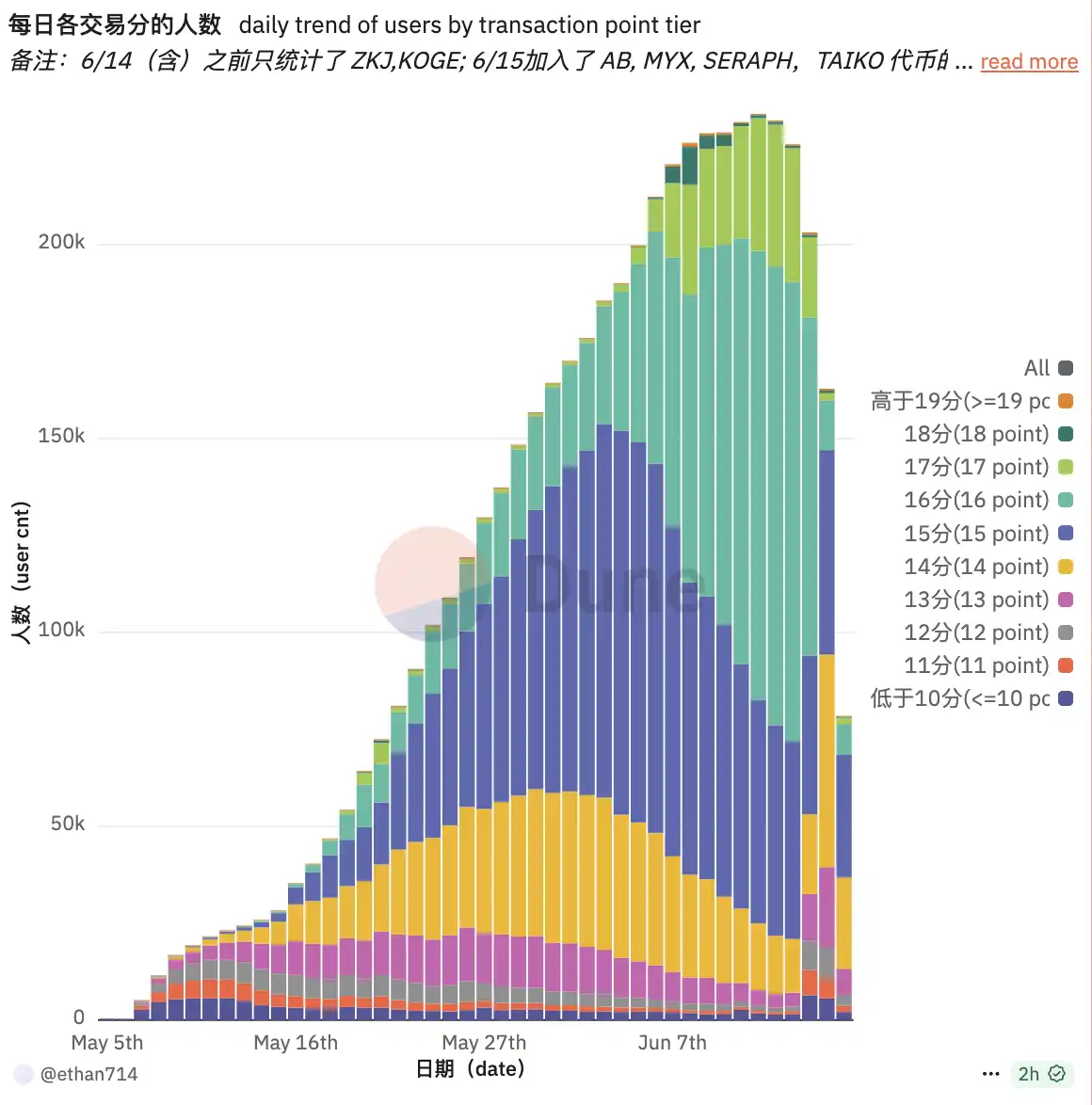

在 $ZKJ 和 $KOGE 闪崩事件后,Binance Alpha 的活跃度出现明显下滑。根据 Dune 数据,Alpha 交易用户数从 6 月 12 日的 23.3 万人高点骤降至 6 月 15 日的 19.5 万人,仅三日内流失近 4 万人,跌幅显著。而截至今日,实际在平台上发生交易的用户数量已进一步缩减至 7 万人,显示出用户热情与参与意愿的断崖式下跌。与此同时,刷分的边际成本显著上升,Alpha 游戏的性价比正在快速恶化。

