比特币(BTC)本周突破111,000美元后回落至108,000美元,短期高位震荡;以太坊(ETH)突破2,700美元阻力位,市占率升至9.8%;AI Meme、Virtuals、永续合约DEX板块涨幅领先;Plasma 10亿美元存款额度迅速售罄;Bullish再度递交上市申请;美国参议院通过《GENIUS稳定币法案》程序性表决。

摘要

行情点评

热门概念

本周比特币高位震荡,距离突破前高仅一步之遥。山寨币涨跌不一,市场资金仍然持观望状态。据Coingecko数据,本周内AI Meme、Virtuals生态、永续合约DEX等板块涨幅优于市场平均表现,七天内分别上涨约16.3%、15.2%与13.9%。上述三大板块的共性在于技术或叙事发展具有较高热度,都属于长期热点赛道。

AI Meme

AI Meme是结合AI与Meme文化的加密资产,通常以趣味性形象包装AI技术概念,具备社群传播力强、市场话题度高等特点。随着AI概念在加密货币市场持续升温,AI Meme项目借势崛起,受到资金追捧。一方面,它们结合技术叙事与娱乐元素,吸引更广泛投资者;另一方面,也成为投机资金在热点轮动中重点布局的对象。——过去7天该板块涨幅达16.3%,其中TERMINAL、SHOGGOTH及FARTCOIN等表现突出。

Virtuals生态

Virtuals生态是一种以虚拟资产和虚拟角色为核心的新兴加密生态系统,融合了虚拟偶像、AI、NFT与链上互动体验,强调沉浸式社交与数字身份构建。该生态受到资金青睐,主要因其具备强社群粘性、内容延展性与品牌塑造能力,能快速吸引年轻用户和创作者参与。同时,AI驱动的角色智能化和链上经济模型的结合,为投资者带来新的增长预期与应用场景。——过去7天该板块涨幅达15.2%,其中POLY、BRAIN及VADER等表现突出。

永续合约DEX

永续合约DEX是指支持无到期杠杆交易的去中心化交易所,用户可在链上直接进行衍生品交易,无需托管资产。其受到资金青睐,主要因其具备去中心化、安全透明、操作自由等优势,满足用户对高杠杆、低滑点交易的需求。随着市场对链上衍生品需求激增,相关项目代币表现强劲,如HYPE突破40美元,反映出资金对该赛道成长性的高度认可与布局热情。——过去7天该板块涨幅达13.9%,其中LVN、ZEX、HYPE等表现突出。

本周聚焦

稳定币公链项目Plasma 10亿美元存款额度迅速售罄

随着Circle顺利IPO且取得亮眼的上市表现,市场对于稳定币的关注度逐渐上升。今日稳定币公链项目Plasma官方发文表示,上午9时重新开放存款上限至10亿美元,该存款额度迅速被市场消化。Plasma表示,10亿美元的筹集存款并不是XPL代币销售本身,XPL公开销售尚未开始,所有资金将被桥接到Plasma主网测试网,并完全归存款人所有,存款人根据锁定时的最终单位所有权参与销售。公开销售条款保持不变:将出售5亿美元XPL额度,完全稀释估值为50亿美元。

据官方介绍,Plasma不只是一个稳定币链,更是专为比特币打造的金融基础设施。它兼具比特币侧链、隐私保护和稳定币功能,有望原生支持USDT,并通过Tether提供深度流动性,满足BTCFi场景下用户对低滑点兑换和无信任借贷的强烈需求。

Plasma架构以比特币为最终结算层,引入BitVM2及无需原生代币支付Gas的模型,大幅降低使用门槛与对手方风险。同时,其内建隐私机制支持选择性披露,兼顾监管需求。作为由Tether直接支持的项目,Plasma将稳定币从流动性工具跃升为链上核心资产,并构建出与银行支付系统相媲美的稳定币结算网络。其结合Rollup、隐私与支付基础设施三大趋势,有望成为比特币生态中最具价值的金融层。

Bullish再度递交上市申请

6月初,Circle成功登陆美股,成为稳定币第一股,首日股价飙涨168%,募资11亿美元,引发行业连锁反应,交易平台Bullish也被曝已向SEC提交上市申请。Bullish的发展战略高度聚焦合规,不仅选择与Circle(USDC)合作,规避USDT,同时在香港和德国等地取得加密金融牌照,布局全球市场。其曾经尝试通过SPAC曲线上市,但最终未果,现正重启IPO进程。

