近日 Binance 宣布将 Sonic 链集成至 Binance Wallet,并将对 Binance App 或 Binance Wallet 上交易 Binance Alpha 上线的 Sonic 生态代币的用户给予空投奖励。尽管在「猴市」大盘不停波动,但 Sonic 似乎在这场波动中持续的稳定发展,早在三月份上线仅 4 个月 Sonic 链的 TVL 已经突破了 20 亿美元大关,而更是在而其代币$S 更是在 15 亿美元市值附近拥有不错的支撑位。

逐渐丰富的生态加上这次 Binance 的鼎力支持,是否 Sonic 能在当前失去新叙事方向的 Crypto 中将 DeFi 概念重新带回巅峰?本文将介绍 Sonic 的第二季度积分模式、 Sonic 的 Binance Alpha 以及 Sonic 的一些有意思的新项目。

Season2 来袭——新的积分模式

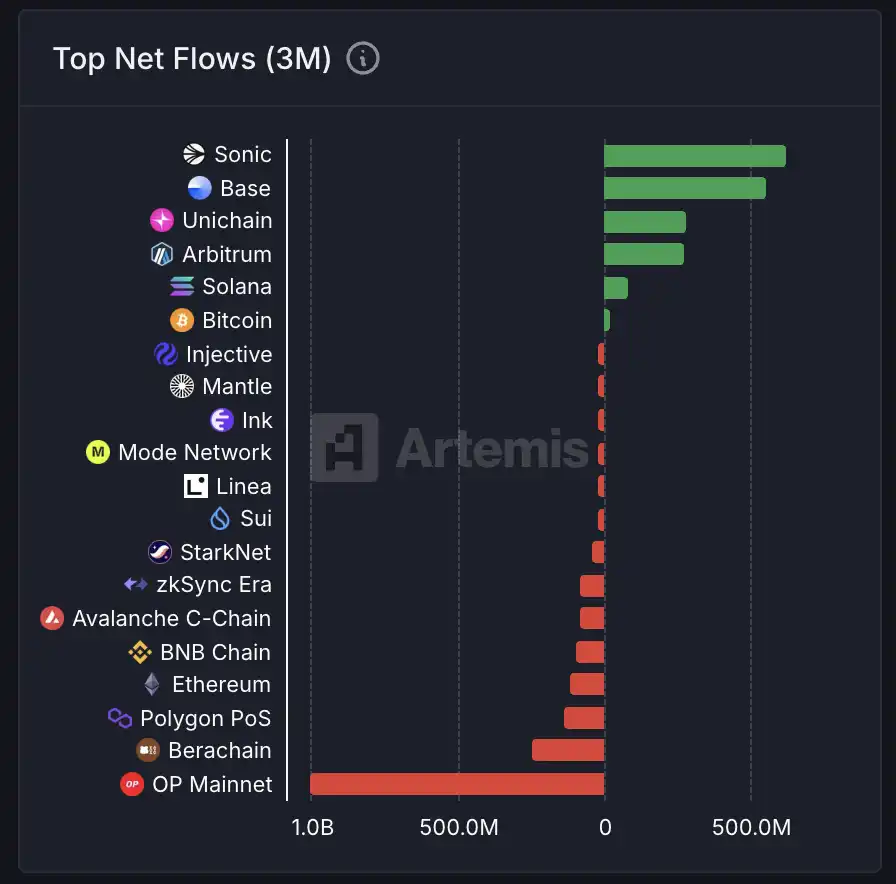

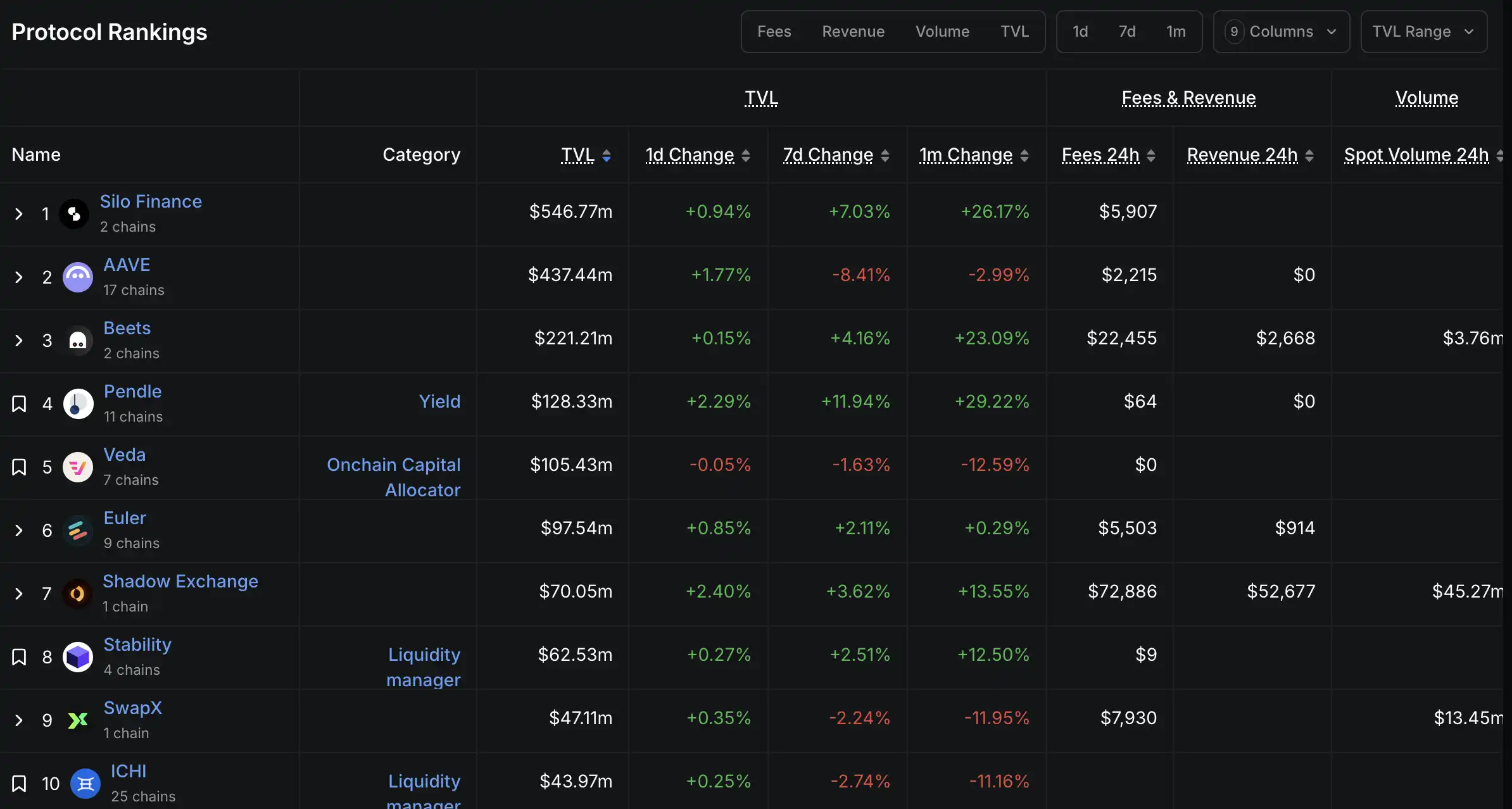

三个月前笔者曾撰写过一篇 Season1 时赚取积分的指南,其中提到了包括 Silo Finance、Ring 等主流平台的收益策略,当时丰富的 DeFi 生态已经让其 TVL 在一个月内增长近 5 倍。而三个月后 Sonic 的 TVL 再次增长了近 3 倍,TVL 从 8 亿美元一跃增长至 22 亿美元资金,近三个月全链净流入量第一。

延伸阅读:《TVL 一个月增长五倍,梳理 Sonic 上最赚钱的收益策略》

Sonic 在 5 月 6 日至 5 月 8 日于 MAK Museum 以及 Museum of Fine Arts 举办的 Sonic Summit,高规格的艺术氛围被参与者连连夸赞,而正是在会议上 Sonic 项目方同时宣布了第二季的积分规则,相比于前一季度更加的规范化以及可视化。

