原文作者:Lorenzo Valente

原文编译:Luffy,Foresight News

在 ARK 的《Big Ideas 2025》报告中,我们为投资者提供了加密资产领域的深度洞察,其中包括稳定币。自今年 1 月以来,稳定币供应量飙升 20% 至 2470 亿美元,超过美国 M2 货币供应量的 1%。Tether 和 Circle 分别以 1500 亿美元和 610 亿美元的规模继续主导市场,合计市场份额超过 85%。

我们认为,稳定币可能在未来 5-10 年成为美国政府最重要的战略资产之一。为何如此?过去 15 年,外国持有美债的比例急剧下降,鉴于地缘政治压力演变,这一趋势可能持续。与此同时,美联储因持续推进量化紧缩,不太可能加大美债购买力度。

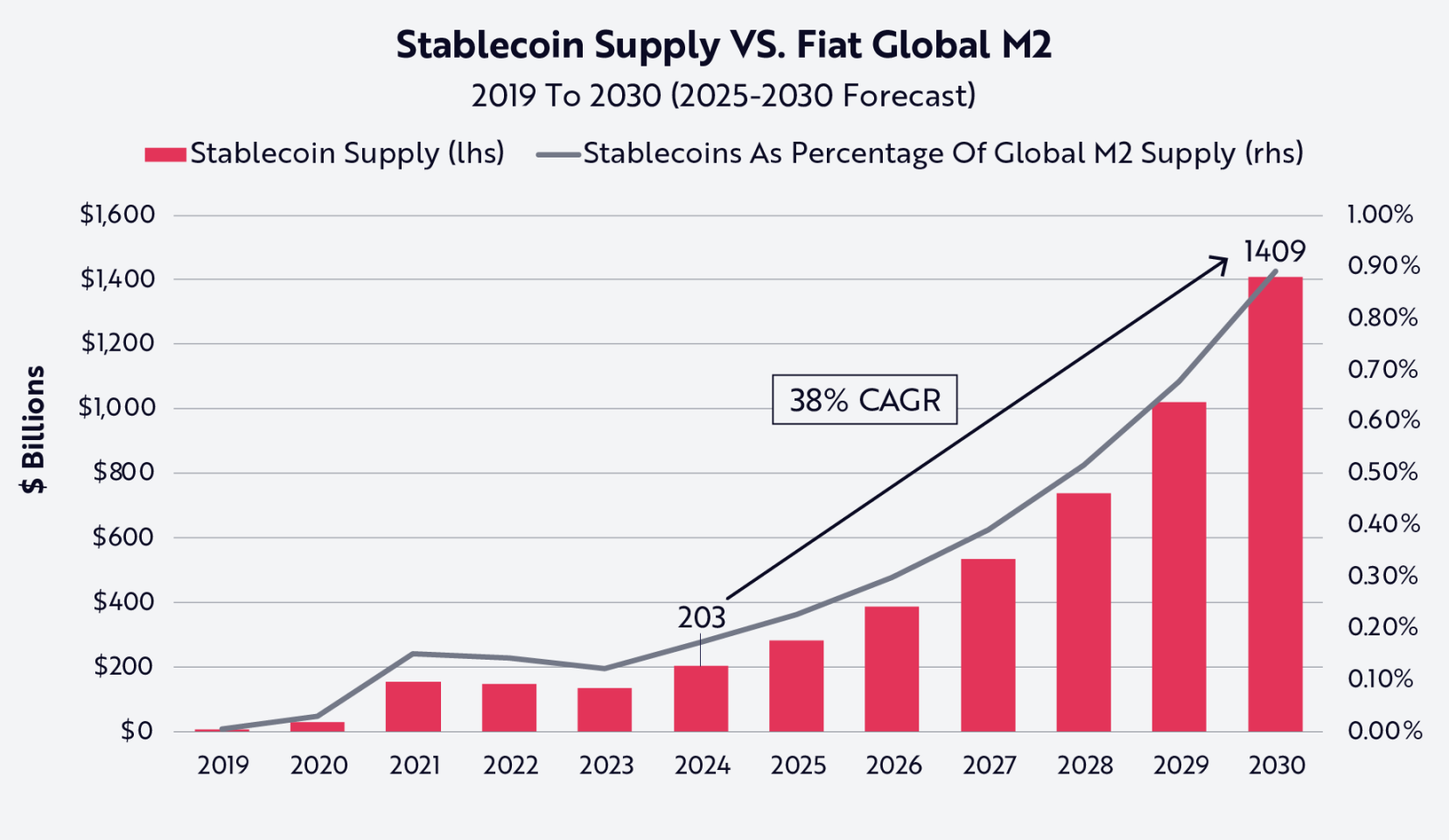

我们相信稳定币市场将迎来指数级增长,未来五年供应量预计将增长 5-10 倍。这一扩张可能将美债需求推至曾由主权国家支撑的水平。此外,稳定币正覆盖传统银行体系未能服务的地区和人群,抵消当前的去美元化浪潮。

