一百二十五架美国飞机,包括七架B-2隐形轰炸机,周六从俄亥俄州的怀特曼空军基地起飞。当天晚上,轰炸机在伊朗的两个战略核设施——福尔多和纳坦兹投下了数十枚30,000磅的“破坏碉堡”导弹。第三个地点伊斯法罕则遭到了一艘美国潜艇的攻击,该潜艇发射了超过二十枚战斧导弹。比特币(BTC)在此后不久暴跌。

(伊朗地图,显示美国军队周六袭击的三个核设施的位置 / BBC)

这次行动被称为“午夜锤”,五角大楼将其描述为“美国历史上最大规模的B-2作战打击”,但这可能会付出代价。伊朗誓言要报复,并在周日威胁关闭霍尔木兹海,这是一条中东贸易路线,便利全球五分之一的石油供应通过。

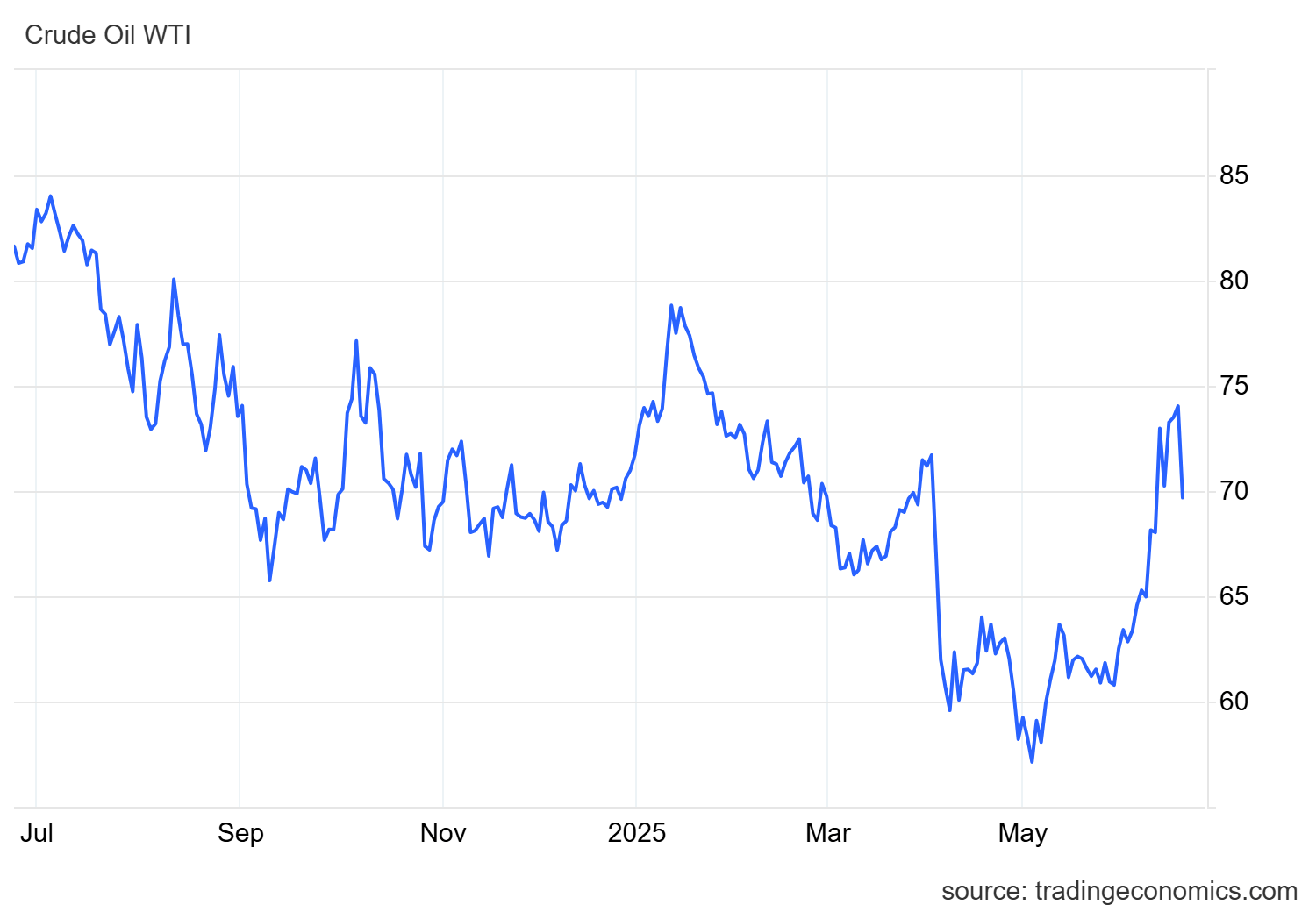

