今年 2 月,Base 生态中的 AI 协议 Virtuals 宣布跨链至 Solana,然而加密市场随后进入流动性紧缩期,AI Agent 板块从人声鼎沸转为低迷,Virtuals 生态也陷入一段蛰伏期。

三月初,BlockBeats 对 Virtuals 联合创始人 empty 进行了一次专访。彼时,团队尚未推出如今被广泛讨论的 Genesis Launch 机制,但已在内部持续探索如何通过机制设计激活老资产、提高用户参与度,并重构代币发行与融资路径。那是一个市场尚未复苏、生态尚处冷启动阶段的时间点,Virtuals 团队却没有停下脚步,而是在努力寻找新的产品方向和叙事突破口。

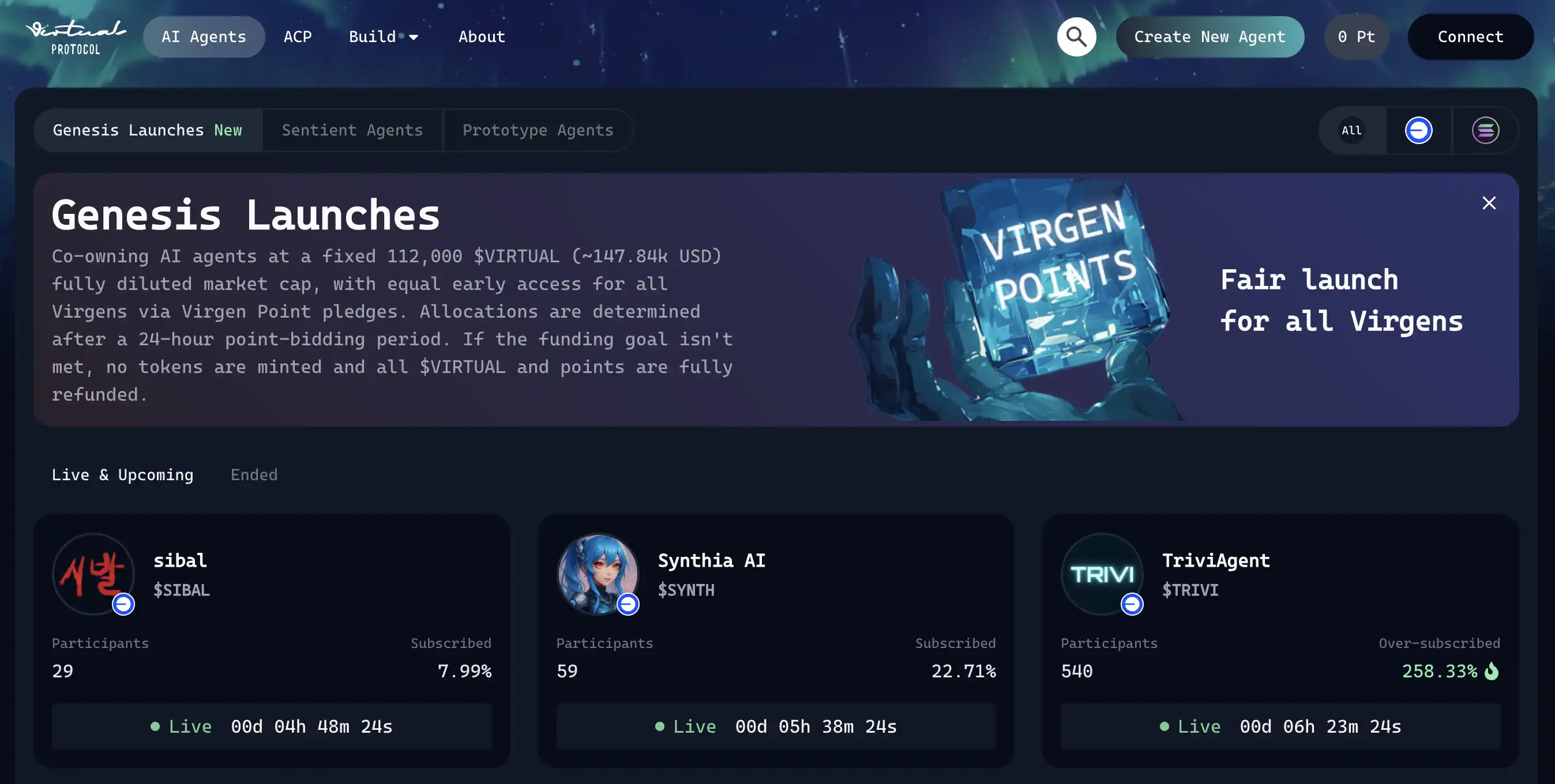

两个月过去,AI Agent 板块重新升温,Virtuals 代币反弹超 150%,Genesis 机制成为带动生态回暖的重要触发器。从积分获取规则的动态调整,到项目参与热度的持续上升,再到「新代币带老代币」的机制闭环,Virtuals 逐渐走出寒冬,并再次站上讨论焦点。