我们分六个部分阐述了稳定币的论点和分析:

展示历史上美债主要持有国的持仓持续下降;

论证宏观经济动态(包括地缘政治变化)使这些国家对美债投资兴趣降低;

描述顽固的通胀如何降低美联储短期内大规模购债的可能性;

说明稳定币如何填补历史上美债主要持有国留下的需求真空;

阐述以美债为背书的稳定币如何像 「特洛伊木马」 一样促进贸易,并使美元回流美债;

论证稳定币已显著增强美元的全球主导地位。

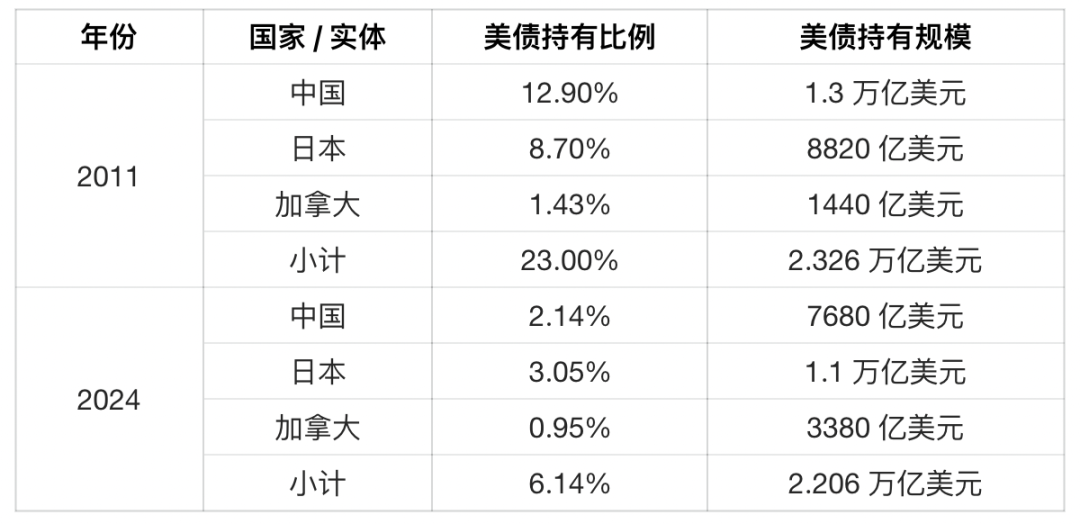

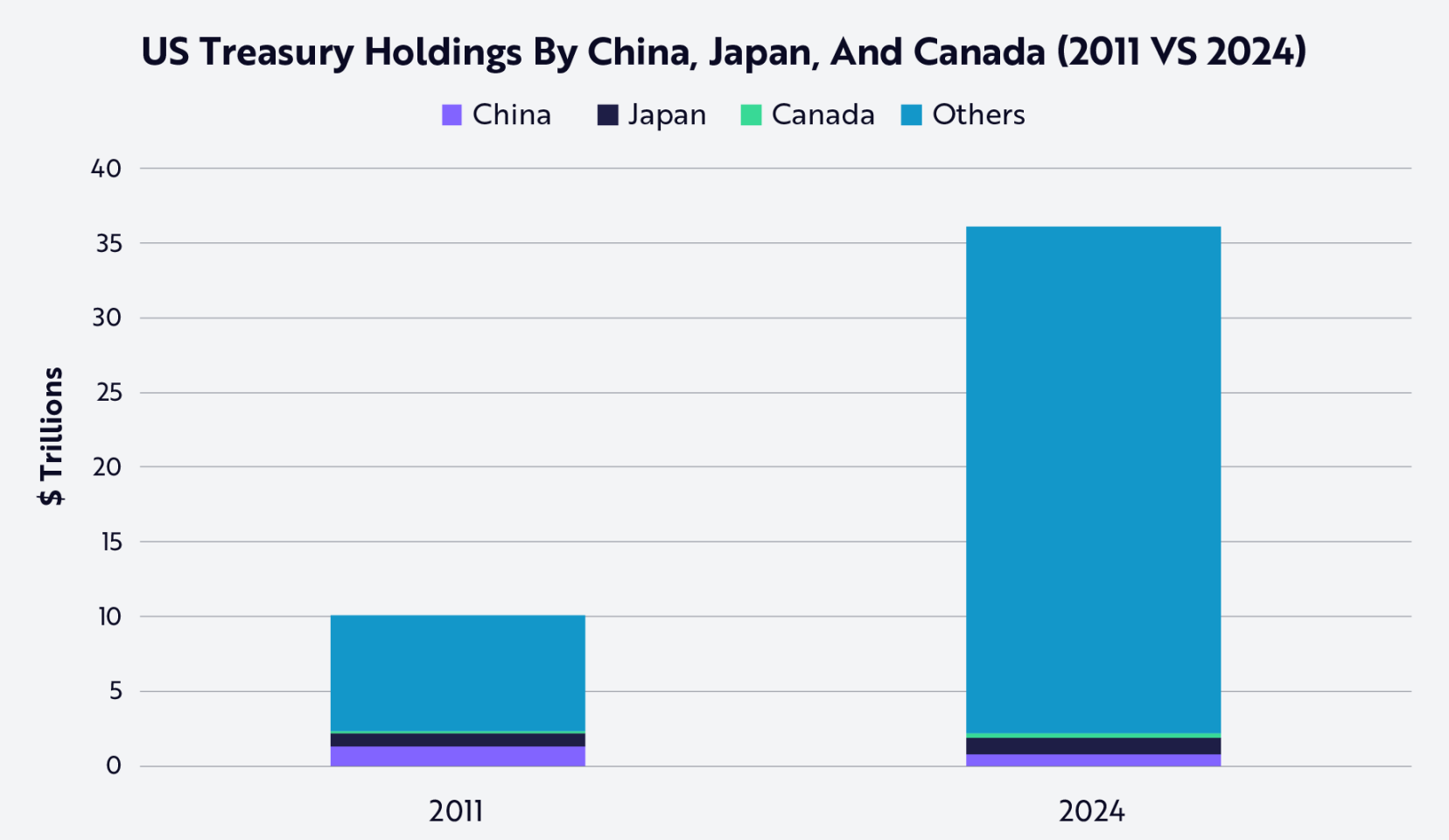

美国政府正失去最大的债券买家

2011 年,在 10.1 万亿美元的未偿美债中,中国、日本和加拿大分别占 12.9%、8.7% 和 1.43%,合计 23%。截至 2024 年 11 月,在 36 万亿美元未偿美债中,三国持仓分别降至 2.14%、3.05% 和 0.95%,合计约 6%,如下表和图表所示:

数据来源:ARK,截至 2025 年 5 月 15 日

需要重申的是,在短短约 13 年内,美债最大债权人的持仓比例从 23% 骤降至 6%,详情如下:

数据来源:ARK,截至 2025 年 5 月 15 日

发生了什么?

历史上,中国每年通过巨额贸易顺差积累美元并购买美债,其主要动机可能是控制人民币兑美元汇率并维持出口竞争力,这对中国经济增长至关重要。但过去五年,中国贸易失衡收窄,对美债的需求也随之下降。美中贸易数据显示,2018 年贸易逆差为 4192 亿美元,2024 年降至 2954 亿美元,短短六年内就缩小了 29% 以上。