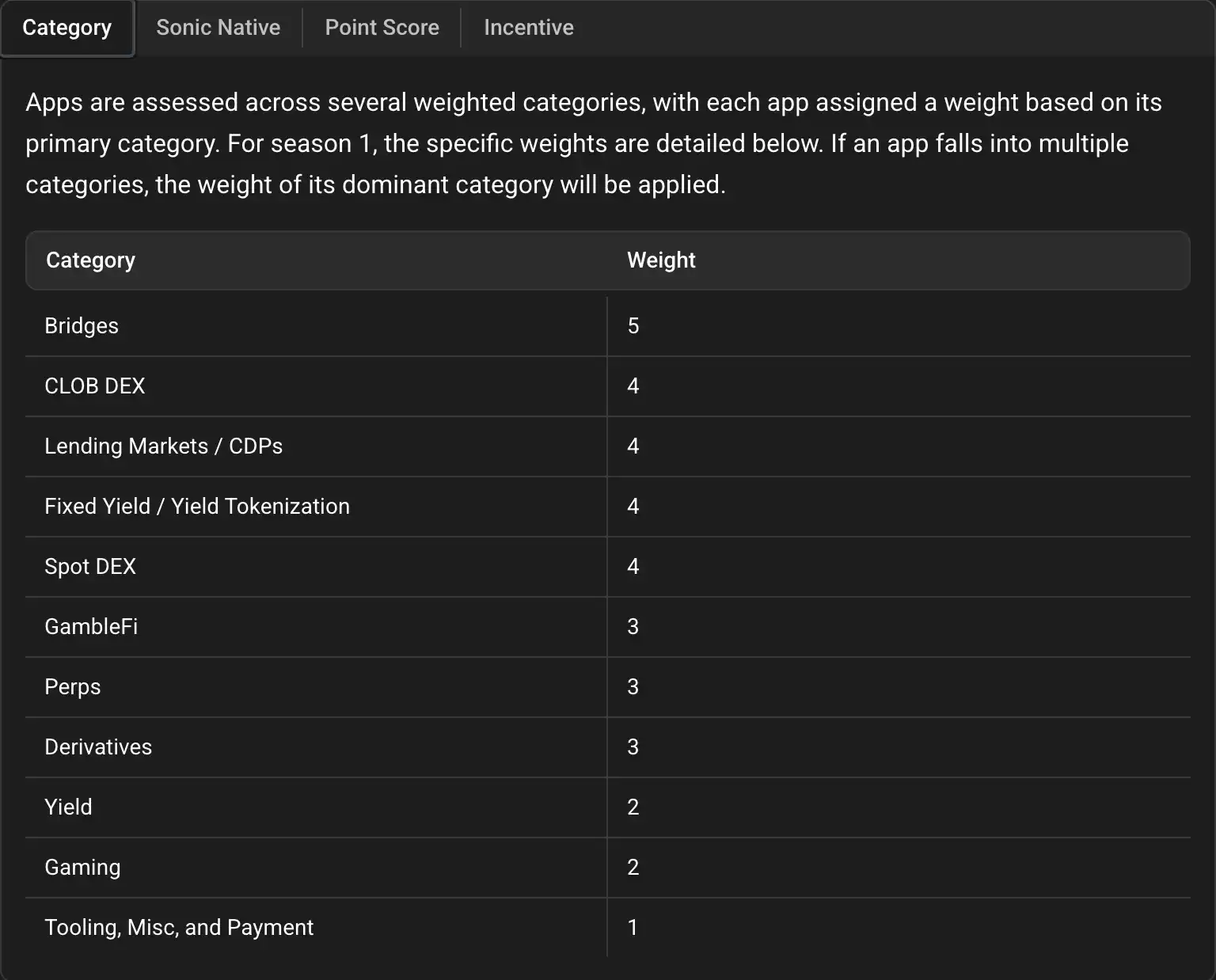

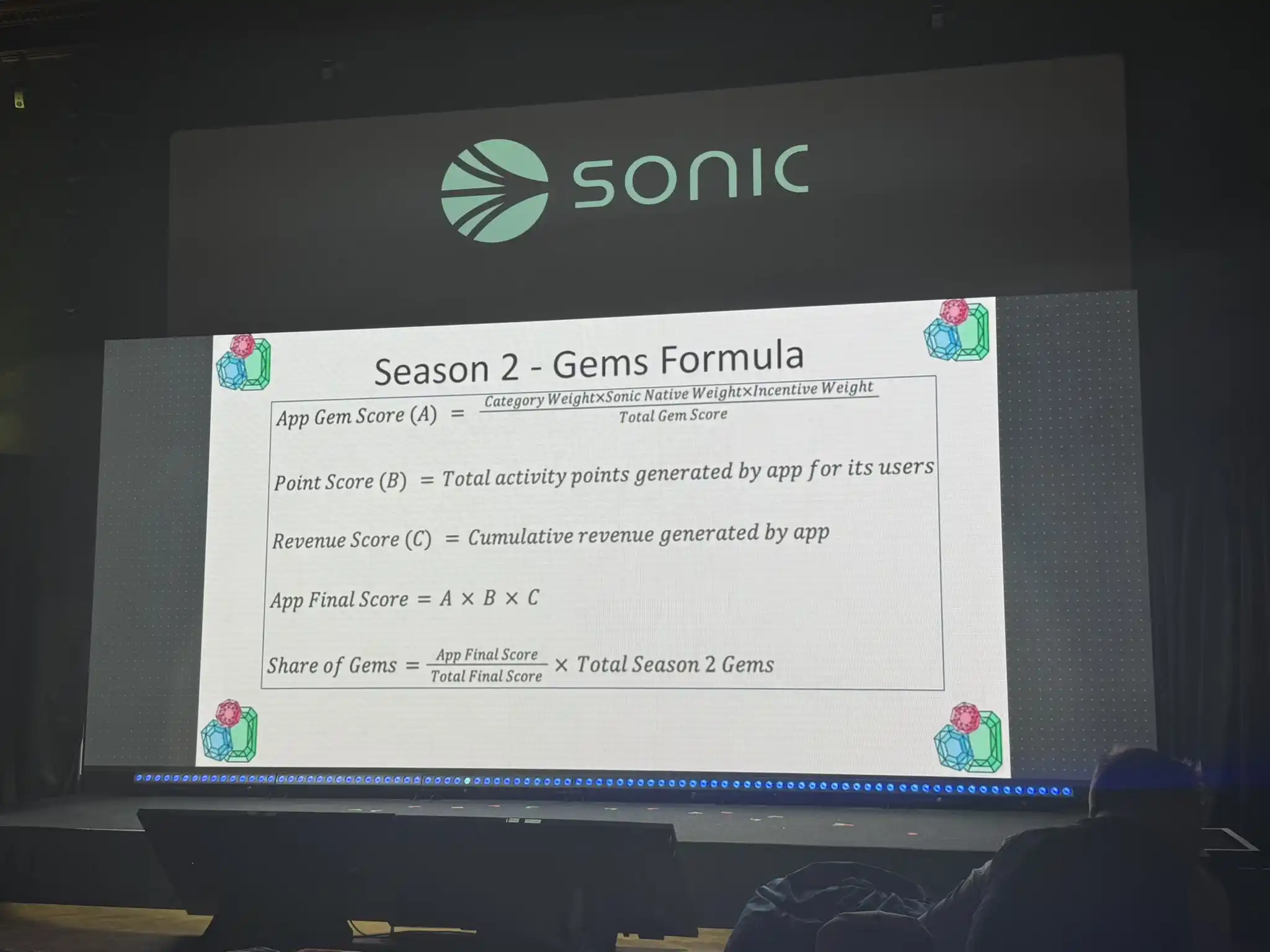

Season 2 中每个 App 能获得的 Gems 数量取决于其最终得分「App Final Score」,而最终得分由三个核心指标相乘得出。

App Gem Score(A):该得分基于应用的类型权重「Category Weight」、是否为 Sonic 原生「Sonic Native Weight」以及激励权重「Incentive Weight」综合计算得出,体现的是平台对不同类别 App 的战略倾斜。

Point Score(B):代表该 App 为用户产生的所有活动积分总和,衡量用户活跃度。

Revenue Score(C):即该 App 累计产生的收入,体现其商业能力。

最终,App 的总得分计算公式为:A × B × C。根据这个最终得分,平台会将总 Gems 奖励池按比例分配给各个 App,具体公式为某 App 的 Gems =「App 的总得分÷ 所有 App 的总得分」× Season 2 总 Gems 数量。

