US-China London Talks Conclude, Both Sides Reach Agreement Framework in Principle; BTC Approaches Previous High, ETH Funding Rate Hits Stage Record

Macroeconomic Interpretation: The first meeting of the US-China economic and trade consultation mechanism has concluded in London, with both sides reaching a principled consensus on implementing the leaders' consensus, showing signs of a phased easing in economic and trade relations. While this reduces the geopolitical risk premium, it also subtly alters the market's demand expectations for "safe-haven assets"—traditionally favored during geopolitical tensions, Bitcoin now needs to find new narrative support.

The shift in macro expectations directly influences market nerves. Traders are betting that the Federal Reserve will only cut interest rates once in 2025, a prediction that marks the smallest expected cut in nearly three months. Deutsche Bank's research judgment is quite representative: the upcoming US May CPI data (expected annual rate of 2.5%, previous value of 2.3%, third article) will only reinforce the Fed's wait-and-see stance. The CPI data set to be released tonight at 20:30 has become a litmus test for market sentiment—stronger-than-expected data may douse the exuberant market, further weakening rate cut expectations.

Regulation and product innovation are brewing structural opportunities. The CLARITY Act has passed the review in the US Financial Services Committee with a vote of 32:19 and is about to enter the full House vote. If this act is ultimately enacted, it will provide a clearer framework for crypto regulation, benefiting the compliance process in the long term. Musk's expression of "regret" regarding his comments about Trump led Tesla's US stock to rise over 2% in pre-market trading, reflecting the extreme volatility in the US public opinion arena. This uncertainty could also disrupt risk appetite at any moment.

Bitcoin itself has reached a critical juncture. Market analysis points to a warning signal: the widespread expectation of Bitcoin reaching "historical highs" on social media. Historical experience shows that when retail investors are unanimously bullish, the market often requires a longer time to consolidate. Interestingly, Bitcoin's current price is only 2.1% away from the historical peak of $111,970 set on May 22, and this close yet difficult-to-break stalemate reflects the market's hesitation amid macro fog.

Explosive catalysts come from the expectation of a "Summer of Altcoin ETFs"—Bloomberg analyzes that the SEC may approve ETFs tracking a broad cryptocurrency index as early as next month, with Solana and staking ETFs also likely to be released ahead of schedule. If these products come to fruition, they will introduce unprecedented incremental funding channels to the crypto market, fundamentally changing the liquidity landscape of altcoins.

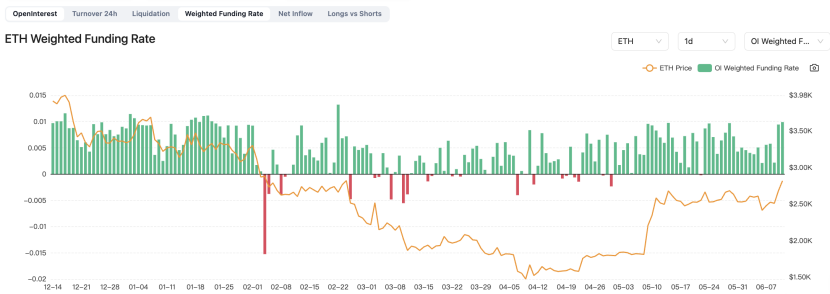

Where will the market head? In the short term, the CPI data and the Federal Reserve's interest rate decision next week (the market has priced in a hold) will dominate volatility. If inflation data is mild, it may briefly boost risk assets, but the continued weakening of rate cut expectations will ultimately suppress upward space. Bitcoin's tug-of-war near historical highs requires stronger spot demand (rather than Ethereum-style leverage-driven) or new positive catalysts (such as accelerated ETF fund inflows) to achieve effective breakthroughs. Market observations note that the current Ethereum price is mainly driven by high-leverage futures (with funding rates soaring to 13.7%), making the market structure increasingly fragile, amplifying the potential impact of macro data shocks.

In the long term, if the "Summer of Altcoin ETFs" can be realized, it will trigger a "seesaw effect" of internal fund rotation in the market, potentially weakening Bitcoin's dominant position temporarily. The advancement of the CLARITY Act marks an irreversible process of compliance for crypto assets within the mainstream financial system, laying a more solid foundation for the next bull market.

In the summer of 2025, crypto investors need to stay alert: as Bitcoin approaches its previous high, what the market is truly waiting for may be the starting gun that breaks the balance, whether it comes from a dovish shift by the Federal Reserve or an approval that opens the era of altcoin ETFs. The fog will eventually clear, and those who are prepared with ammunition will occupy the high ground in the next charge.

ETH Data Analysis: According to CoinAnk data, the funding rate for Ethereum futures contracts is close to 0.01%, with the annualized rate having surged to 13.7%, the highest level since the beginning of the year, which is seen as a positive signal by the market and may stimulate inflows into Ethereum ETFs. However, the open interest in derivatives is approaching last year's historical peak, indicating that the current price increase is mainly driven by leveraged futures trading rather than spot demand. In contrast, Bitcoin remains predominantly spot-driven, while Ethereum's performance shows a clear divergence. At the same time, the surge in call option purchases and the gamma hedging effect have intensified the risk of price gaps, increasing market vulnerability and sensitivity to short-term volatility.

High funding rates reflect excessive market optimism, but the accumulation of leverage may amplify volatility risks. Historical experience shows that similar situations are susceptible to macro event shocks, such as changes in Federal Reserve policy or geopolitical tensions, triggering a chain liquidation. In terms of impact on the crypto market, inflows into Ethereum ETFs are expected to boost confidence and prices, with Standard Chartered predicting that ETH could rise to $8,000. However, if the derivative-driven rally reverses, it will affect the entire market, especially impacting the altcoin ecosystem and exacerbating overall volatility. In the long term, ETF approvals may enhance institutional participation and promote market legitimization, but the current fragile state requires caution against short-term pullback risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。