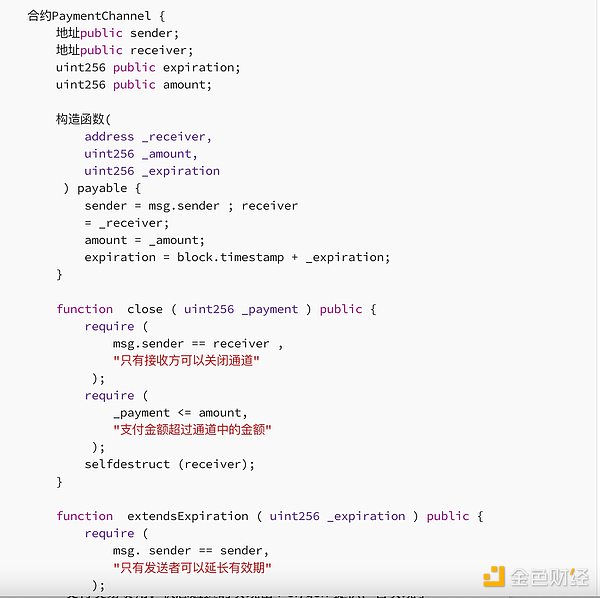

状态通道最初是在比特币闪电网络中实现的,后来在以太坊上进行了扩展。通过这种方式,我们基本上在主网账本上有两个记录,其中相关方必须承诺一些资金,这些资金可能会被使用,也可能不会被使用。例如,假设 Bob 想要创建一个侧通道来支付客户费用,并承诺支付 10 个 ETH。然后,他将创建一个通道合约。承诺的 ETH 将在通道有效期内被锁定,并且无法使用。Bob 可以给 Alice 2 个 ETH,给 Carol 3 个 ETH。完成后,他将提交完成的交易,Bob 将收回 5 个 ETH,Alice 和 Carol 分别获得 2 个 ETH 和 3 个 ETH。最后,Bob 只需发布汇总数据,并且只需为主网账本上的两次承诺支付交易费用。状态通道的实现由 Polygon 提供,它实现了完整的 EVM 兼容性和低交易费用。以下是一个例子:

Layer 2: Roll-ups

扩大以太坊规模的最佳机制之一是通过Roll-ups和侧链将交易转移到链下。

Optimistic Roll-ups

这些机制在链下处理交易,并假定交易有效(本质上是一种「信任并验证」的方法)。只有当交易出现争议时,它们才会占用主网上的计算资源。因此,在交易真正确认到主网之前,需要一段「挑战期」的延迟。

在 Arbitrum 中,欺诈观察员会分析交易,如果发现欺诈交易,观察员会将欺诈证明发布到主网。实际上,Arbitrum 可以识别与欺诈分析相关的代码行,然后将其发布到主网。主网随后可以对欺诈证明进行裁决,并决定是否执行所需的代码。Arbitrum 有七天的提现期。

Optimism也采用了链下方法,并结合了 Optimism Roll-up,并假设交易有效。它使用观察者(或验证者)来确定是否存在欺诈性交易,一旦发现此类交易,观察者可以提交欺诈证明,相应交易将被撤销。观察者将因发现欺诈性交易而获得奖励。总体来说,质疑期约为七天。若欺诈证明属实,相关交易将被回滚。

零知识Roll-ups(zk-Rollups)

这些技术将计算和状态存储转移到链下,并采用一种无需信任的方式。一旦状态更新回主网,只需极少的更新即可完成状态变更及其相关的证明。由于我们拥有压缩格式的证明,因此可以快速验证更新后的交易,同时保障交易的隐私性。有了这种技术,与需要数天才能提交的 Optimistic Rollups 不同,使用 zk-Rollups(基于 zkSnarks)我们只需大约一小时即可验证证明。这确保了没有双重支付,并且所有交易都具有偿付能力。ZKsync 就是一个例子。

使用 zk-

使用 zk-

Rollups,交易的有效性有加密证明,并连接到主网。因此,进行欺诈交易将极其困难。使用 Optimistic Rollups,由于缺乏加密证明,因此在承诺返回主网之前,存在延迟,从而可以检测到欺诈交易。

侧链

这是一个独立的侧链,是一条桥接到主网的独立区块链。与 roll-up 方法不同,更新后的交易可以在需要时回显到主网。总的来说,它们拥有自己的区块链和共识机制,例如权威证明 (PoA)。Polygon 就是一个侧链基础设施的例子。侧链的总体弱点在于,它们的安全模型可能与以太坊主网不同。

结论

在我看来,在离线链中使用零知识证明是最佳解决方案,因为这样可以快速验证主链上的交易,并且能保护交易双方的隐私。我们还可以在零知识证明中使用选择性披露,这在揭示重要信息时很有用,比如一个人是否有权访问某个资源。

对于 Optimistic Rollups,我们假定交易有效,除非有相反的证明,并且需要一个挑战期,在此期间交易在最终确定前可以被质疑。而使用 zk-Rollups,我们的交易是有效的,因为有相关联的证明,并且能快速提交到主网。遗憾的是,zk-Rollups 需要对密码学和区块链有深入的理解,这可能会减缓开发进程。

显然,以太坊并非唯一的选择,Polygon、Solana、Cardano 和 Polkadot 等提供了比以太坊更具扩展性的替代方案。不过,我们热爱这个为我们带来智能合约和以太坊虚拟机(EVM)的区块链,许多人希望它能够克服可扩展性问题,同时保持同样的去中心化和安全性水平。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。