与此同时,Binance Alpha 近期的一些上线项目又呈现出「上线即浇给」的迹象。

BlockBeats 计算了 Binance Alpha 新积分领取项目 VELO 的利润,在一般情况下(1000 美元本金),本期 Alpha 用户收益为微盈利状态。若采用 Alpha 代币之间进行交易计算可得每天交易磨损达 4 美元,30 天预期收益达 224 美元,30 天预期成本达 120 美元,30 天预期盈利达 104 美元,日均 3.5 美元。

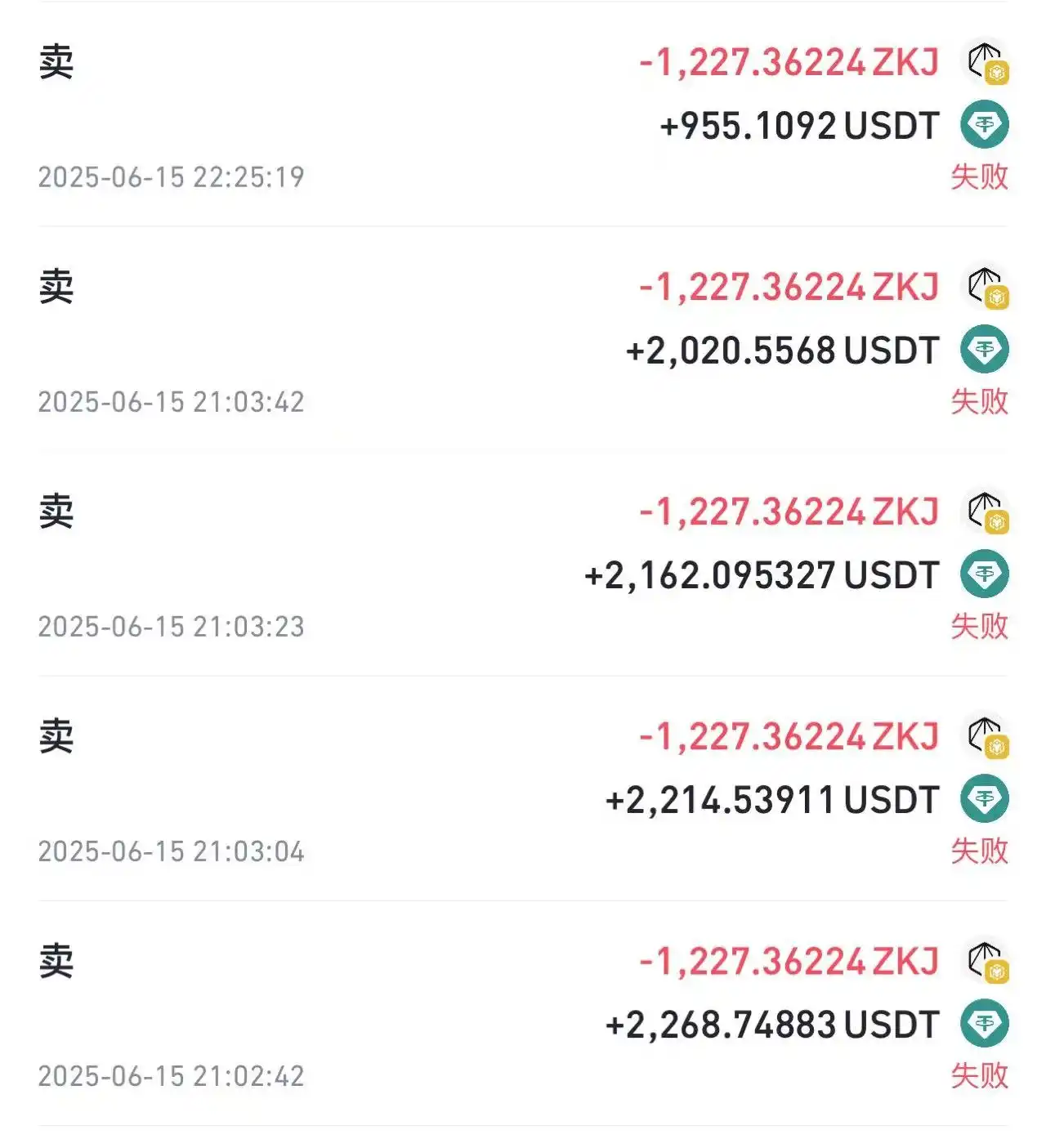

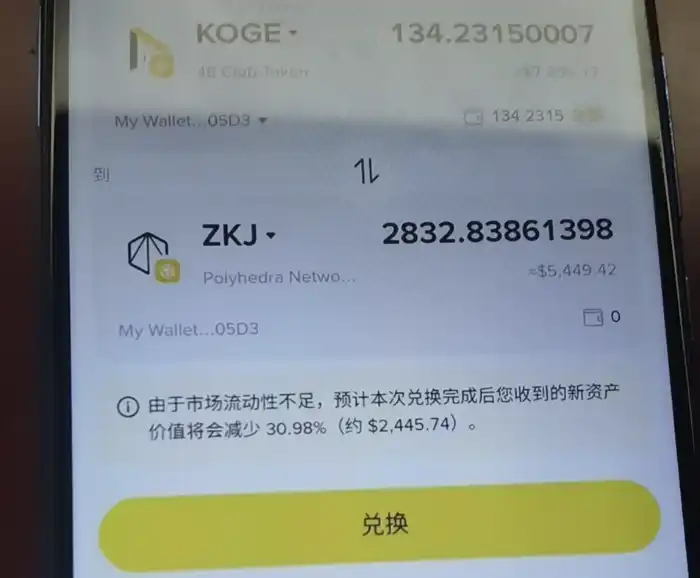

自 2025 年 6 月 17 日 00:00(UTC)起,Binance Alpha 正式启用新规,Alpha 代币之间的交易量将不再计入 Alpha Points 计算。这意味着曾依赖 ZKJ/KOGE 等刷分池套利的策略将不再有效,用户将面临更高的积分获取门槛与更复杂的流动性结构。

可以预见,受 $ZKJ 暴跌影响,Binance Alpha 的激励模型进入调整期。而这场机制更替的直接后果,是大量原本活跃在 Alpha 生态中的用户正在选择离场。有人在 $ZKJ/$KOGE 的双币池中亏损离开,也有人发现刷分边际收益已低于交易成本,不再愿意投入精力。

在这篇专访中,BlockBeats 采访了多位 Alpha 用户,既有在本轮暴跌中遭遇实际亏损的 LP 提供者,也有曾尝试「刷分套利」但收益不及预期的普通参与者。他们之中有人已经决定彻底退出 Alpha 游戏,也有人仍在犹豫是否继续寻找新的机会。在他们的讲述中,我们得以还原这场「断崖式离职潮」背后的真实情绪与思考。

放弃的那些人

「前期收益是真的高,手续费还低,特别是还吃上了冒险岛。5 月下旬就陆续加到 20 个号,因为频繁人脸,我就把号主的账号交给他们自己打理,每天也是维持着 1.6 万美元实际交易额在刷。」

