The crypto market has just staged a thrilling drama: in the past 24 hours, the total liquidation across the network reached $143 million, with short positions accounting for $91.01 million, a significant portion! The price of ETH soared to $2,640.08, rising 3.75% in 24 hours, with a liquidation amount of $39.9 million, making up 27.8% of the total. BTC also showed strength, priced at $107,419.63, up 1.82%. This short squeeze has caused market sentiment to fluctuate like a roller coaster, with volatility hitting new highs!

This typical cycle of "price breakout - chain liquidation - amplified emotions" has once again played out among mainstream coins. However, the reasons behind this liquidation are far more complex than just a technical surge.

The "GENIUS Act" and US Stocks: The Hidden Driver of Liquidation?

On the surface, this liquidation was triggered by a rapid price increase, but from a broader perspective, the market has long been brewing beneath the surface.

- At 4:30 AM on June 18 (Beijing time), the US Senate will vote on the "GENIUS Act" (S.1582), which is a significant bombshell! The bill requires stablecoins to be 100% backed by liquid assets like the US dollar and prohibits tech giants like Meta and Amazon from issuing stablecoins. The market may have sensed a positive signal: if the bill passes, the trust in compliant stablecoins like USDT and USDC will increase, potentially stabilizing the liquidity of BTC/ETH trading pairs and stimulating bullish sentiment, squeezing out shorts. However, this connection is somewhat speculative; the bill's vote has not yet concluded, and short-term volatility may be more about the market's anticipation of "clear regulation."

Related news and updates:

Flash News 1 -- “Bernstein: Once the GENIUS Act Takes Effect, Stablecoins Will Become Internet Cash”

Flash News 2 -- “Coinbase CEO: Congress Should Pass the CLARITY Act and the GENIUS Act Together”

- Looking at the global market, on June 17, the three major US stock indices opened strongly: the Dow Jones rose 0.48%, the S&P 500 rose 0.56%, and the Nasdaq rose 0.7%. This "risk appetite" sentiment often spills over into the crypto market, with BTC and ETH being favored as "digital gold" and "tech stocks." The optimistic atmosphere in US stocks may have boosted the confidence of bulls, driving up prices and triggering short liquidations.

Beneath the surface of liquidation lies a complex interplay of speculative leverage, regulatory games, and global capital sentiment.

Technical Analysis: Are Bulls Gaining the Upper Hand?

If liquidation is the echo of emotions, then the candlestick chart is the true signal light for the next direction.