值得注意的是,Virtuals 的 Genesis 机制与近期 Binance 推出的 Alpha 积分系统有一些相似之处,评估用户在 Alpha 和币安钱包生态系统内的参与度,决定用户 Alpha 代币空投的资格。用户可以通过持仓、交易等方式获得积分,积分越高,参与新项目的机会越大。通过积分系统筛选用户、分配资源,项目方能够更有效地激励社区参与,提升项目的公平性和透明度。Virtuals 和 Binance 的探索,或许预示着加密融资的新趋势正在形成。

回看这次对话,empty 在专访中所展现出的思路与判断,正在一步步显现其前瞻性,这不仅是一场围绕打新机制的访谈,更是一次关于「资产驱动型 AI 协议」的路径构建与底层逻辑的深度讨论。

从「产品」到「平台」:AI Agent 的华尔街式基础设施

BlockBeats:可以简单分享一下最近团队主要在忙些什么?

empty:目前我们的工作重点主要有两部分。第一部分,我们希望将 Virtuals 打造成一个类似「华尔街」的代理人(Agent)服务平台。设想一下,如果你是一个专注于 Agent 或 Agent 团队建设的创业者,从融资、发币到流动性退出,整个流程都需要系统性的支持。我们希望为真正专注于 Agent 和 AI 研发的团队,提供这一整套服务体系,让他们可以把精力集中在底层能力的开发上,而不用为其他环节分心。这一块的工作其实也包括了散户买卖相关的内容,后面可以再详细展开。

第二部分,我们在深入推进 AI 相关的布局。我们的愿景是构建一个 AI 社会,希望每一个 Agent 都能聚焦自身优势,同时通过彼此之间的协作,实现更大的价值。因此,最近我们发布了一个新的标准——ACP(Agent Communication Protocol),目的是让不同的 Agent 能够相互交互、协作,共同推动各自的业务目标。这是目前我们主要在推进的两大方向。

BlockBeats:可以再展开说说吗?

empty:在我看来,其实我们面向的客户群体可以分为三类:第一类是专注于开发 Agent 的团队;第二类是投资者,包括散户、基金等各种投资机构;第三类则是 C 端用户,也就是最终使用 Agent 产品的个人用户。

不过,我们的主要精力其实是放在前两类——也就是团队和投资者上。对于 C 端用户这一块,我们并不打算直接介入,而是希望各个 Agent 团队能够自己去解决 C 端市场的拓展问题。

此外,我们也认为,Agent 与 Agent 之间的交互应该成为一个核心模式。简单来说,就是未来的服务更多应该是由一个 Agent 销售或提供给另一个 Agent,而不是单纯卖给人类用户。因此,在团队的 BD 工作中,我们也在积极帮助现有的 AI 团队寻找这样的客户和合作机会。

BlockBeats:大概有一些什么具体案例呢?

empty:「华尔街」说白了就是围绕资本运作体系的建设,假设你是一个技术团队,想要融资,传统路径是去找 VC 募资,拿到资金后开始发展。如果项目做得不错,接下来可能会考虑进入二级市场,比如在纽约证券交易所上市,或者在 Binance 这样的交易所上币,实现流动性退出。

我们希望把这一整套流程打通——从早期融资,到项目开发过程中对资金的灵活使用需求,再到最终二级市场的流动性退出,全部覆盖和完善,这是我们希望补齐的一条完整链条。

而这一部分的工作和 ACP(Agent Communication Protocol)是不同的,ACP 更多是关于 Agent 与 Agent 之间交互标准的制定,不直接涉及资本运作体系。

BlockBeats:它和现在 Virtuals 的这个 Launchpad 有什么区别呢?资金也是从 C 端来是吗?

empty:其实现在你在 Virtuals 上发币,如果没有真正融到资金,那就只是发了一个币而已,实际是融不到钱的。我们目前能提供的服务,是通过设定买卖时的交易税机制,从中提取一部分税收返还给创业者,希望这部分能够成为他们的现金流来源。