地缘政治变化加速了这一趋势。针对乌克兰战争的制裁迫使俄罗斯更依赖替代贸易伙伴,尤其是中国。如今,俄中 92% 的贸易以卢布和人民币结算,这是去美元化的显著标志。随着贸易紧张升级(包括与通用人工智能竞赛相关的国家安全制裁),中国政策制定者面临降低对美金融服务和证券依赖的压力。

2025 年 4 月 2 日,唐纳德・特朗普举行 「解放日」 仪式,宣布全面关税以解决贸易失衡并支持国内产业:

全球:对所有美国进口商品征收 10% 关税;

中国:对中国商品关税升至 145%,包括 125%「对等」 关税和与芬太尼政策相关的 20% 附加税;

加拿大和墨西哥:从两国进口商品征收 25% 关税,原油和天然气等能源产品降至 10%。

除非中国像特朗普首次执政时那样贬值人民币,否则关税将使中国对美出口显著涨价,这成为中国聚焦东盟、中东和金砖国家等其他贸易伙伴的又一原因。在这些市场,中国越来越多地以人民币、当地货币或大宗商品结算贸易。例如,上海国际能源交易中心以人民币结算石油交易,且中国已成为巴西、阿根廷、澳大利亚和南非等许多快速增长经济体的最大贸易伙伴。

日本同样面临自身经济和人口结构问题,促使日本银行(BOJ)对通胀压力和收紧的劳动力市场采取更鹰派的应对措施。2025 年 1 月,日本银行将短期利率上调 25 个基点至 0.50%,为 2007 年以来最高水平,并暗示若通胀接近或超过 2% 目标,可能进一步加息。