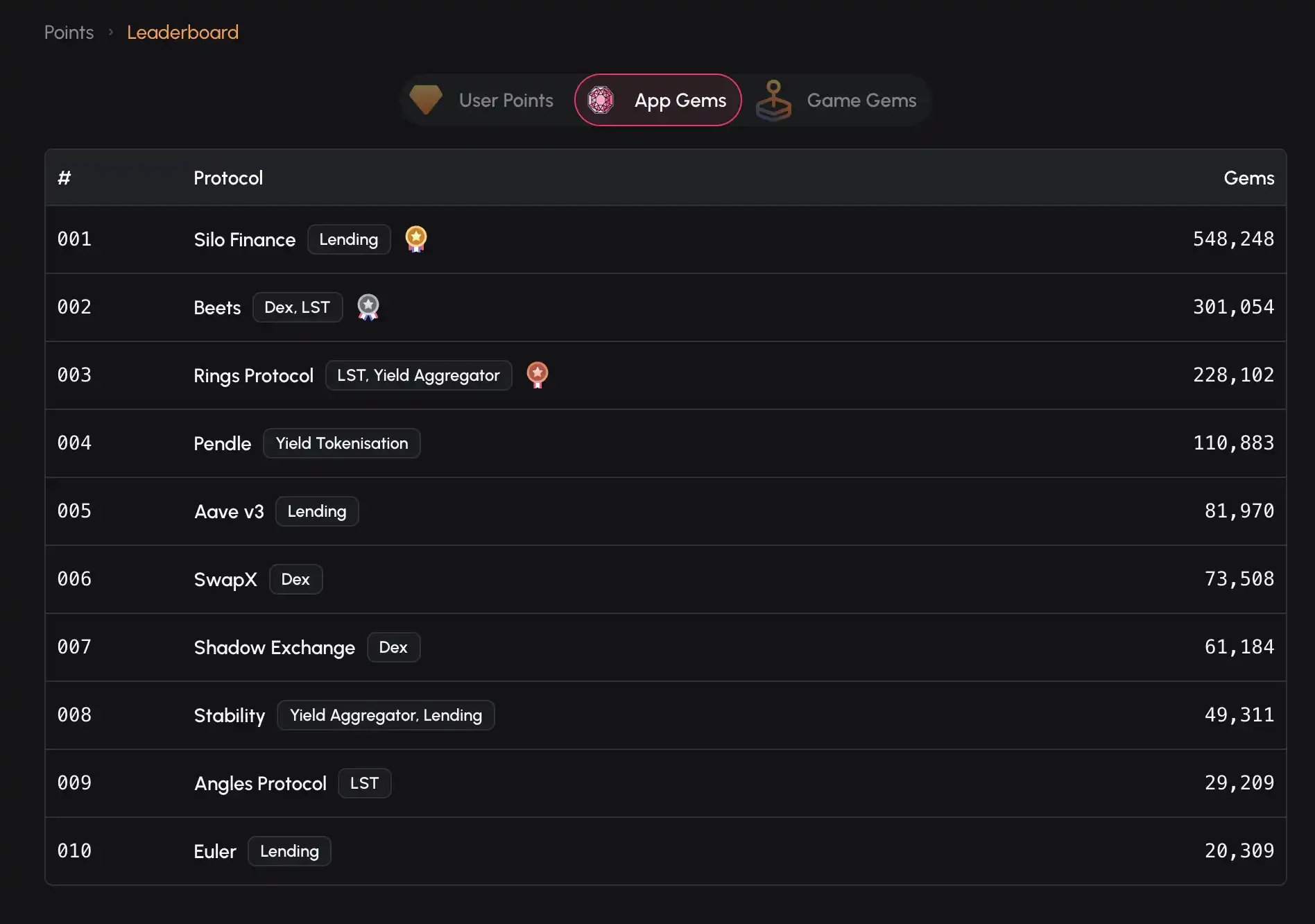

当前 App Gem 前 10 除了 Aave 和 Pendle 这类老牌 DeFi 几乎全都是 Sonic 原生的项目

相比于第一季的 Gems 规则算法,第二季显得更完善,主要是多了「C」Revenue Score。

「A」体现出了 Sonic 想要激励项目方输出更多类型的「原生」项目,虽然现在具体的种类细则还未公布,但从此前 Sonic 的第一季对项目种类的分配比例来看,最占优势的是跨链桥,其次是 DEX 交易相关的功能。

而「B」则属于激励项目方更多的带给用户价值,更类似于大众点评的店铺积分,店家给用户提供更好的服务或附加的价值「带来更多的积分或奖励」,用户反馈给大众或生态更好的评价「项目方获得的 Point Score 更高」,从而形成一种用户与项目方之间的互惠平衡。

而「C」则是希望能够激励产出更多的「Killer APP」,也就是大家常说的「有用」的应用。

更新后的 Gems 规则更加全面的去激励了用户与生态的粘着度,但同时也提高了项目方需要具备的各方面素质,可能会迫使现有团队的升级,或者更多优秀团队的加入。

Sonic Summit Jailbreak

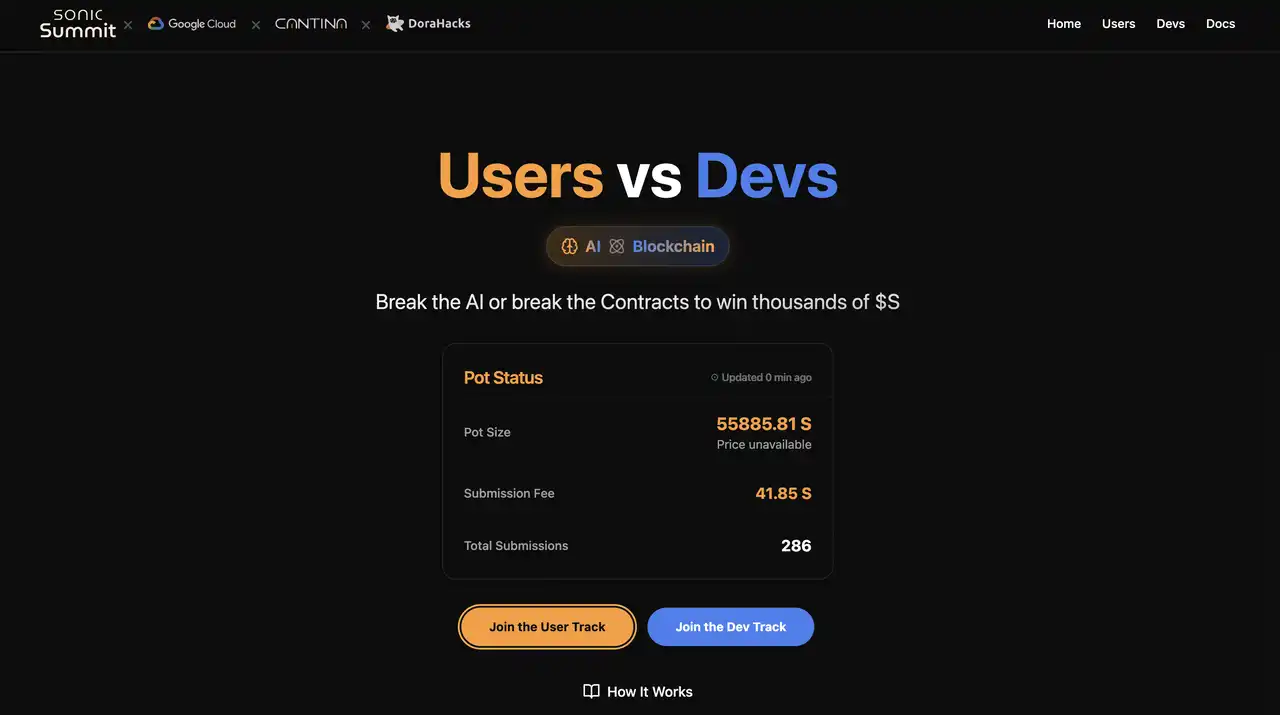

在举行 Sonic Summit 期间 Sonic 还举办了一个有意思的小游戏,不会编程的用户「Users」可以通过「诱骗 AI」参与,参与者需通过设计巧妙的提示,诱导由 Google Gemini AI 守护的系统泄露一组私钥。每次提交提示需支付一定数量的 S 代币,费用逐渐增加并计入奖金池。成功提取私钥并通过验证的用户将赢得奖金池。

而会编程的开发者「Devs」则可以利用智能合约的漏洞解题,开发者需识别并利用由 Cantina 团队故意嵌入的智能合约漏洞,以获取奖金池中的资金。成功利用漏洞并通过验证的开发者将赢得奖金池。

