Author: Carbon Chain Value

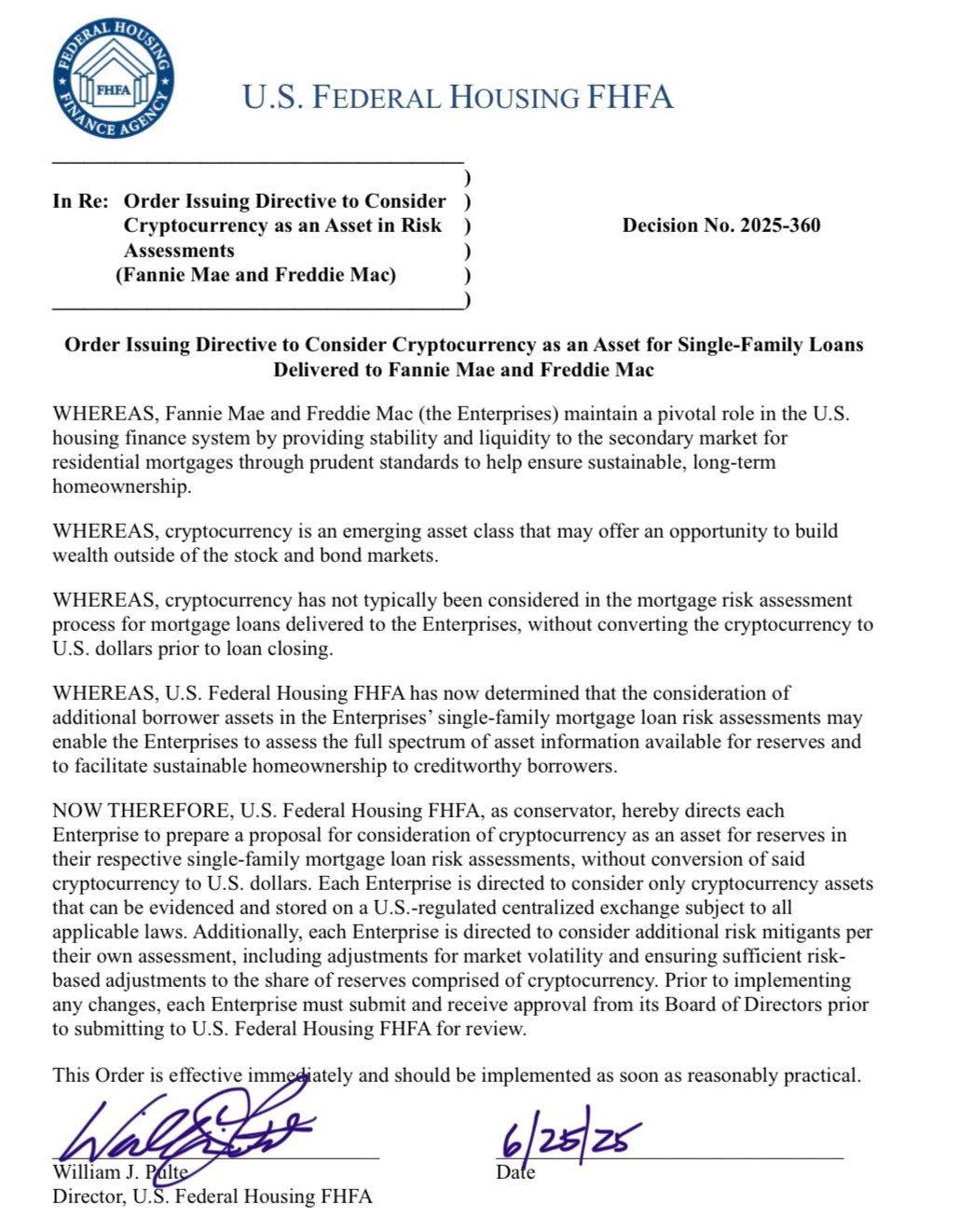

On June 26, Bill Pulte, Chairman of the Federal Housing Finance Agency, announced that he has instructed Fannie Mae and Freddie Mac to prepare a proposal to consider cryptocurrencies as mortgage assets.

According to Bloomberg, not all cryptocurrencies will be accepted. The directive stipulates that these cryptocurrencies must be stored in centralized exchanges that are regulated by the U.S. and comply with all applicable laws.

This move aims to help mortgage applicants who own crypto assets qualify for loans, as the number of mortgage applications has significantly declined in recent years due to the housing crisis in the U.S. Additionally, Bill Pulte noted that Fannie Mae and Freddie Mac currently hold over $7.8 trillion in assets.

Michael Saylor, founder of MicroStrategy and a Bitcoin advocate, stated on X that Bitcoin has been recognized as a reserve asset by the U.S. housing system. This marks a decisive moment for institutional adoption of BTC and recognition of it as collateral.

On June 23, Bill Pulte hinted at this announcement in a statement on X, where the Director of the Federal Housing Finance Agency indicated that his agency would "explore the use of cryptocurrency holdings in relation to mortgage eligibility."