过去 30 年,日美利差悬殊催生了大规模套利交易:投资者以超低日元利率借款,投资收益率更高的美元计价美债。据嘉信理财数据,套利交易规模已达 1 万亿美元,德意志银行则称达 20 万亿美元。尽管投资者可通过外汇掉期对冲汇率风险,但对冲成本上升正侵蚀净收益优势。

2024 年夏季,套利交易突然剧烈平仓,表明许多投资者可能未完全对冲风险。若日本银行继续加息,套利交易吸引力将进一步下降,日本国债对本土投资者的吸引力则会上升,加速资金从美债流出。

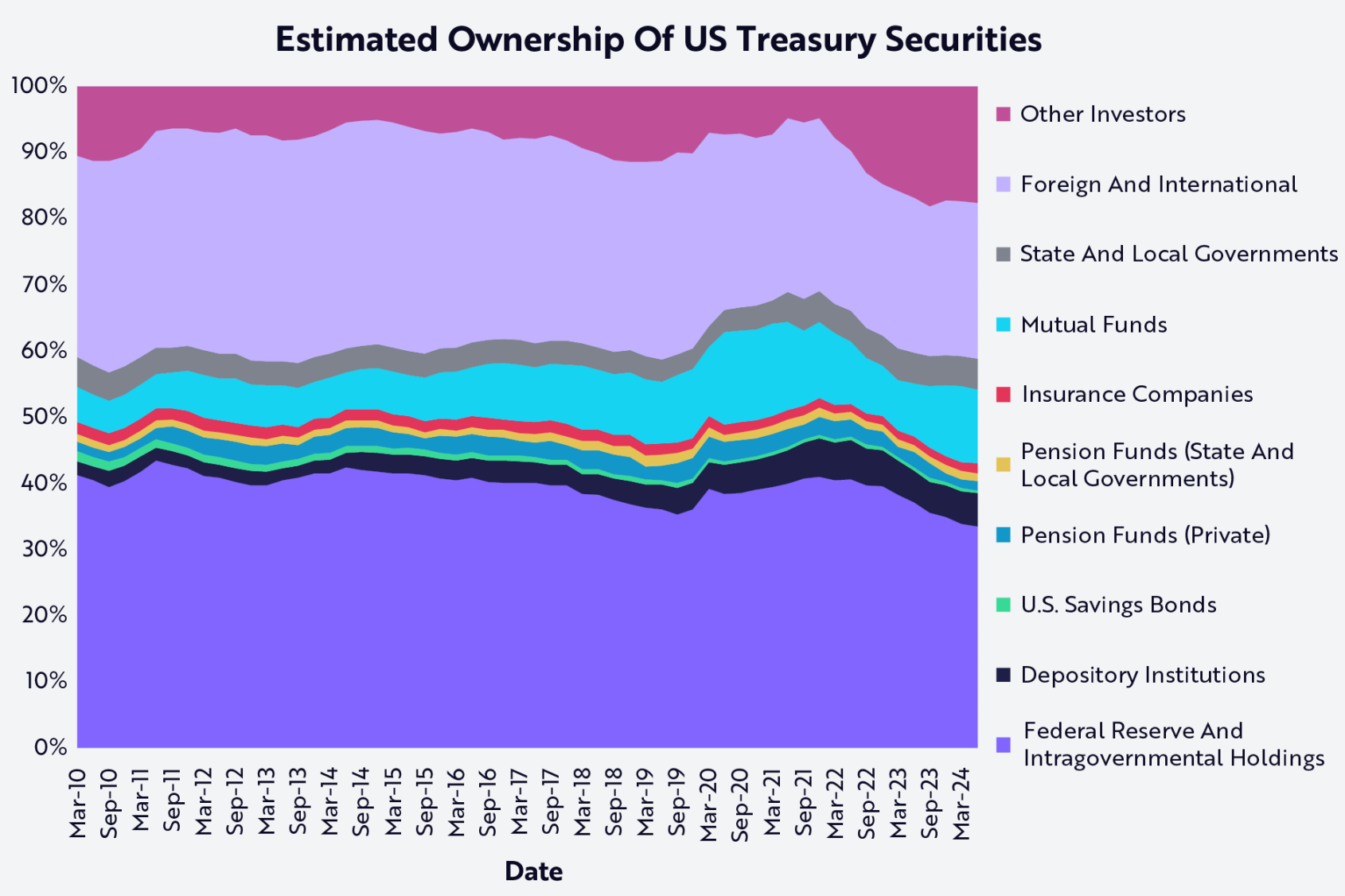

美联储不太可能购买美国国债

2020 年 2 月至 2022 年 4 月,美联储资产负债表从 4 万亿美元扩张至 9 万亿美元,2024 年 6 月稳定在 7.3 万亿美元左右。如今,量化紧缩表明美联储更可能是美债的卖家而非买家。

