关键要点

– 世界自由金融(WLFI)将美元背书的稳定币 USD1 与社区驱动的治理代币 $WLFI 相结合,打通传统金融与 DeFi。

– $WLFI 设计为不可转让,1000 亿枚代币分别用于销售、社区激励、支持者和团队。

– WLFI 已完成超 5.5 亿美元融资,多链上线 USD1,并促成一笔 20 亿美元的结算交易,展现出迅猛的落地能力。

– 投资者需在 WLFI 独特的政治背景与透明储备之间权衡,关注监管压力和代币锁定带来的流动性风险。

你有没有想过,世界自由金融到底是什么?

想象一下,WLFI 就像一个 2024 年末上线的全新金融中枢,将美元背书的稳定币USD1和社区共治的治理代币 $WLFI 融合在一起。USD1 已在 Ethereum、BNB Chain 和 Tron 上线,让跨境支付既快速又省手续费。

与此同时,持有 $WLFI 的用户可以通过投票决定平台升级和激励方案。WLFI 在短时间内筹集了超过 5.5 亿美元,并促成了一笔 20 亿美元的 USD1 结算交易,证明了它的市场竞争力。本文将全面解析 WLFI/USDT 交易对(包括WLFI/USDT场前交易对)、代币经济、投资里程碑、参与方式、竞品格局、风险与展望。

目录

世界自由金融(WLFI)概述

World Liberty Financial(WLFI)以“The Dollar. Upgraded.”为口号,将可随时一比一兑换美元的稳定币 USD1 和总量上限 1000 亿枚的治理代币 $WLFI 融合在一起。USD1 已先后在以太坊(Ethereum)、币安智能链(BNB Chain)和波场(Tron)上线,只需几秒钟,就能以极低手续费将资金发送到全球任何角落。所有美元和美国国债储备由 BitGo 托管,并定期接受独立审计,确保透明可信。

Image Credit:World Liberty Financial

持有 $WLFI 后,你可以参与平台治理,从调整手续费到新增公链一键投票决定。WLFI 还计划接入 Aave V3,实现USD1的借贷功能,并提供简洁易用的兑换界面,让你随时将其他代币兑换为 USD1。未来,所有支付、兑换、借贷和投票功能都将集成到一款手机 App 中,一站式搞定。

Image Credit:World Liberty Financial Governance

在大牌投资人和加密创始人的早期支持下,USD1 的流通量在数周内迅速突破 20 亿美元。其中最引人注目的一笔,是阿布扎比一家公司动用 USD1 向 Binance 注入 20 亿美元。凭借值得信赖的托管服务、公开透明的审计流程、熟悉的美元稳定性以及前沿的 DeFi 工具,WLFI 正为机构和普通用户打造一个值得信赖的数字美元新世界。

WLFI 代币经济、分配与销毁

$WLFI 是平台治理代币,就像你参与投票表决方向的通行证。主要信息如下:

– 总供应量:启动时铸造 1000 亿枚,永不增发。

– 不可转让:社区投票解锁前,钱包之间无法转账。

– 投票上限:单个钱包最多只能投出 5% 的总票数,确保公平。

WLFI 代币分配

$WLFI 本身没有销毁机制,全部锁定用于治理,而“升级后的美元”USD1稳定币则按经典的铸造/销毁模式运行——用户存入美元时铸币,赎回时销毁。

持有 $WLFI,意味着你可以参与协议升级、手续费调整、新功能上线和激励方案制定。虽然不直接产生利息或分红,但不定期的 USD1 空投会回馈活跃用户,保持社区活力。