当前的获胜者是用户「Users」利用了提示词成功突破 AI 守卫的防御找到了私钥而获得约 30,000 美元的奖金。

金牌赞助商

本次活动的赞助商根据赞助的「深度」分别分了几个等级「金」、「银」、「铜」,而下最多血本的三个「金主」都大有来头。

Galaxy 在 2018 年创建,公司总部位于纽约市,并在北美、欧洲和亚洲设有办事处。提供包括交易、借贷、战略咨询服务、机构级投资解决方案、专有比特币挖矿和托管服务、网络验证器服务以及企业托管技术开发等服务,据称其平台上的资产在 2024 年的财报已经达到 100 亿美元体量。他们在近日宣布,计划将于 5 月 16 日在纳斯达克上市。

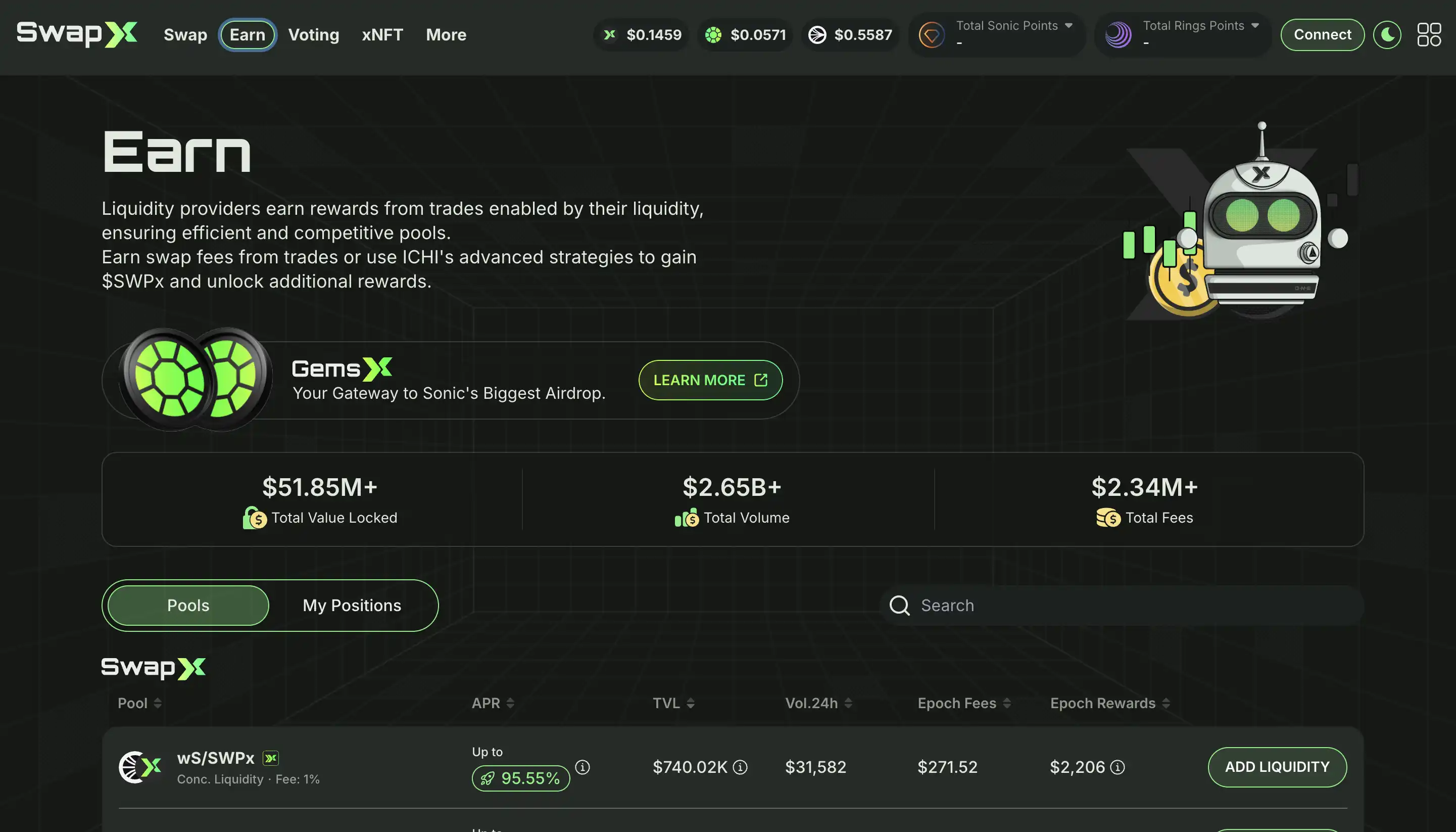

SwapX 是 Sonic 上的多功能型 DEX,集成了 Algebra 的 Integral V4 平台「类似于 Uniswap V4 的 HOOK」,集中式流动性机制、自动化流动性管理和插件式架构,这几种技术的结合带来低滑点高深度的交易体验。

相比传统 AMM,SwapX 支持 LP 精准设定流动性范围,并引入的 ve(3,3) 模型则进一步将激励机制与治理深度绑定。通过采用 EIP-4337 账户抽象标准允许用户通过邮箱或 Google 登录,作为 All in one 的 Sonic Dex,布局应该是让不管是作为 Web2 进入 Crypto 的入口,还是 Web3 Native 的用户都在不同程度上拥有一定的可玩性。

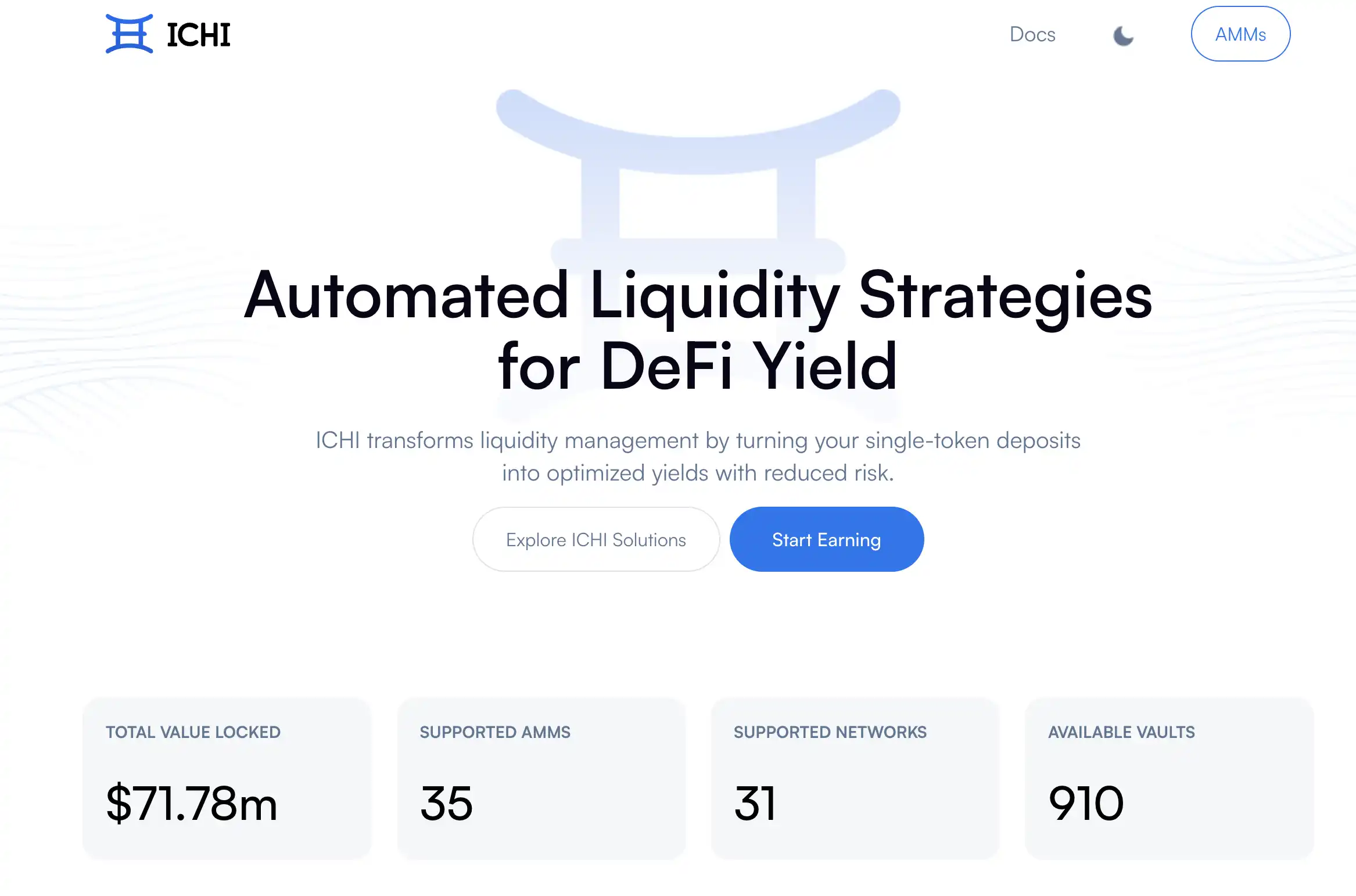

ICHI 是一个非托管 DeFi 协议,简化和优化代币项目、DAO、资产管理者和区块链生态系统的流动性管理。通过支持将单代币存入集中流动性池,ICHI 实现了 AMM 之间的流动性配置流程自动化。ICHI 的自动化金库目的是支持代币发行、维持价格稳定并持续提升流动性深度,同时降低流动性提供者的无常损失风险。