不过,问题其实还分成两块。第一是如何真正帮助团队完成融资,这个问题目前我们还没有彻底解决。第二是关于当前项目发行模式本身存在的结构性问题。简单来说,现在的版本有点像过去 Pumpfun 那种模式——即项目刚上线时,部分筹码就被外卖给了外部投资人。但现实是,目前整个市场上存在太多机构集团和「狙击手」。

当一个真正优秀的项目一发币,还没真正触达普通散户,就已经被机构在极高估值时抢购了。等到散户能够接触到时,往往价格已经偏高,项目质量也可能变差,整个价值发行体系被扭曲。

针对这一问题,我们希望探索一种新的发币和融资模式,目的是让项目方的筹码既不是死死握在自己手里,也不是优先流向英文圈的大机构,而是能够真正留给那些相信项目、愿意长期支持项目的普通投资者手中。我们正在思考该如何设计这样一个新的发行机制,来解决这一根本问题。

BlockBeats:新模式的具体思路会是什么样子呢?

empty:关于资金这一块,其实我们目前还没有完全想透。现阶段来看,最直接的方式还是去找 VC 融资,或者采取公开预售等形式进行资金募集。不过说实话,我个人对传统的公开预售模式并不是特别认可。

在「公平发售」这件事上,我们正在尝试换一个角度来思考——希望能从「reputation」出发,重新设计机制。

具体来说,就是如果你对整个 Virtuals 生态有贡献,比如早期参与、提供支持或建设,那么你就可以在后续购买优质代币时享有更高的优先权。通过这种方式,我们希望把资源更多留给真正支持生态发展的用户,而不是被短期套利的人主导。

如何从交易税中「自养」团队

BlockBeats:您会不会考虑采用类似之前 Fjord Foundry 推出的 LBP 模式,或者像 Daos.fun 那种采用白名单机制的模式。这些模式在某种程度上,和您刚才提到的「对生态有贡献的人享有优先权」的想法是有些相似的。不过,这类做法后来也引发了一些争议,比如白名单内幕操作、分配不公等问题。Virtuals 在设计时会考虑借鉴这些模式的优点,或者有针对性地规避类似的问题吗?

empty:我认为白名单机制最大的问题在于,白名单的选择权掌握在项目方手中。这和「老鼠仓」行为非常相似。项目方可以选择将白名单名额分配给自己人或身边的朋友,导致最终的筹码仍然掌握在少数人手里。

我们希望做的,依然是类似白名单的机制,但不同的是,白名单的获取权应基于一个公开透明的规则体系,而不是由项目方单方面决定。只有这样,才能真正做到公平分配,避免出现内幕操作的问题。

我认为在今天这个 AI 时代,很多时候创业并不需要大量资金。我经常跟团队强调,你们应该优先考虑自力更生,比如通过组建社区,而不是一开始就想着去融资。因为一旦融资,实际上就等于背上了负债。

我们更希望从 Training Fee的角度去看待早期发展路径。也就是说,项目可以选择直接发币,通过交易税所带来的现金流,支持日常运营。这样一来,项目可以在公开建设的过程中获得初步资金,而不是依赖外部投资。如果项目做大了,自然也会有机会通过二级市场流动性退出。

当然最理想的情况是,项目本身能够有稳定的现金流来源,这样甚至连自己的币都无需抛售,这才是真正健康可持续的状态。

我自己也经常在和团队交流时分享这种思路,很有意思的是,那些真正抱着「搞快钱」心态的项目,一听到这种机制就失去了兴趣。他们会觉得,在这种模式下,既无法操作老鼠仓,也很难短期套利,于是很快选择离开。

但从我们的角度来看,这其实反而是一种很好的筛选机制。通过这种方式,理念不同的项目自然会被过滤出去,最终留下的,都是那些愿意真正建设、和我们价值观契合的团队,一起把事情做起来。

BlockBeats:这个理念可以开发出一些能够创造收益的 AI agent。

empty:我觉得这是非常有必要的。坦白说,放眼今天的市场,真正拥有稳定现金流的产品几乎凤毛麟角,但我认为这并不意味着我们应该停止尝试。事实上,我们每天在对接的团队中,有至少一半以上的人依然怀抱着长远的愿景。很多时候,他们甚至已经提前向我们提供了 VC 阶段的资金支持,或者表达了强烈的合作意愿。

其实对他们来说想要去收获一个很好的社区,因为社区可以给他们的产品做更好的反馈,这才是他们真正的目的。这样听起来有一点匪夷所思,但其实真的有很多这样的团队,而那种团队的是我们真的想扶持的团队。

AI Agent 该卖给谁?

