所谓的“特朗普效应”在周五早晨展现得淋漓尽致,当时总统唐纳德·特朗普宣布对所有进入美国的欧盟(EU)商品征收50%的关税,导致传统市场和加密市场双双下跌。

Coinmarketcap显示,加密市场的市值下降了1.63%,缩减至3.45万亿美元。根据CNBC的报道,股票市场也遭遇类似回撤,标准普尔500指数、纳斯达克和道琼斯指数分别下跌了0.74%、0.96%和0.58%。

如果新欧盟关税实施,将于6月1日生效。特朗普还威胁对未在美国生产的苹果iPhone征收25%的进口税。消息传出后,苹果股票下跌了2.53%。

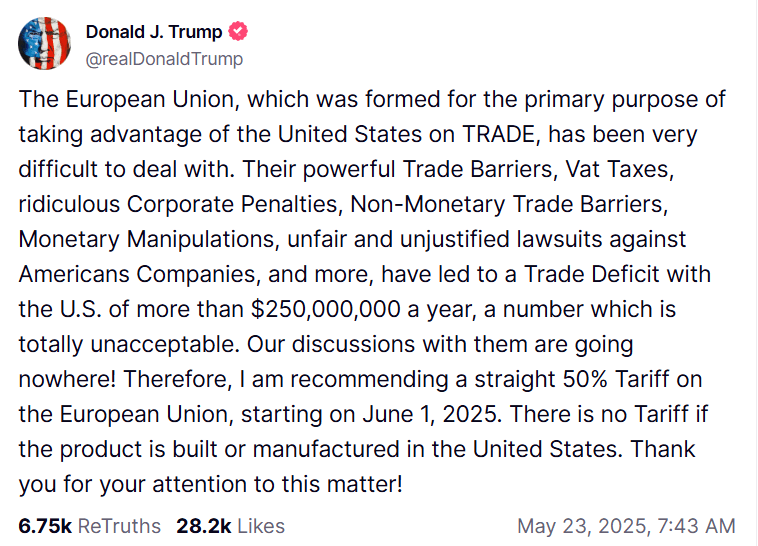

“欧盟的成立主要是为了在贸易上利用美国,处理起来非常困难,”特朗普在Truth Social上发帖写道。“因此,我建议对欧盟直接征收50%的关税,从2025年6月1日开始。”

(特朗普在Truth Social上发布消息,威胁对所有进入美国的欧盟商品征收50%关税 / 唐纳德·特朗普总统)