而 SwapX 与 ICHI 同时也是深度的合作伙伴,不仅同时作为本次 Sonic Summit 的金牌赞助商,在场馆外还合作了「美食餐车」为参会者提供午餐,而 ICHI TVL 的 7100 万美元其中有 4600 万美元属于 SwapX。双方的深度合作可能在接下来会为 Sonic 带来更多的生态延展。

Binance Alpha 联动推波助澜

5 月 1 日 Binance 宣布 Binance Wallet 集成支持 Sonic 主网。在公布后,Sonic 上各个协议的 TVL 都有不同程度的上升,而根据Nansen的数据来看,Sonic 在 7 天内的活跃地址数直接迎来了 289% 的增长,该链的手续费也增长了 72%。

而 5 月 8 日,Binance 正式公布了 Sonic 链上交易大赛总奖励约 220 万美元,活动从 5 月 8 日到 5 月 23 日,根据用户用 Alpha 的 Sonic 链上交易,对$SHADOW 交易量排名前 13,000 位的 SHADOW 代币用户的将平均分配 22,100 SHADOW 代币。$BEETS 交易量排名前 1,200 位的 BEETS 代币用户的将平均分配 1,824,000 BEETS 代币。$ANON 交易量排名前 10,000 位的 ANON 代币用户的将平均分配 153,000 ANON 代币。而 Sonic Chain 综合交易量排名前 7,000 位的用户将平均分配 1,001,000 S 代币。

但在活动初期许多社区用户反应在 Biance Alpha 交易的磨损过大,更有甚者磨损超过了 50 美元。可能也是本次活动中 Binance 官方对限价订单特别奖励双倍权重的原因之一。

延伸阅读:《Binance Alpha 掘金指南:如何低成本高效刷分》

除了用 Binance 刷积分,Sonic 还有什么项目可以关注的?

DeFi

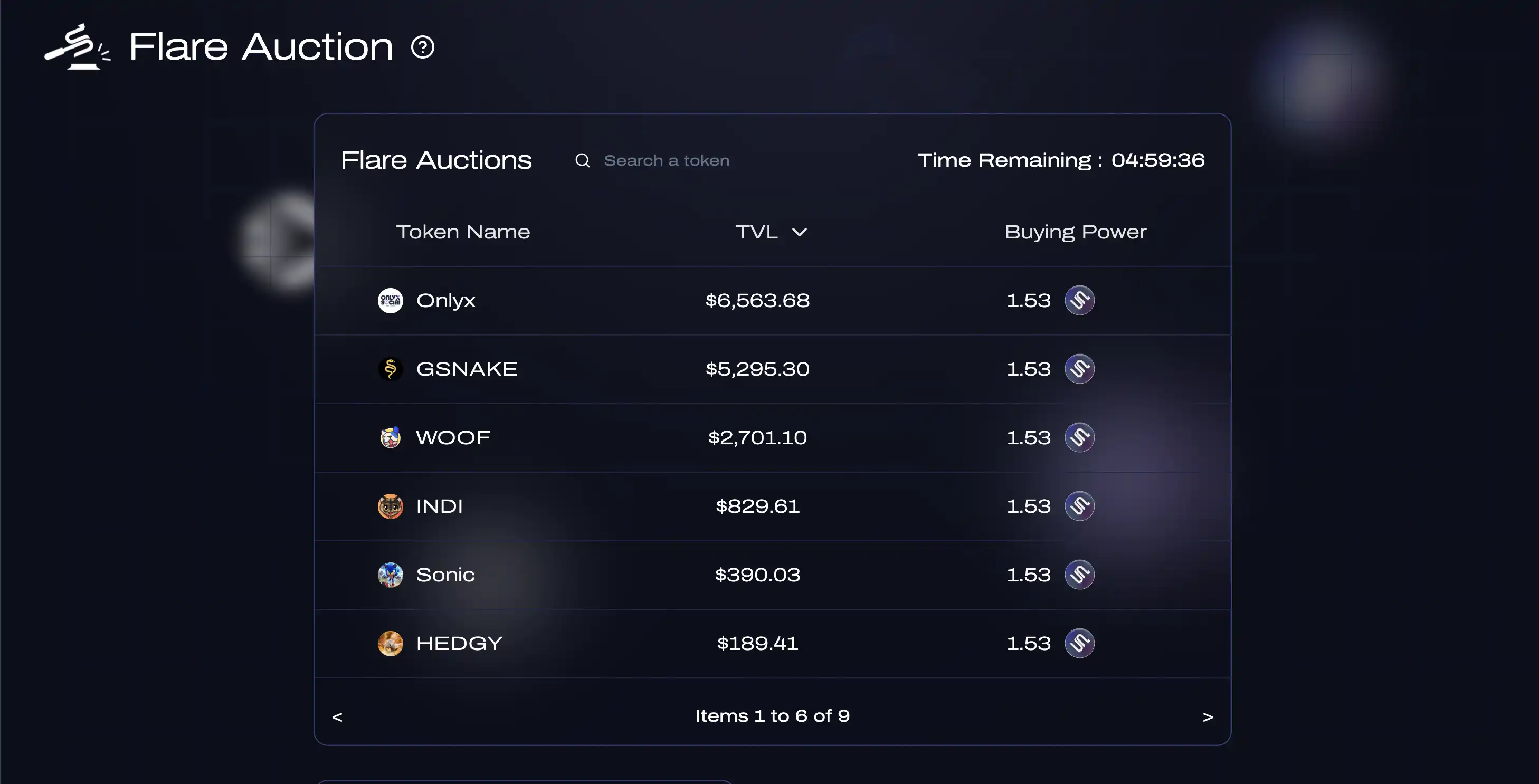

SilverSwap 是 Sonic 链的 DEX 和 DeFi 组件,提供集中流动性、拍卖功能「Flare/Snatch」、集成桥接、永续合约交易以及针对流动性提供者的高额费用奖励,并计划推出 LaunchPad「LSW」。

比较有意思的是 SilverSwap 拥有两种资产拍卖模式,Flare 允许用户使用 SilverSwap 的资金/费用自动回购他们心仪的代币。

Flare 拍卖是 SilverSwap 的回购机制,每 12 小时为一个周期。在每个周期中,平台会将总交易手续费的 4.25% 累积成一个资金池。用户可以使用 AG 代币竞标,指定该资金池用于回购某个特定代币。周期结束时,出价最高的用户的指定代币将被回购,所使用的 AG 代币将被销毁。这种机制为项目方提供了一个利用手中 AG 代币支持其代币价格的高效途径,同时通过销毁 AG 代币实现通缩。

Snatch 允许用户从 SilverSwap 上部署的任何流动性池中赚取 42.5% 的 DEX 交易费,而获胜者将获得 AG 奖励。Snatch 拍卖是面向用户的机制,每个流动性池在每个 12 小时的周期中,会将该池产生的交易手续费的 4.25% 转化为 AG 代币,形成一个奖池。用户可以使用 AG 代币竞标该奖池,周期结束时,出价最高的用户获得整个奖池的 AG 代币,而其出价的 AG 代币将被销毁。这种机制不仅为用户提供了获取额外 AG 代币的机会,还通过销毁 AG 代币促进平台代币的通缩。

