格兰特·卡多恩(Grant Cardone),房地产投资公司Cardone Capital的首席执行官,急于向比特币财库公司Strategy的主席迈克尔·塞勒(Michael Saylor)展示他的计划。卡多恩知道,各公司正在争相筹集资金以购买比特币(BTC),他将这种情况形容为21世纪的“淘金热”,因此他的计划既雄心勃勃,又小心翼翼地与房地产相结合,这是卡多恩的专业领域。

“现在就像是淘金热,”卡多恩在接受Bitcoin.com采访时说道。“每当我感到这种热潮涌动时,我的脖子后面就会起鸡皮疙瘩。”

格雷·卡多恩(Gary Cardone),格兰特的同卵双胞胎兄弟,也是知名的比特币倡导者,在2025年1月安排了与塞勒的初次会面。之后,卡多恩兄弟迅速制定了一个计划,立即加入比特币财库的行列,但格兰特并不想冒险。“我是一个非常保守的投资者,”卡多恩解释道。

确实,卡多恩在与塞勒的后续讨论中提出的计划反映了他的风险厌恶:一系列将投资于房地产和比特币的基金。塞勒对卡多恩基金中房地产与比特币的比例产生了好奇。

“我说,‘85%是房地产,15%是比特币,’”卡多恩解释道。“不过到第四年,迈克,我会变成70:30。”卡多恩继续描述,他将在战略的第五年左右达到50%房地产和50%比特币的资产组合,这可能还包括上市,但塞勒嘲笑他过于谨慎。

“你真是小心翼翼,”塞勒对卡多恩说道。“你应该从80%比特币和20%房地产开始。”

卡多恩考虑了塞勒的评论,但决定坚持自己的保守做法。

“迈克,我是个房地产人,”卡多恩解释道。“如果我去80%比特币和20%房地产,我就不再是房地产人了。”

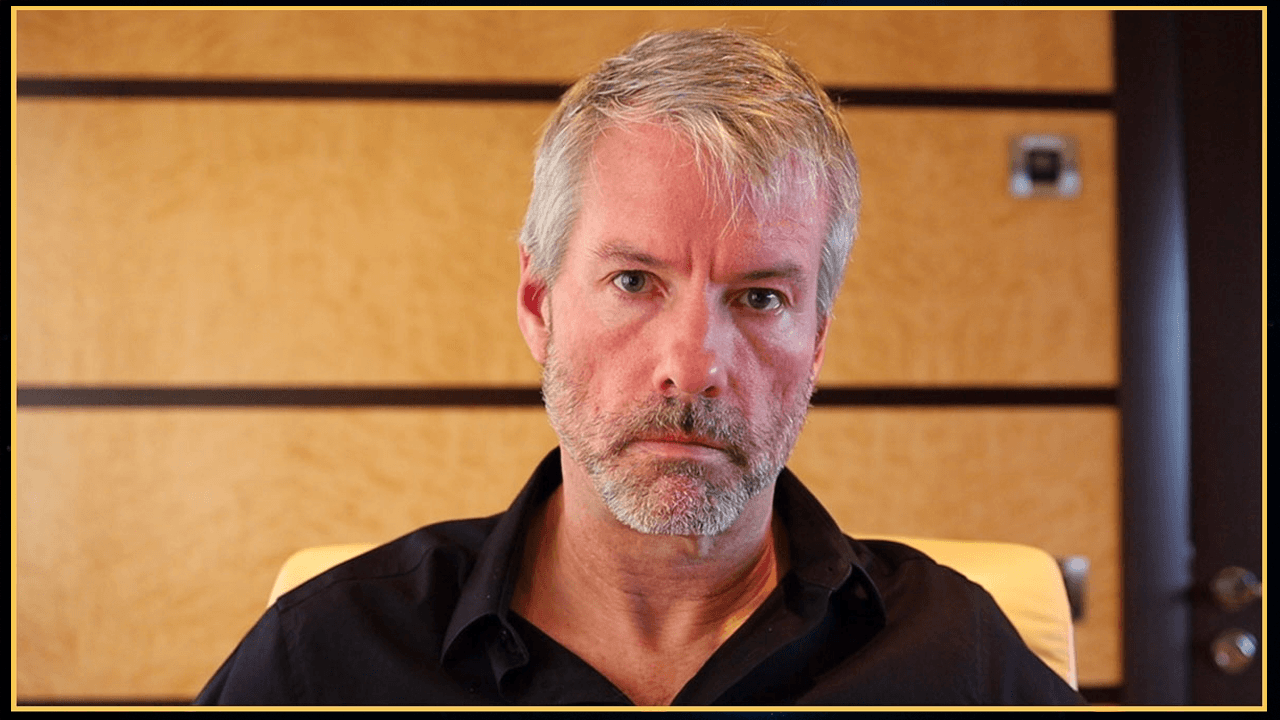

(Strategy的主席迈克尔·塞勒告诉格兰特·卡多恩停止“小心翼翼”,全力投入比特币 / strategy.com)

卡多恩表示,在与塞勒的对话后,他启动了四个比特币房地产基金。最近的一个是“10X迈阿密河比特币基金”,这是对卡多恩畅销书《10X法则》的引用。他计划在今年推出总共十二个基金。

他的总体投资策略涉及以折扣价购买现金流为正的物业。市场价值与购买价格之间的差额用于购买比特币。现金流、价格折扣和折旧带来的税收减免共同创造了一个飞轮效应,使卡多恩能够在每次基金推出时增加公司持有的比特币。

“美国有4万亿美元投资于房地产投资信托,”卡多恩说。“我们将击败这些,因为它们每年可能只能做到12%。当我们将比特币加入其中时,我们的房地产投资组合将达到30%和40%的回报。”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。