Bullish背后是EOS母公司Block.one,该公司曾在2018年通过IC0募集42亿美元,是加密史上最大融资案。EOS项目后期因技术、治理、资金分配等问题陷入低谷,Block.one则转向合规交易平台Bullish。2021年Bullish上线,官方宣称启动资金超过100亿美元,投资方包括Peter Thiel和Mike Novogratz等。

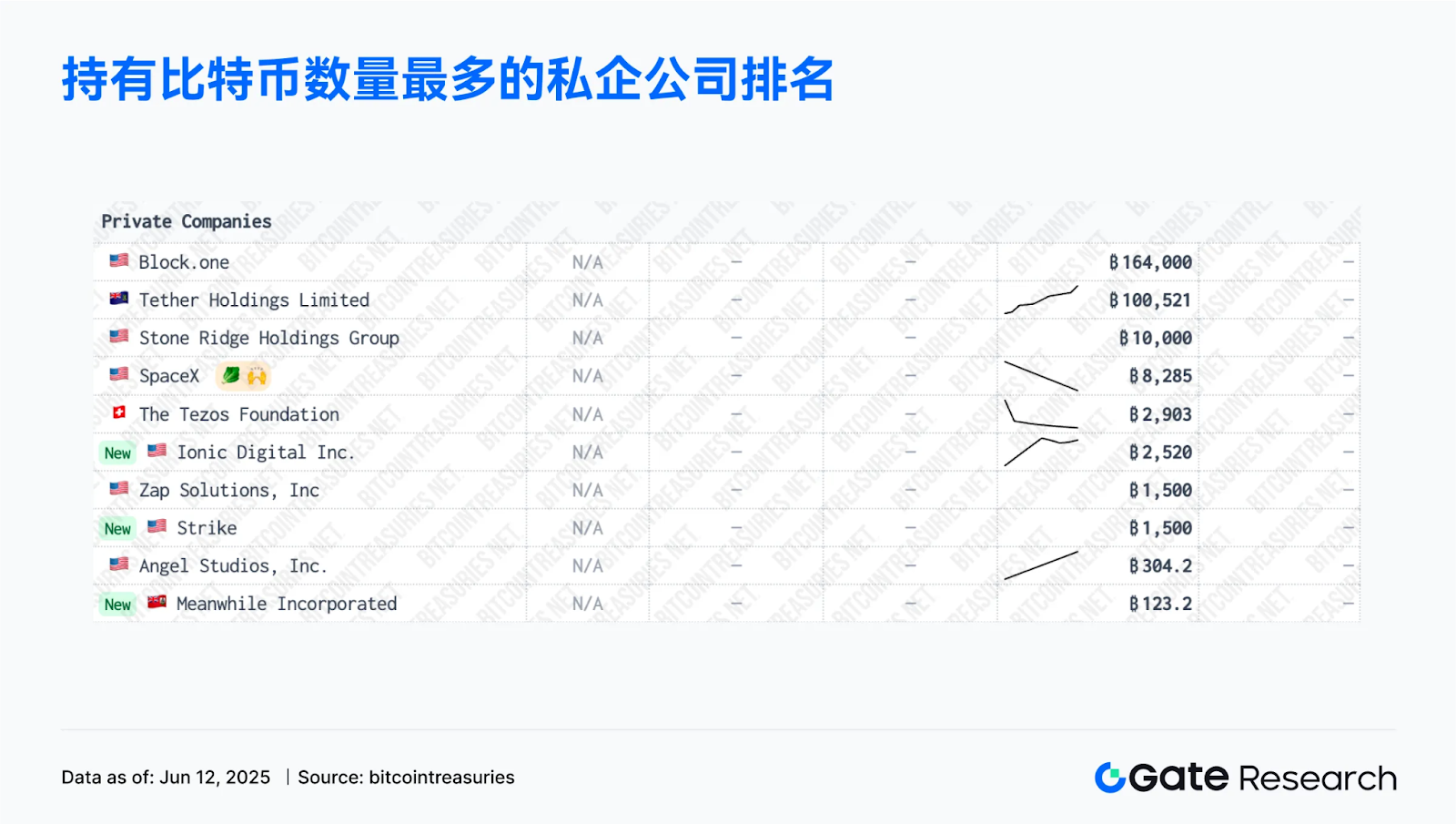

Bullish与EOS社区关系紧张,后者认为Block.one弃EOS投向Bullish是"背叛"。EOS社区曾通过硬分叉和法律诉讼与其彻底分裂,并于2025年将项目更名为Vaulta,代币更名为A,试图摆脱过去。至今,Block.one仍持有16万枚比特币(价值逾175亿美元),是全球比特币储备最多的私企之一,靠保值与投资成为币圈最赚钱的项目方。