XT.comWLFI/USDT场前交易对

World Liberty Financial 投资里程碑

– 融资情况:WLFI 私募和公募共筹集超 $5.5 亿,吸引全球合格投资者。

– 战略背书:Justin Sun 的 $7500 万投资和 DWF Labs 的 $2500 万做市合作,迅速为 USD1 填平流动性。

– USD1 快速增长:数周内流通量突破 $21 亿,显示对全额背书数字美元的强劲需求。

– 重磅结算:阿布扎比机构用 USD1 向 Binance 注资 $20 亿,验证稳定币在企业级交易中的实用性。

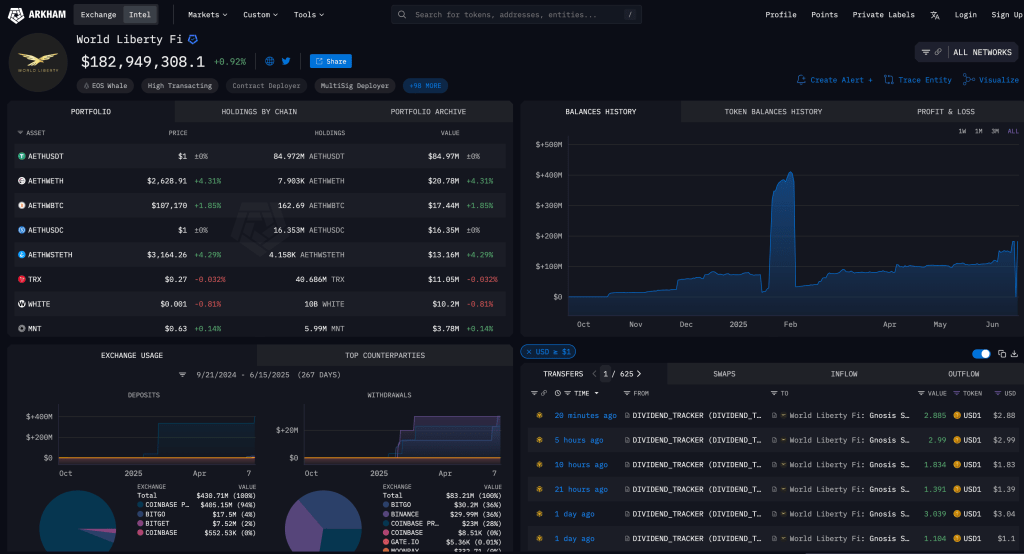

– 生态扩展:USD1 已入驻多家 CEX 与 DEX,并获 BitGo 托管和 PeckShield 审计,为关注 WLFI/USDT 的投资者提供了信心。

这些成就突显了 WLFI 坚实的资金基础和快速的市场落地,是追踪 “WLFI 今日价格” 的关键参考。

Image Credit: Arkham (World Liberty Financial Crypto Holdings)

如何参与并获取 WLFI 代币

想拿到 $WLFI,可不像普通加密项目那样随时在交易所买到,因为代币默认是锁定状态。具体途径如下:

官方代币发售

早期参与者通过私募和公募认购获得代币。合格投资者和 WLFI 白名单用户可直接向项目方购买。代币名额有限,记得关注官方公告,抢先一步申请。

XT.comWLFI/USDT场前交易对

战略投资

大型机构、风投和加密做市商通过私下定向增发与 WLFI 库存达成协议。这些合作虽然不对外开放,却为代币流动性和生态发展打下坚实基础。

社区激励

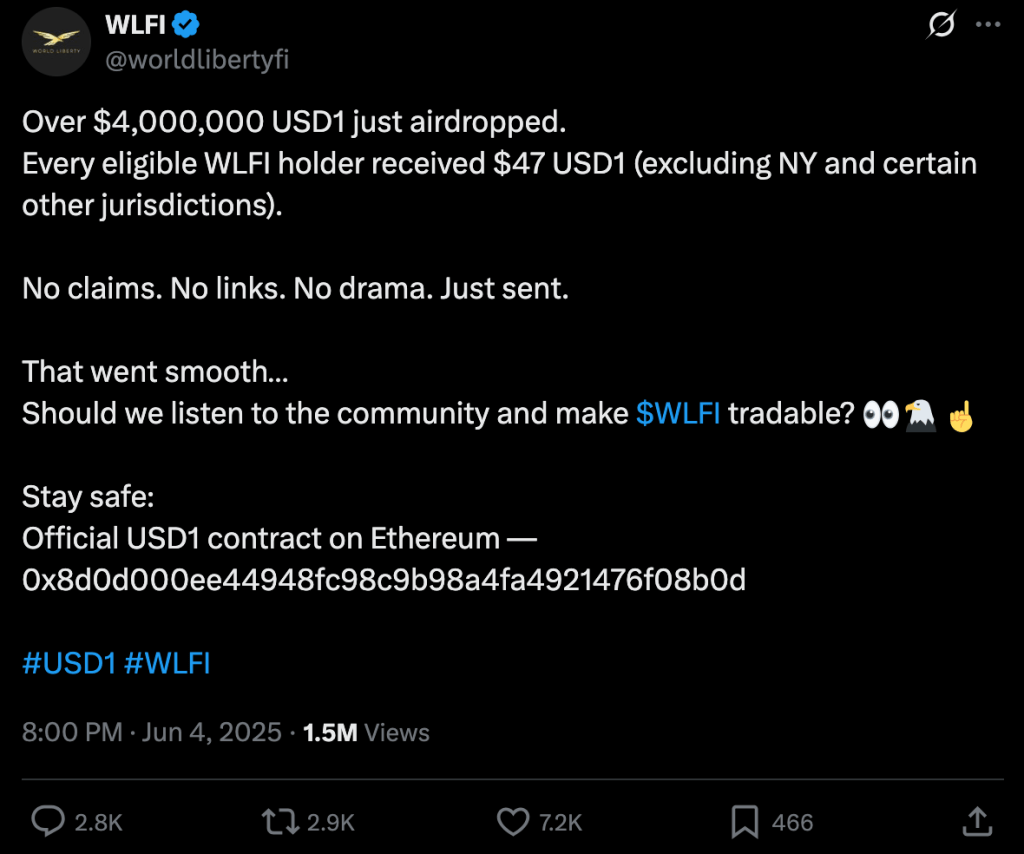

WLFI 将 32.5% 代币用于社区增长,包括空投、奖励和任务活动。只要参与社区论坛讨论或投票,就有机会在后续分发中获得福利。

目前 $WLFI 尚未在公开交易所上线,短期内无法在常用平台交易。任何解锁或上所进展,官方都会第一时间通过 Twitter、Telegram 和 Discord 通知。

Image Credit:World Liberty Financial Tweet

如果你想使用稳定币USD1,可以在主流中心化交易所(XT.com、Binance、Gate.io、HTX)购买,或在去中心化交易所(Uniswap、PancakeSwap)兑换。完成 KYC 后,也可直接在 WLFI 平台铸造或赎回 USD1,立即体验“升级后的美元”。

XT.comUSD1/USDT现货交易对

World Liberty Financial 竞争格局

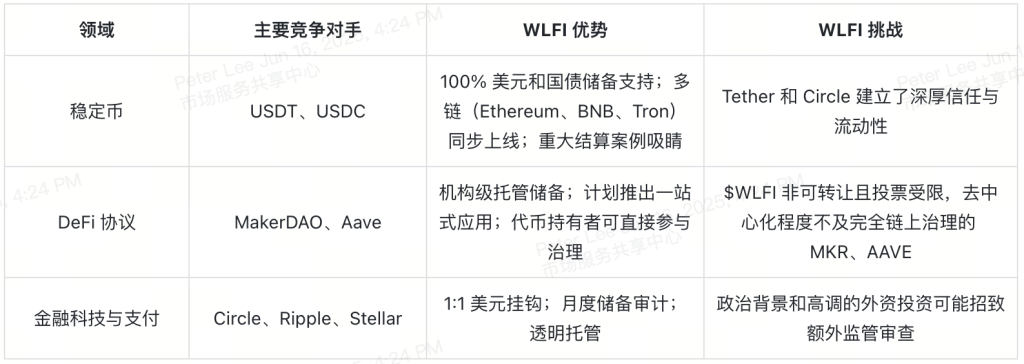

World Liberty Financial 处于三个主要赛道的交汇点,每个赛道都有强大的 incumbents 和各自挑战。下面来看看 WLFI 的优势与劣势:

