一、链上操作的精密性与市场操纵范式的革新

本次闪崩事件展现了加密市场操纵的新高度。三个核心地址通过流动性撤出 + 跨币种联动砸盘 + 合约对冲的组合策略,在短短数小时内完成对高流动性代币的系统性收割。具体操作路径如下:

流动性池的精准爆破

地址 0x1a2...69972 与 0x078...8bdE7 分别从 KOGE/ZKJ 流动性池中撤出价值 376 万美元和 207 万美元的 KOGE,以及 53.2 万美元和 138 万美元的 ZKJ12。这种 “双边抽离” 直接破坏了流动性池的平衡机制,导致做市商被迫以更低价格承接卖单,形成价格下跌的初始压力。跨代币联动砸盘

攻击者先通过抛售 KOGE 制造恐慌情绪,再将 KOGE 换仓为 ZKJ,利用后者更高的流动性进行集中抛售。例如,地址 0x078...8bdE7 在 20:35-20:37 期间抛售 100 万枚 ZKJ(价值 194.8 万美元),直接击穿关键支撑位,触发 KOGE 的 K 线出现连续大阴线29。这种 “先弱后强” 的攻击顺序,完美利用了市场对关联代币的心理锚定效应。合约市场的套利闭环

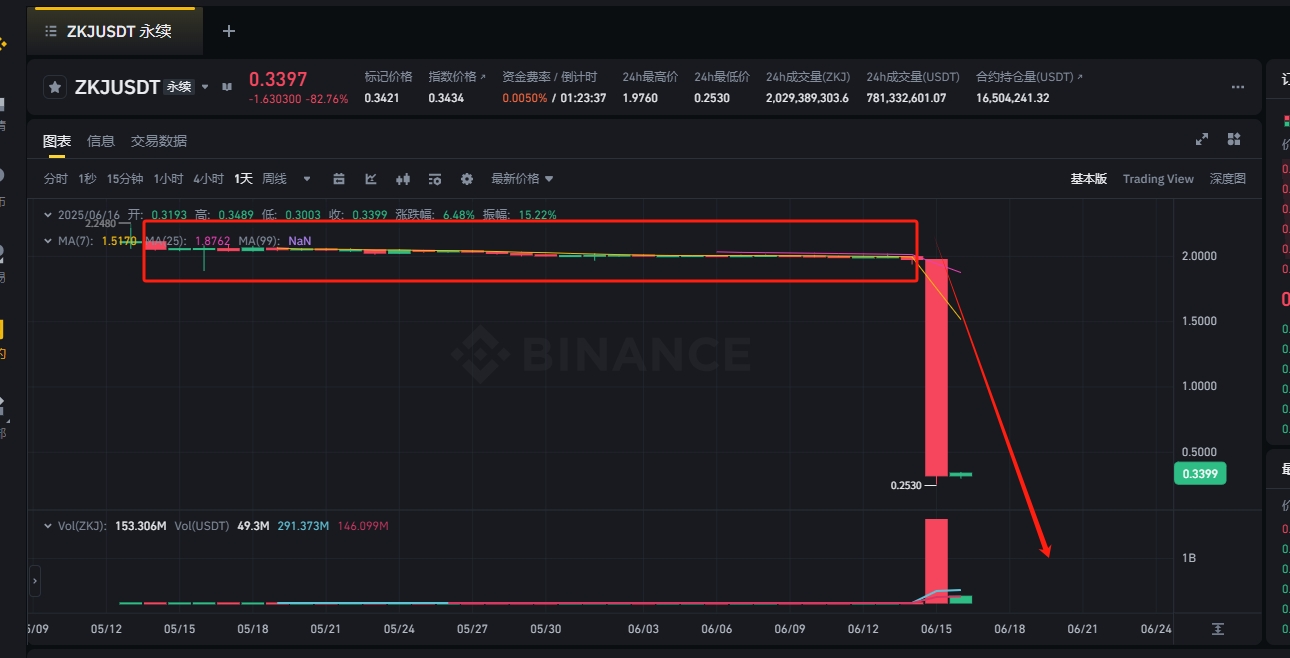

ZKJ 作为中心化交易所的永续合约标的,攻击者提前在币安、OKX 等平台开空单,随后通过链上砸盘现货价格,同步在期货市场获利。数据显示,ZKJ 在 20:57 出现多单强制清算,单笔清算金额超百万美元1,这种 “现货砸盘 - 期货获利 - 流动性枯竭” 的循环,构成了完整的套利链条。

二、对加密货币市场的直接冲击与长期信任危机

(一)短期市场反应:流动性恐慌与资产价格重构

市值蒸发与投资者损失

ZKJ 市值从近 20 亿美元暴跌至不足 2 亿美元,跌幅超 90%;KOGE 同步崩盘,LP(流动性提供者)因价格跌破狭窄区间而被迫以低价卖出代币,大量资金被锁定在下跌资产中15。链上数据显示,至少三个核心地址通过此次操作获利超千万美元,而普通投资者成为主要受损方。跨市场情绪传导

事件引发对高流动性代币的信任危机,市场对 “稳定币 + 流动性挖矿” 模式产生怀疑。类似项目如 Taiko(TAIKO)、Pyth Network 因供应激增和流动性不足同步下跌,Nyan Heroes 等代币甚至出现 59.5% 的单日跌幅21。恐慌情绪蔓延至中心化交易所,币安对 ACT 代币的风控调整导致其价格暴跌 50%,进一步放大市场波动22。资金避险与资产再平衡