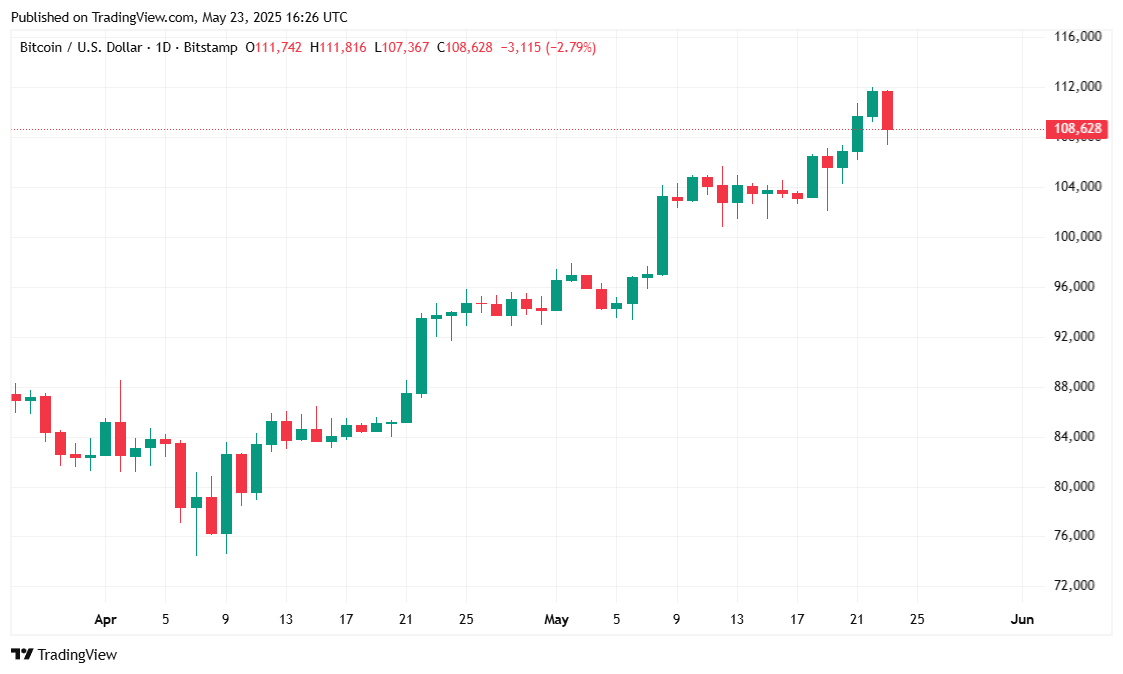

尽管特朗普的举动以及比特币随之经历的回撤,加密货币仍以108,574.13美元的可观价格交易,接近其之前的历史最高点。价格反映出当天下降了2.64%,但在过去一周仍上涨了4.35%。根据Coinmarketcap的数据,在过去24小时内,比特币的价格在107,385.27美元和周四下午创下的新历史最高点111,970.17美元之间波动。

(比特币价格 / Trading View)

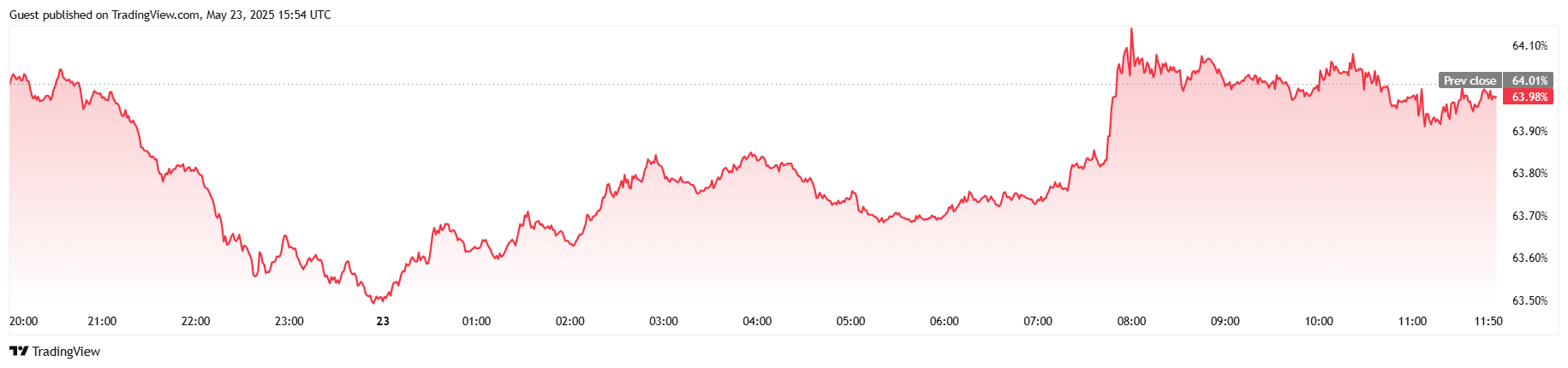

交易活动降温,24小时交易量降至656.8亿美元,下降了25.83%,反映出周四牛市狂潮后的消化。同时,比特币的市值下滑了1.87%,降至2.17万亿美元。比特币的市场主导地位也略微下降0.05%,降至63.98%,这可能表明投资者的关注点向山寨币发生了适度转移。

(比特币主导地位 / Trading View)

在衍生品市场,比特币期货的未平仓合约下降了3.12%,降至780.4亿美元,表明杠杆头寸减少。Coinglass的清算数据显示,多头承受了主要压力,总清算额达到372万美元,其中328万美元为多头头寸,仅有44.065万美元为空头。这一修正突显了在波动激增期间过度杠杆的风险,尤其是在一位能够通过一条社交媒体帖子影响市场的总统面前。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。