meme币投资者在周一醒来,发现市场经历了一场血腥的洗礼,整个行业的跌幅都达到了两位数。

以太坊 代币 Pepe 在过去24小时内暴跌12%,至$0.000010,SPX6900下跌11.55%,至$1.40,而Fartcoin 则下跌8.99%,至$1.13。事实上,在整个加密市场中,只有门罗币、AB、Form和比特币SV显示出任何涨幅,且涨幅均低于1.5%。每个交易者心中现在都在思考的问题是,这是否代表着一个黄金买入机会,还是更深层次修正的开始。

随着地缘政治紧张局势升级,传统市场出现疲软迹象,整个加密货币市场正经历显著的卖压,形成了对风险资产特别打击的完美风暴。

加密货币的惨烈并非孤立发生。在以色列上周五对伊朗进行一系列空袭后,标准普尔500指数下跌,黄金和石油等商品价格飙升。比特币的市场主导地位上升至63.83%,这清楚地表明投资者正在从风险资产转向对冲资产。在传统金融中,这意味着从股票转向商品;在加密货币中,这意味着从垃圾币转向比特币。

Pepe面临鲸鱼驱动的分配

以太坊代币Pepe交易数据。图片来源:TradingView

Pepe的12%日跌幅反映出一系列看跌因素的汇聚,暗示未来可能会有更多痛苦。周线图上的技术图形显示出明显的分配模式:价格略低于$0.000010,代币已跌破关键支撑位。

