Perhaps U.S. President Donald Trump’s incessant name-calling has finally taken effect after Federal Reserve Governor Christopher Waller hinted at an interest rate cut “as early as July” during a CNBC interview on Friday.

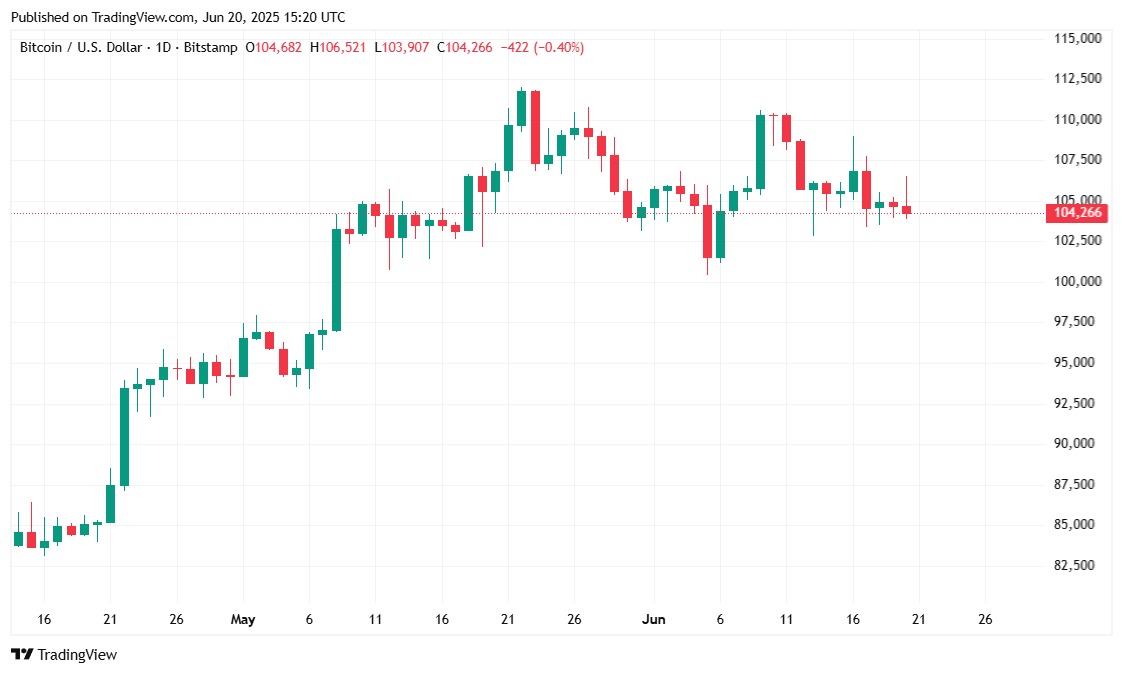

Crypto and stock markets initially jumped on the news, with bitcoin climbing past $106K, but the cryptocurrency has since retreated to $104K at the time of reporting. Markets were mixed, with the Dow up 0.16% and the S&P 500 and Nasdaq both down 0.26% and 0.64% respectively. Crypto markets didn’t fare much better, initially inching up 0.47% before shedding 0.13% at the time of writing.

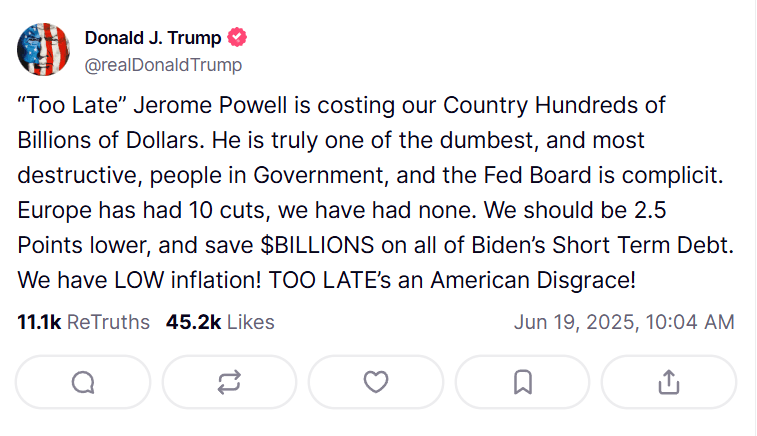

(Federal Reserve Chairman Jerome Powell has been the target of vicious name-calling by U.S. President Donald Trump / Donald Trump on Truth Social)