BlockBeats:您刚才提到的这套「AI 华尔街」的产品体系——从融资、发行到退出,构建的是一整套完整的流程。这套机制是否更多是为了激励那些有意愿发币的团队?还是说,它在设计上也考虑了如何更好地支持那些希望通过产品本身的现金流来发展的团队?这两类团队在您这套体系中会不会被区别对待,或者说有什么机制设计能让不同路径的创业者都能被合理支持?

empty:是的,我们 BD 的核心职责其实就是去鼓励团队发币。说得直接一点,就是引导他们思考发币的可能性和意义。所以团队最常问的问题就是:「为什么要发币?」这时我们就需要采用不同的方式和角度,去帮助他们理解背后的价值逻辑。当然如果最终判断不适合,我们也不会强迫他们推进。

不过我们观察到一个非常明显的趋势,传统的融资路径已经越来越难走通了。过去那种融资做大,发币上所的模式已经逐渐失效。面对这样的现实,很多团队都陷入了尴尬的境地。而我们希望能从链上和加密的视角,提供一套不同的解决方案,让他们找到新的发展路径。

BlockBeats:明白,我刚才其实想表达的是,您刚刚也提到,传统的 AI 模式在很大程度上仍然依赖「烧钱」竞争。但在 DeepSeek 出现之后,市场上一些资金体量较小的团队或投资人开始重新燃起了信心,跃跃欲试地进入这个领域。您怎么看这种现象?这会不会对当前正在做 AI 基础研发,或者 AI 应用层开发的团队产生一定的影响?

empty:对,我觉得先不谈 DeepSeek,从传统角度来看,其实到目前为止,AI 领域真正赚钱的只有英伟达,其他几乎所有玩家都还没有实现盈利。所以实际上没有人真正享受到了这个商业模式的成果,大家也仍在探索如何面向 C 端打造真正有产出的应用。

没有哪个领域像币圈一样能如此快速获得社区反馈。你一发币,用户就会主动去读白皮书的每一个字,试用你产品的每一个功能。

当然,这套机制并不适合所有人。比如有些 Agent 产品偏 Web2,对于币圈用户而言,可能感知不到其价值。因此,我也会鼓励做 Agent 的团队在 Virtuals 生态中认真思考,如何真正将 Crypto 作为自身产品的差异化要素加以运用与设计。

BlockBeats:这点我特别认同,在 Crypto 这个领域 AI 的迭代速度确实非常快,但这群用户给出的反馈,真的是代表真实的市场需求吗?或者说这些反馈是否真的符合更大众化、更具规模性的需求?

empty:我觉得很多时候产品本身不应该是强行推广给不适合的用户群体。比如 AIXBT 最成功的一点就在于,它的用户本身就是那群炒作他人内容的人,所以他们的使用行为是非常自然的,并不觉得是在被迫使用一个无聊的产品。mass adoption 这个概念已经讲了很多年,大家可能早就该放弃这个执念了。我们不如就认了,把东西卖给币圈的人就好了。

BlockBeats:AI Agent 与 AI Agent 所对应的代币之间,究竟应该是什么样的动态关系?

empty:对,我觉得这里可以分为两个核心点。首先其实并不是在投资某个具体的 AI Agent,而是在投资背后运营这个 Agent 的团队。你应该把它理解为一种更接近于风险投资的思路:你投的是这个人,而不是他当前正在做的产品。因为产品本身是可以快速变化的,可能一个月之后团队就会发现方向不对,立即调整。所以,这里的「币」本质上代表的是对团队的信任,而不是某个特定 Agent 本身。

第二则是期望一旦某个 Agent 产品做出来后,未来它能真正产生现金流,或者有实际的使用场景(utility),从而让对应的代币具备赋能效应。

BlockBeats:您觉得有哪些赋能方式是目前还没有看到的,但未来可能出现、并且值得期待的?

empty:其实主要有两块,第一是比较常见的那种你要使用我的产品,就必须付费,或者使用代币支付,从而间接实现对代币的「软销毁」或消耗。

但我觉得更有趣的赋能方式,其实是在获客成本的角度进行思考。也就是说,你希望你的用户同时也是你的投资者,这样他们就有动机去主动帮你推广、吸引更多用户。

开源≠赋能,开发者≠社区

BlockBeats:那基于这些观点,您怎么看 ai16z,在项目设计和代币机制方面,似乎整体表现并不太乐观?