然而随着参与人数增加,竞争加剧,江酒表示自己 6 月中旬就已经察觉到了不对劲的信号:「14 号就察觉不太对劲,那天有个别几个号出现了极大的损耗,加起来 160U,太不对劲了,但是因为苦恼怎么改变策略,忽略了可能即将到来或者是说我不愿承认的风险,还是期望太大了。」

更遗憾的是,在 ZKJ 暴跌期间,江酒的一位朋友因其一句「刷完了吗」误以为是在催促,仓促加仓 ZKJ,最终亏损高达 60%。江酒回忆,当时原本是想等朋友回复后再提醒不要继续刷,先观望局势,但对方误解了他的意图,立即下场交易。买入后发现无法顺利卖出,才向江酒求助。而江酒一时也没来得及详细解释如何挂个低价快速脱身,最终导致朋友只能眼睁睁看着价格下跌。对此他坦言,这场损失的核心,不在运气、而在于信息研判和沟通成本。

在谈及是否联系过项目方时,江酒表示,并未尝试寻求反馈,「这种事在加密圈太常见了,除非交易平台愿意带头,否则散户亏钱就是亏钱了,没地方说理去,还是得自己保持谨慎。」

他还补充道,自从失去了 ZKJ 和 KOGE 这类低手续费刷交易的池子后,刷分的损耗显著增加,每期奖励也降至 50-60U 左右,分数门槛却越来越高,自己已处于放弃的边缘,「但还是想挣扎一下看看后续几期的收益,不如意只能放弃了。

与江酒不同,蚊香操作着四个账号,暴跌前总盈利约 5000U。在暴跌前一天就发现了 ZKJ 的异常波动,但因为当时币价回升,反而增加了他的侥幸心理。

「前一天发现 ZKJ 波动了,我是硬抗了一小时,发现涨回来了还赚了 5U。当天暴跌的时候我发现插针很厉害,以为跟前一天一样。」

这种侥幸心理导致蚊香在第一个账号被套 30U 后,仍然使用第二个账号继续入场,「我以为会和前一天一样,正常插针,于是我这个号没动,用第二个号继续做任务 1800U,结果第二个号也开始暴跌。」