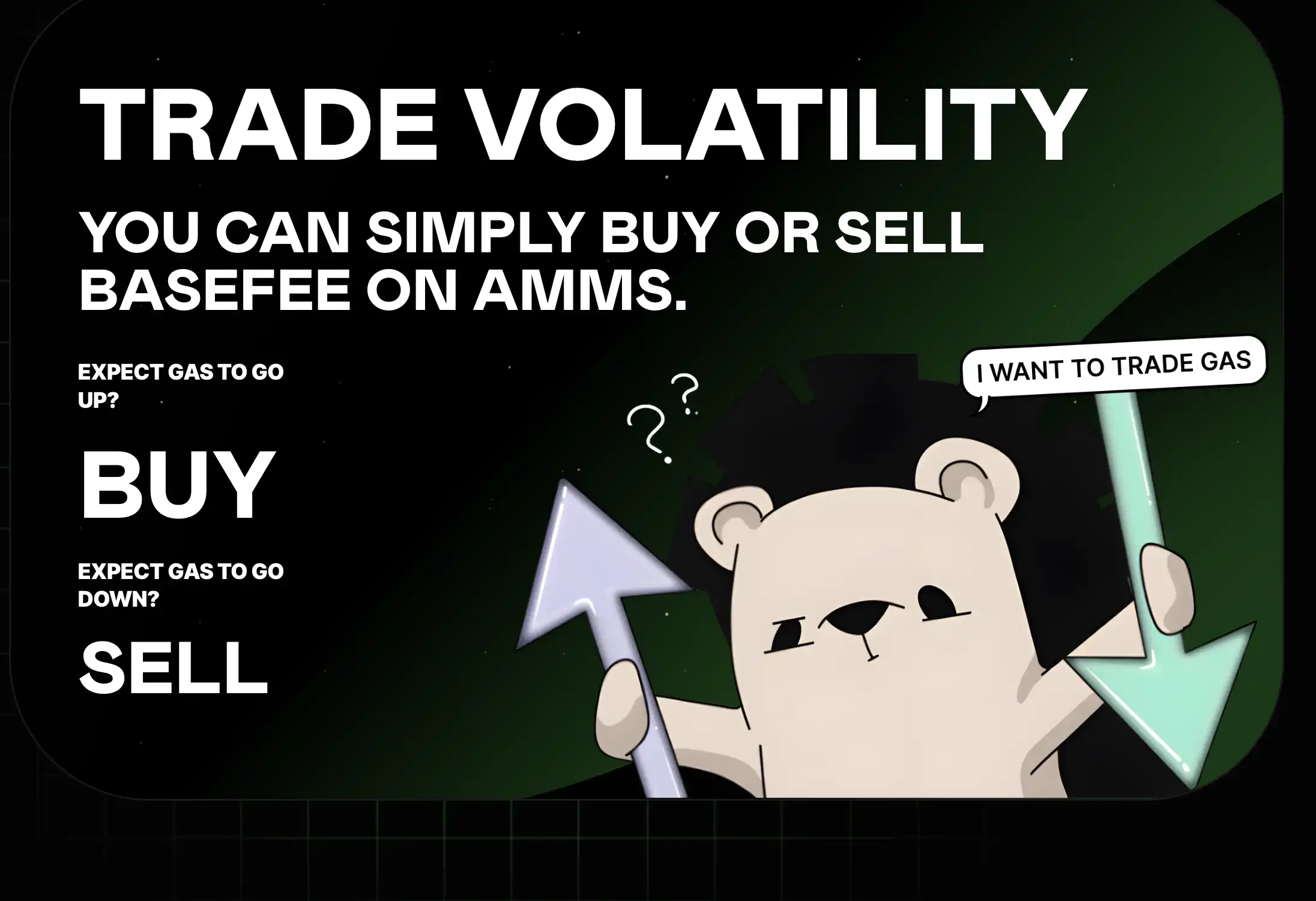

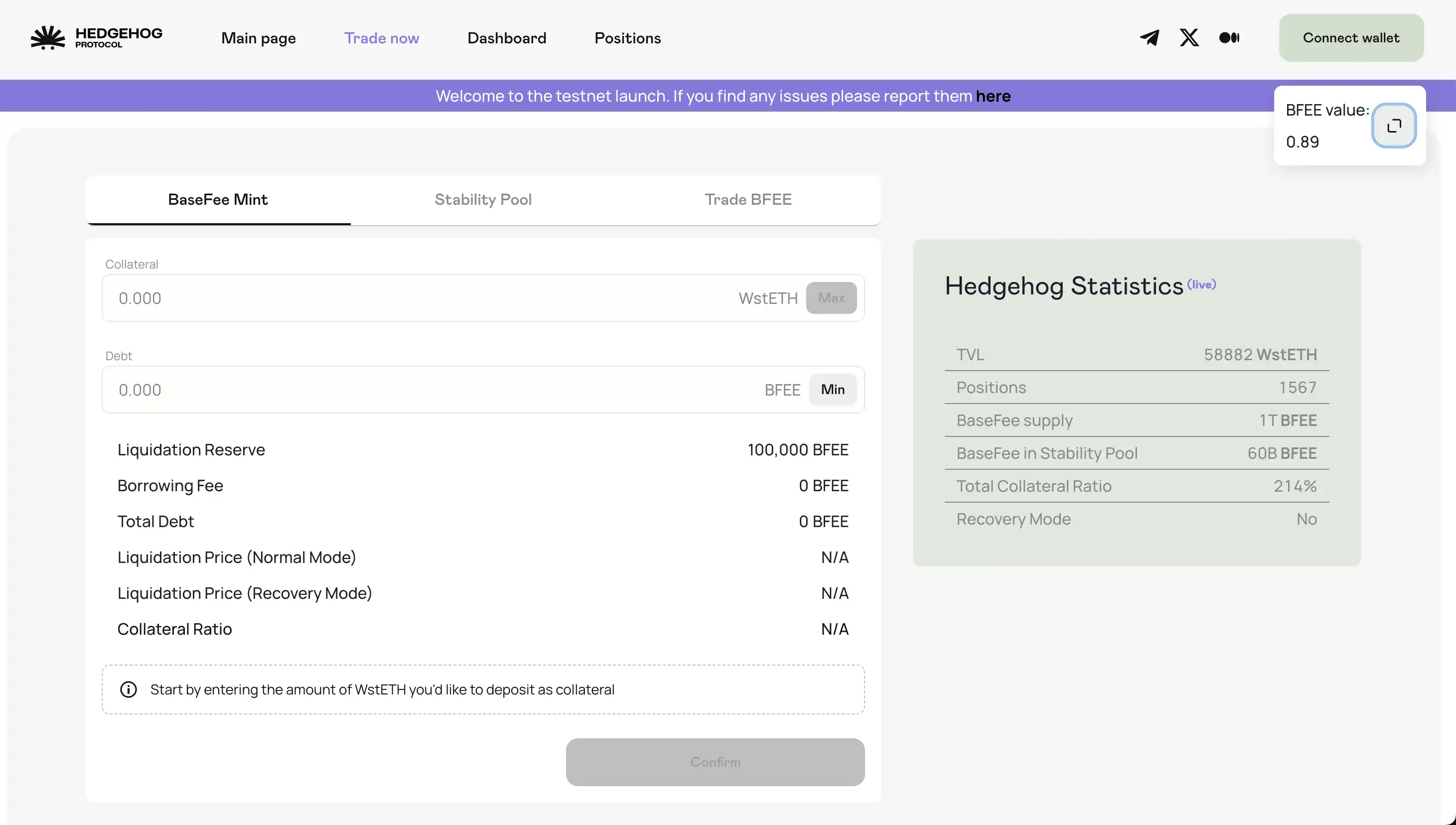

刺猬协议提出了一个很有趣的观点,交易市场情绪,也就是 BASEFEE。这是一种类似于永续合约中的资金费率,或者链上 Gas 的一种指标,项目方将其比作是市场的脉搏。

BASEFEE 就像资金费率在永续期货市场中多头和空头头寸之间交换的定期支付的功能一样。他们通过激励交易者选择不太受欢迎的一方来保持市场平衡。用户可以利用它们来衡量市场情绪并寻找套利机会。

而具体的方式是通过链上智能合约实现资金利率掉期、跨平台套利、预测市场的交易、支付和结算的自动化行为套利,直接跳过中介机构,用户不再押注价格,而是押注行为。当然这个概念的成功与否取决于该项目的流动性以及预言机的稳定性,无论是哪一方的缺失都会直接撼动底层的理论支柱。现在测试网已经开放,但积分详情还未公布,测试网的行为与后期的积分获取是否相关还未可知。