empty:从一个非常纯粹的投资角度来看,撇开我们与他们之间的关系,其实很简单。他们现在做的事情,对代币本身没有任何赋能。从开源的角度来看,一个开源模型本身是无法直接赋能代币的。

但它仍然有价值的原因在于,它像一个期权(call option),也就是说,如果有一天他们突然决定要做一些事情,比如推出一个 launchpad,那么那些提前知道、提前参与的人,可能会因此受益。

开发者未来确实有可能会使用他们的 Launchpad,只有在那一刻,代币才会真正产生赋能。这是目前最大的一个问号——如果这一模式真的跑得通,我认为确实会非常强大,因为他们的确触达了大量开发者。

但我个人仍然有很多疑问。比如即使我是一个使用 Eliza 的开发者,也并不代表我就一定会选择在他们的 Launchpad 上发币。我会货比三家,会进行比较。而且,做一个 Launchpad 和做一个开源框架,所需要的产品能力和社区运营能力是完全不同的,这是另一个重要的不确定性。

BlockBeats:这种不同是体现在什么地方呢?

empty:在 Virtuals 上我们几乎每天都在处理客服相关的问题,只要有任何一个团队在我们平台上发生 rug,即便与我们没有直接关系,用户也会第一时间来找我们投诉。

这时我们就必须出面安抚用户,并思考如何降低 rug 的整体风险。一旦有团队因为自己的代币设计错误或技术失误被黑客攻击、资产被盗,我们还往往需要自掏腰包,确保他们的社区至少能拿回一点资金,以便项目能够重新开始。这些项目方可能在技术上很强,但未必擅长代币发行,结果因操作失误被攻击导致资产损失。只要涉及「被欺骗」相关的问题,对我们来说就已经是非常麻烦的事了,做这些工作跟做交易所的客服没有太大区别。

另一方面,做 BD 也非常困难。优秀的团队手上有很多选择,他们可以选择在 Pumpfun 或交易所上发币,为什么他们要来找我们,那这背后必须要有一整套支持体系,包括融资支持、技术协助、市场推广等,每一个环节都不能出问题。

BlockBeats:那我们顺着这个话题继续聊一下 Virtuals 当前的 Launchpad 业务。有一些社区成员在 Twitter 上统计了 Virtuals Launchpad 的整体盈利状况,确实目前看起来盈利的项目数量比较少。接下来 Launchpad 还会是 Virtuals 的主要业务板块吗?还是说,未来的重心会逐渐转向您刚才提到的「AI 华尔街」这条路径?

empty:其实这两块本质上是一件事,是一整套体系的一部分,所以我们必须继续推进。市场的波动是很正常的,我们始终要坚持的一点是:非常清楚地认识到我们的核心客户是谁。我一直强调我们的客户只有两类——团队。所以市场行情的好坏对我们来说并不是最重要的,关键是在每一个关键节点上,对于一个团队来说,发币的最佳选择是否依然是我们 Virtuals。

BlockBeats:您会不会担心「Crypto + AI」或「Crypto AI Agent」这一类叙事已经过去了?如果未来还有一轮牛市,您是否认为市场炒作的焦点可能已经不再是这些方向了?

empty:有可能啊,我觉得 it is what it is,这确实是有可能发生的,但这也属于我们无法控制的范围。不过如果你问我,在所有可能的趋势中,哪个赛道更有机会长期保持领先,我依然认为是 AI。从一个打德扑的角度来看,它仍然是最优选择。

而且我们团队的技术框架和底层能力其实早已搭建完成了,现在只是顺势而为而已。更重要的是,我们本身是真的热爱这件事,带着好奇心去做这件事。每天早上醒来就有驱动力去研究最新的技术,这种状态本身就挺让人满足的,对吧?

很多时候,大家不应该只看产品本身。实际上很多优秀的团队,他们的基因就决定了他们有在规则中胜出的能力——他们可能过去在做派盘交易时,每笔规模就是上百万的操作,而这些团队的 CEO,一年的薪资可能就有 100 万美金。如果他们愿意出来单干项目,从天使投资或 VC 的视角来看,这本质上是用一个很划算的价格买到一个高质量的团队。

更何况这些资产是 liquid 的,不是锁仓状态。如果你当下并不急着用钱,完全可以在早期阶段买入一些优秀团队的代币,静静等待他们去创造一些奇迹,基本就是这样一个逻辑。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。