美国参议院通过《GENIUS稳定币法案》程序性表决

2025年6月12日,美国参议院以68比30票通过《GENIUS稳定币法案》(Guiding and Establishing National Innovation for U.S. Stablecoins Act of 2025)的程序性表决,正式启动全院辩论,为最终投票铺平道路。若顺利通过,该法案将提交众议院审议,并有望成为美国首部针对加密资产的全面联邦立法。

法案内容聚焦稳定币监管,提出涵盖100%储备、反洗钱(AML)合规、消费者保护等要求,旨在提升市场透明度、降低系统性风险,并推动稳定币在主流支付体系中的应用。这些规定不仅建立了合规清晰的运行框架,也意味着美国政府对数字美元版图的主动塑形。

从行业层面看,该法案一旦落地,将对稳定币市场格局产生深远影响,有助于合规项目获得更大机构和银行的支持,推动PayPal USD、USDC等法币挂钩资产走向主流。当前市场对法案普遍持积极态度,认为其可降低政策不确定性,提升合规稳定币的可接受度,并加快传统金融与加密金融的融合进程。

亮点数据

Sonic累计交易笔数突破1亿

截止本周,Sonic官方宣布其区块链网络累计交易笔数正式突破1亿笔,这一成就标志着Sonic作为新兴Layer 1区块链在全球范围内的快速崛起和广泛采用。根据Sonic基金会于2025年6月8日发布的官方数据,自Sonic主网上线以来,链上交易笔数已达到1.02亿笔,日均交易量呈现持续增长态势,反映出其高吞吐量、低成本和高扩展性的技术优势正逐步转化为实际用户和开发者的青睐。

Sonic区块链累计交易笔数突破1亿笔,凭借高性能Layer 1网络和低成本优势,FoMoney全链上游戏吸引超百万玩家,Chaos Finance和Chillonic推动DeFi与NFT交易激增。突破1亿笔交易彰显其市场竞争力,未来技术升级和跨链计划将进一步推动其成为Web3重要基础设施。

Uniswap v4上线4个月,交易额突破400亿美元

Uniswap官方近日披露,自2025年1月31日正式上线以来,Uniswap v4在短短四个月内实现交易额突破400亿美元,展现出强劲的市场吸引力与用户活跃度。据数据统计,Uniswap v4的交易额已占2025年截至目前去中心化交易市场总量(约4,620亿美元)的8.7%。其整体生态在DEX市场中继续保持领先地位,占据23%的市场份额,进一步巩固了其作为行业第一大DEX的地位。

Uniswap v4凭借创新的"钩子"机制和动态手续费,配合与Unichain Layer 2的深度集成,显著提升了去中心化交易所(DEX)的灵活性与交易效率。Unichain以其惊人的250毫秒区块时间和高达95%的成本降低,迅速超越以太坊,成为Uniswap v4交易量的主导链,占据近75%的市场份额。此外,约4,500万美元的流动性激励成功推动Unichain的总锁定价值(TVL)从900万美元飙升至2.67亿美元,充分展现了用户对其的高度认可。这一系列进展不仅彰显了Uniswap在DeFi领域的强大创新能力,更进一步巩固了其作为去中心化金融基础设施领导者的地位。

TRC20-USDT发行量突破787亿

截至2025年6月,TRC20-USDT的发行量已达787亿枚,占全球USDT总量(1,500亿枚)的52.5%。2025年迄今新增190亿枚,远超2024年4月时的70亿枚,同比增长近11倍。其中,5月单月增发70亿枚,6月已新增约10亿枚。

这一显著增长不仅彰显了波场TRON在稳定币领域的主导地位,也突显了区块链技术在重塑全球金融体系中的深远影响。未来,TRON有望通过与金融机构合作及融合新兴技术,进一步拓展其Web3生态,拓宽TRC20-USDT的实际应用场景。与此同时,随着竞争加剧与监管不确定性上升,TRON仍需持续巩固技术优势,避免因外部争议影响用户信心。

TRX作为Tron链的原生代币,在过去数年中价格表现相对坚挺,一直维持在市值前10的位置。自2024年以来,TRX累计涨幅超150%,在Layer1公链中表现相对较好。

相关推荐:美国合众银行(U.S. Bancorp)探索稳定币领域,加密托管业务迎来复苏

原文: 《 Plasma 10亿美元存款额度迅速售罄|美众议院通过GENIUS稳定币法案 》

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。