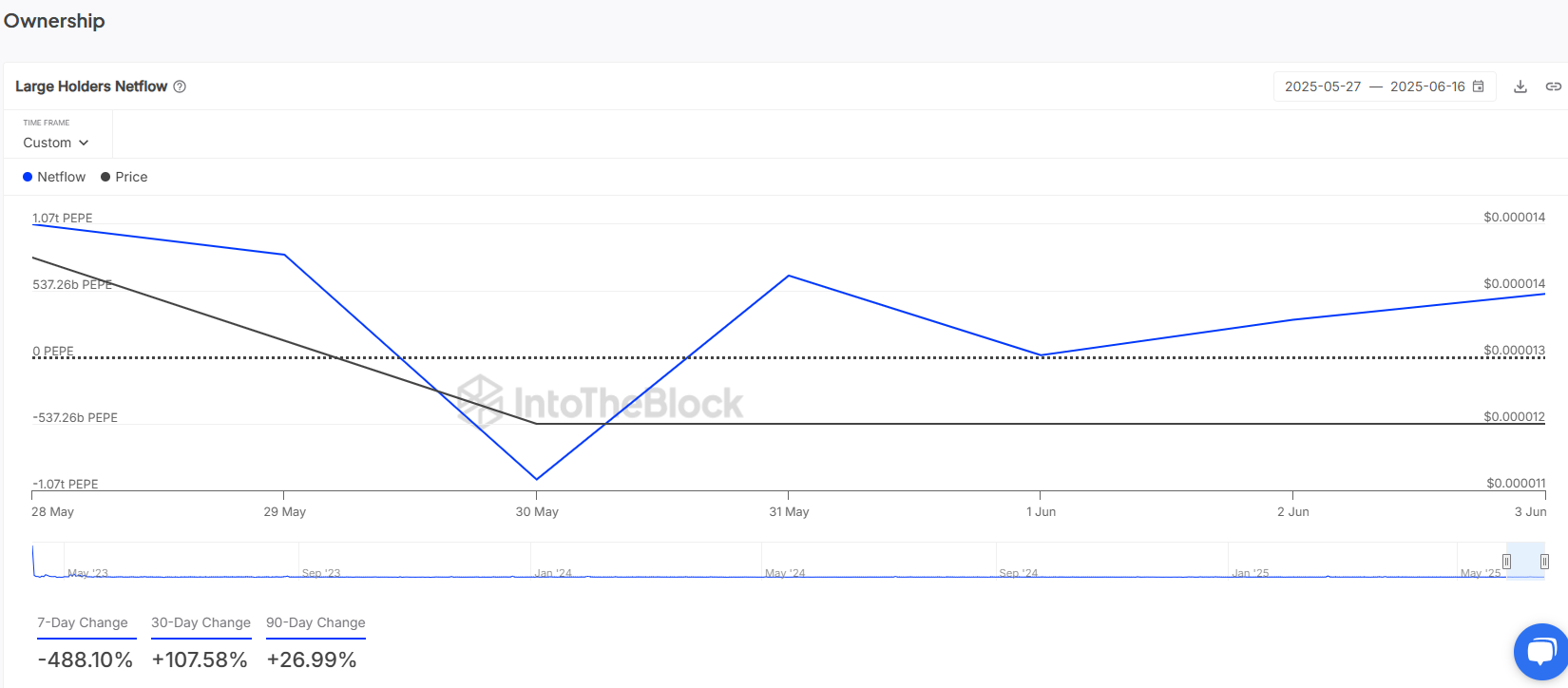

链上数据显示,鲸鱼净流入在6月16日激增,发出分配和卖压的信号。当鲸鱼(在此情况下定义为控制超过1%供应量的地址)开始将代币转移到交易所时,通常会预示着显著的价格下跌。除非是为了抛售,否则没有理由将meme币转移到中心化交易所。

以太坊代币Pepe交易数据。图片来源:TradingView

技术指标同样显示出看跌的图景。相对强弱指数(RSI)衡量资产是否被超买或超卖,目前在周线时间框架上为40.5,表明动能减弱,但尚未达到可能触发反弹的超卖条件。平均方向指数(ADX)为26,显示出一个趋势看跌的市场正在增强。ADX衡量趋势强度而不考虑方向。

需要关注的关键支撑位包括$0.0000104的斐波那契回调低点——跌破此水平可能会引发连锁清算,并将损失扩大至$0.0000085。50日EMA(过去50天的平均价格)约为$0.0000118,现在作为阻力,使得任何反弹尝试都可能面临卖压。

SPX6900测试其看涨性

SPX6900 meme币交易数据。图片来源:TradingView

SPX6900的11.55%下跌发生在一个非凡的上涨之后,该代币在5月至6月之间上涨了230%。目前交易价格为$1.50,这个嘲讽地将自己定位为加密货币的标准普尔500的meme币,在达到不可持续的高度后,正经历经典的获利回吐。

上涨的总是会下跌。

每周图表显示SPX6900在一个大型对称三角形模式内整合,目前这一周的蜡烛图威胁着突破下趋势线。RSI从超过75的超买水平降至69(不是meme),而ADX为26则表明之前的强劲趋势正在失去动能,但仍在发挥作用。

关键支撑位在$1.30。如果周线收盘低于此水平,将确认三角形破位,并可能加速向$1.08的卖出,短期EMA在此处提供潜在支撑。如果看涨趋势保持稳固,下一个阻力位可以设定在约$1.80。

Fartcoin面临市场现实

Solana代币Fartcoin交易数据。图片来源:TradingView

Fartcoin的8.99%下跌在其同行中似乎显得温和,对于一个degener来说,这只是正常的一天,但技术设置表明这个基于Solana的meme币面临显著的逆风。当前交易价格为$1.13,该代币在经历了抛物线式的上涨后,正努力维持动能。

日线图显示Fartcoin被困在一个小的短期下降通道中,目前这一周的蜡烛图即将测试下边界。从更广泛的视角来看,尽管情况看起来看涨,但该代币在6月25日的最后高点$1.50未能匹配5月的高点$1.60。这可能表明多头在经历看跌修正后可以推动反弹,但不足以维持几周前的速度。

ADX读数为17,表明缺乏方向性强度,暗示该代币被困在一个可能向任一方向解决的整合阶段。然而,周线时间框架上的RSI为37,日线为47,似乎表明交易者可能看跌,试图迅速抛售他们的代币。

买入回调还是逃之夭夭?