AI

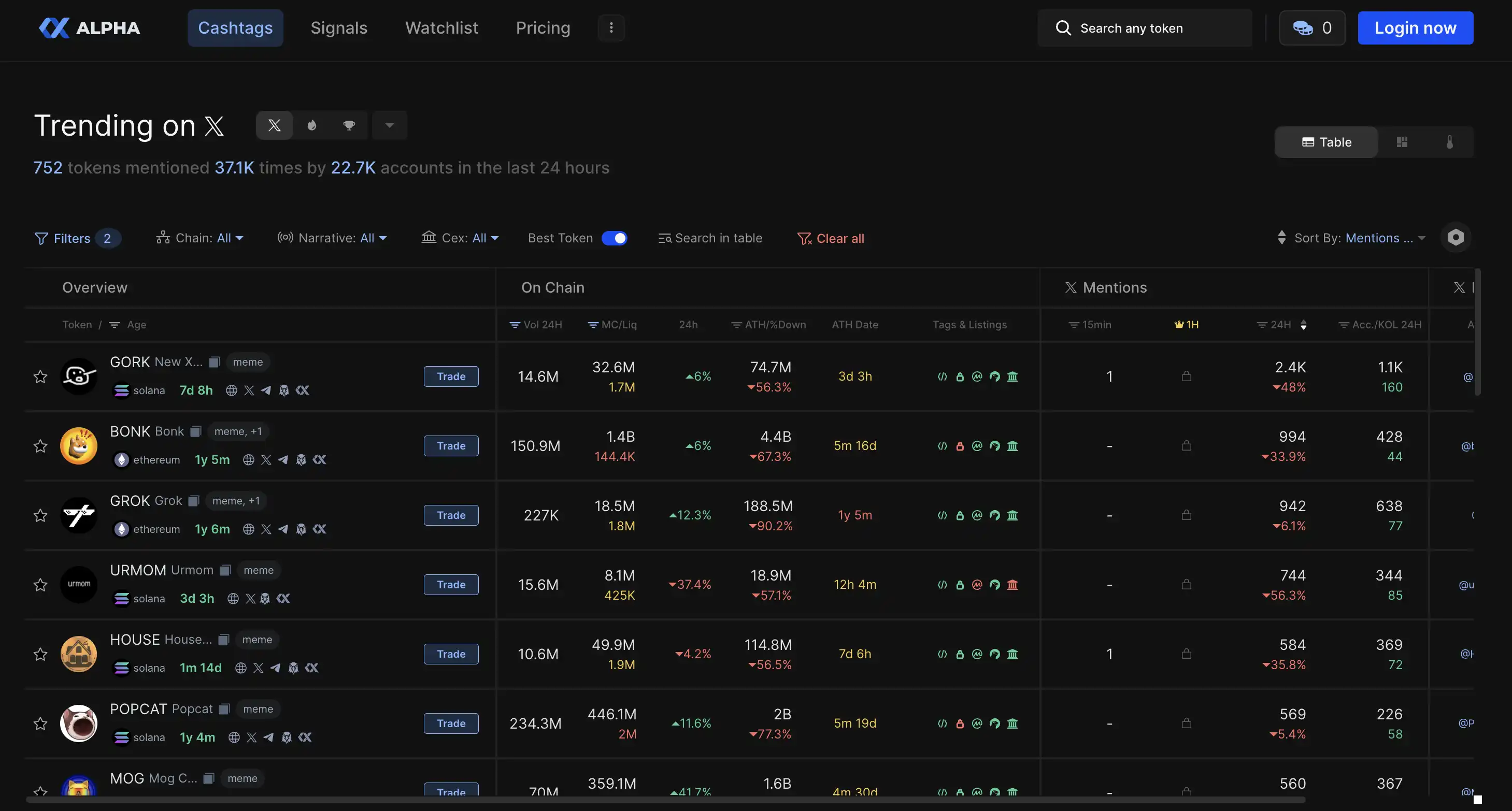

XAlpha 是一个 AI 指标的 Alpha 平台,最新推出了网页插件可以在 X 中翻阅帖文时展示包括作者见解、代币标签提及、相关代币以及之前标记过的账户的关联等增量信息。

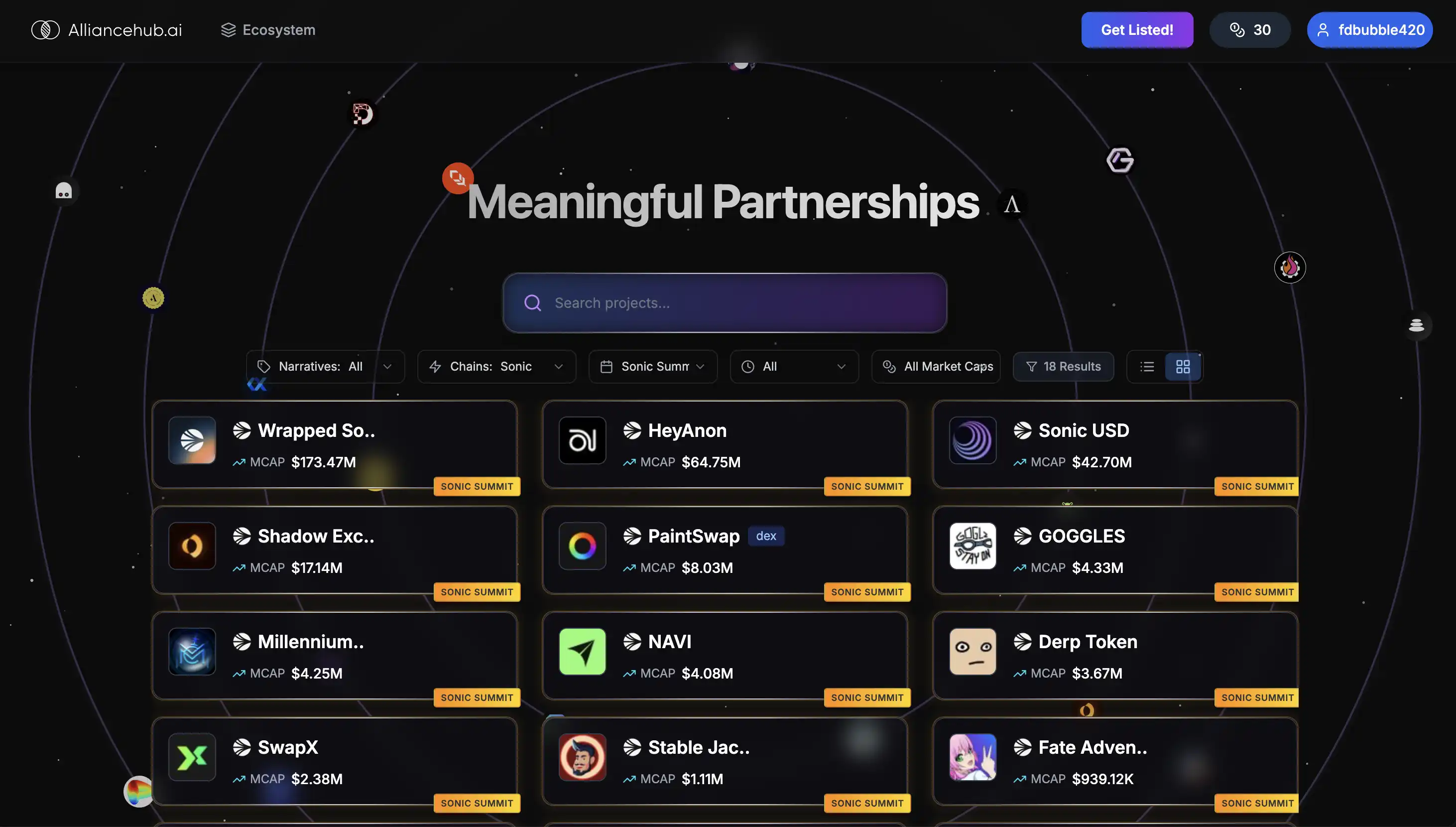

AllianceHub 基于大量的加密项目数据进行训练,包括他们的白皮书、历史、社交活动、KOL 影响力、链上数据、链下信息等,从而用 AI 分析跳过项目之间的个人联系「BD」或人工研究,直接让 AI 系统处理项目的多层面信息,包括项目基本面、市场活动、社交信号、技术细节,然后分析出项目之间合作的契合度以及可能性。