但在报道时,霍尔木兹海仍然开放,令人惊讶的是,油价已下降超过5%,跌至70美元以下。像Metaplanet这样的机构急于以折扣价购买这种加密货币,加密投资者安东尼·庞普利亚诺刚刚宣布成立一家名为Procap的十亿美元比特币国库公司。尽管面临前所未有的地缘政治动荡,比特币表现出显著的韧性。

(尽管美国对伊朗的攻击,油价在周一意外下跌5%,伊朗是全球最大的石油生产国之一。原油价格跌破70美元。 / Trading Economics)

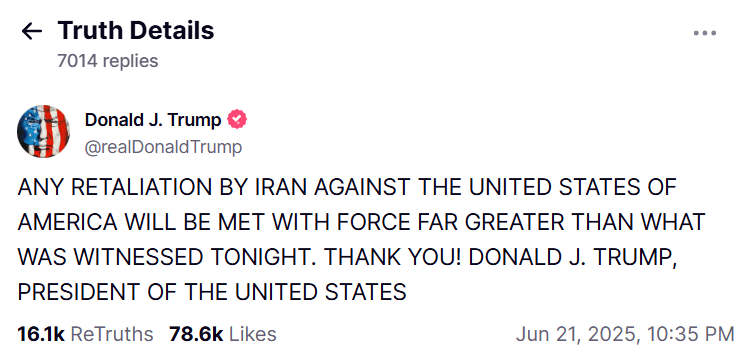

至于伊朗的报复,美国总统唐纳德·特朗普对任何此类行动发出了严厉警告。

(美国总统唐纳德·特朗普对伊朗发出严厉警告,针对周六美国轰炸袭击后的任何潜在报复 / 唐纳德·特朗普在Truth Social上)

