War has taken center stage in global consciousness ever since Israel and Iran began trading blows last week—a conflict that hasn’t let up. According to Google Trends, global interest in the phrase “World War” has climbed dramatically over the past 90 days. It hit a peak score of 85 out of 100 on June 15. Narrowing the focus to 30-day data, the term scored 99 on June 14 and maxed out at 100 the following day. Searches for the word “War” are following a similar trajectory.

As tensions mount, gold is holding steady on June 17, with the metal now priced at $3,385 per ounce. Stock markets aren’t faring as well—major U.S. indexes are slipping on Tuesday, and the crypto economy has dropped 3% in the past 24 hours. Yet amid the sell-off, defense and military-focused shares are bucking the trend and moving higher. Take RTX Corp. (formerly Raytheon Technologies), for example—its stock has climbed 5.91% across the past five trading sessions.

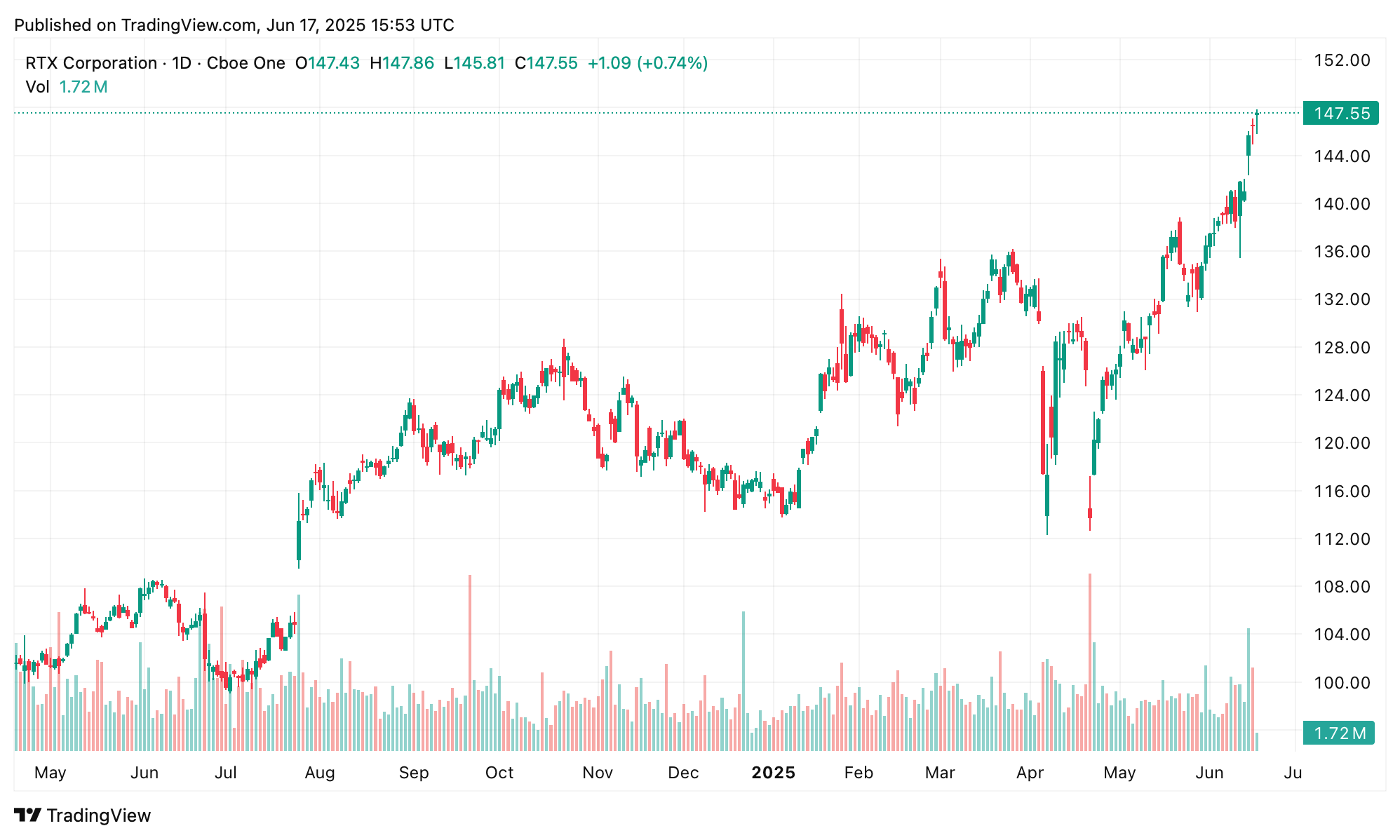

RTX Corp. on June 17, 2025.

Lockheed Martin Corp. (NYSE: LMT) gained 2% on Tuesday alone and is up 2.36% over the last five days. General Dynamics (NYSE: GD) has advanced 1.33% this week, while Northrop Grumman Corporation (NYSE: NOC) tacked on 3.67% over the same stretch. Howmet Aerospace Inc. (NYSE: HWM) also edged higher, notching a 1.84% increase over five days. Meanwhile, GE Aerospace, Leidos Holdings, Curtiss-Wright Corporation, HEICO Corporation, and Huntington Ingalls Industries are all holding steady with solid gains this week.

The current swell in defense-related investments hints at a broader shift in market psychology—one that prizes geopolitical hedges over risk assets. As volatility reshapes capital flows, investors appear increasingly willing to bet on war-driven industries. Something that always comes to the forefront during times of conflict. This pivot reflects not just reactionary positioning, but a deeper recalibration of priorities in an era where diplomacy feels ever more fragile.

Search trends and trading activity together suggest that anxiety is no longer confined to headlines and speculation—it’s embedded in behavior. Whether driven by fear or foresight, the allocation of capital toward conflict-aligned sectors shows a public reckoning with risk. As uncertainty thickens, both sentiment and strategy are recalibrating to a world where stability feels less like the default.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。