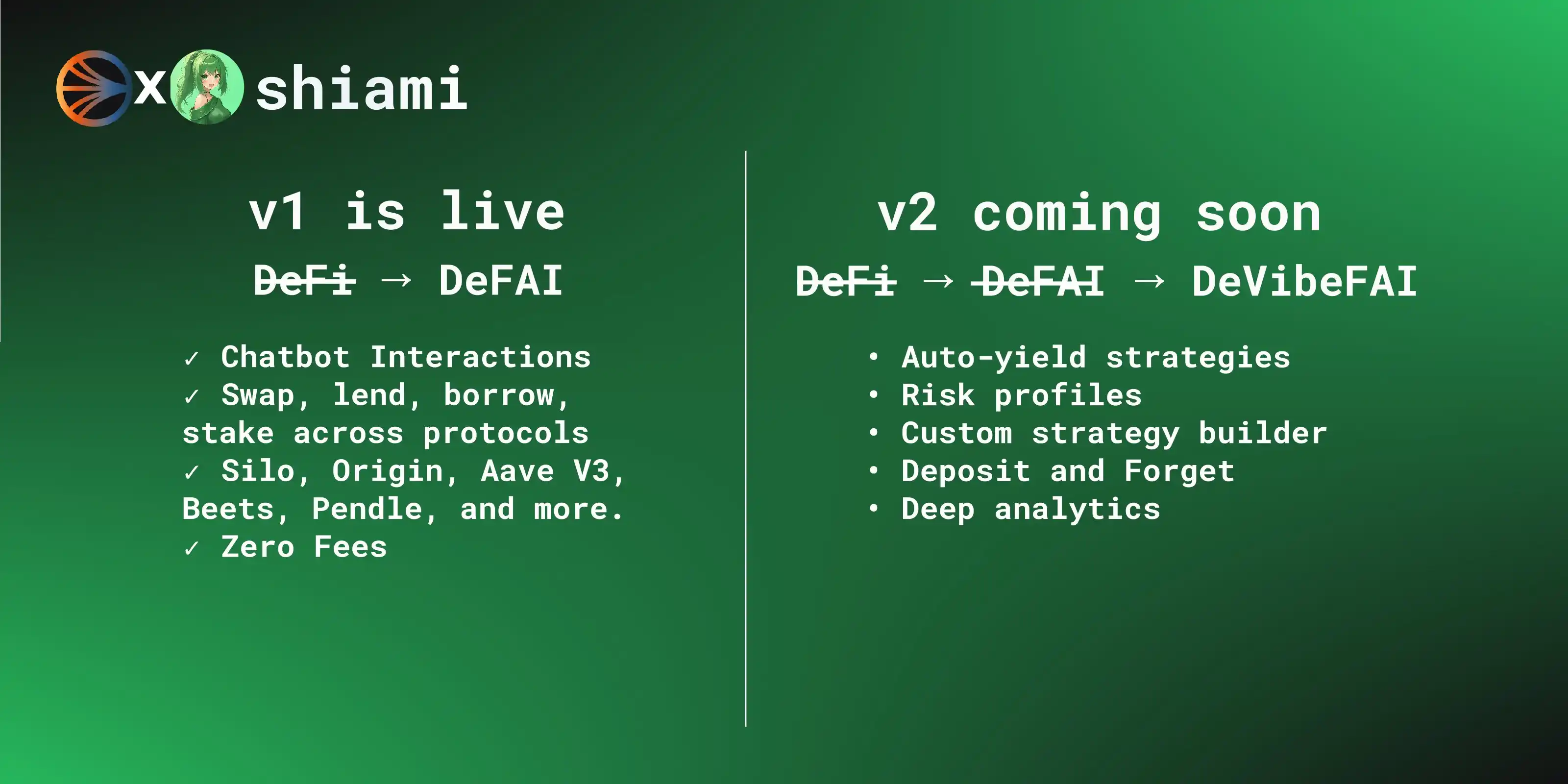

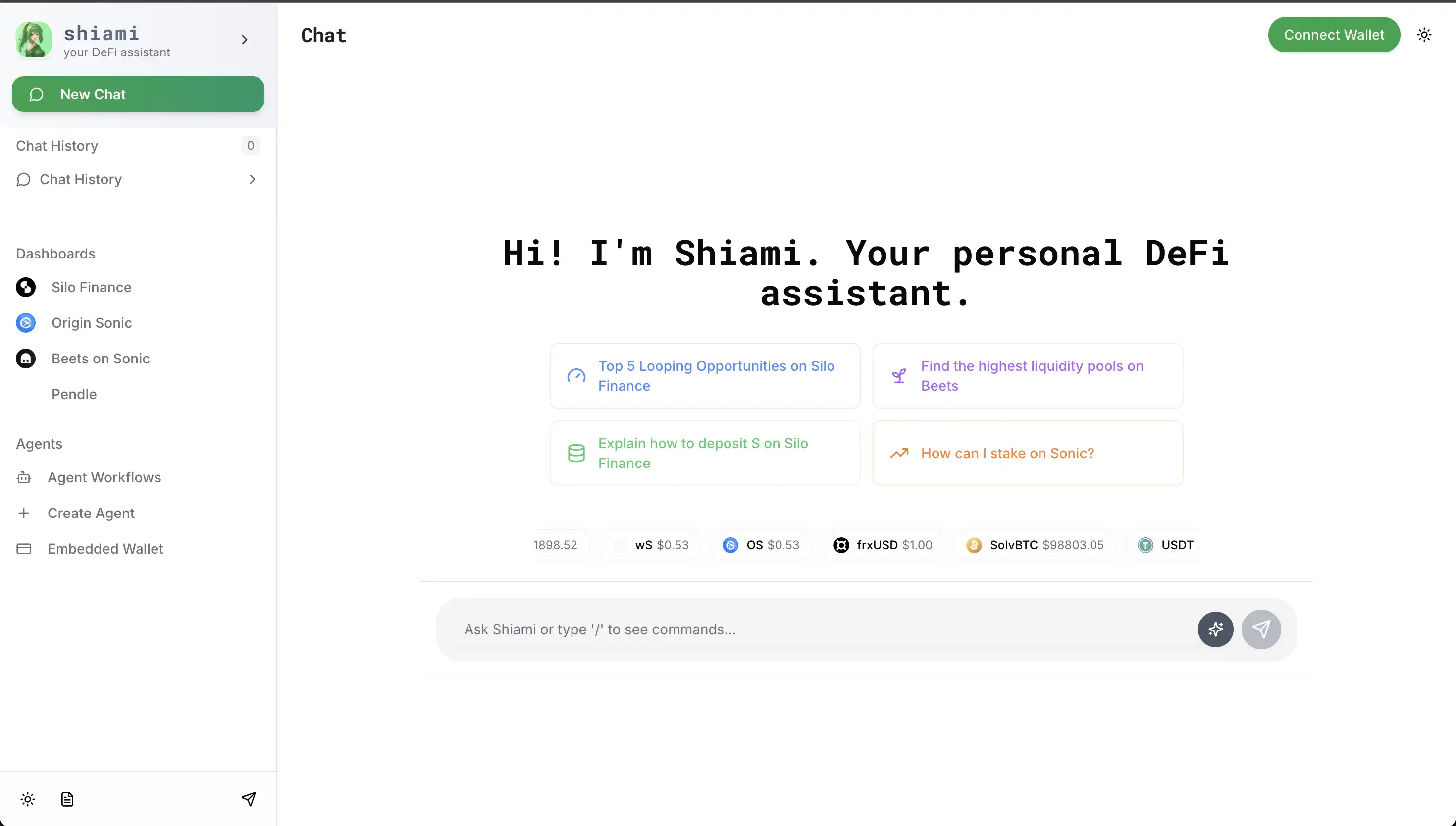

在四月初结束的 @SonicLabs和@DoraHacks 联办的 DeFAI 黑客马拉松中获得了第二名,现已支持 Silo Finance、Aave V3、Beets.fi、Pendle Finance、Shadow 等主流 DEX 以及 Angles, Beets, Beefy 等 Sonic 原生的质押平台。在接下来的 V2 版本特别提出了一个新的概念,将 DeFAI 晋升至 DeVibeFAI,「Vibe」一词在最近 AI Agent 的热潮中十分常见,Vibe Code 意指无需编程基础仅通过自然语言进行编程的概念。

其主要功能涉及自动收益策略「智能分配至表现最佳的策略」以及自动重新平衡「定期在最高 APY 池之间自动重新平衡」。用户可以设计自己的人工智能 DeFi 策略,可以选择想要参与的协议、资产以及执行的风险级别和条件,而用户设计的策略在未来将可以进行公开或者私人的共享功能。

随着 Sonic 生态的越发壮大,此前创始人 AC 对 Famton 的「弃盘」的 FUD 的声音逐渐消失,越来越多的开发者加入 Sonic 生态。尽管社区认为该链的 APR 还是不如预期,但如此一条专注于 DeFi 的链在 Binance 注入流动性深度合作后也也让人愈发的期待持续更长久的金融模型的诞生。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。