所有三种主要meme币的技术证据表明,这一修正还有进一步下行的空间(以不好的方式)。Pepe的鲸鱼分配、SPX6900的衍生品平仓以及Fartcoin的技术破位的结合,描绘出一个经历必要但痛苦重置的行业,之前的涨幅不可持续。

然而,对于具有强风险承受能力的逆向投资者来说,这些水平可能代表着积累机会。历史表明,恐慌性抛售很少导致明智的决策,市场通常将资金从不耐烦者转移到耐心者。但这并不是说我们在推荐耐心(或者说任何建议),因为meme币以其短暂的生命周期而闻名。

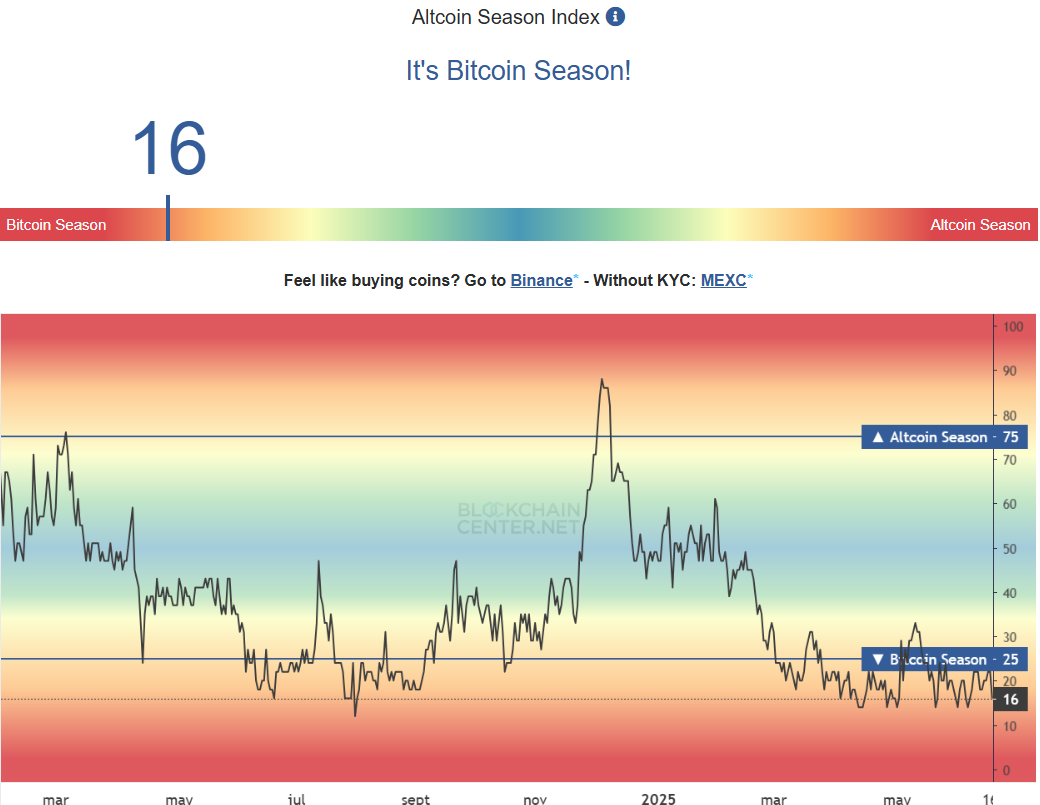

关键的区分因素将是比特币的轨迹和当前地缘政治紧张局势的解决。如果比特币能够保持在$100,000以上,而中东紧张局势缓解,meme币可能会看到一次反弹——模仿BTC,但波动性更大。但随着比特币主导地位的上升,以及山寨币季节指数处于极低水平,这些投机代币的最低阻力路径似乎是向下。

山寨币季节指数。图片来源:截图

对于考虑入场的交易者来说,等待明确的支撑保持和动能转变将是明智的。Pepe需要重新夺回$0.0000118,SPX6900必须捍卫$1.30,而Fartcoin需要突破$1.28以发出潜在底部的信号。在此之前,meme币的屠杀可能还会有更多的伤亡。

作者表达的观点和意见仅供信息参考,并不构成财务、投资或其他建议。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。