Original | Odaily Planet Daily (@OdailyChina)

Author | Nan Zhi (@Assassin_Malvo)

On June 10, Huma Finance released the Huma Staking Rewards Proposal, which provides a detailed explanation of the Feather points coefficient calculation rules for Season 1 (the second staking event). In the first staking and TGE activities, the annualized yield for participants staking Huma USDC exceeded 100%, making it one of the few "big yields" in the current environment of diminishing returns. So, is it worth participating in the second event?

In this article, Odaily Planet Daily will collect data and perform calculations to clarify the return expectations for Season 1.

Proposal Details

The original link to the proposal is: https://www.notion.so/huma-fi/Huma-Staking-Rewards-Proposal-20eefc699c5a80f5bcc1e6f010ccd135. The consultation period will end on June 17, and this article will base calculations on the current version, with key rules for score calculation including:

LP Lock-up Period and Mode Multipliers: Different base multipliers are provided based on the LP's lock-up duration (e.g., 3 months, 6 months) and mode (Classic or Maxi). The minimum is 1x for no lock-up in Classic mode, and the maximum is 15x for a 6-month lock-up in Maxi mode. (Note: Here, LP refers to the deposit of USDC, not the traditional AMM LP.)

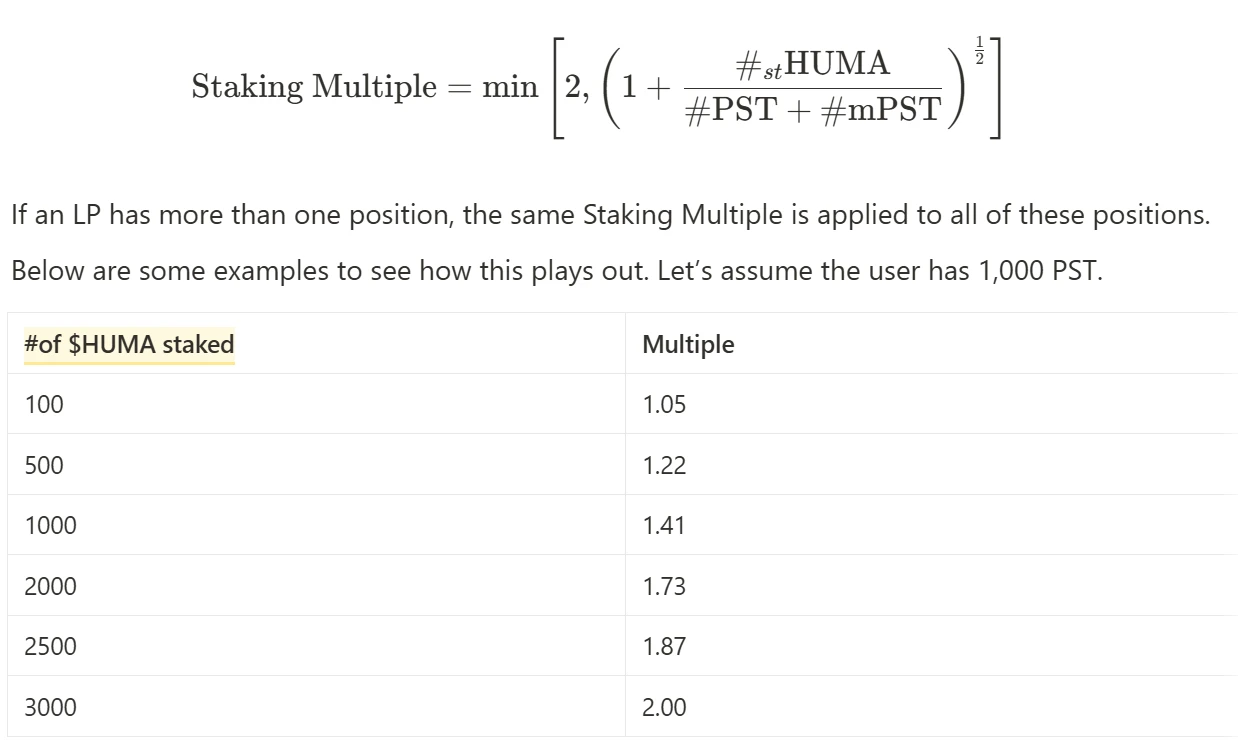

Staking Multipliers: The additional bonus for LP rewards is determined by the ratio of the number of HUMA tokens staked by the user to the total number of LP tokens. When the staked HUMA reaches three times the number of LP tokens, the multiplier caps at 2. The official calculation formula is as follows:

OG LP Status: Users who participated in Huma Season 0 and currently have deposits of over $100 in Huma will receive a fixed bonus of 1.2x. For users who have transferred assets, assets must be returned to restore OG status by July 1.

Vanguard Status: Users who stake all their airdrop tokens before June 15, as well as those who have not received an airdrop but have staked over 100,000 HUMA, will receive a 1.2x Vanguard status reward bonus if they stake for 6 months or more.