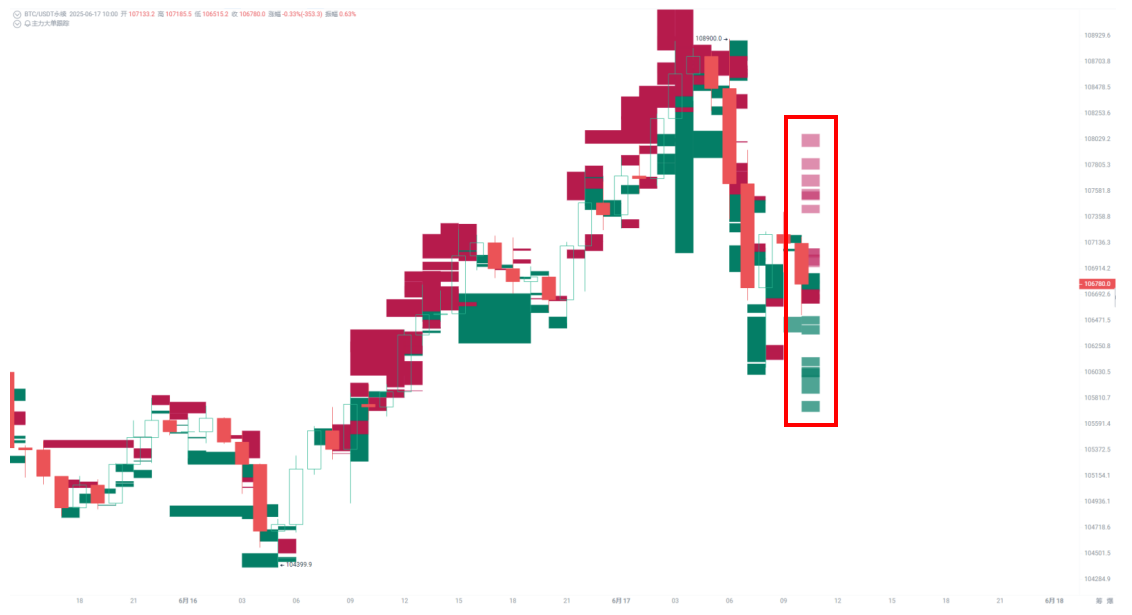

BTC

Currently, the price of BTC is around $107,133. Although it has rebounded strongly from the lows, peaking at $108,900, it was subsequently pushed back down, with both bulls and bears fiercely contesting. Technically, the RSI has rebounded from 32 to 62, escaping the oversold zone but not yet reaching the overbought area—indicating that market momentum is warming up but not fully ignited. Meanwhile, on the MACD front, the DIF and DEA have just crossed negatively, and the histogram has just turned from green to red; while there are signs of a potential trend reversal, caution is needed against false breakouts.

In simple terms, the current BTC market is a duel between skilled players, with neither side willing to reveal their cards. From AiCoin's major order data, there are significant buy orders from major funds at lower support levels, clearly "protecting the market"; however, above the $108,000 threshold, there is a concentration of short positions waiting to be triggered. If the price approaches that level, the bears are likely to either sell off or continue to add positions, creating strong pressure. Thus, we are in a classic "tug-of-war phase," and we can only wait to see which side breaks out of the trenches first.

