撰文:董静,华尔街见闻

6 月 10 日,据 Blockworks 报道,SEC 已要求潜在的索拉纳 ETF 发行商在下周内提交修订后的 S-1 表格,这一举动被业内人士视为审批流程显著提速的信号。

三位知情人士透露,监管机构此举可能将索拉纳 ETF 的批准时间缩短至 3-5 周内。

消息传出后,SOL 代币价格立即上涨 4%,逼近 165 美元关口。这也凸显了市场对机构级加密货币产品的渴望程度。索拉纳目前是全球第六大加密货币。

更为值得只关注的是,有分析指出,SEC 最早可能在下个月就开始批准一些与加密货币相关的交易所交易基金,从而拉开「代币 ETF 夏天」的序幕。

SEC 态度急转

据报道,更引人注目的是,SEC 在文件修订要求中显示出对质押功能的开放态度。

两位消息人士表示,监管机构要求更新有关实物赎回和质押方法的措辞,并明确表示愿意将质押纳入索拉纳 ETF 的组成部分。

这一态度转变对于依赖质押收益的投资者而言无疑是重大利好。SEC 必须在 7 月 2 日前做出决定,彭博分析师给出了 90% 的批准几率。

目前,Grayscale、VanEck、21Shares、Canary Capital、Bitwise 和 Franklin Templeton 等主要资产管理公司均已向 SEC 提交 Solana ETF 申请。

其中,Grayscale 正寻求将其 SOL 信托转换为现货 ETF,复制其比特币和以太坊 ETF 的成功模式。

华尔街见闻此前文章指出,索拉纳最初因前加密货币亿万富豪 Sam Bankman-Fried 的支持而引起广泛关注。2022 年,在他的加密货币交易所 FTX 和关联的 Alameda Research 基金崩溃后,索拉纳的生存曾备受质疑。但由于其相对于竞争对手收取的费用较低,索拉纳此后实现了强势回归。

代币 ETF 夏天即将来临

有分析表示,美国证监会最早可能在下个月就开始批准一些与加密货币相关的交易所交易基金(ETF),从而拉开「代币 ETF 夏天」的序幕。

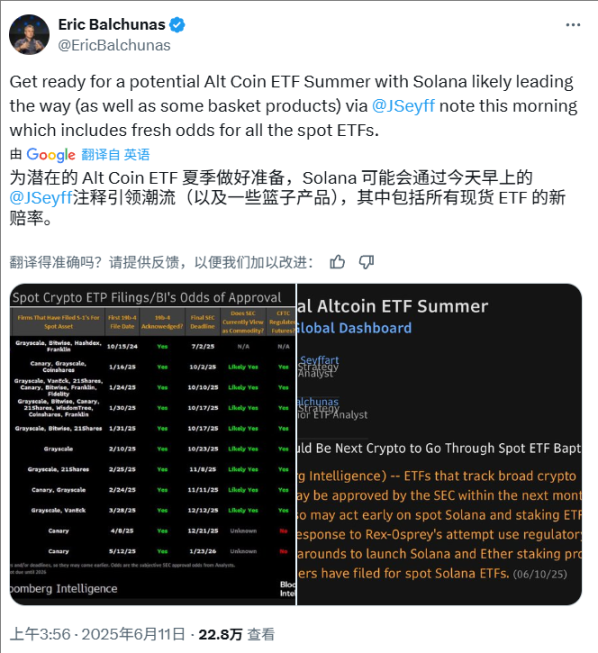

彭博高级 ETF 分析师 Eric Balchunas 周二在社交媒体 X 上发布了同事 James Seyffart 的一份报告,称「追踪广泛加密货币指数的 ETF 可能在下个月获得 SEC 批准」。

报告指出,SEC 还可能对索拉纳和质押 ETF 申请「提前行动」,Balchunas 表示要「为潜在的山寨币 ETF 夏天做好准备,索拉纳可能领跑」。

另外,21Shares 总裁 Duncan Moir 在巴黎举行的 Proof of Talk 机构资本流入路线图会议上表示,随着更多资产管理公司进入加密货币 ETF 竞争,「篮子产品将变得更加有趣」。

他指出,当投资者无法确定哪个加密货币会成为赢家时,购买一篮子产品成为「不费脑筋的选择」。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。