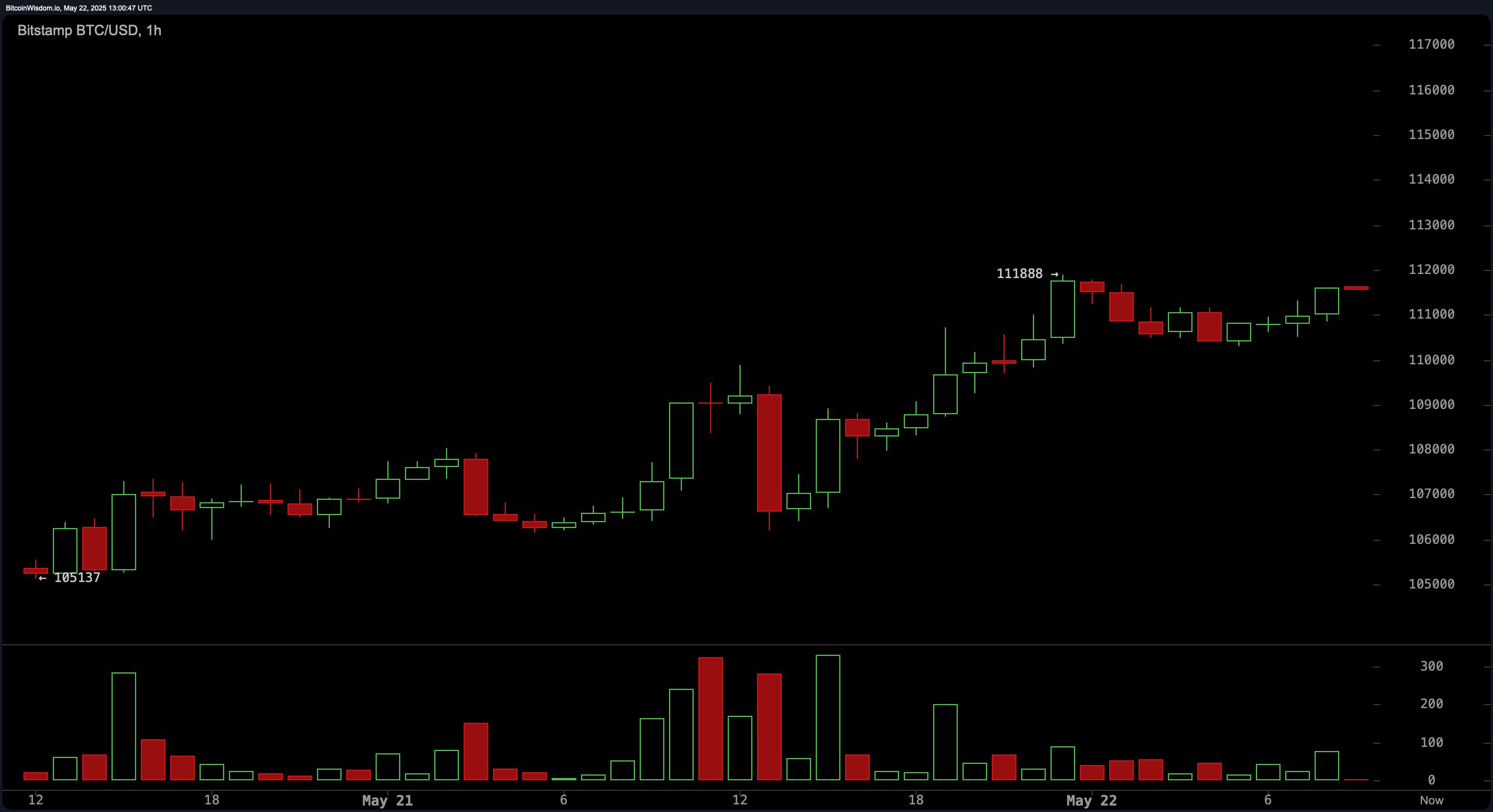

在1小时图上,比特币尽管结构波动,但仍保持了一系列更高的低点,价格在达到111,888美元后遇到了日内阻力。最近小时蜡烛的交易量有所下降,暗示短期内动能可能正在减弱。峰值后的看跌红蜡烛也进一步强化了在该水平附近形成短期顶部的观点。短线交易者关注在110,000美元附近的入场机会,并在109,800美元以下设置紧密止损,而在弱交易量下未能重新夺回111,800美元可能会促使建立空头头寸。短线交易者的获利区间被确定在111,800美元到112,500美元之间。

2025年5月22日通过Bitstamp查看的BTC/USD 1小时图。

从4小时的角度来看,比特币的结构确认了在成功突破108,000美元阻力位后的上升趋势。随后回调至107,500美元至108,500美元区间保持稳固,并导致反弹,突破时伴随健康的交易量激增,随后是低交易量的回调——这通常表明持续的看涨兴趣。入场水平目标设定在109,000美元到110,000美元之间,以期望继续上涨,保守的多头则在112,000美元以上确认突破后再入场。交易者应关注在阻力位附近的看跌背离或蜡烛反转形态的早期迹象。

2025年5月22日通过Bitstamp查看的BTC/USD 4小时图。

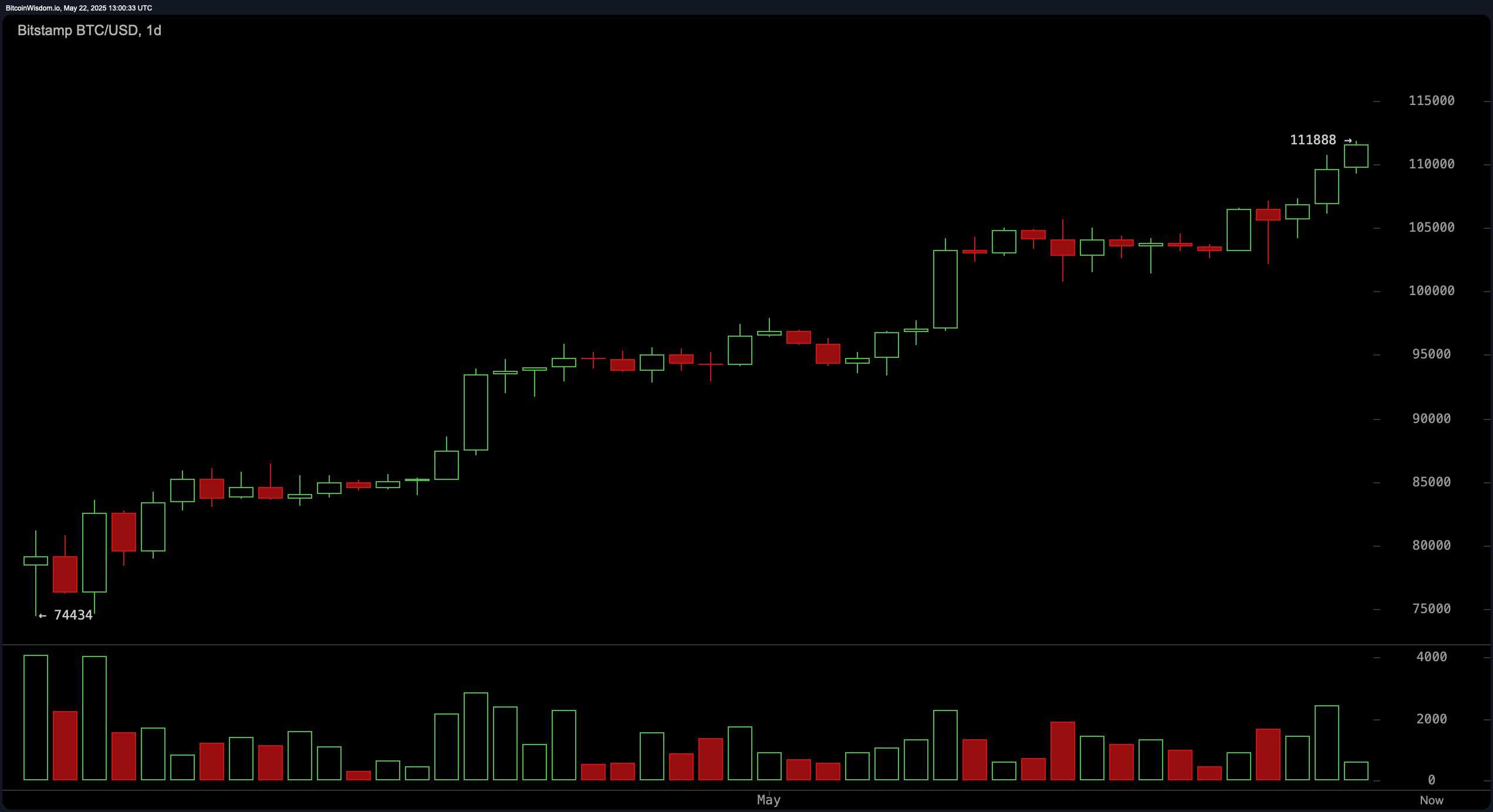

日线图进一步验证了看涨趋势,比特币形成了一致的更高高点和更高低点。最近的价格走势以强劲的绿色蜡烛为特征,走出了一段整合期。111,888美元的日内高点可能作为心理阻力位和获利区间。如果价格回调至105,000美元至107,000美元区间,特别是如果得到看涨吞没或锤子蜡烛形态的支持,可能会出现战略买入机会。退出目标设定在历史高点之上,即111,888美元到113,000美元区间,尽管建议交易者跟踪止损以捕捉延续的走势。

2025年5月22日通过Bitstamp查看的BTC/USD 1日图。

动能指标总体上与看涨情绪一致。动能振荡器发出看涨信号,而MACD也反映出积极的交叉动态。所有跟踪的移动平均线,包括短期、中期和长期的指数移动平均线(EMA)和简单移动平均线(SMA),均发出乐观信号。值得注意的是,10日EMA和SMA的值分别为106,369美元和105,839美元,表明当前价格走势下方有强劲支撑,进一步强化了上升趋势。

尽管相对强弱指数(RSI)在78和随机指标在95等关键振荡器的值较高,均表明超买状态,但它们的中性评级意味着尽管资产已扩展,但尚未触发反转警报。这种支撑水平上升、建设性交易量行为和看涨指标一致性的组合强调了市场倾向于继续而非立即修正。然而,在阻力高点附近仍需保持警惕,特别是在交易量未能确认向上冲击时。

看涨判断:

比特币的更高低点排列、所有主要移动平均线的一致支撑,以及动能指标如动能振荡器和MACD的看涨确认,支持了上升趋势的延续。在较低时间框架上的成功突破回测和交易量动态进一步强化了看涨结构。持续突破111,888美元的心理障碍可能会标志着价格发现的新阶段。

看跌判断:

尽管整体趋势仍然看涨,但由于包括相对强弱指数(RSI)和随机指标在内的多个振荡器徘徊在超买水平附近且表现中性,因此需要保持谨慎。短期内交易量下降以及在111,888美元的拒绝表明潜在的疲软。如果未能在增强的交易量下重新夺回这一高点,可能会导致短期回调至约107,000美元或更低的支撑水平。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。