数据来源:ARK,截至 2025 年 5 月 28 日

美联储通过量化紧缩缩减资产负债表,允许到期债券在无需再投资的情况下进行展期。当美联储出售美债(或不将到期债券收益再投资)时,公开市场必须吸收美债供应,在其他条件不变的情况下,这往往会推低债券价格并抬高收益率。

美联储不太可能在 2025 年重启美债购买。2 月 12 日,鲍威尔主席重申 「我们在减少央行债券持仓方面还有很长的路要走」,并解释称市场未见流动性恶化到足以放缓量化紧缩进程的迹象。截至 2 月下旬,美联储每月允许约 250 亿美元美债和 350 亿美元抵押贷款支持债券到期。

与此同时,国会预算办公室预测 2025 财年赤字将达 1.9 万亿美元,接近 GDP 的 6.4%。未来十年,累计赤字可能达 20 万亿美元,这意味着美国财政部每年至少需发行约 2 万亿美元的短期、中期和长期债券为政府支出融资。

尽管特朗普政府致力于压低长期美债收益率,但在通胀和实际增长未显著下降或缺乏美债需求新来源的情况下,利率更可能走高。随着美债最大持有国需求持续下降,以及关税战推动贸易伙伴大幅降低对美债的依赖,供应增加可能让债券投资者不堪重负。

Tether 和 Circle 能否接过中日接力棒,推高美债需求?

