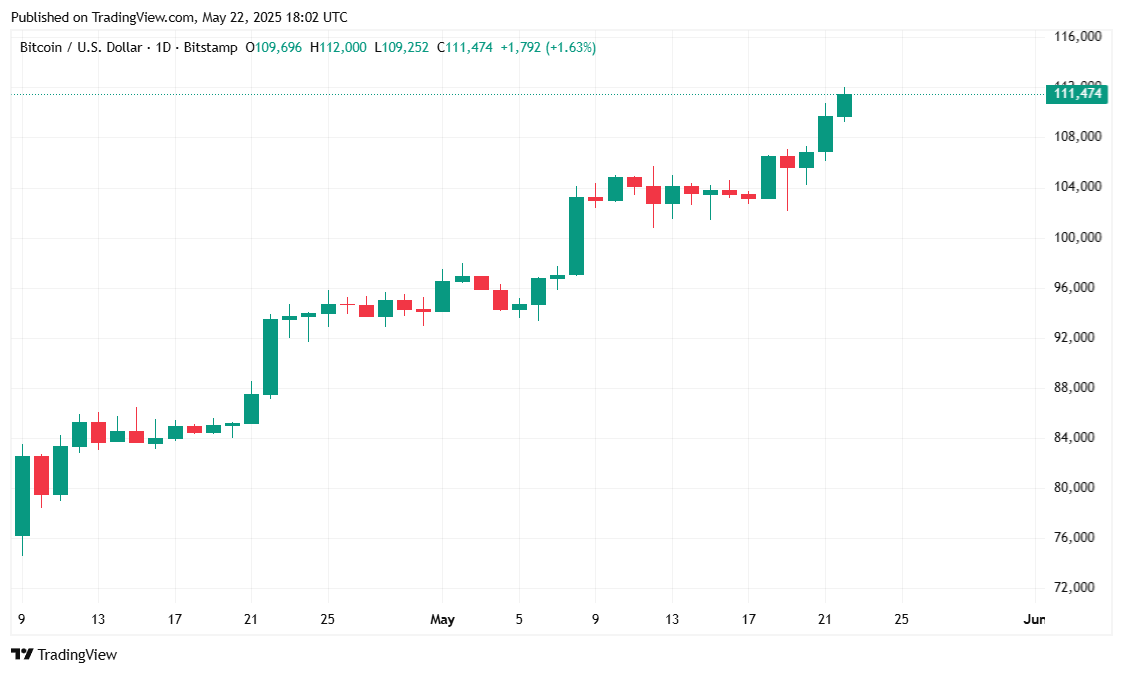

Bitcoin surged to an all-time peak of $112K on Bitstamp this afternoon and has been hovering around $111.7K as it gradually advances to the $120K target forecasted by Geoffrey Kendrick, head of digital assets research at London-based bank Standard Chartered.

In a newsletter distributed early Thursday, Kendrick and his team reviewed three key metrics that support the team’s projections: spot bitcoin exchange-traded fund (ETF) flows, institutional purchases, and the U.S. Treasury premium.

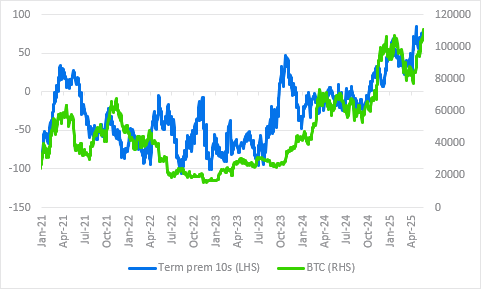

The U.S. Treasury premium represents the additional cost foreign investors pay to hold U.S. treasuries versus purchasing U.S. dollars directly. As the premium increases, so does the price of bitcoin, according to Kendrick, which is exactly what has been happening.

(The U.S. Treasury premium is positively correlated with the price of bitcoin and has been trending upward, according to Geoffrey Kendrick / Standard Chartered)

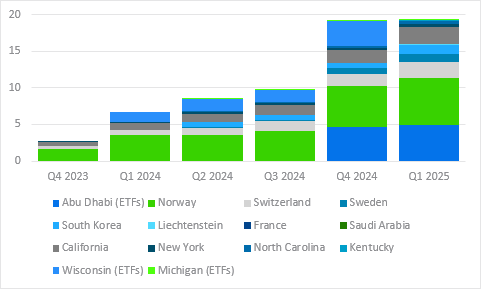

Net bitcoin ETF flows have now surpassed $43 billion, according to data from sosovalue.com, and institutional BTC purchases continue to grow, with companies like Strategy now holding 576,230 BTC, currently worth more than $64 billion. Even government entities have jumped onto the bitcoin bandwagon as evidenced by their 13-F filings which show an increasing allocation towards bitcoin ETFs and BTC proxies such as Strategy stock.

(SEC 13-F filings show an increased appetite for bitcoin ETFs and BTC proxies / Standard Chartered)

All these factors, according to Kendrick and his team, have put the cryptocurrency on a path to $120K by the summer, and much higher by the end of the year and beyond.

“Everything is working,” Kendrick explained. “My official forecasts for bitcoin are $120K end Q2, $200K end 2025, and $500k end 2028. All are well in hand.”

Bitcoin continues to set new all-time highs and is currently trading at $111,462.53, a 4.57% gain on the day and a 7.25% increase over the past week, according to Coinmarketcap data. The digital asset traded in a wide range between $106,220.61 and $111,970.17 according to CMC’s weighted average, breaking past key resistance levels. Bitcoin’s total market capitalization rose to $2.21 trillion, up 4.74% from the previous day.

( BTC price / Trading View)

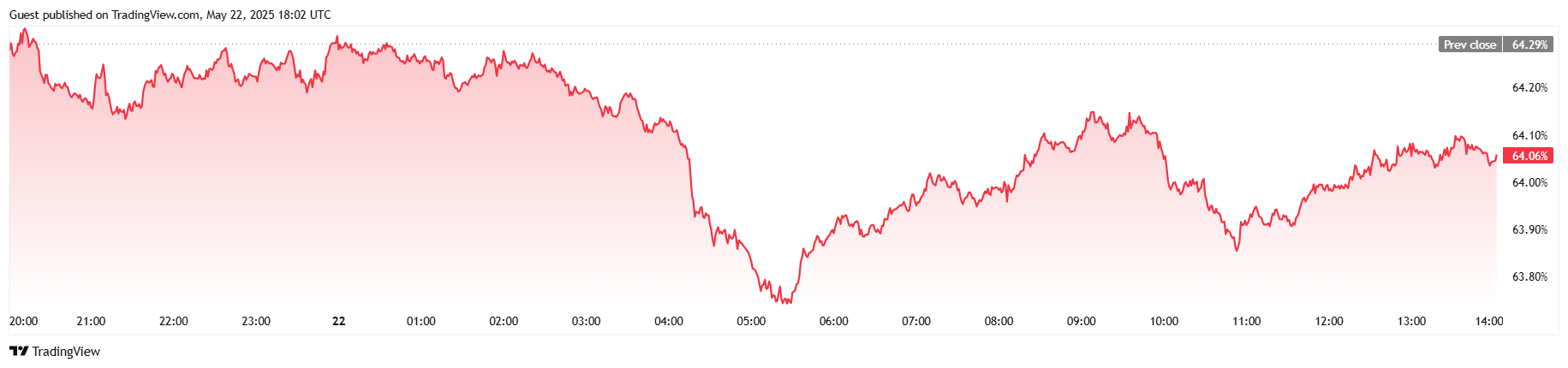

Trading volume climbed to $77.93 billion, an 8.40% increase, which indicates strong market engagement. However, BTC dominance slipped slightly by 0.33 percentage points to 64.08%, a sign of increased investor interest in altcoins. In the derivatives market, bitcoin futures open interest surged 6.78% to $81.05 billion, which suggests traders are willing to take on more leveraged exposure.

( BTC dominance / Trading View)

Coinglass data shows that bears were once again caught on the wrong side of today’s rally. In the past 24 hours, total bitcoin liquidations reached $4.21 million, with short positions accounting for $4.10 million, while longs saw just $107,220 liquidated. The sharp move upward appears to have left bearish traders scrambling.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。