精选要闻

1.特朗普在 Truth 平台发布包含 PEPE 及其本人形象的图片

2.中国台大高材生运营国际毒品交易网站被捕,曾因遭钓鱼攻击损失巨额加密资产

4.Reddio (RDO) 开盘触及 0.021 美元,市值暂报 1750 万美元

5.当前主流 CEX、DEX 资金费率显示市场更偏向于看跌比特币

Trending 话题

来源:Overheard on CT(tg:@overheardonct),Kaito

LOUD

今天关于 LOUD 的讨论主要集中在 @stayloudio 项目上,该项目因其独特的「初始注意力发行(IAO)」机制和排行榜系统而受到广泛关注。该项目通过奖励表现突出的发言者,营造出一种竞争激烈的环境,潜在奖励可观。许多推文对该项目的可持续性和盈利能力展开了猜测,有人表达了对其长期可行性的质疑。社区正在积极参与讨论,围绕潜在收益、分发机制以及该项目对加密行业的影响展开广泛交流。

SOPHON

Sophon(SOPH)因在 Binance、OKX 和 Upbit 等多家主流交易所成功上线而备受关注,短时间内交易量就达到了约 6 亿美元。此次上线还伴随着一次广受欢迎的空投活动,并且其与 Mintify 和 SyncSwap 等平台的整合也备受肯定。Sophon 专注于通过其构建在 zkSync 技术上的 Layer 2 区块链,打造面向消费者友好的加密体验,其创新的「社交预言机(Social Oracle)」功能受到好评。该项目旨在将区块链无缝融入游戏、社交媒体和人工智能等日常应用,使其更容易为大众所用。

GME

GameStop(GME)因宣布购买了 4,710 枚比特币(约合 5.12 亿美元),成为比特币金库公司而成为热门话题。这一举动引发了市场的热烈反应,有人认为这是对货币贬值的战略性对冲,也有人批评该决策的执行方式,并对公司管理层表示质疑。消息公布后,GME 股价短暂上涨,但部分投资者仍对其长期影响保持谨慎。

HUMANITY

今天关于 HUMANITY 的讨论聚焦于 Humanity Protocol 即将上线的消息,以及其通过生物识别手掌扫描来进行身份验证的创新方式。该协议旨在解决互联网身份问题,确保空投公平分配并保障线上互动的安全,帮助区分真实用户和机器人。项目已向 Kaito 质押者和 Humanity Yappers 分配了价值 220 万美元的 $H 代币,激发了大量关注和参与。社区对该协议在 Web3 中重新定义身份验证的潜力感到兴奋。

TON

TON 今天因多项重大进展而引发广泛关注。TON 基金会已任命前 Visa 高管 Nikola Plecas 为支付副总裁,旨在为 Telegram 庞大的用户群扩展支付能力。此外,Telegram 宣布与埃隆·马斯克的 xAI 达成 3 亿美元合作,将 Grok AI 集成至其平台,推动 TON 价格上涨了 20%。此外,Telegram 还计划通过发行债券融资 15 亿美元,投资者包括 BlackRock、Mubadala 和 Citadel。这些消息共同推动 TON 成为加密社区讨论热度最高的项目。

精选文章

1.《特朗普 25 亿美元 All In 比特币背后,股市流入「BTC 芬太尼」》

5 月 28 日,GameStop 宣布购入 4710 枚比特币后股价暴跌近 11%,而在此之前,特朗普旗下媒体科技集团(TMTG)也已宣布豪掷 25 亿美元 All In 比特币。共和党人 Vivek Ramaswamy 创立的 Strive 宣布完成 7.5 亿美元融资打造「比特币国库公司」,并通过并购 Asset Entities 再募 7.5 亿美元,持续加码 BTC。另一边还有 SharpLink Gaming 融资 4.25 亿美元建立 ETH 国库。种种迹象表明,「BTC 芬太尼」正迅速渗入股市。

2.《一边谈出售、一边冲刺 IPO,Circle 想干什么?》

大约一个月前,Circle 宣布启动首次公开募股计划,但受外部政策环境变化的影响,该进程被迫推迟。在此期间,Circle 同步与包括 Coinbase 和 Ripple 在内的潜在买家就收购事宜展开了深入谈判。然而,由于估值金额产生分歧而未能达成一致。Circle 并非急于出售,其策略意图明显:一方面,希望通过公开市场 IPO 的定价来验证并获得更高的公司估值;另一方面,也是在向潜在收购方施压,期待对方能进一步提升报价。本质上,Circle 是在进行一场精明的「比价」博弈,旨在为股东争取最大化的利益。

链上数据

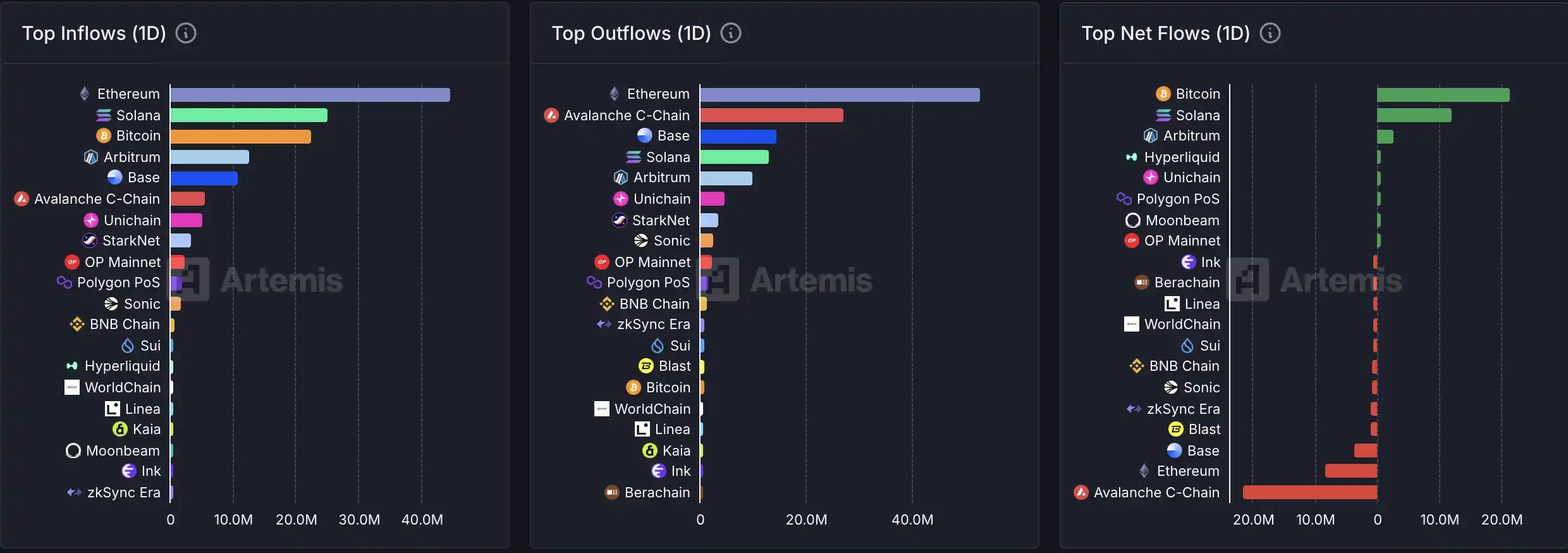

5 月 29 日当日链上资金流动情况

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。