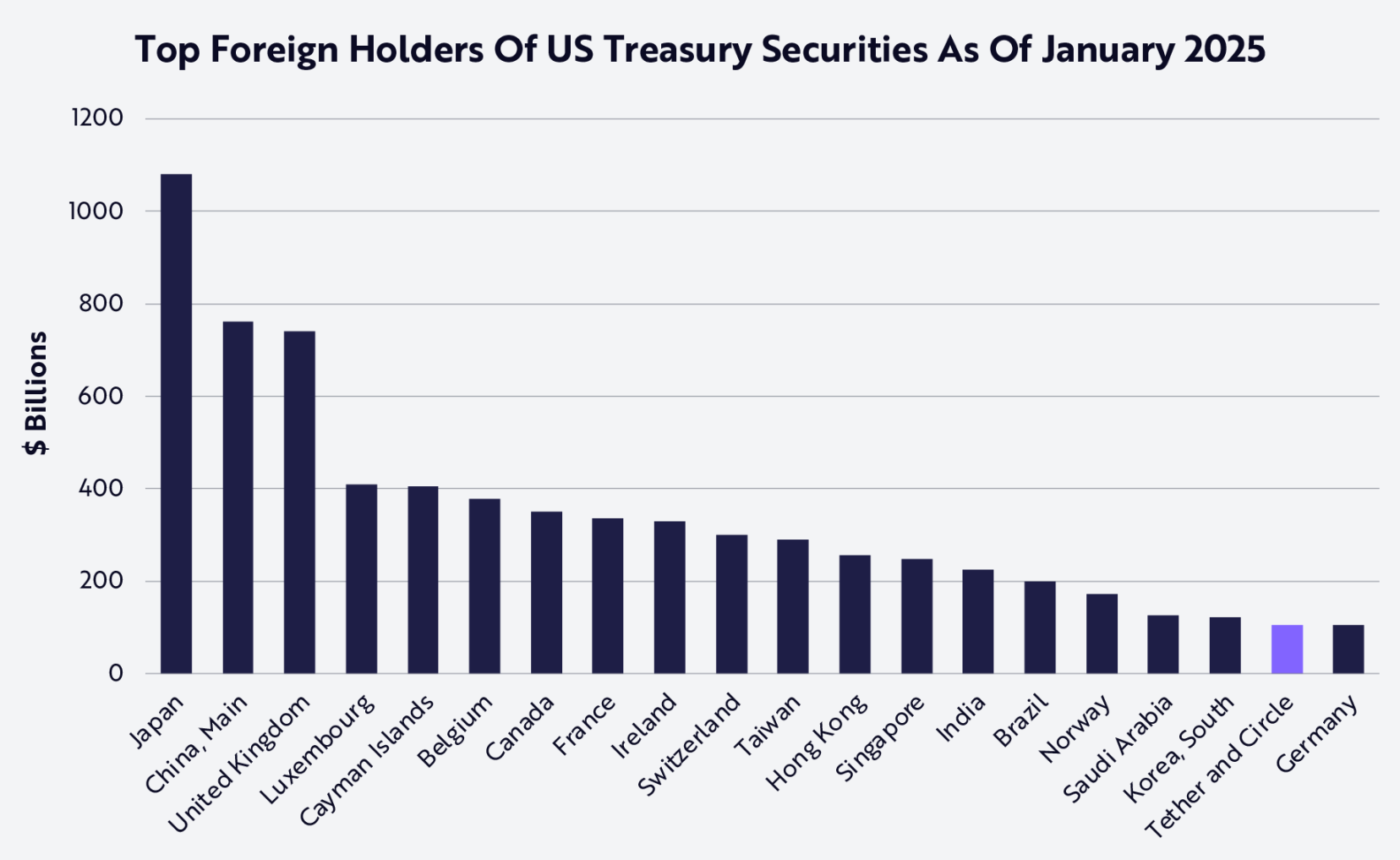

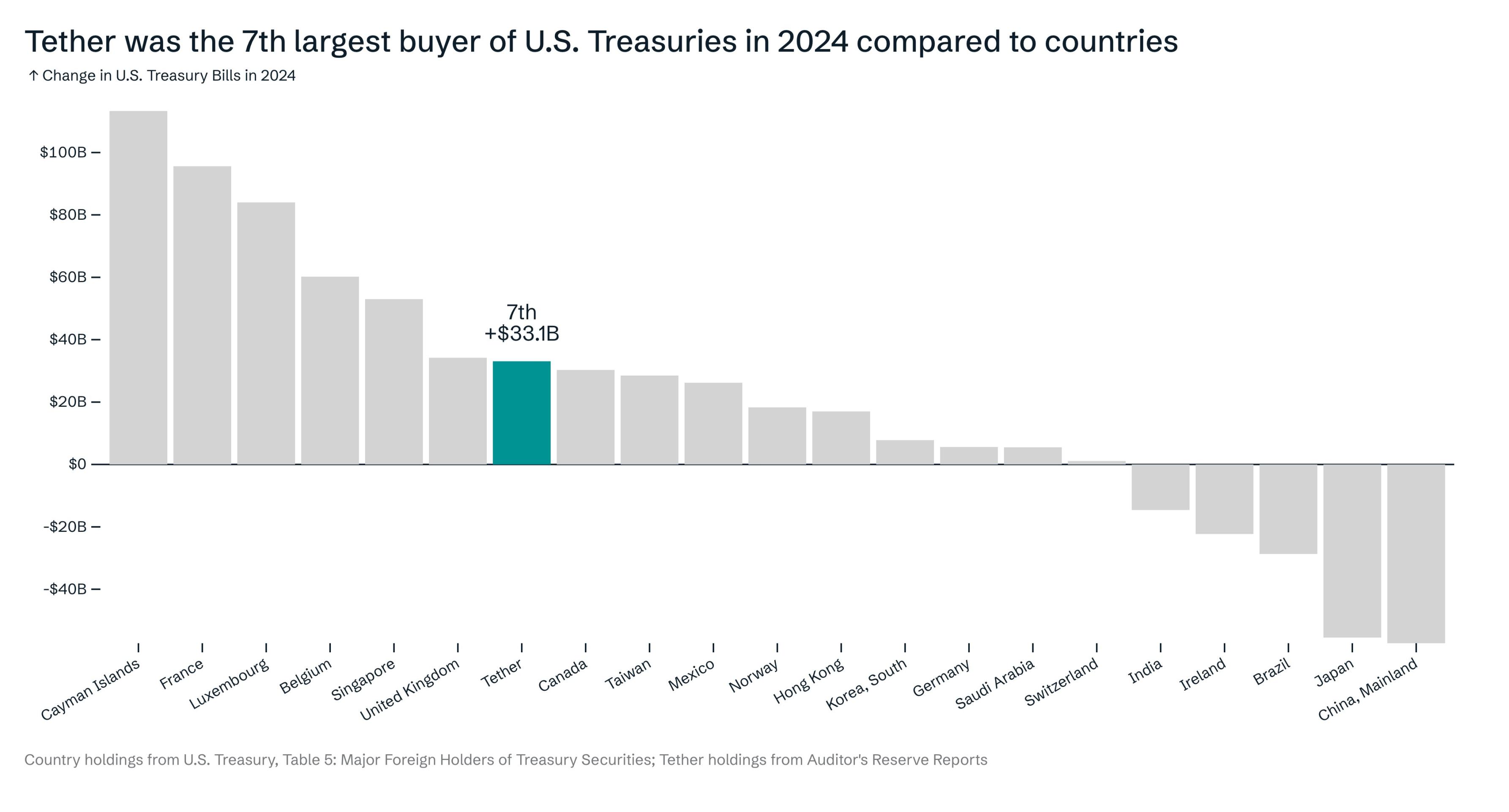

过去几年,尽管拜登政府对数字资产持负面态度,稳定币市场仍持续飙升。在加密市场剧烈波动的背景下,稳定币发行方悄然成为了全球最大的美债持有者之一,如下所示:

数据来源:ARK,截至 2025 年 5 月 15 日

2025 年 1 月 31 日,Tether 年度审计报告披露了惊人的 2024 年财务业绩:全年利润 137 亿美元,仅第四季度就赚取了 60 亿美元。此外,该公司在第四季度发行了 230 亿美元稳定币 USDT,全年发行量达 450 亿美元。截至 2025 年 3 月最新透明度报告,Tether 目前持有 980 亿美元美债。

与此同时,截至 1 月下旬,第二大稳定币发行方 Circle 持有超 220 亿美元美债。Tether 和 Circle 合计成为美债第 18 大持有方,落后于韩国但超过德国。细看 2024 年,Tether 是美债第七大买家(排在英国和新加坡之后),而最大卖家是中国和日本。

数据来源:Ardoino 2025,截至 2025 年 5 月 15

按当前发行速度,我们认为到年底它们有望超越四到五个国家。

在 ARK《Big Ideas 2025》中,我们估计到 2030 年稳定币总供应量可能达 1.4 万亿美元。若 Tether 和 Circle 维持当前市场份额及美债配置,它们合计可能持有超 6600 亿美元美债,接近中国目前的 7720 亿美元持仓,仅落后于中日。

资料来源:ARK,数据截至 2024 年 12 月 31

显然,Tether、Circle 和更广泛的稳定币行业可能在未来几年创造对美国国债的最大需求来源之一,并有可能在 2030 年取代中国和日本成为最大持有者。如果是这样,那么稳定币行业可能对降低美国长期利率的目标做出重要贡献。

稳定币可抵消去美元化影响

去美元化运动有两个目标:

移除美元作为世界储备货币的地位,尤其是计价货币;

阻止贸易顺差资金流入美债。

尽管在新兴市场,替代美元计价贸易的努力已取得一些进展,但在其他地区成效有限。乌克兰战争及对俄制裁加速了莫斯科推动金砖国家(巴西、俄罗斯、印度、中国、南非)绕过 SWIFT 网络,采用替代货币和系统。

该集团扩展为金砖 +(纳入埃塞俄比亚、伊朗、沙特阿拉伯和阿联酋),显然是为了强化联盟并推动新金融秩序。

2024 年,普京推出拟议的 「金砖桥」 国际支付框架,旨在进一步促进非美元交易,但该倡议未获其他成员国热情响应,其可行性和实施也遭质疑。

与此同时,金砖国家和其他新兴经济体间的本币双边贸易协议日益普遍,例如印度、中国、巴西和马来西亚之间的最新协议。约 50 年前,石油美元协议巩固了美元作为全球石油销售主要计价货币的地位,俄罗斯对战争相关制裁的回应标志着该协议的终结。据 Oilprice.com 数据,截至 2023 年底,20% 的全球石油交易以其他货币结算,但这些收益往往会再兑换成美元。

尽管许多去美元化尝试成效有限,但有一个残酷现实不容忽视:仅就 GDP 而言,美国已不再是世界最大经济体。随着沙特、阿联酋、埃及、伊朗和埃塞俄比亚的加入,金砖 + 集团 2024 年 GDP 合计达 29.8 万亿美元,略超美国的 29.2 万亿美元。

在过去二十年中,趋势清晰可见:金砖 + 经济体增速显著快于七国集团(G7),所有迹象表明这种变化可能持续。

稳定币在不断演变的全球金融格局中具有独特地位。它们是短期美债最具流动性、效率和用户友好的 「包装器」,有效解决去美元化的两大障碍:维持美元在全球交易中的主导地位,同时确保美债需求持续。

换言之,每当阿根廷、土耳其或尼日利亚公民购买 USDT 或 USDC 等稳定币时,他们既强化了美元作为首选计价货币的地位,又创造了对短期美债的需求。因此,稳定币已成为美债的 「特洛伊木马」,确保全球用户对美债的需求持续(甚至增加)。