Despite the U.S. homeownership rate remaining relatively stable at about 62% over the past 50 years, the number of new applications has sharply declined in recent years, forcing a record number of young Americans to live with their parents or struggle with renting for decades.

By mid-2024, the number of mortgages issued has dropped to near historical lows, with little improvement expected in the first quarter of 2025, as most consumers still perceive interest rates as exorbitant. The decline in mortgage issuance, particularly in refinancing, is attributed to multiple factors.

Firstly, the growth in housing supply has not kept pace with demand. Housing construction has lagged, with more homes being purchased by investors rather than potential buyers, and older homeowners are choosing to stay in their homes rather than move to retirement facilities.

The cost of borrowing is also rising, with many attributing the decline in loan issuance to the Federal Reserve's interest rate hikes aimed at curbing inflation. Bill Pulte has frequently criticized the Fed's interest rate policies, even calling for the resignation of Fed Chair Jerome Powell, who is set to testify before Congress on June 26.

In light of these adverse factors, Bill Pulte is seeking ways to make it easier for homeowners to borrow, with cryptocurrency emerging as a potential game-changer.

While some boutique lenders have already allowed borrowers to use cryptocurrencies as collateral, the research and endorsement from the Federal Housing Finance Agency would represent a significant step forward for cryptocurrency adoption, especially amid declining mortgage applications.

According to CoinTelegraph, the formal recognition of cryptocurrencies by the Federal Housing Finance Agency (FHFA) could open up substantial federal loan programs for more borrowers. In 2024 alone, the Federal Housing Administration issued over 760,000 single-family home mortgages, totaling $230 billion.

Under the banking rules established by the U.S. Securities and Exchange Commission (SEC) in Staff Accounting Bulletin No. 121, most banks will not be able to offer cryptocurrency-backed loans or mortgages until January 23, 2025. This rule requires financial institutions to classify cryptocurrencies as liabilities rather than assets on their balance sheets. This rule was quickly repealed after President Trump took office.

However, loans obtained through federal programs such as the Federal Housing Administration (FHA), the Department of Veterans Affairs (VA), and the U.S. Department of Agriculture (USDA) currently do not allow borrowers to use their cryptocurrencies as collateral. In fact, according to Sam Cooling, editor at 99Bitcoins, some federal loans may not even permit the use of dollars from the sale of cryptocurrencies for down payments.

Personal finance expert Andrew Lokenauth stated that potential homeowners hoping to buy a house with Bitcoin earnings need to "keep meticulous records and retain relevant documentation."

Bitcoin supporters have praised Pulte's open attitude towards Bitcoin (BTC), with some noting that digital assets inherently possess features that lenders favor, such as transparent paper trails.

Mitchell Askew, an analyst at Blockware, which offers Bitcoin mining as a service, stated that the liquidity and transparent custody of the asset (i.e., its public blockchain) make it "the perfect collateral" for housing loans.

CJ Konstantinos, founder of the Bitcoin mortgage and bond company People's Reserve, stated that Bitcoin could further help reduce the risks in the mortgage-backed securities market regulated by the FHFA by regulating Fannie Mae and Freddie Mac. "It's obvious."

Currently, only a handful of lenders allow borrowers to provide cryptocurrencies as collateral, and the number is quite limited. These institutions tend to cater to the investor demographic among homebuyers, which carries risks that some may find difficult to bear.

Milo (formerly MiloCredit) will immediately approve a borrower's loan, but the borrower must first prove they have enough cryptocurrency to cover the entire loan. Milo CEO Josip Rupena stated that many clients are purchasing second homes, vacation properties, or investment properties.

He said, "Many people have substantial incomes, but traditional banks won't qualify them for the full value of these homes."

Another company offering Bitcoin mortgages, Strike, noted that the current form of cryptocurrency loans carries certain risks. Volatility is a major factor. If the price of BTC drops significantly, the loan-to-value ratio will increase, "which could trigger margin calls or liquidations—being forced to sell at an inopportune time."

Lenders also face risks. One commentator remarked, "The risk models in this area are simply insane. Traditional mortgage assumptions are based on the borrower's income and assets being relatively stable. Now, you're dealing with borrowers whose net worth could fluctuate by 50% in a week. How do you stress-test a portfolio when your collateral includes everything from Bitcoin to random DeFi tokens?"

However, in the U.S., cryptocurrency ownership is becoming increasingly common, and lawmakers and regulators in Washington are rapidly implementing rules and legal frameworks that are friendly to the industry.

Recent studies indicate that cryptocurrencies are no longer exclusive to the super-rich but are increasingly viewed as legitimate retail assets by ordinary investors. According to the National Cryptocurrency Association's report "The State of Cryptocurrency in 2025," it is estimated that about 20% of Americans (approximately 65 million people) currently own cryptocurrencies.

Their investments are not astronomical; about 74% of cryptocurrency portfolios in the U.S. are valued at less than $50,000.

If Bitcoin is added to the list of other securities that can be used to obtain mortgages, allowing the use of cryptocurrencies as down payments or collateral could unlock homeownership for an increasing number of investors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。