最终,蚊香决定在币价跌至 0.8 时割肉离场,总亏损超过 2000U,「还是对风险不够重视,应该多观察池子大小,当天确实池子出现大批量撤走的情形。」

蚊香认为 Alpha 项目已接近尾声,「投入和产出不成正比了,被夹几次就白玩,今天所有的号都领了低保撤出了。」

不止是蚊香,在 BlockBeats 的采访中,还有多位提及如今 Binance Alpha 投入产出比下降的采访对象,不少人都不再选择多号策略。

Alpha 的红利窗口或许正在关闭。

沉没成本之下,刷分仍在继续

杰哥是一位 BSC 生态社群的组建者,从最初的 Shell 打新开始就一直参与 Alpha 活动。作为社群中的信息传递者,他同样没能避免这次的系统性风险。

「我当时感受到了,当『稳定币』不再稳定的时候价格波动就会很多,其实已经嗅觉到了灰犀牛即将来临。但是由于号的管理工作以及刷交易的时间会充斥着个人的生活,(便没能及时控制住)」杰哥说。

在暴跌期间,杰哥第一时间进行了止损并通知群内成员,但依然面临较大损失。他认为这次亏损不能完全归咎于运气:「只能说再次需要向市场交学费了。还是有很多方法可以避免这种情况的。只不过自己在大额对刷的时候正好赶上了这个时间,并且两个号同时在刷,没法避免当场腰斩的情况。」

这次经历让杰哥反思了自己的风控策略,尤其是链上监控工具的重要性,他觉得之后需要一些引入链上监控的工具,「第一时间感受到了这个币价,池子的容量在减少,那么币价就会带来更大的波动。」

尽管如此,杰哥表示会继续参与 Alpha,「有利润就值得继续努力吧,当然也期待 Alpha 更多的创新的公平发射的模式。」

「前期策略 33 次六万档,然后 66 次 13 万档,收益目前还没详细计算」,Siner 介绍道。这种高频次、高额度的交易策略在币价稳定时期能带来可观收益,但也暴露了更大的操作风险。

他的主要亏损并非来自市场波动,而是人为失误:「亏钱主要是自己人为操作出现失误占比最多,第一个就是 16 号 Koge 忘记卖了,然后决定刷 13 万档有点太激进了,忘记卖的号现在都从 1000u 跌成 400u 了。」

大规模账号操作也带来了效率挑战。「我一般 1-2 小时刷完全部,但是 17 万档工作量太大了,导致连续刷了四五天,出现了空刷的情况。」

与市场上纷纷离场的用户不同,Siner 对 Alpha 的未来依然充满信心,当被问道还会继续刷 alpha 吗?Siner 表示「必须继续,刚刚已经找到无损的方法了。」这意味着他仍将继续在 Alpha 生态中寻找投机撸毛的机会,即使在规则调整后。

而对于没有在 ZKJ 暴跌中亏损的天哥来说,退出 Alpha 意味着前期投入的沉没成本无法挽回,「前期已经有了两百分的沉没成本,如果放弃,就相当于都打水漂了。而且如果后面有个好项目上 Alpha,一波就回本了。」

天哥这样总结参与 Alpha 项目的心态——「刷分撸羊毛,都是垃圾项目,不要有感情。」

结语

江酒坦言 Alpha 刷分收益已经无法覆盖操作成本,「现在奖励只有五六十 U,分数门槛又高,交易滑点越来越大,做一天可能只挣三四块。」而 ZKJ/KOGE 崩盘带走的不只是本金,更是一种低成本套利路径。一旦 Alpha 项目取消了代币对之间交易量计入积分的规则,用户将面临更高的交易磨损和更复杂的积分博弈结构。

Binance Alpha 一度被视为重振链上活跃度与用户参与度的创新机制,但当前的积分模型显然高估了交易量与 LP 的长期激励效力,也低估了结构性挤兑的风险。

随着 Binance 新规的实施,Alpha 正在从刷分套利工具,逐步转向更加注重真实交互和价值捕获的激励机制。这意味着积分获取不再只看交易量或 LP 额度,而更多向持仓时长、交互深度、真实需求等维度倾斜。

然而对于许多依赖低成本刷分策略的用户来说,这种转变迫使他们重新评估参与的意义。未来的 Alpha 若想重启增长引擎,势必要在公平分配与风控机制之间找到新的平衡点。

对于仍在 Alpha 生态中探索的用户,建议加强风险管理意识,关注池子结构、代币基本面和 LP 集中度等指标,避免在下一次系统性风险暴露时成为接盘者。毕竟在这个不断试错的 Web3 世界里,套利的窗口永远存在,但踩雷的代价也从未降低。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。