黑石集团以7.5亿美元购买以太坊,ETF、稳定币和真实资产齐头并进

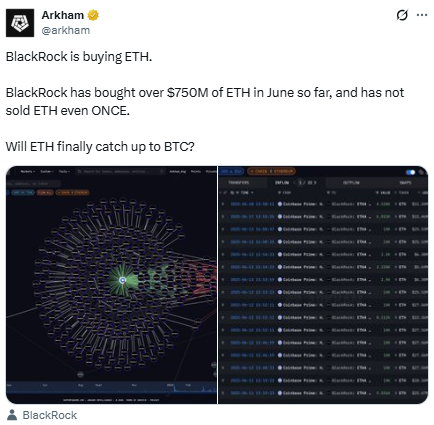

以太坊再次回到聚光灯下,这次不仅仅是加密货币爱好者。全球最大的金融机构黑石集团在6月份单独购买了超过7.5亿美元的ETH,并且没有出售一枚货币。这家全球最大的资产管理公司的这一看涨举动让许多人开始质疑:黑石是否在大举押注以太坊的未来?这是否是它终于能够追赶比特币的时刻?

机构信心正在蓬勃发展

尽管价格疲软且零售投资者近期抛售,但黑石的大胆举动显示出一些重大变化正在酝酿之中。事实上,单日内增加了1500万美元的ETH,机构的ETF流入在短短19天内超过了12.5亿美元,这是自2017年以来最大的购买潮。

与此同时,持有这种加密货币的鲸鱼钱包数量正在增加,许多人认为这种安静的积累阶段并非偶然。分析师表示,价格被激进的做空压制,以便大型投资者可以在较低的水平上继续购买,然后再进行爆发性上涨。

以太坊的10K之路:是什么推动了这一激增?

这不仅仅是另一种加密货币,它是一些最关键的加密基础设施的基础。随着天才法案即将获得全面批准,势头是真实的。这项立法将规范稳定币,而稳定币已经由以太坊主导。大约40%的USDT和75%的USDC存在于以太坊网络上。

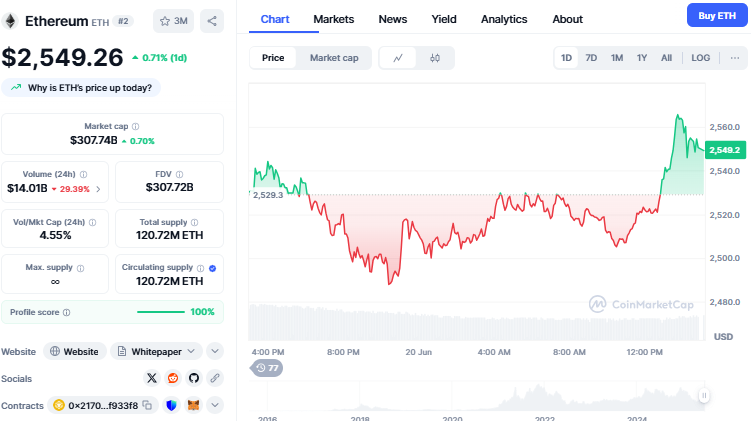

甚至像摩根大通这样的主要银行也在以太坊上构建代币化存款。如果稳定币成为加密货币中最大的部分,正如许多人所预测的那样,这种加密货币将受益最多。目前它的交易价格为2549.26美元,24小时内上涨了0.71%。由于伊朗-以色列战争引发的地缘政治紧张局势,交易量下降了29.39%。

质押ETF将推动巨大的需求

ETH增长的另一个主要原因是质押。目前,29%的总ETH被质押,并为持有者带来被动收益。随着Bitwise的质押ETF计划在7月4日获得批准,机构可能很快就能通过受监管的产品质押ETH。

这将为这种数字货币注入数十亿美元,使其资产更加吸引人。在安全、受监管的代币上产生收益的可能性将对传统金融(TradFi)投资者来说是一个游戏规则的改变者。

真实资产和第二层扩展

这种数字资产在整个加密行业中已经占据了55%的总锁定价值(TVL)。它的主导地位显而易见。但它的未来更加光明。从第二层网络到真实资产(RWA)代币化,以太坊是首选平台。

随着银行、政府和金融科技公司探索加密解决方案,这个网络是他们的首选,这意味着它的使用案例只会增长。

银和以太坊:一个熟悉的模式?

有趣的是,著名投资者彼得·希夫最近发布了关于银的当前状况,表示它可能会跟随黄金的突破。有些人现在将这种加密货币与银进行比较,就像比特币曾经与黄金进行比较一样。如果比特币遵循黄金的路径,那么ETH是否会跟随银的路径?

最后的思考

截至目前,以太坊在爆发前保持冷静。黑石的大规模ETH购买、鲸鱼活动的增加、即将到来的质押ETF以及稳定币的主导地位都指向一个方向,这种货币正在为重大突破做好准备。

一旦做空头寸解除,机构投资者完成加仓,它可能会迅速朝着10,000美元的目标前进。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。

来源:

来源: