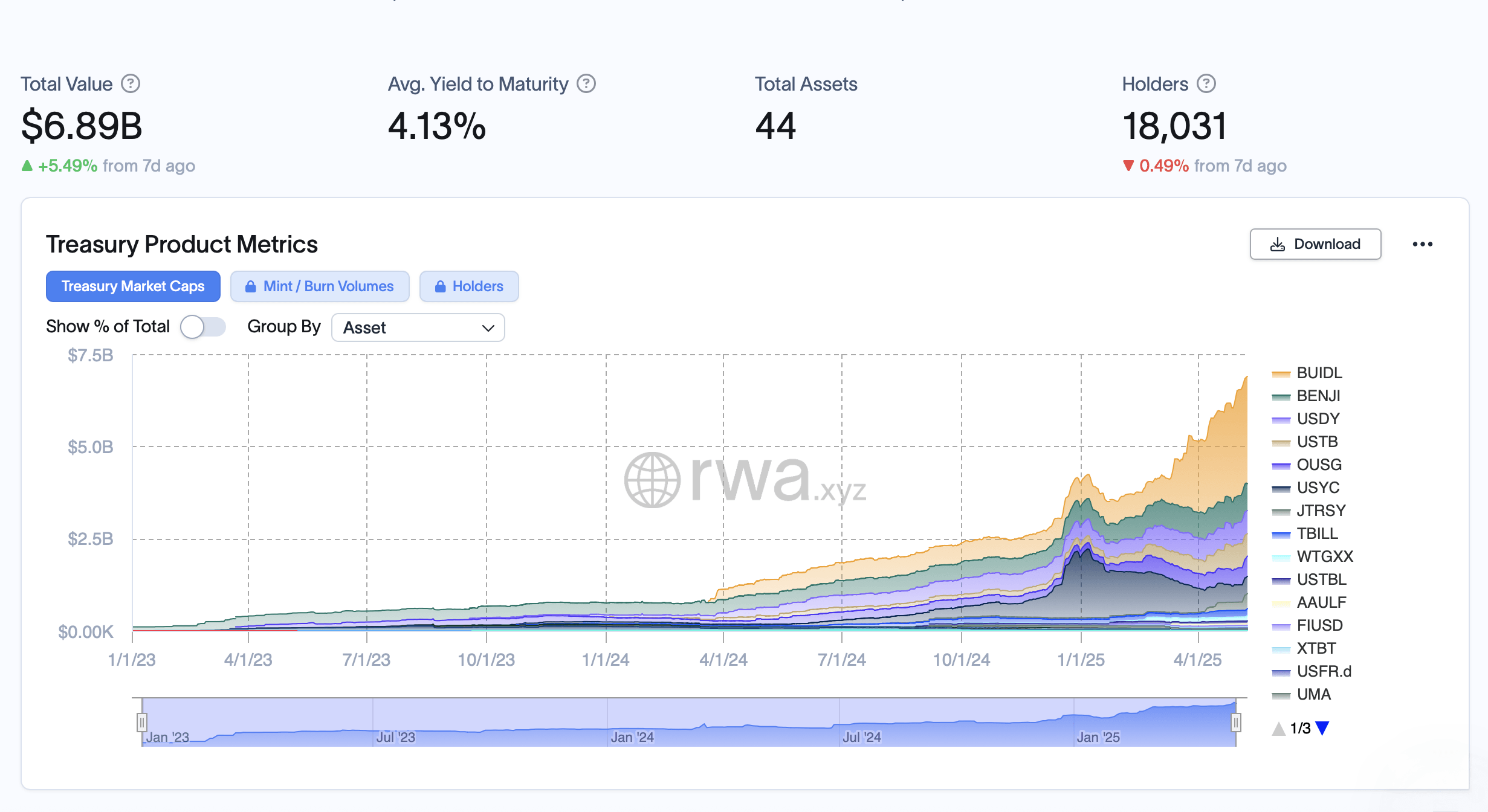

上周五,5月2日,代币化国债的累计价值达到了65亿美元,创造了历史里程碑。在短短一周内,这一数字增长了6%,扩展至68.9亿美元,并吸引了约3.9亿美元的新资本。

自2025年1月1日以来,代币化国债市场增长了71%,从40.3亿美元增加到目前的68.9亿美元估值。贝莱德的美元机构数字流动性基金(BUIDL)自5月2日以来注入了3600万美元,使其总额从28.71亿美元提升至29.07亿美元。

在过去的一周中,富兰克林邓普顿的链上美国政府货币基金(BENJI)增加了1061万美元,从7.1684亿美元上升至7.2745亿美元。同时,Ondo的USDY基金超越了两位主要竞争者,增加了4853万美元,从5.812亿美元扩展到目前的6.2973亿美元。

尽管Superstate的短期美国政府证券基金(USTB)经历了下降,但根据rwa.xyz的指标,其他基金——包括OUSG、USYC、JTRSY、TBILL、WTGXX和USTBL——在过去一周均有增长。前一周的数据表明,USTB的总价值从6.5151亿美元下降至6.0743亿美元。

持续流入代币化国债的资金突显了资产管理者及其客户对区块链基础设施的日益信任,表明围绕政府债务的数字包装不再是实验性的好奇,而是当今的现实。如果收益保持吸引力,结算优势依然明显,链上基金可能会从小众配置转向最主要的国债操作。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。