Trump has poked fun at Federal Reserve Chairman Jerome Powell for weeks on end, calling him a “numbskull,” “dumb,” and “stupid” for not cutting rates. The president has even concocted a nickname, “Too Late,” a reference to Trump’s assertion that Powell is dragging his feet and not lowering rates quickly enough. But now, the president may finally see the rate cut he’s been calling for as soon as next month, at least according to Waller.

“I think we’re in the position that we could do this and as early as July,” Waller said, referring to a potential rate cut. “That would be my view, whether the committee would go along with it or not.”

Bitcoin is currently hovering around $104,294.98 and has been trading between $103,932.09 and $106,539.38 over the past 24 hours. The current price represents a marginal 0.05% dip on the day and a 1.22% decline over the past week.

( BTC price / Trading View)

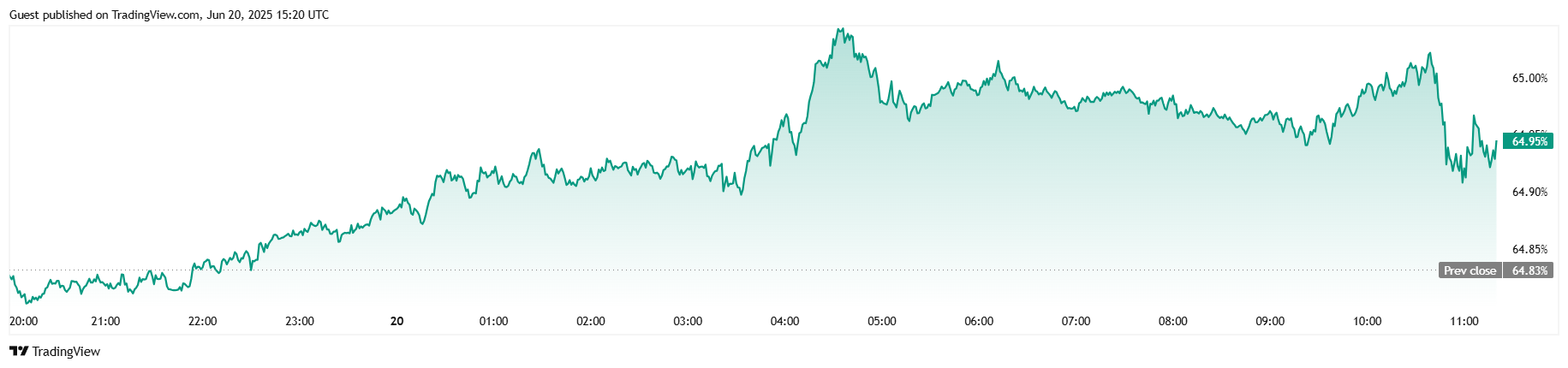

Trading volume edged up by 1.54% to $42.65 billion, indicating continued interest from market participants. Bitcoin’s total market capitalization fell slightly to $2.07 trillion, down 0.06% from the previous day. Despite the choppy performance, BTC dominance saw a small uptick to 64.94%, suggesting modest outflows from altcoins.

( BTC dominance / Trading View)

Meanwhile, BTC futures open interest climbed 0.90% to $70.09 billion, which could mean increased speculation in derivatives markets. Liquidations paint a picture of overzealous bulls whose long positions got wiped out to the tune of $40.03 million over the past 24 hours. $22.61 million in shorts was also liquidated, resulting in $62.64 million in total liquidations since yesterday.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。