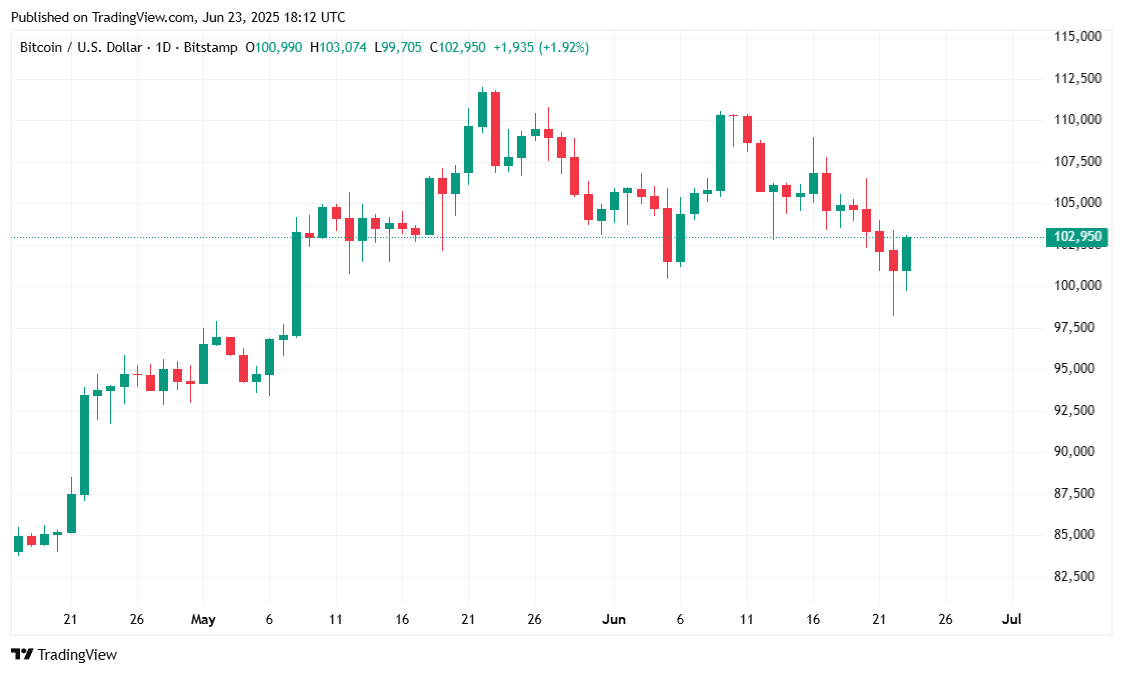

在“午夜锤”行动后,比特币在周一经历了急剧反弹。在经历了剧烈下跌后,这种加密货币在过去24小时内上涨了3.34%,交易价格为102,916.34美元。此次反弹是在一个波动的交易时段后发生的,该时段比特币曾跌至98,286.21美元,随后达到103,016.66美元的峰值。但尽管反弹,比特币本周仍下跌了4.63%。

(比特币价格 / Trading View)

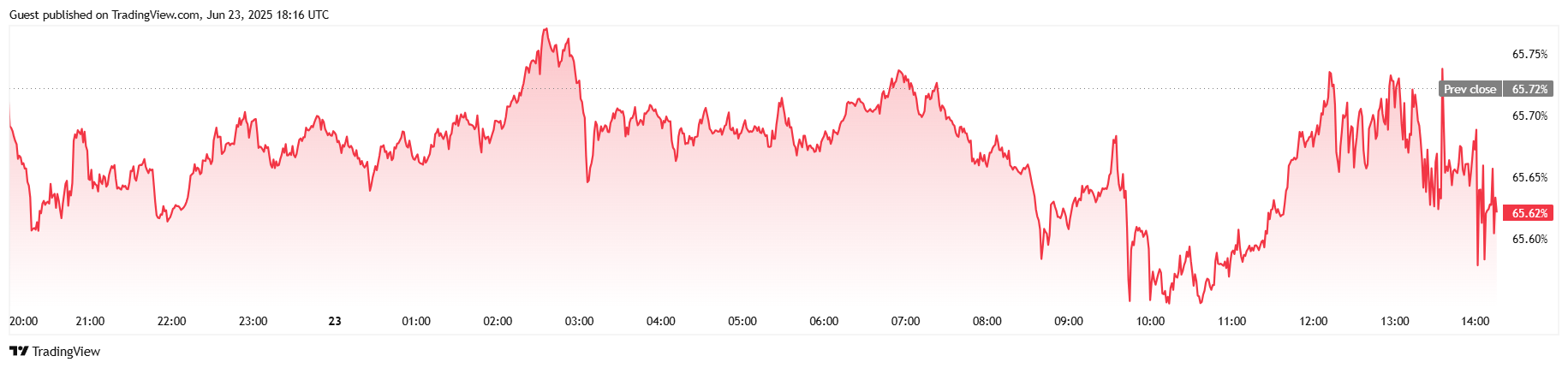

该数字资产的市值上升至2.04万亿美元,比前一天上涨了3.53%,尽管交易量下降了10.02%,降至579.6亿美元,这表明一些交易者采取了观望态度,特别是在中东冲突不断升级的情况下。比特币的市场主导地位自昨天以来略微下降至65.63%,但仍高于近期水平。与此同时,期货市场活动有所上升,未平仓合约增加了1.32%,达到681.4亿美元。

(比特币主导地位 / Trading View)

衍生品数据显示市场情绪明显倾斜。Coinglass报告称,在过去24小时内,总清算额为1.1888亿美元,空头承受了更大的损失,空头清算为6993万美元,而多头清算为4895万美元。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。