尽管石油美元协议去年正式终结,但类似的默契协议实际上已在形成,未来几十年可能同样关键。若有人想在美国以外购买比特币、以太坊或其他数字资产,在全球流动性最强的交易所中,美元仍是大多数交易所需的货币。这一金融护城河已存在五年以上:美元稳定币(尤其是 USDT)一直是币安、OKX、Upbit、Bybit 和 Bithumb 等主要亚洲交易所的主要交易对。

以全球最大加密交易所币安为例,其储备证明显示,在 1660 亿美元的代币余额中,客户持有超 340 亿美元 USDT 和 60 亿美元 USDC。以美元计价的 BTC、ETH 和 SOL 等加密货币交易,在海外创造了对 USDC 和 USDT 的巨大需求。

稳定币崛起为互联网原生美元基础设施

截至 2024 年 10 月,Tether 报告称超 3.3 亿个链上钱包和账户持有 USDT,其中 8600 万个在币安和 OKX 等中心化交易所持有。总计约 4.16 亿个钱包以某种方式与 USDT 互动。

Tether 目前占据稳定币总市场份额的 70%。鉴于其报告的约 4 亿个地址,合理估计全球持有稳定币的地址数接近 5.7 亿。

不过,个人和企业通常使用多个钱包,许多地址属于交易所或机构,它们将众多用户资金汇集到单个地址。根据 Chainalysis 2024 年报告,约 30%-40% 的地址属于个人用户,这意味着全球持有稳定币的个人数量在 1.7 亿至 2.3 亿之间,这一估计与其他可用数据吻合。例如,我们知道每月约 4000 万个钱包活跃,全球估计有 6 亿人持有加密货币。

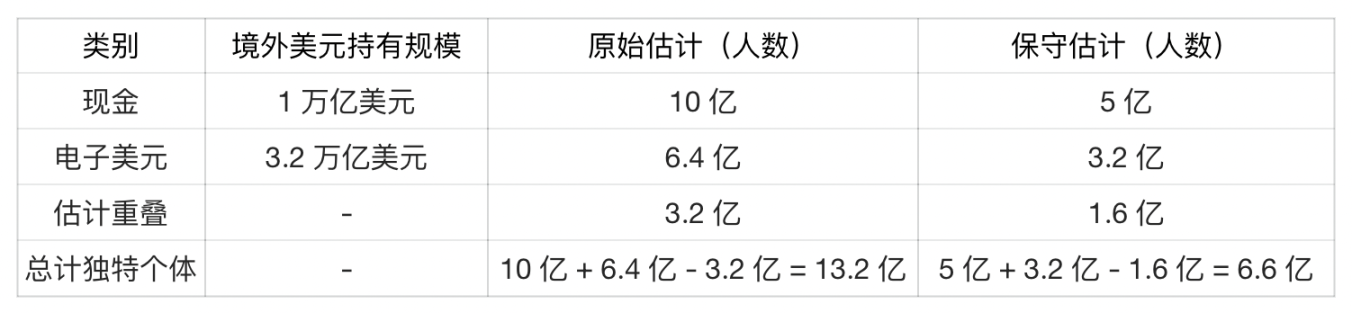

在此背景下,一个有趣的数据是将稳定币持有者数量与传统美元持有者(包括纸币 / 现金和银行账户中的美元)进行比较:

纸币美元:截至 2022 年,约 2.3 万亿美元流通中美元,据估计 50% 在境外。按人均 1000 美元计算,全球约 10 亿人持有实物美元现金。

电子美元:国际清算银行(BIS)报告称,跨境美元负债达 12 万亿美元,包括银行间交易。假设其中四分之一由家庭持有,即 3.2 万亿美元个人美元存款。按平均 5000 美元余额计算,全球约 6.4 亿人持有美元银行存款。

假设持有数字美元的个人中有一半也持有现金美元,重叠约 3.2 亿人。

数据来源:ARK,截至 2024 年 12 月 31 日

仅五年多时间,稳定币已覆盖全球约 2 亿用户,占非美居民美元持有者总数的 15-20%。考虑到美元已流通数世纪,这是一个惊人的成就。

鉴于 USDT 在新兴市场的强大影响力及其作为供应量最大稳定币的地位,我们可假设 USDT 持有者构成净新增美元持有者的很大比例,且与纸币美元和美元账户的重叠率较低。

尽管曾被误解和批评,但在 FTX 和 LUNA 崩盘后,稳定币经历了戏剧性转型。事实上,特朗普政府、新任加密货币「沙皇」及许多立法者正将稳定币誉为战略资产,通过创造对美债的持续需求,有效强化美元全球主导地位。因此,Tether、Circle 和整个稳定币行业可能演变为美国政府最可靠、最具韧性的金融盟友之一,在巩固美元全球贸易地位的同时,确保美债获得长期支撑。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。