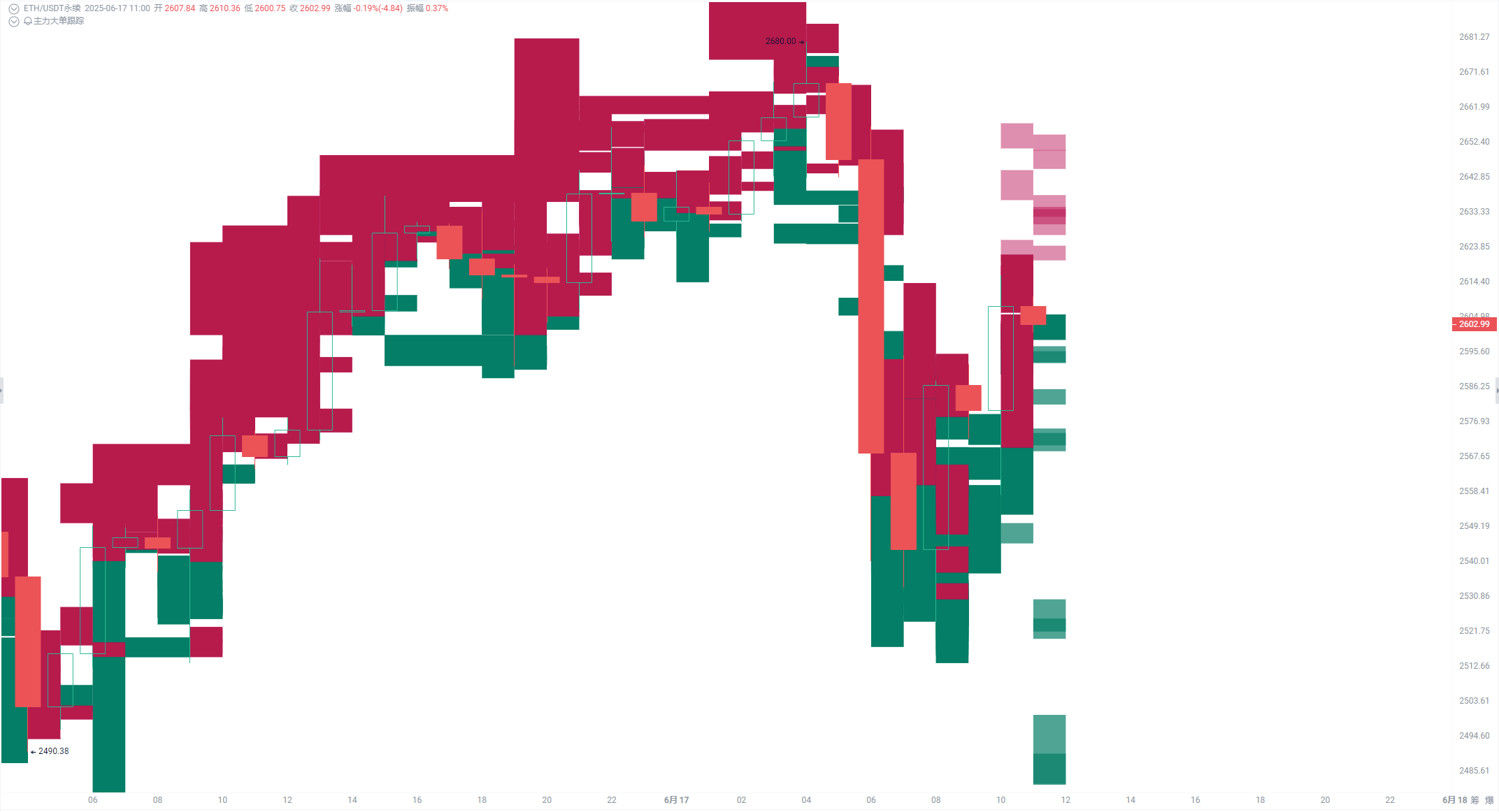

ETH

On the ETH side, the rebound momentum is clearly stronger than that of BTC. After a sharp decline, the price quickly "bounced back," with the RSI even rising from the oversold zone (below 30) to near the midpoint, indicating a rapid recovery of market sentiment. Although the MACD is still in a death cross state, the DIF line has begun to turn upward, approaching the DEA line—if a golden cross forms, it will signal continued bullish momentum! On the candlestick chart, a "V-shaped reversal" is taking shape, suggesting that bulls are vying for the initiative.

From the major order data, ETH is also a battleground. Above $2,650, there is a large concentration of short positions; if the price rebounds to this level without accompanying trading volume, it could easily be pushed back down. Meanwhile, between $2,480 and $2,500, there are many large green orders, indicating that bulls are using real capital to defend the bottom, with a clear intention to protect the market. This shows that both bulls and bears are unwilling to "call a truce," and the market remains in a critical tug-of-war zone.

So, don’t assume that just because there’s liquidation, the direction has already been chosen. The true trend has yet to be determined.

For us, the smartest move right now is—not to rush to "pick a side," but to use AiCoin's indicator alert function to set reminders at key levels (such as BTC's $108,000, ETH's $2,650 and $2,500) in advance. Once one side truly "charges," you can capture the signal immediately, deciding when to enter or exit. Until the direction is clear, patience is your strongest weapon.

What Does This Liquidation Teach Us?

This $143 million liquidation event provides us with several key signals:

- The leverage structure is already very fragile. Although the current stalemate is evident, once the price breaks through important resistance, shorts are likely to face a cascading liquidation.

- Investor sentiment fluctuates sharply with regulatory expectations. The "GENIUS Act" has not yet passed, but the mere possibility of a "positive outcome" can trigger market expectations. This behavior indicates that the market is extremely eager for "certainty."

- Liquidity is concentrating towards mainstream assets. The expectation of compliant stablecoins may eliminate smaller stablecoins, with mainstream assets like ETH/BTC likely to emerge as winners, especially core tokens in on-chain trading pairs and DeFi protocols.

The most crucial point is: liquidation is not the end, but the starting point for a redistribution of the market.

Conclusion: Is It Time to Go Long? Or Beware of a Bull Trap?

The crypto market is never short of liquidations, but those that can trigger structural shifts often carry significant signals. ETH's strong breakout may be the fuse for the next wave of mainstream coin trends; however, blindly chasing after good news before it materializes is equally dangerous.

The key observations moving forward are:

- Whether the vote result of the "GENIUS Act" brings about a regulatory "shoe drop";

- Whether US stocks can maintain a high-risk appetite;

- Whether ETH and BTC can stabilize and gain volume at key resistance areas.

The direction of the market often hides behind those "unexpected events." Is this liquidation the end or the beginning? The answer lies within the candlestick charts.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。