Yield Calculation

According to previous official announcements, Season 1 will allocate 2.1% of the tokens, but the proportion allocated to LPs is currently unclear. Starting from the simplest scenario, assuming all users adopt the same staking method and 2.1% is fully allocated to LPs, we have the following data:

The current TVL is $56.65 million, FDV is $462 million, and the value of 2.1% of the tokens is $9.7 million. Season 1 lasts for 3 months, thus the absolute yield is 970/5665=17.1%, equivalent to an annualized yield of 68.4%.

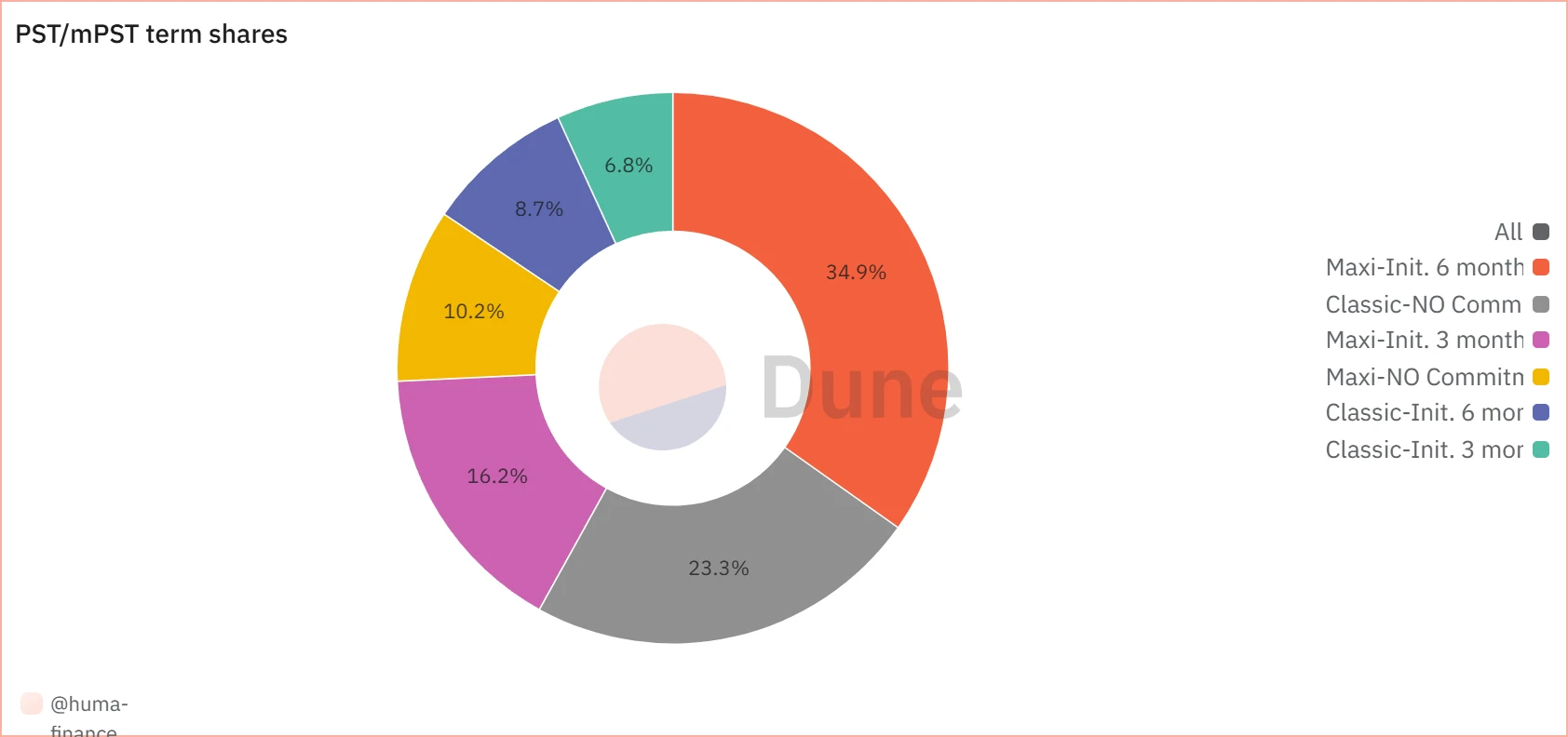

Further differentiation shows that there are two staking modes, Maxi and Classic, and three staking durations, resulting in six scenarios. The current choices of users are shown in the figure below.

Based on the different point acquisition coefficients, the APR varies, with the most popular choice being the 6-month lock-up Maxi mode, which translates to an APR of 127.06%; while the second most popular choice, the no-lock Classic mode, yields 8.47%.

Additionally, there are ways to increase point acquisition efficiency through OG, Vanguard, and staking HUMA, with a maximum amplification of 1.2×1.2×2=2.88 times, but the specifics depend on each user's strategy, making precise calculations in this dimension impossible.

In summary, based on the current TVL and unchanged coin price, choosing the 6-month lock-up Maxi mode in the second airdrop event of Huma Finance is expected to achieve an APR of over 100%, especially for users who participated in the first staking event. Not making any changes to their assets and continuing to participate in the second event will be very beneficial.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。