稳定币 vs. USDT 和 USDC:

WLFI 的USD1由现金和美国国债全额支持,月度审计透明度高,并一次性在多条公链上线,迅速实现规模化应用——包括一次 20 亿美元的 Binance 结算。但USDT和USDC作为市场先行者,早已稳固占据交易量和开发者心智。

DeFi 协议 vs. MakerDAO 和 Aave:

WLFI 计划接入AaveV3,提供借贷、兑换和治理于一体的统一平台,其储备支持模式更易获得机构认可。相对而言,$WLFI 的不可转让设计和投票上限,让它在链上去中心化程度上不及MKR、AAVE等原生 DeFi 代币。

金融科技与支付 vs. Circle、Ripple、Stellar:

USD1 完全挂钩美元,由 BitGo 托管并定期审计,为企业级支付场景提供信心。只是 WLFI 的政治标签和国外大额投资,使其在合规审查方面面临其他稳定币发行方没有的额外复杂性。

Image Credit: Fast Company

WLFI 风险与注意事项

– 监管审查:高调的政治背景和大额境外投资可能引发伦理调查或法律挑战。

– 代币流动性:$WLFI 在社区投票解锁前一直锁定,持有人无法随时退出。

– 托管与跨链风险:USD1依赖第三方托管(如 BitGo)和跨链桥,存在被攻击或网络中断的可能。

– 治理集中度:尽管每个钱包投票上限为 5%,早期背书者仍掌握较大话语权。

– 市场竞争:USDT、USDC 等成熟稳定币和主流 DeFi 平台拥有深厚流动性与开发者支持。

– 审计与合规依赖:定期的储备审计至关重要,任何疏漏都可能损害 USD1 的信任度。

– 战略权衡:WLFI 透明的储备和快速采用固然吸引人,但投资前需仔细评估这些结构性和监管风险。

World Liberty Financial(WLFI)展望

展望未来,WLFI 的成长关键在于推出核心 DeFi 工具——借贷市场、无缝代币兑换和预期中的移动端 App。随着更多用户将 USD1 用于日常支付和收益策略,项目将迎来自然增长。若社区投票解锁 $WLFI 交易,上市后其价格可能会更直观地反映平台的实际价值。

当然,监管阻力或开发进度延误也可能打击热情。但到目前为止,WLFI 已完成 20 亿美元级别的结算,数周内构建了 21 亿美元的USD1生态,并吸引了重量级支持者。如果团队能持续兑现里程碑并保持透明储备,WLFI 有望在数字美元领域开辟一条独特路径,将美元的可信度与 DeFi 的灵活性和收益潜力完美结合。对于想要引导新用户进入加密世界或探索数字美元创新的人来说,WLFI 都值得重点关注。

WLFI 常见问题解答

1. 什么是 WLFI 代币?

$WLFI 是治理代币,可用于投票决定平台升级、合作和激励方案。社区批准解锁前,它不可转让。

2. USD1 与 WLFI/USDT 有何关系?

USD1 是 WLFI 的美元稳定币;WLFI/USDT 指交易所上线后,治理代币对 Tether 的交易对。

3. 什么是 World Liberty Financial?

World Liberty Financial 同时发行 1:1 美元背书的稳定币USD1和社区共治的治理代币 $WLFI,将传统金融的稳定性与 DeFi 的灵活性融合。

4. 什么因素影响 WLFI 今日价格和 WLFI 价格?

主要取决于 USD1 的使用广度、治理投票(如解锁代币)、新功能上线情况以及整体加密市场情绪。

5. 我可以在哪关注 WLFI 动态?

– Twitter (X):@worldlibertyfi

– Telegram:https://t.me/defiant1s

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。