部分投资者转向比特币、以太坊等主流资产避险,比特币价格在事件后短暂反弹,但整体市场仍处于观望状态。机构资金加速撤离高风险项目,转向合规稳定币(如 USDT、USDC)和受监管的交易所产品,推动市场流动性向头部集中。

(二)长期信任危机:DeFi 生态与监管框架的双重挑战

DeFi 流动性池的脆弱性暴露

ZKJ 和 KOGE 的 LP 区间通常设置在极窄的价格范围(如现价 ±1%),攻击者通过小额抛售消耗该区间的买单,一旦击穿支撑位,价格将跌入无承接的 “真空地带”,引发 LP 恐慌性撤离,形成死亡螺旋9。这种机制与 2022 年 LUNA 崩盘具有相似逻辑,但此次攻击者更精准地利用了跨代币联动和合约对冲,凸显 DeFi 协议在抗操纵能力上的缺陷。项目方治理与透明度争议

KOGE 团队 48Club 声明 “从未锁定国库持仓,且未承诺不出售”,直接动摇了投资者对项目方的信任5。Polyhedra 虽回应称 “技术基础强劲”,但未公布具体应对措施(如回购计划或流动性补充方案),市场对其能否恢复代币价值存疑19。这种 “危机响应滞后 + 信息披露不足” 的模式,可能导致用户流失和生态萎缩。监管政策的潜在收紧

事件为全球监管机构提供了 “教科书式” 的市场操纵案例。香港作为加密资产监管试点地区,可能加速完善牌照制度,要求稳定币发行方披露储备资产和流动性管理策略16。欧盟《加密资产市场监管法案》(MiCA)或将流动性池纳入风险分级监管,强制项目方公开代币分配和锁仓计划13。中国南阳法院对 “流动性撤回” 案件的判决14,也预示着司法机关可能将此类行为定性为欺诈,推动跨国执法协作。

三、市场重构的三大趋势与投资者应对策略

(一)行业演进方向

流动性池设计的迭代

未来项目可能引入 “动态流动性调整” 机制,如根据价格波动自动增减流动性区间;或采用 “保险基金” 模式,由 DAO 社区共同出资对冲黑天鹅风险。部分去中心化交易所(如 Uniswap v4)已在探索 “做市商白名单” 和订单簿混合模式,以提升抗操纵能力。合规化与机构入场加速

香港、新加坡等地的合规交易所将吸引更多传统资金,而高风险项目面临边缘化。例如,XBIT 交易所与主权财富基金合作开发 “机构级流动性池”,通过智能合约锁定黄金、国债等避险资产,降低加密货币的波动性17。这种 “传统资产 + 加密货币” 的混合模式,可能成为未来市场的主流形态。监管技术与跨司法协作

监管机构将加强链上数据分析工具的应用,实时监测大额转账和异常交易。例如,美国 SEC 可能要求中心化交易所公开做市商持仓数据,欧盟计划拨款 5 亿欧元支持跨境支付合规试验17。跨司法辖区的信息共享(如 FATF 黑名单)将压缩市场操纵者的活动空间。

(二)投资者应对策略

风险控制的优先级提升

止损机制:单笔交易亏损超过账户 5% 时立即离场,避免陷入 “沉没成本陷阱”。

流动性评估:参与 DeFi 项目前,需通过 Etherscan 等工具核查流动性池的锁仓周期、做市商分布及代币分配情况,警惕 “高 APY + 低锁仓” 的组合13。

资产分散:减少对单一代币或生态的依赖,将资金配置于主流币、合规稳定币和受监管的金融产品(如比特币 ETF)。

警惕新型操纵手法

跨链联动:攻击者可能通过跨链桥转移资产,制造多链协同砸盘,需关注代币在以太坊、BNB Chain 等多链上的持仓变化。

舆论操控:利用社交媒体散布利好消息吸引散户接盘,随后集中抛售。建议通过项目方官方渠道(如白皮书、Telegram 群组)获取信息,避免轻信第三方 KOL 推荐。

关注政策与技术变革

监管动态:跟踪香港、欧盟等地的稳定币监管细则,合规项目可能迎来估值重塑;而未达标的高风险代币或面临退市压力。

技术创新:零知识证明(ZK)、隐私计算等技术的应用,可能提升交易匿名性和抗审查能力,但也需警惕其被用于非法活动。

四、历史镜鉴与市场韧性展望

回顾加密货币历史上的重大黑天鹅事件(如 Mt.Gox 破产、LUNA 崩盘、FTX 暴雷),每次危机都推动行业向更成熟的方向进化。例如,LUNA 事件后,算法稳定币逐渐被法币抵押型稳定币取代;FTX 破产则促使交易所加强资产隔离和用户资金审计。

此次 ZKJ/KOGE 闪崩事件,或将成为 DeFi 协议治理升级和监管框架完善的催化剂。尽管短期市场情绪低迷,但长期来看,加密货币作为 “数字黄金” 和 “可编程金融” 的核心叙事未变。投资者需以更审慎的态度穿越周期,在风险与机遇并存的市场中,寻找合规性与创新性兼备的投资标的。

结语

加密货币市场的波动性本质上是创新与监管博弈的结果。ZKJ/KOGE 事件揭示了市场操纵的复杂性和流动性池的脆弱性,也为行业进化指明了方向。未来,合规化、机构化和技术创新将成为市场的主旋律,而投资者需在风险控制与价值发现之间找到新的平衡。这场 “闪崩” 不仅是一次危机,更是加密货币从 “野蛮生长” 迈向 “规则重构” 的关键转折点。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。